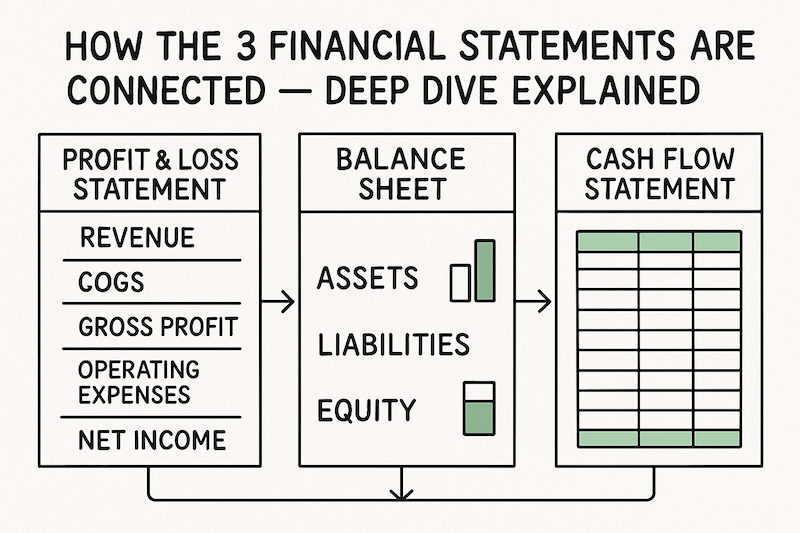

📊 Connection Between The 3 Reports

Summary:

- This article explains how the Profit & Loss Statement, Balance Sheet, and Cash Flow Report are interconnected in simple, practical terms. Also, don’t forget to test your understanding with our interactive quiz here.

Introduction

Let me ask you something.

If I gave you the Profit & Loss account of a company, let’s say it’s making Rs.10 lakhs in annual profit, does that tell you everything you need to know?

Most people would think, “Yes, its a profitable company, what else do I need?”

But in finance, that’s not enough enough.

Because the real story of a company isn’t told by just one report. You need all three, the Profit & Loss account, the Balance Sheet, and the Cash Flow Statement. They work together to built a realistic story of a company.

Not many would realize this, but these three reports don’t function in isolation. They’re like three childs of the same parent (The Annual Report).

So in this post, let’s understand how these three financial statements are linked (interrelated).

The Profit & Loss Account

This is usually the first thing people look at.

The Profit & Loss Account, or Income Statement, tells you if the company is making money. It lists down all the revenues, subtracts the expenses, and shows you the final profit or loss.

Suppose a small business sells handmade soaps. In a year, it earns Rs.50 lakhs in revenue. After paying for raw materials, salaries, rent, and all other expenses, it has Rs.8 lakhs left. That’s the net profit.

But there is something important to remember about the net profit.

This Rs.8 lakhs is an accounting number.

It includes some expenses that don’t involve new cash going out during the period (like depreciation, where the cash was spent earlier and is now being allocated over time).

It also doesn’t show what the company did with that Rs.8 lakhs. Did they keep it? Did they invest it back? Did they pay off a loan?

For that, we need to look at the other two reports.

The Balance Sheet

The Balance Sheet is like a photo of the company’s financial position at a specific point in time.

It shows what the company owns (Assets), what it owes (Liabilities), and what belongs to the owners (Equity).

So, where does the profit from the P&L account go?

Well, it flows into the Equity section of the Balance Sheet. More specifically, it accounted for under the Retained Earnings head.

If our soap business made Rs.8 lakhs in profit, and didn’t distribute any of it as dividends, the owner’s equity will increase by that amount (Rs.8 Lakhs).

Also, the Balance Sheet changes whenever the company buys or sells something, takes a loan, or repays its existing loans.

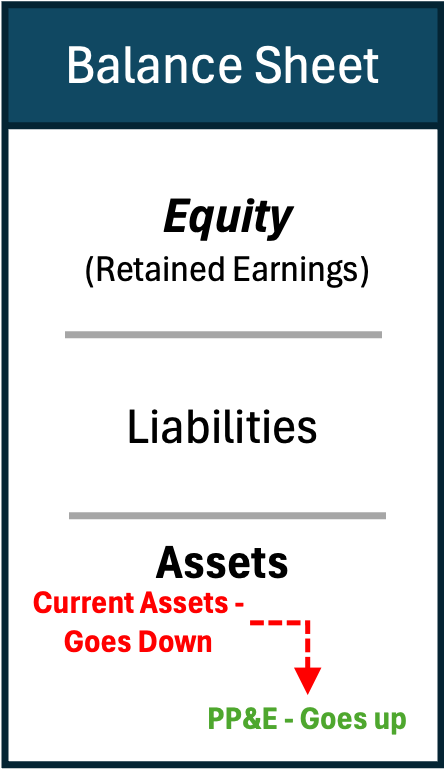

For example, if the business used Rs.5 lakhs of its profit to buy a new machine, the Assets (under Plant & Machinery – PP&E) will go up, while Cash (also an Asset – current asset) will go down by the same amount. The total Assets stay the same, and Equity and Liabilities remain unchanged.

Equity stays the same, unless the company brings in new funds or withdraws some.

Now we will get into the third report that will tie it all together.

The Cash Flow Statement: The Real Movement of Money

Here’s a common confusion: “If a company made Rs.8 lakhs in profit, does that mean it has Rs.8 lakhs in the bank?”

No. Not at all.

The Cash Flow Statement tells us how much actual cash the business received and spent during a period. It clears the fog around what the P&L doesn’t show.

Let me give you a simple example.

Imagine your customer bought soaps worth Rs.3 lakhs, but hasn’t paid yet. From this Rs.3 Lakhs sale, you are expecting a profit of Rs.15,000 (5% margin). That Rs.3 lakhs will show up as you revenue in the P&L. But your bank account didn’t receive it yet. So the cash hasn’t come in. In this case, though the company will report Rs.3 Lakhs as revenue and Rs.15,000 as profit in their P&L Accounts, but this money is not there in your bank account.

Similarly, if you bought inventory for Rs.2 lakhs and paid upfront, that’s cash going out — but it doesn’t show up as an expense in the P&L until you sell the product. Why? Because in accounting, buying inventory is not an expense, it becomes a current asset until the inventory is sold.

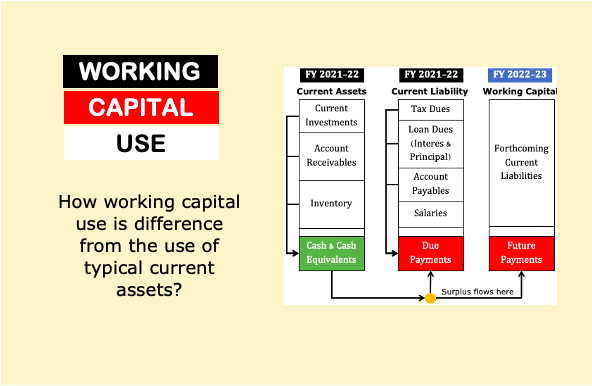

That’s why the Cash Flow Statement starts with Net Profit from the P&L and then adjusts it. It adds back non-cash expenses like depreciation. It subtracts changes in working capital like receivables and payables. It also shows investment activity (like buying equipment) and financing activity (like taking loans).

In the end, it tells you, did cash go up or down?

Let’s Link It All

Let’s say a company starts the year with ₹10 lakhs in cash.

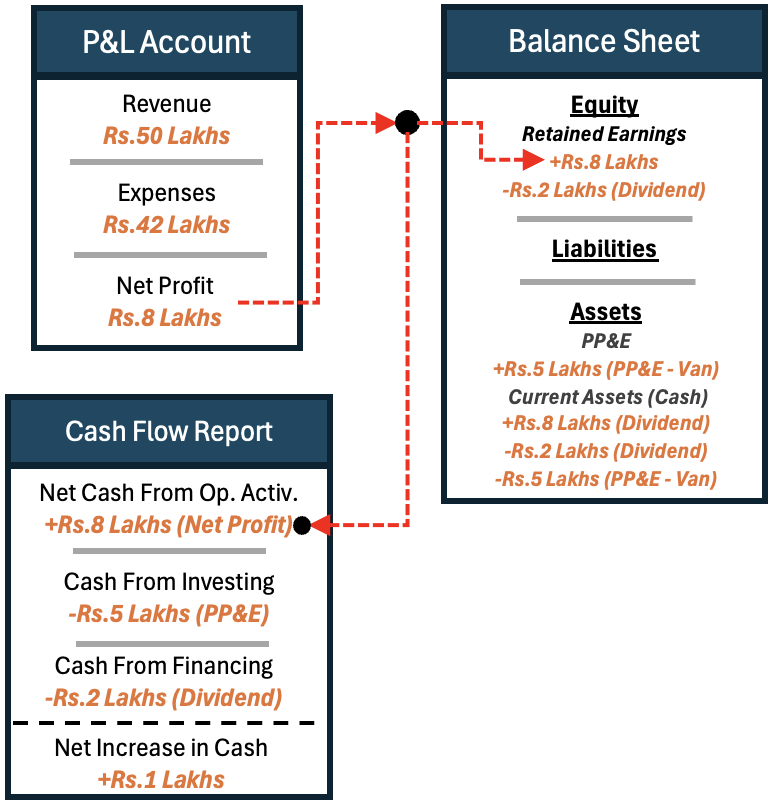

It makes ₹50 lakhs in sales, spends ₹42 lakhs on expenses, and earns ₹8 lakhs in net profit. Great.

Now it buys a delivery van for ₹5 lakhs.

Out of the ₹8 lakhs, it pays ₹2 lakhs as dividends to shareholders.

What do the reports say?

- P&L shows Rs.8 lakhs profit.

- Balance Sheet shows Rs.5 lakhs of new assets (van), cash reduced, and Rs.6 lakhs increase in retained earnings (Rs.8 lakhs profit – Rs.2 lakhs dividends).

- Cash Flow Statement starts with Rs.8 lakhs net income, subtracts Rs.5 lakhs for the van, and Rs.2 lakhs for dividend. So only ₹1 lakh cash increase. Final cash is Rs.11 lakhs.

Now you see how it all fits together.

Each report is telling a part of the story. Alone, they’re useful. Together, they’re powerful.

Why This Matters

Whether you’re a student of finance, a stock investor, or someone just interested in business, you need to understand this connection.

Let’s say you’re looking at a company to invest in.

It may show a profit every year, but still have no cash. Why? Because the cash is stuck in receivables or being used to pay off old loans.

The P&L won’t tell you that. Only the cash flow will.

Or maybe the balance sheet is heavy with debt. That may not affect profit today, but it can crush the business later.

You need all three reports to understand this.

This is not just textbook theory. In the real world, this is how investors, lenders, and smart business owners look at numbers.

Conclusion

Finance doesn’t have to be scary.

The three financial statements are like pieces of a puzzle. Once you know how they fit together, the picture becomes clear.

So next time you look at a company’s financials, don’t stop at the profit. You can ask, where did that profit go? What changed in the assets or liabilities? How much actual cash came in?

That’s how you move from looking at numbers, to truly understanding them. As Warren Bufett says – build your circle of competence. This is that way to do it. If you are able to visualize how the cash of the company is moving from P&L to balance sheet to cash flows, you are beginning to understand the business.

And once you do that, you’ll see business decisions, your own or someone else’s, in a completely new light.

Have a happy investing.