Though I am not an expert to find a flaw in the banking system, something stunning has come to my notice. Why do I call it stunning? (I mean it in a negative way). I was surprised but was “not” happy to observe something like this. What do I mean by “something like this”? I wrote one post about the business model of banks some time back.

According to that post, the banks do business like this: Banks first collect deposits. Then, from these deposits, it issues loans. But to my surprise, this understanding is not 100% accurate. Where is the problem?

Suggested Reading: India’s Bitcoin (Digital Currency)

Banks can issue more loans than their deposits?

Yes, this is true.

Let me give you an extreme example of this case (USA).

[Though India is better placed than USA]

- Total Money Supply in USA (June’2018) – $14,112 Billion.

- Total Credit Market Debt (Q1’2010) – $50,042 Billion.

What we know about bank’s till date?

Banks take deposits. From these deposits, it issues loans.

But what the above chart is showing?

Forget deposits, whatever money is there in circulation, 3.546 times of that has been given as loans in USA.

How this is alarming?

USA has $14,112 Billion worth of money supply in 2018. For sure all of this money is not held by banks as deposits.

But for sake of some “accounting rules”, lets say that all of this money in showing as “deposits” in accounts of people.

So loans must be issued from these deposit-base, right?

If banks are allowed to give 90% of their deposits as loan (say), so how much loan can be issued in USA?

90% of $14,112 = $12,700 Bn.

But USA’s account is showing, total debt of $50,042 Bn. How it is possible.

How total debt issued is more than total money available in the system?

Be reminded that there is no bungling done here. These are done as per rules.

Hence I used the term “a flaw in banking system”.

What is Money Supply Vs Debt Ratio for India?

India is one of those countries which has managed to keep this Ratio comparatively low.

But the value is still surprising for me. Debt is more than money supply.

Total Money Supply (M3):

Data Source: RBI

- Currency with public : Rs.17.60 Lakh Crore.

- Demand Deposits (Savings + Current) : Rs.14.836 Lakh Crore.

- Time Deposits (FD/RD): Rs.106.957 Lakh Crore.

- Deposit with RBI: Rs.0.2391 Lakh Crore.

- Total Money Supply : Rs.139.63 Lakh Crore.

Total Debt issued by Indian banks:

Data Source: Internet

- GDP of India: $2.848 Trillion.

- Household Debt: 10.9% of GDP: $0.31 Trillion.

- Corporate Debt: 45% of GDP: $1.281 Trillion.

- Government Debt: 68.7% of GDP: $1.956 Trillion.

- Total Debt: $3.547 Trillion (Rs.246 Lakh Crore)

If physical money is not there, how banks can lend more?

This is a good question. In good old days, it was not possible.

What was good old days? When only paper currency was available.

But now-a-days we have two types of money:

- Digital Money.

- Paper Money.

It is the advent of this digital money that has made “excess money available for the banking system”. How?

It is result of a banking rule called “Fractional Reserve Banking”.

What is Fractional Reserve Banking?

According to this rule, banks can keep a fraction of deposit (say 10%) in reserves and issue the balance (90%) as loan.

On face of it, it looks normal, right? This is normal banking practice.

In simple language, this rule allows banks to use our deposits to give loans to the needy.

Their reasoning is, the money (our deposit) is any ways lying idle in banks. Hence they will use it for following purposes:

- Lend money to needy.

- Banks can make money out of it (interest on loans).

- The depositors (we) will also earn interest on deposits.

I looks like a win-win situation for everyone. Rule made in heaven, right?

But the problem is, this is only one side of the story. Very less people talk about the other flawed side of fractional reserve banking.

What is this scepticism?

Because people who made this rule were not Mother Teressa or Mahatma Gandhi.

They introduced this rule to ease out the process of lending money.

Why they wanted to ease the process? Because the more money they will lend, the more interest (bank’s source of income) they will earn.

Here the root of all evil is the word “interest”. Lets see how…

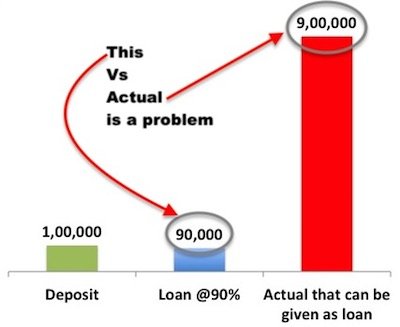

Suppose a bank has Rs.100,000 as deposit.

Now less make another assumption, as per fractional reserves banking rule, the bank must keep 10% as reserves.

So how much money bank can give as loan? 90% of Rs.100,000 (Rs.90,000).

Suppose interest rate is say 7.5% p.a. So the bank can earn Rs.6,750 from Rs.90,000.

Here comes a second (flawed) side of fractional reserve banking rule.

As per this rule, against deposit of Rs.100,000, banks are allowed to give Rs.9,00,000 (9 lakhs) as loan.

But we thought only Rs.90,000 could be given as loan, right? This is the fallacy.

Income from Rs.90,000 was Rs.6,750 @7.5% per annum. Similarly, income from Rs.9,00,000 @7.5% will be Rs.67,500 p.a.

By following fractional reserve banking, the income of banks jumps by 10 times. No doubt why all banks of the world follow this model.

You can see the above charts:

- USA issued loan: 3.546 Times its deposits.

- India issued loan: 1.765 Times its deposits.

These are still better than 9 times, right? But its still alarming.

Biggest Disadvantage of Fractional Reserve Banking?

The biggest danger is bank-run. What is it?

Bank run is a situation where depositors try to cash-out, but banks are not able to give cash. How this can happen?

It can happen when banks do not have enough cash, to pay to all depositors.

But banks must have cash, right? Not necessarily.

This is what is fractional reserve banking model.

See for yourself, the scenario in India.

If we see the break-up of money supply, it looks like this:

- Demand Deposits (Savings + Current) : Rs.14.836 Lakh Crore.

- Time Deposits (FD/RD): Rs.106.957 Lakh Crore.

- Total Deposits: Rs.121.793 Lakh Crore

- Total Notes Issued by RBI: Rs.17.6 Lakh Crore.

Cash in economy is only Rs.17.6 Lakh Crore compared to Rs.121.793 Lakh Crore (6.92 times) deposits.

All deposits above Rs.17.6 Lakh Crore is only digital money.

So this is certain that, if all depositors wants cash-out, banks will fail.

Moreover, Indian banks do not keep more than 4% in Cash (See CRR Ratio). So what does it mean?

It means, out of 121.793 Lakh Crore deposits, only 0.704 Lakh Crore (4% of Rs.17.6 Lakh Crore) is available in cash at banks lockers.

Even if 1% depositors turn out for cash-out, banks will need Rs.1.21793 Lakh Crore cash for payout.

Banks does not have even this much cash. This is bank-run. It cannot serve even 1% payout (1% of all deposits).

This also explains why, financial reserve banking system is so risky.

Everything is based on an assumption that, more people will not need to cash-out at a same point in time.

This assumption is not biased. But what makes it faulty is the number of times the digital currency has grown over cash.

Why to Fear Digital Currency?

To understand this we will have to learn about the following:

- Barter system,

- Gold standard and,

- Fiat money (Cash).

- Fiat money (Digital).

Lets leave this for some other day. But just to explain the impact of digital currency lets make an assumption.

Suppose you are on a desert safari, where you have no mobile or internet connection.

You also have no cash in wallet, and you want to buy some food. How you will do it? It will be tough.

This is why whenever we go out, we find solace in carrying cash.

Anyways, I know this is not a very good explanation of why digital money is not always good, but I hope it conveys my point, right?

Moreover, digital currency is a fiat money. The fiat money system has its own limitations.

A dollar is worth Rs.69 today. What is the math behind it? You will be surprised, there is no math.

The strength of a currency is all based on our belief that a Dollar is stronger than a Rupee.

Yes, it is just a belief. If the belief falters, dollar/Rupee ratio will change.

What can make beliefs to falter? A lot of factors like…read more on strength of currency.

So lets come back to our main topic. What is it? Flawed banking system.

A Flawed Banking Model.

Though the fractional reserve banking in itself is not alone responsible for it, but it is from here that all originates.

What is a bank? Investopedia says,

“A bank is a financial institution licensed to receive deposits and make loans“.

Mark the order of usage of words: Deposits comes before loans.

But today’s banks does not works like this. They have started working like a typical “Private Business Organisation”.

See profit, and work accordingly. What’s wrong with this rule?

Nothing wrong, till we know how banks run their business? What’s the point about business?

- Tata Group also makes profit. But it does its business in a way which is lawful and reasonable.

- Nirav Modi also makes profit. But these are the people who flee the nation.

What do I mean, banks operate like Tata’s or Nirav Modi? I will say its in between. How?

Because there is a bias (or selective preference) towards banks. This selective preference helps banks to make money.

Ok, lets go step by step to see the banks flawed business model (which exists now).

How banks earn money?

They earn money by issuing loans to public.

Do they make money by accepting deposits, printing notes etc? No.

This is why the focus of all banks have become “more and more loan issuance”.

This is why we receive frantic phone calls these days from banks asking for loans, credit cards etc.

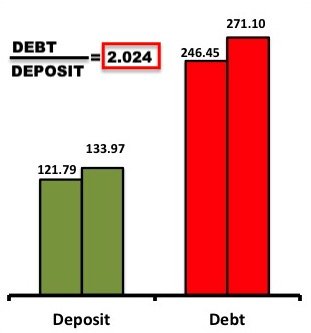

But all loans must be backed by some deposits right? Lets recheck the situation of India.

- Total Deposits in India: Rs.121.793 Lakh Crore.

- Total Debt paid by banks: Rs.246.45 Lakh Crore.

- Debt to Deposit Ratio = 2.024

Lets assume that 2.204 is the maximum ratio that RBI and GOI wants to maintain always.

But in the process of issuing more and more loans, our banks issued 10% more loans compare to present.

As a result the loan amount surged to Rs.271.10 lakh crore from 246.45 Lakh Crore.

Now the Debt/Deposit Ratio will increase beyond 2.204. What banks will do now?

Banks must increase their deposit level from Rs.121.79 lakh crore to Rs.133.97 Lakh Crore.

How banks will increase the deposit level? They will borrow money from RBI.

Now this is where the things becomes interesting. How?

RBI can lend money in two ways to banks:

- Out of their cash reserves (which is good).

- Else, they may also considering printing more notes (bad idea).

Printing notes is a bad idea because, it will lead to inflation (Read more about this here…).

So you must note 2 important points about how money is made in a flawed banking model.

First: Banks can issue more and more loans till they have a certain amount of deposits.

In our example, if a bank has Rs.100 in deposit, it can keep issuing loan worth Rs.202.4 (Debt/Deposit ratio of 2.204).

Is it not like printing money? In modern world this is how money is made (from debt).

Second: This is more traditional way of making money. Printing notes by RBI.

So what is the problem? Isn’t the money generation looking to easy?

Banks can give loans like mad (2.204 times their deposits) and RBI can just print notes. Simple.

The ease with which money is made these days is the main flaw in our banking system.

What is the root cause? Fractional Reserve Banking.

What is the problem in RBI printing notes?

RBI is one of the most respected organisations in India. No doubt in their ethics.

It is this RBI that has given us stalwarts like Bimal Jalan, Raghuram Rajan, Subbarao etc.

But the problem is, what is the value of notes that RBI is printing?

What are notes? A piece of paper with some numbers on it. Who decides, if the note is worth that number printed on it.

RBI & Government makes us believe on those numbers. Yes, valuation is based mostly on believe. How I say it?

Before explaining that, let me present a simple example.

If one wants a personal loan of Rs.40 lakhs, following facts will be checked.

- Income Levels: Say it is Rs.1 lakh/month.

- Asset: Say a property worth Rs.50 lakhs.

This person will easily get a loan of Rs.40 lakhs. why?

Because his/her income level is enough to pay the monthly EMI’s. Moreover, there is also a back-up of asset. If anything goes wrong, back can seize the property.

So the point is, when we plan to take a liability (loan), there are many cross checks.

But when RBI takes a liability (every note issued by RBI is its liability), there are fact checks done? I don’t think so.

That is why I say, notes can be printed too easily in our flawed banking system.

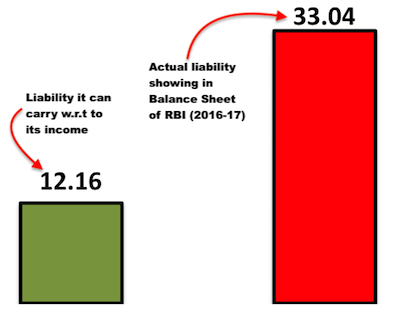

Lets check the asset and income level of RBI:

- RBI’s Income minus Expense (profit) = Rs.0.306 Lakh Crore.

- Total Assets of RBI: Rs.33.04 Lakh Crore

- Gold: Rs.1.32 Lakh Crore

- Investment: Rs.31.245 Lakh Crore.

- Others: 0.475 Lakh Crore.

What does this numbers prove?

Income: From this perspective

In todays scenario, a common man who earns Rs.1.0 Lakhs per month can get a loan (carry a max liability) of Rs.40 lakhs (say).

Using a same analogy, a bank earning Rs.0.304 Lakh Crore per month can carry a liability of Rs.12.16 Lakh Crore.

But RBI is carrying how much liability? As per FY 2016-17

- Notes Issued: Rs.15.063 Lakh Crore.

- Other Liability: Rs.17,977.63 lakh Crore.

- Total Liability: Rs.33.04 Lakh Crore.

Asset: From this perspective

In todays scenario, a common man who’s earning is not much, but has an asset worth Rs.100.0 Lakhs.

Upon hypothecation, how much maximum loan this person can get? Lets say 80% of asset value (Rs.80 Lakhs).

Using a same analogy, a bank having an asset worth Rs.33.04 Lakh Crore can carry a liability of 80% of 33.04 (Rs.26.432 Lakh Crore).

But RBI is carrying how much liability? Rs.33.04 Lakh Crore.

The difference between allowable liability (Rs.26.432) Vs actual liability (Rs.33.04) is not so much. So it means everything is right?

Well, I hope I could say that.

Conclusion

What we have seen here is really alarming.

We work to earn money. What we do with this money?

We use it to buy goods and services. Means, in exchange for money, others give us their goods and services.

But why people agree to part away with their goods in exchange for money?

Because they consider money of some value.

What happens if the value of our money suddenly drops to zero (like it has happened in Zimbabwe recently)?

We will not be able to buy any goods and services. This is called devaluation of money.

Our present banking system is flawed as it allows our money to become devalued over time.

The reason is not only inflation. The bigger demon is the way banks issue loans (fractional reserve banking).

As a common man what we can learn from this? One must not rely totally on our banking system.

It is essential to diversify our investments between:

- Currency based investments &

- Hard assets.

Equity and debt based investments are examples of currency based securities.

Real estate, gold etc are examples of hard assets. One must always keep ones investment well diversified.

Suggested Reading:

Thoroughly enjoyed this article, Mani.

More or less the same was the concept of Mr.Yuval Noah Harari in the Book “Sapiens”.

Thanks

So how come fractional banking does not cause inflation?

Sure it does. Inflation is the net effect of such a system