In this blog post I will talk about Focused Mutual Funds. So why I am referring to Sun Pharma stock here? Because it will help me explain the utility of focused mutual funds in a perspective.

In last weeks, I read about Sun Pharma stock in a newspaper. They are considering that, this stock might be trading at undervalued price levels. Hence, it can be a good buy for long term.

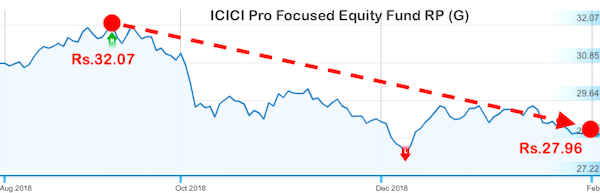

There is a focused mutual fund called “ICICI Pru Focused Equity Fund (G)“. In last 5 months (since Sep’18), the NAV of this Focused fund has fell from Rs.32.07 to Rs.27.96 (fall by more than 12.5%).

The reason for the NAV fall of this Focused fund is attributable to Sun Pharma stock. How? Back in Sep’18, ICICI Pru Focused Equity Fund had close to 13.5% exposure in Sun Pharma.

In the same period (between sep’18 & feb’19), Sun Pharma stock’s price have tumbled from Rs.678 levels to Rs.415 levels. This is price fall of more than 38% in last 5 months.

Some might ask here, why ICICI Pru Focused fund had such high stakes (13.5% holdings) in Sun Pharma? Generally speaking, a typical muti-cap fund limits its exposure below 5% in a single stock.

So why ICICI Pru maintained such high stakes, was it a mistake? No, it is not a mistake, because this is how focused funds operate.

What are focused mutual funds?

Focused mutual funds maintains a relatively concentrated portfolio. They hold not more than 25-30 stocks of companies at a time. This eventually also limits their exposure to too many sectors.

Focused mutual funds objective is to generate capital appreciation in long term by channelising their attention on few good stocks. They do a detailed stock research, and include only their best stocks in the portfolio.

Generally, a multi-cap fund can have 75+ stocks in their portfolio. But focused funds makes it a point that they do not over-diversify their portfolio.

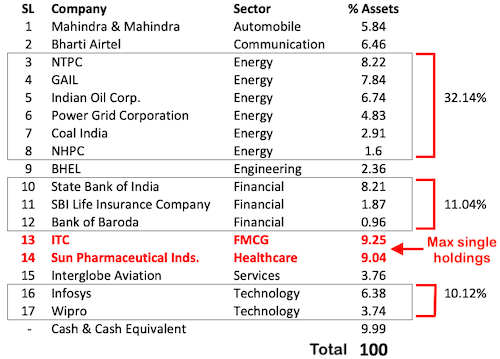

Example: Portfolio composition of ICICI Pru Focused Fund is shown below:

Who should invest in focused mutual funds?

There are two types of equity investors who dominate the equity market.

- First: Who invest directly in individual stocks.

- Second: Who invest indirectly in stocks via diversified mutual funds.

Investors in direct stocks has a very high exposure to the risk of loss. Why? Because if the stock performs badly, there is no fall-back alternative. The investor is bound to make a loss. But if the stock performs well, there can be windfall gains.

Investors in diversified funds has relatively lower exposure to the risk of loss. Why? Because the portfolio of the fund has mix of several stocks (50-100 numbers). Hence, bad performance of one stock gets neutralised by other good performing stocks.

Hence diversified funds are much more safer than direct stocks. But their potential to give ‘high returns’ are also limited (unlike direct stocks).

Now, here comes the third type of investors. They are neither as ambitious as direct-stock investors, nor as risk-averse as diversified-fund investors. Where such investors can invest their money?

These type of investors can invest in focused mutual funds. Why?

Because investing in focused funds will prevent the over-exposure in single stock, and would also ensure some diversification benefits.

So risk averse equity investors should not invest in focused funds?

I personally would not like to tag focused funds as “not suitable” for risk-averse investors. Why?

Because, again there can be two types of risk averse ‘equity’ investors.

- Risk averse – but can hold on to the units for 5+ years.

- Risk averse – but can hold on to the units only for less than 5 years.

For me, focused funds are not for the latter. But people who are ready to hold on to their units for 5+ years should consider focused funds for sure.

Why focused funds are not for the latter? Because in shorter time horizons (< 5 years), the NAV of focused funds can be very volatile. Means, more often there is a possibility that the portfolio shows negative returns.

Why focused funds is for the former? Because, for these investors near term volatility will not make a difference. Why? Because they are anyways going to hold the units for 5+ years.

When one is investing in focused funds (same as direct stocks), long term holding periods shall be ensured. This will ensure above average returns.

When holding period is more than 5+ years, such concentrated and actively managed portfolio has high chance of generating above average returns.

Focused funds are always very volatile?

Not all focused funds will be as volatile. Why?

Suppose there is a focused fund which holds only 25 stocks in its portfolio. All these 25 stocks are such stocks whose beta (measure of volatility) is low (say < 0.9). What do you think, how volatile will be the NAV of this focused fund?

For sure, this fund will be more resistant to price fluctuations with respect to stock index’s movements.

So, depending on the ‘beta of the portfolio‘ of focused fund, a risk averse investor can take a buy decision. How?

For a risk averse investor, a beta of say 1+ means danger. But a beta like 0.85 shall be ok, right?

Example: Beta of Portfolio of few mutual funds:

- ICICI Pru Bluechip Fund: 0.93

- ICICI Pru Multicap Fund: 0.87

- ICICI Pru Mid Cap Fund: 0.83

- ICICI Pru Small Cap Fund: 0.98

- ICICI Pru Dividend Yield Fund: 1.03

- ICICI Banking Fund: 1.05

Conclusion…

Focused mutual funds can work as a good alternative to direct stock investing.

Recently there are few stocks whose stock prices have tumbled down by more than 30%. Which are these stocks?

| SL | Name | Current Price (Rs.) | % Change from 52W High Price |

| 1 | Vedanta | 161.45 | -53.13 |

| 2 | Sun Pharma | 412.75 | -39.19 |

| 3 | JSW Steel | 273.3 | -35.52 |

| 4 | Indian Oil | 134.7 | -34.69 |

| 5 | Tata Steel | 470.6 | -34.69 |

These are all large cap stocks. But their prices have remained very volatile in last 12 months, for valid reasons.

Hence it might me possible that, an investor might be tempted to buy these stocks, considering them as undervalued. But there will also be confusion. Why?

Because stocks like Vedanta, Sun Pharma, Indian oil, steel sector stocks, has their own share of concerns. A small retail investor may not want to get stuck with a potentially sick stock in long term.

The biggest dilemma with majority small investors is that, they do not know which stock is sick, or otherwise. But they also do not want to miss the available opportunity.

Such investors can take a position by investing in focused funds, which can have high stakes in such stocks. Example: ICICI Pru Focused Equity Fund has high stakes in Sun Pharma.

List of Few Focused Funds and their single largest holding…

(Updated on: 05-Feb’2018)

| SL | Focus Fund Name | Single Largest Holding | Single Largest Holding % | Fund’s ROI (Last 5Y) % |

| 1 | Reliance Focused Equity Fund (G) | SBI | 9.54% | 23.30% |

| 2 | Quant Focused Fund (G) | L&T | 9.77% | 20.30% |

| 3 | Franklin Focused Equity F (G) | SBI | 9.84% | 20.10% |

| 4 | SBI Focused Equity Fund (G) | HDFC Bank | 9.19% | 19.80% |

| 5 | JM Core 11 Fund (G) | Titan Co. | 9.89% | 19.40% |

| 6 | Axis Focused 25 Fund (G) | HDFC Bank | 8.62% | 17.30% |

| 7 | ABSL Focused Equity Fund (G) | HDFC Bank | 10.17% | 16.60% |

| 8 | M.Oswal Focused 25 Fund (G) | HDFC Bank | 9.56% | 16.60% |

| 9 | Principal Focused Multicap Fund (G) | HDFC Bank | 7.50% | 15.50% |

| 10 | Sundaram Select Focus (G) | HDFC Bank | 9.58% | 14.60% |

| 11 | HDFC Focused 30 Fund (G) | Infosys | 7.78% | 14.50% |

| 12 | IDFC Focused Equity Fund (G) | ICICI Bank | 7.90% | 13.80% |

| 13 | ICICI Pru Focused Equity Fund (G) | ITC, Sun Ph | 9.25%, 9.04% | 13.50% |

As Focused funds come under the category of actively managed funds, hence their “expense ratio” is higher. On an average, a focused mutual fund will have an expense ratio of 2.35%.

Have a happy investing.

Hi Mani, I am following your publication from last 4 years. I don’t know how to contact you. I am planning for long term mutual fund > than 10 years to mitigate my interest charges for home loan taken. Can you suggest something thing.

Interest mitigation is best done through loan prepayment. Read more about it here. Thanks for asking.

good coverage

Hats off..very nice.