‘Authorised Share Capital’ and ‘Paid Up Share Capital’ are two terms that we as investors must know about. Why? Because changes in the numbers of these metrics can effect our investment returns (read here).

Company needs capital to establish its assets and run its operations. From where the company will source its capital? It can be done in three ways?

First, the company can issue share in the market. This type of accumulated fund is called share capital. It is here that the terms authorised capital and paid-up capital find its relevance. We will read more about it in this article.

Second form of capital generation can be by retaining the profits of the company. In our balance sheet it is represented as “Reserves” or retained earnings. Read: How company use retained earnings.

Third form of capital generation is debt. Here the company approaches banks or NBFC’s etc and seek loans. Read: about debt free companies.

Before we go and see authorised and paid-up capital from point of investors, let’s get an introduction of authorised capital and try to visualise how it is related to its other entities.

Relationship: Authorised, Issued, Subscribed & Paid-Up Capital

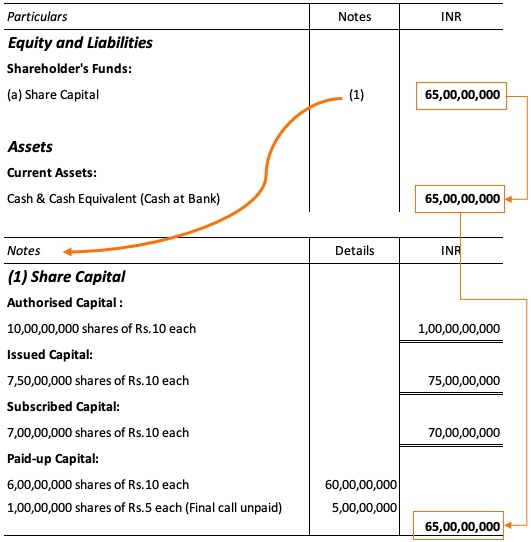

- Authorised Capital (AC): When a company is formed and registered, a legal document is prepared called Memorandum of Association (MOA). Authorised Capital is indicated in MOA. As per MOA, the maximum capital a company can raise by issuing shares to public is capped as Authorised Capital. Amendment of AC can be done by taking the consent of shareholders. For example sake, lets’ say AC is Rs.100 Crore for a company.

- Issued Capital (IC): When the need comes, a company can issue its shares and generate capital from shareholders. But the issued capital shall be less than the Authorised Capital. Example, say the company issued shares worth Rs.75 Cr out of the total AC of Rs.100 Cr.

- Subscribed Capital (SC): Company can issue its shares in the market, but it is not necessary that all issued shares will be taken/subscribed by investors. Though for good companies, issued shares can also get oversubscribed in IPO. So, subscribed Capital is a portion of issued capital which people has applied for purchase during IPO. Example, say the company issued shares worth Rs.75 Cr out which only Rs.70 Cr worth shares was subscribed. This is an example of undersubscribed IPO.

- Paid-up Capital (PuC): There can be three steps of subscription for the shareholders. It means, the shareholders will have to pay to the company in three steps. These steps can be (a) Upon application, (b) On Allotment, & (c) On Call. Suppose few subscribers failed to pay the last instalments. In this case paid-up capital will be less than the subscribed capital. For example, consider paid-up capital as Rs.65 Cr. out of the total subscription of Rs.70 Crore.

Example

Suppose company ABC was formed with an authorised Capital of say Rs.100 Crore divided into 10 crore number shares of Rs.10 each (Face Value). The Company issued 7.5 crore number shares to public with intention to raise capital worth Rs.75 crore (issued capital). Read: about shares issued at premium.

Money will be collected from public in following instalments:

- Rs.3: On Application.

- Rs.5: On Allotment.

- Rs.2: On Final Call.

Upon public issue of shares in IPO, it was found that only 7.0 crore number shares were subscribed by public, which means a subscribed capital of Rs.70 Crore. The balance 0.5 crore number shares received no application.

Moreover, out of the total subscribed capital, about only Rs.65 Crore got paid (Paid-up Capital). A schematic representation of the capital structure is shown in the above infographics.

To make it more interesting, let’s see how the above capital structure is written in the book of accounts (Balance Sheet) of the company. The way entry is done, gives great clarity about the concept of authorised vs paid-up capital.

What happens to unsubscribed share capital in IPO

First of all, it must be remembered that all IPO’s must be at least 90% subscribed on the date of closure of the offer. If this threshold is not reached, then the company will have to refund all money back to the investors. Investors will see no loss.

Secondly, if IPO is subscribed by 90% or more, in this case what happens to the balance capital (10%)? There can be two things that can be done:

- Lowering of Issue Price: If the shares are issued at a premium, then company may lower its issued price. The lowering in price may attract more investors and thus the whole IPO may get subscribed. Though in this case, the issuing company will generate less capital than their target.

- Underwriters will buy: Underwriters are basically investment banks who manage the IPO for the company. The company may ask their underwriters to buy the unsubscribed shares for the moment.

Company’s Balance Sheet

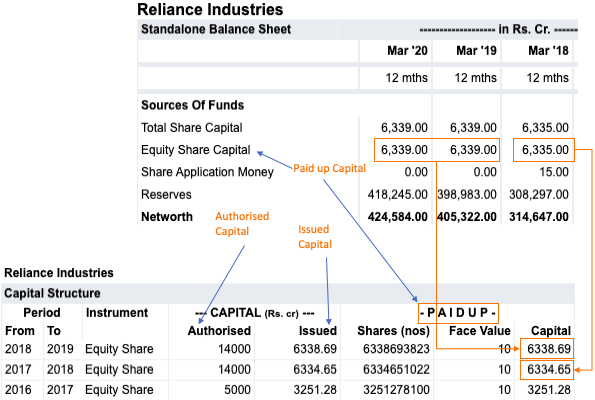

To make this discussion on Capital Structure more practical, allow me to show you a snapshot of Reliance Industries (RIL). In the snapshot you will see two things: (a) Balance Sheet and (b) Capital Structure Schedule.

We will use these two snapshots to see a correlation between how the numbers are indicated in the balance sheet, and how the company has issued its shares (Authorised, vs issued, vs paid-up capital).

In the snapshot you can see three numbers very clearly:

- Authorised Capital: RIL’s authorised capital is Rs.14,000 Crore. Face value of each share of RIL is Rs.10. It means that, total number of shares available for issue with RIL is 1,400 crore numbers (=14,000/10). Now we will see, out of these 1,400 crore number share, how much is already issued by RIL for subscription.

- Issued Capital: RIL’s capital schedule report is showing an issued capital of Rs.6,338.69 Crore. At a face value of Rs.10/share, total number of shares issued by RIL as on date is 633.869 crore number shares. It means, RIL has issued only 45.27% (=633.869/1400) of their total Authorised Capital.

- Paid-up Capital: You can see in the balance sheet, what is showing there is the company’s paid-up capital. For a famous company like RIL, their issued capital and paid-up capital are often the same value. Why? Because IPO’s of these company’s are often oversubscribed.

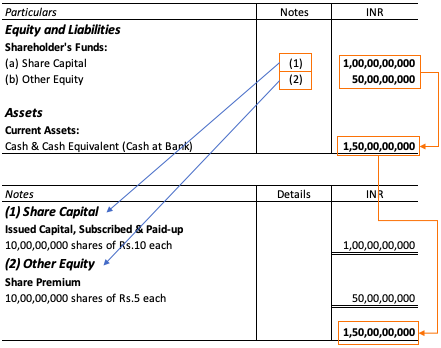

How Accounting is done when shares are issued at a premium in IPO?

What it means when shares are issued at premium? In this case shares are issued above it face value.

Issue Price = Face value + Premium

When a company issues its shares at a premium, the fund thus generated are shown in company’s balance sheet a bit differently. We will understand this using a hypothetical example of a company.

- Face Value = Rs.10 per share.

- Nos. of shares issued = 10 crore number.

- Issue Price = Rs.15 per share.

- Premium = Rs.5 (15 – 10).

In this case, there will be two line items under equity. First, Equity Share Capital of Rs.100 crore (10 crore nos x Rs.10 face value). Second, Share Premium Account of Rs.50 crore (10 crore nos x Rs.5 premium price).

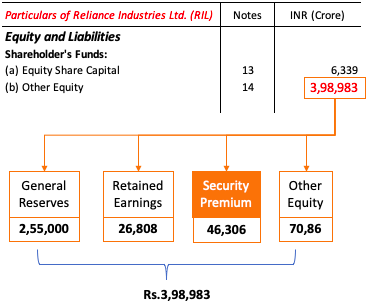

Allow me to show you how Reliance Industries shows a break-up of the equity in their balance sheet. In the balance sheet of RIL, total equity is shown as Rs.4,05,322 (=6339+398983). Out of these Rs.4,05,322 a part is accounted as ‘share capital’ (Rs.6,339 Cr) and balance is shown as ‘other equity’ (Rs.3,98,983 Cr).

It is in the “other equity” segment where we can see one of its break-up being counted as “share premium“. For RIL, Rs.46,306 Crore is accounted under share premium account.

Seeing ‘Equity Share Capital’ From The Point of View of Investors

When a company’s balance sheet displays a sporadic increase in share capital year on year, more often than not, it is a bad sign. Why? Because increase in share capital means the company is issuing more shares. More shares issue dilutes the value of existing shareholders.

Having said that, it is also true that issuance of new shares is not always a bad thing. This is particularly true for well managed companies. Such company’s, when they issue more shares, from their basket of authorised share capital, shareholders know that it is done for long-term good of all stakeholders (see here).

What can be the long term good of the shareholders:

- Increase in dividend yield over time.

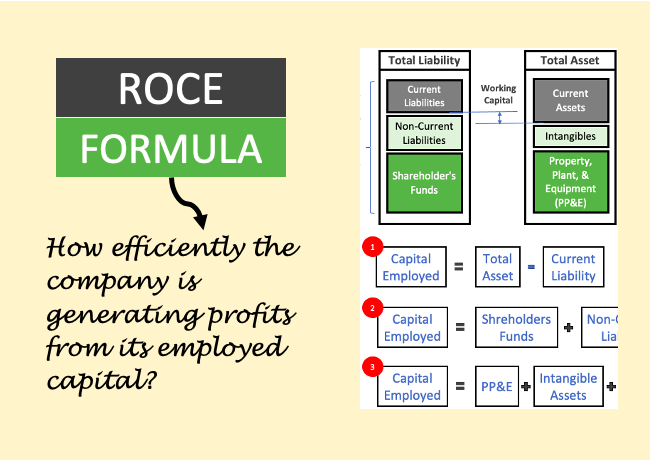

- Improvement of the company’s ROE & ROCE resulting in higher capital appreciation in tomes to come.

But only few companies can claim this distinction. For most of the other companies, share-issue is rampant and often goes miss-managed.

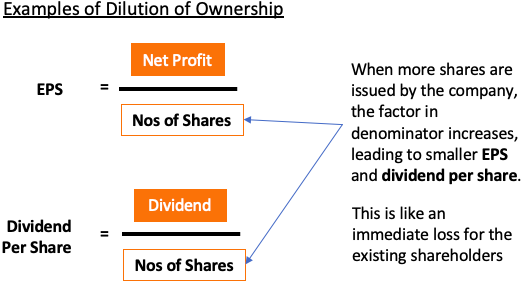

Dilution Of Ownership

When more shares are issued, existing shareholders are at disadvantage. Why? Because this way their proportionate claim on the company’s earnings (ownership) gets reduced. Hence, their shareholding becomes less valuable. This is the reason why, before a company can issue more shares to public, it needs a majority approval of its existing shareholders.

But unfortunately, for most public companies, among the board of directors itself, there is a majority shareholding. It means small retail investors like me and you are left high and dry. Little we can say or do when company’s decide to raise capital by issuing more shares – and diluting our ownership.

Alternate way to look at increasing share capital

Till share capital is not increasing abysmally, we shareholders should not worry about it a lot. What we can do to check if everything is going okay or not? We can compare the increase in share capital with a proportional increase in the following fundamentals:

- Sales.

- Operating Profit.

- EPS.

- Operating Cash Flow.

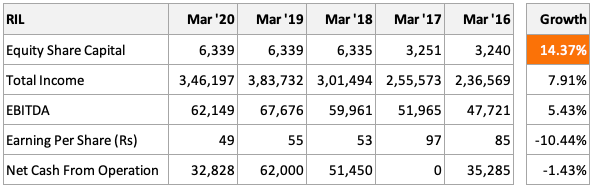

The above screenshot shows a comparison of 5 years trend of RIL’s equity capital growth vs other growth rates. In last 5 years, share capital has grown @14.37% p.a. But this growth rate has not got translated into a compareable income growth, profit growth, or even cash flow growth.

This is an example of numbers that we would not like to see as an investor when we compare equity share capital increase with other other financial metrics.

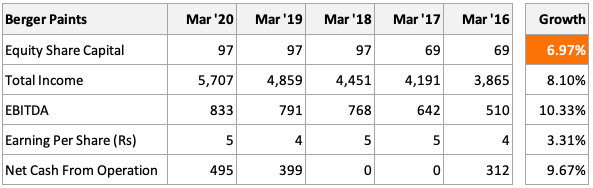

A comparatively better example of growing share capital translating into growth of other financial metrics is seen in BERGER PAINTS. Check its snapshot shown below. By looking at these numbers, we can say that the company is utilising its share capital reasonably (though low EPS growth rate is a concern).

Conclusion

Authorised Capital and Paid-up Capital is more used as financial jargons among people. But jargons do not actually help in making wise investments. What can help is a detailed understanding of capital structure.

This is the objective of this article. It helps us to realise the relationship and differences between authorised, issued, subscribed and paid-up capital. This knowledge will help us to read and interpret the balance sheet of a company. This is why I’ve tried to explain the concept using real life examples.

More importantly, I’ve explained why investors should be concerned when they see a rising trend of share-capital in company’s balance sheet. It is a indicator that the shareholders benefits are getting diluted.

But increasing share capital is not necessarily bad. How to confirm that? By seeing if the increase in share capital has contributed sufficiently for the company’s future growth (see here).

Suggested Reading: How a beginner can start investing money.

Nice one

Very informative article sir

VERY NICELY EXPLAINED. ALL DOUBTS ARE CLEARED

Thanks