The objective of this article is to highlight the use, effectiveness, and limitation of a Bad Bank. For the shareholders of banking stocks, especially government banks, it is interesting to know why the concept of Bad bank was introduced in India. If this Bank will function well, it has the potential to wash out the NPAs of the commercial banks.

Introduction

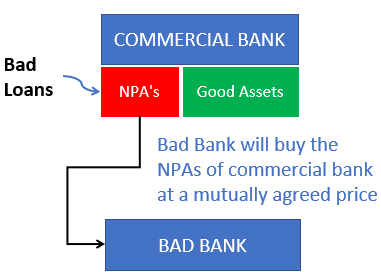

A Bad Bank does not function as a standard bank. It does not take deposits or lend loans. Its purpose is to buy the NPAs of commercial banks. The taken-over NPAs are then managed in a way that a part or all of the loan outstandings are recovered.

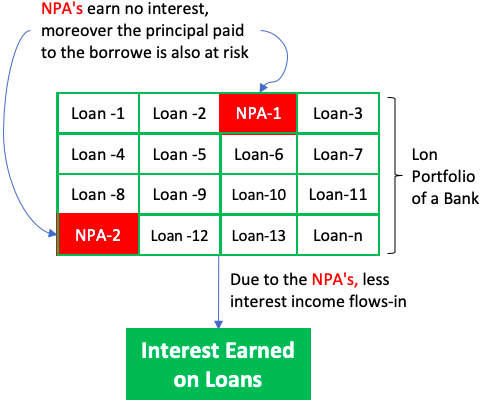

Before we can discuss Bad Banks, allow me to talk about the NPA (Non-Performing Assets). NPAs are those loans that are not earning any interest for commercial banks. Moreover, for NPAs, the loan’s principal amount is also at risk.

The concept of a bad bank is not new in India. As of Jan’2023, India has about 29 number ARCs (Asset Reconstruction Companies) listed with the Reserve Bank of India (RBI). Corporate names like Reliance (Anil Ambani Group), Aditya Birla, Edelweiss, Indiabulls, JM Financial, etc are registered as ARCs. These ARCs actually function like a Bad Bank.

What is the difference between a Bad Bank and ARCs? All the ARCs who are registered with RBI to date are private companies. For the first time, an Indian government entity is registered with RBI to function as an ARC. The Government’s term for its ARC is “Bad Bank.”

When so many private ARCs were already available, why the Indian government is setting up a Bad Bank?

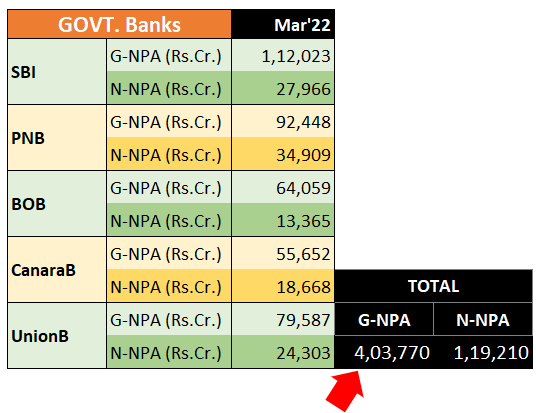

The total gross NPA of the five big government banks in India is about Rs.4.03 Lakh Crore. The existing privately funded ARCs do not have sufficient funds to take over the NPAs of these banks. Hence, the government of India has stepped in to establish its own ARC, a Bad Bank, to help these banks clear their balance sheets.

Video [Hindi]

NPAs in Government Banks of India

It is normal for banks to encounter few NPA from their pool of performing loans. It is an unavoidable happening. Generally, banks keep a provision for their NPAs. It is a manageable situation.

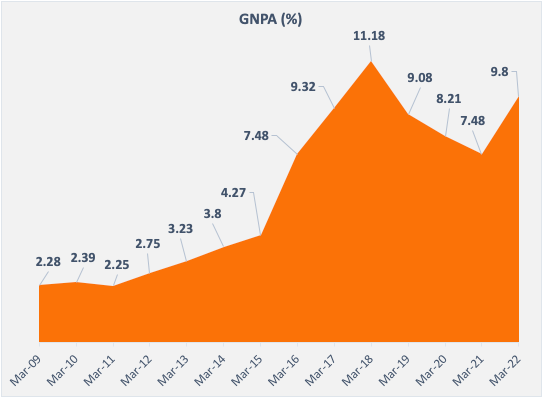

You can see the level of Gross NPA between FY’09 to FY’14. It was kind of stable between 2.25% to 3.8%. But post FY’14, the GNPA of banks is rising steeply. In FY’18 it peaked at 11.18%. After that, there is some cooling down happening. This is because the Banks are taking the hit and writing off some of their NPAs. The provisions kept by the banks are not enough to take care of when the gross NPA numbers cross 7%-8%.

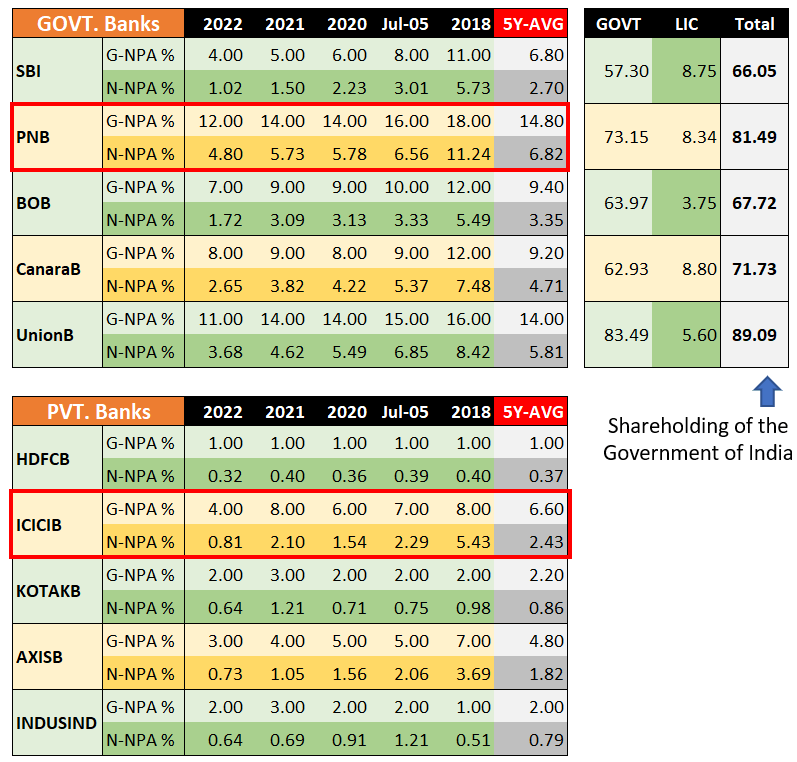

Here is a dataset for the top five government banks of India related to their NPAs. I’ve compared their NPAs with five private banks to give you a perspective on the NPA problem of the government banks.

Compared to the private bank’s NPAs, the NPA level of the government banks is very high, both in percentage and absolute numbers. Hence, the Government of India (GOI) had to intervene to resolve the NPA issue.

Moreover, you can see the stake of the GOI in these banks. It ranges from 65% to 90%. GOI cannot ignore the NPA levels of the public sector banks. GOI , the country, needs the banks to operate at healthy levels.

The Origin of Bad Bank

The roots of a Bad Bank are in the SARFAESI Act of 2002. SARFAESI is an abbreviation for the “SECURITISATION AND RECONSTRUCTION OF FINANCIAL ASSETS AND ENFORCEMENT OF SECURITY INTEREST”. SARFAESI act was passed to tackle the problem of growing NPAs in India. The Act provided banks and other financial institutions with a road map for the recovery of their bad loans.

The act also allowed the formation of Asset Reconstruction Companies (ARCs). In 2002, India’s first ARC was established called ARCIL. Henceforth, multiple private companies were registered with RBI as ARCs.

Banks were allowed to pass on their NPAs to ARCs. These ARCs in turn could approach the borrowers and manage the settlement of the outstanding loans. SARFAESI Act was applicable only to secured loans. For non-secured loans, like personal loans, the route of CIVIL COURT is the only alternative.

Functioning of Bad Bank

The primary function of a Bad Bank is to take over the NPAs of the commercial banks (only government banks) in its books. Once the NPAs are taken over, their outstanding are either strategically collected or their underlying assets are liquidated for cash for the loan recovery.

This way, the commercial banks will get rid of their bad loans (NPAs) thereby they can focus more on their core business and its growth.

The NPAs offloaded by commercial banks are not just written off. The payouts from these NPAs will come over time (read here).

Bank’s Core Business and NPA

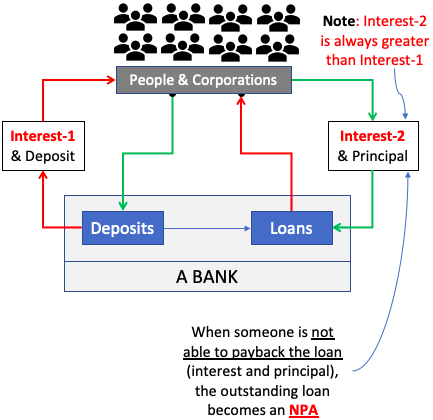

The core business is to accept deposits and offer loans. The deposits are kept in the bank for a period. After the tenure is over the deposit is returned to the depositor along with the accrued interest. The loans are issued by banks to people and corporations. During the loan tenure, people repay the loan to their banks in the form of EMIs.

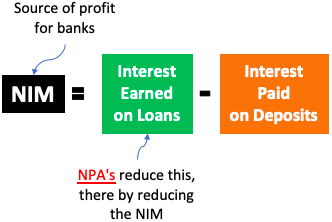

The interest charged on loans is more than the interest paid on deposits. This is what is called the net interest margin (NIM) of a bank. The higher the NIM, the greater profit a bank will make.

When some loan EMI stop flowing in, they become NPAs. After this, commercial banks need to manage these NPAs. Banks get distracted from rendering their core business activity of accepting deposits and issuing loans when NPA starts to accumulate. A large resource of the bank gets engaged in the activities related to NPA management. On one side, the NPAs reduce the bank’s NIM, on the other side it is also increasing the bank’s cost of doing business. A Bad Bank taking over the NPAs of a commercial bank is a boon for the banking sector.

NARCL and IDRCL of Bad Bank

A Bad Bank’s purpose is to help resolve the problem of non-performing assets (NPAs) and bad loans in the banking sector. The government of India established Bad Bank to act as intermediaries for acquiring and resolving NPAs from banks and financial institutions. The aim is to reduce the NPAs on the books of the banks, improve their financial health, and reduce the risk of loan defaults.

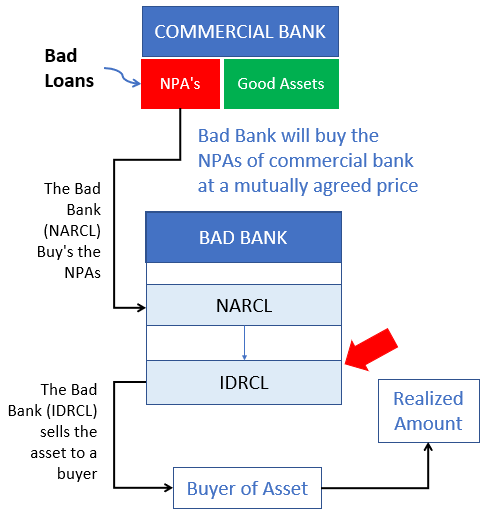

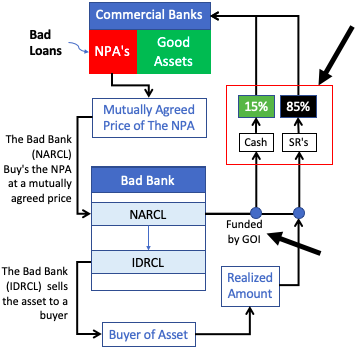

A Bad Bank comprises of two sub-units, NARCL and IDRCL. How NARCL and IDRCL are different from each other?

The NARCL

NARCL is an abbreviation for “National Asset Reconstruction Company Limited.”

NARCL’s primary job is to get in touch with commercial banks, especially government banks, and negotiate the transfer of NPAs. After a positive conclusion of the negotiations, commercial banks transfer their NPAs to Bad Bank at a mutually agreed price.

The IDRCL

IDRCL is an abbreviation for the “India Debt Resolution Company Limited.”

The function of IDRCL starts after the NPAs get transferred to the books of Bad Bank. The primary job of IDRCL is to handle the resolution process. It’s first job is to contact the borrower and discuss the possible repayment plan. If necessary, IDRCL will formulate a debt resolution plan by liquidating the underlying assets of the loan. They are responsible for conducting the auctions and selling the debt-linked assets for cash. The liquid cash so generated will then be used to clear the outstanding dues of the commercial banks.

Benefits Transferred To Commercial Banks by The Bad Bank

Suppose the book value of an asset (attached to a loan) is say Rs.500 crore. But NARCL may not want to acquire the loan and its asset at the book value. So they will explain their limitation to the commercial bank. At this point, both NARCL and the bank must reach an agreement.

Why Banks will agree to a lower price than the book value? Because for banks, anyways the asset is not generating any income (NPA). Moreover, to liquidate the hypothecated asset attached to the loan, they would have to fight a long legal battle. So, the bank may find it suitable to transfer all rights of the asset and the loan to the bad bank, and in turn, pocket some cash.

Bad Bank can offer the payment terms of 15% cash and 85% Security Receipts (SRs) to the commercial banks.

15% of the agreed price will be paid to the bank in cash. To enable this cash transfer, the government has agreed to fund Rs.30,600 crores to the Bad bank. This amount has already been declared by the government as a guarantee for the Bad Bank’s smooth functioning.

IDRCL will try to sell underlying assets of the loan in the market. The sale proceeds will then be used to pay the balance 85%. Once the loans get recovered by IDRCL, commercial banks can redeem their SRs for cash.

In case the bad bank could sell the asset only at a loss, how the bank will get its full balance of 85%? The deficit will be paid from the government alloted fund of Rs.30,600 crores.

Updates About Bad Bank in India

- Registration with RBI: Bad Bank was registered with RBI on 04-Oct’21. But it could not take over any assets (NPAs) in FY22.

- Income/Profit: Between Jul’21 and Mar’22, NARCL reported revenue of Rs.9.6 Crore. The total expense of NARCL was Rs.16.3 Crore. This means NARCL posted a loss of Rs.6.7 Crores. The reported cash balance of NARCL was Rs.1,265 Crore. The majority of this cash was in FD and the balance in deposits. During this period these deposits earned an interest income of Rs.4.3 crore.

- First Milestone: The Indian Bad bank could take over its first asset worth Rs.9,234 Crore of Jaypee Infratech from multiple banks.

- Shareholders: Bad Bank is a GOI undertaking. Its shareholding pattern looks like this:

- 12.0% – Canara Bank

- 09.9% – SBI, Union Bank, BOB, & Indian Bank (each)

- 09.0% – PNB & BOI (each)

- 05.0% – Bank of Maharashtra, IDBI Bank, and ICICI Bank (each).

- NPA Outlook: NPAs of all commercial banks are estimated to decline by about 4% by Mar’2024. If NARCL and IDRCL begin to work effectively, the NPA percentage will go down further.

- Second Milestone: As of Jan’2023, NARCL has emerged as the highest bidder to take over the loans of SERI companies. In total, about Rs.32,000 crore loan was issued to SREI companies that eventually became NPA.

Conclusion

Bad banks are only the firefighters. They are not going to prevent banks from generating more NPA. At present, the majority NPAs are also the result of oversight and corruption within the bank. Hence, banks must be held accountable for their NPAs.

When Bad bank will come into force, there is a chance that banks may become even more complacent in issuing loans. Why? Because they know that if something goes wrong (NPA), it will be transferred to the bad bank. It will not reflect in their balance sheet. In the worst case, for PSBs, the GOI will recapitalize and infuse cash for the bank.

The concept of a bad bank looks good in the present scenario. But it does not tell how the PNBs, Yes Banks, DHFLs, IIF&Ls will not prop up in the future.

So as an investor, I’m keeping my fingers crossed. The hullabaloo created over bad banks looks good on paper. RBI and Finance Ministry has to play their part in making the banks (specially PSBs) work as per the rules.

[Note: Multiple Asset Reconstruction Companies (ARCs) are already operating in India. They function like a Bad Bank. So, why a new entity is required? All ARCs that are currently operations are privately managed. NARCL and IDRCL is a government entities. Moreover, they are funded by the government. Hence, may report better results than present ARCs.]

Have a happy investing.

very informative and well written

Nicely written…..

Thanks