You will like the investment strategy shared in this blog post. Why?

Because it is simple to understand, and also useful.

Why simple? Because you can visualize all steps involved in the process of investing.

Why useful? Because its simplicity will trigger you to start investing from today.

[Read: A definitive guide on saving money…]

The Investment Strategy

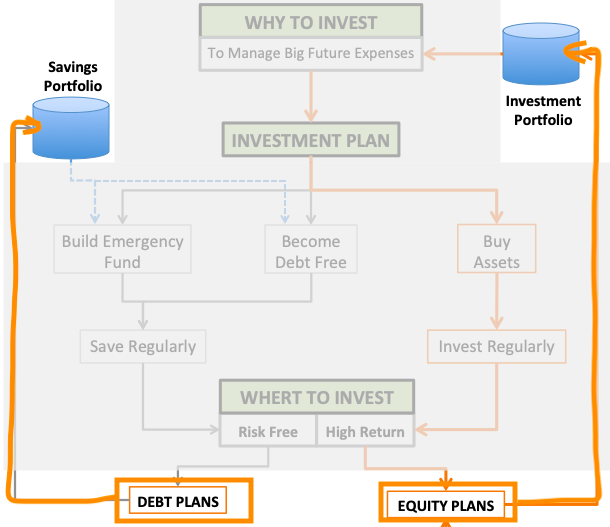

I will represent the strategy by means of a flow diagram.

Why you will like this strategy?

Because it not only talks about investment, but also talks about the related priorities that must run in parallel to investment.

Moreover, the use of flow chart (to explain the strategy) enhances the understandability of the concept.

Why this strategy is good?

What is a good strategy?

A strategy can become good only if it can present a plan to achieve a long term goal. Read: About long term investment strategy.

The above flow chart takes care of these two requirements:

Why I prepared this flow chart (my investment strategy)?

Because it helps me to see what comes where in investment.

It says..

- Why goal fixing comes first?

- How investment portfolio feeds the goal?

- How to build portfolios?

- When to invest in debt and equity?

- Save money for what?

- Invest money for what?

- Utility of savings & investment portfolio, etc.

I’ll suggest you to read the above questions and then see the flow chart.

I’m sure it will help you “see investments in a more objective way“.

Explanation: Investment Strategy

Instead of using words and long sentences, I’ve tried to explain the strategy using a flow chart.

Though this flow chart is self explanatory, but I’ll try to explain it in simple words.

To begin with, the flow chart asks the most important question…

1. Why to Invest money?

No investment strategy will succeed till it knows what is its objective.

How to identify the objective?

By answering this question – “I’m investing for what?“

What should be the answer? The answer is hidden in our needs of life.

These are not any kind of needs; these are those requirements which demand large financial involvement.

Few examples of such needs are as below:

Create a similar need-table for yourself.

Once the table is ready, quantify them in terms of money and date of requirement.

Quantified future needs becomes our financial goals.

Why we invest money? It is done to achieve the financial goals as desired. Read: Goal based investing.

Being aware of the goal enables us to frame a financial plan.

2. What is a investment Plan?

My flow chart handles this question in three steps:

- First: It shows two investment paths.

- Second: It highlights the associated priorities with investment.

- Third: It highlights the discipline required in investing.

Allow me to explain how these 3 steps pans out in our endeavour to decode investment strategy.

2.1 Two Investment Paths:

What are these paths?

Path 1 is the growth path.

Here the investment strategy is to invest with an objective of achieving the “expected long term capital appreciation“.

Path 2 is the savings path.

Here the person is not investing for growth, but for accumulation of savings.

2.2 Associated Priorities

What I mean by associated priorities?

When we are investing money, we cannot only think about investment in isolation.

There are two more things which must be handled in parallel with investment.

Though they may look unrelated – but it matter. Why?

Because if one does not manage these “associated priorities” along with investing, the investment itself will suffer.

What are these associated priorities?

- Building Emergency Fund: What is an emergency fund? Saving enough money to manage current expenses for the next 6 months. When monthly expense grows, the size of the emergency fund must also grow. What is the investment strategy to build an emergency fund? Save regularly (every month) till the goal is reached. Read: Where to keep an emergency fund.

- Becoming Debt Free: We keep accumulating debts in our life. It starts with credit card debt, home loans, auto loans, education loans, personal loans, etc. While we are investing money, it is essential to keep lowering our debts as well. Otherwise investing becomes almost meaningless. Why? Because often the “returns earned on investment” minus “interest paid on loans” is net zero. What is the investment strategy for becoming debt free? Save regularly and prepay the loan. Read: (1) Why to become debt free. (2) Loan prepayment guide.

While one is handling the above priorities, the investment must also continue.

What is done in investing? Purchase of quality assets. Read: About how to build assets and how to invest money.

2.3 Investment Discipline

No investment strategy will work till it is executed without a default.

How people generally default while investing?

They stop investing.

The key to make any strategy successful is to follow it regularly.

So, what is the takeaway from here?

No matter what comes in future, continue saving and investing on regular basis.

How to ensure regular investment/saving? Read more about it in the next section.

In #2 we have discussed about investment planning in general. Now we are ready to discuss the details…

3. Where to Invest Money?

To keep the process simple, I’ve considered only two types of investment vehicles: (1) Equity and (2) Debt. Read: about other investment options.

- Equity: Investing in equity will take care of growth. Though equity-based investing is associated with a risk of loss, but there is a way to manage it. How? A common man can do this in two ways: (a) By investing in equity based mutual funds through SIP route. (b) By continuing the contributions to SIP for at least 4-5 years before redemption. Read more:

- Debt: Investing in debt plans will build savings. Debt based plans are safe, means risk of loss is almost nil. But on down side, their returns are low. But considering that one needs these funds for “emergency” and “prepayment of loans” – investing is debt plans is necessary. Example of debt based plans are: (a) fixed deposits, (b) recurring deposits, (c) debt plans of mutual funds etc. Read more:

3.1 Investment Diversification

If a person can distribute funds between Debt and Equity in a right proportion, it’ll also take care of the required diversification. Read: About diversification.

When the strategy is to build two separate portfolios, investment and savings, diversification happens automatically (in initial years).

But in later years, it will be different.

When investment portfolio is bigger, one will need to buy debt plans even when there is no need.

What I mean by “no need”?

When emergency fund is big enough, and debt is also paid-off.

What a person must do in such a scenario?

Keep increasing the size of emergency fund to keep a balance between debt and equity.

How we can figure out the “balance”? Follow this formula:

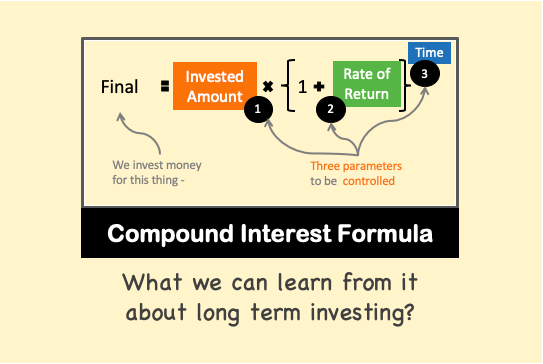

4. How to invest money?

When I ask myself “how to invest money”, what it means to me?

To me it’s about understanding a correlation between the following 3 things:

- Risk,

- Returns, and

- Degree of self involvement.

What is the idea behind this thought process?

When we are dealing with equity, understanding the correlation helps to estimate future returns more accurately.

So what?

When returns are estimated correctly, the investor will exactly know when the goals will get realised.

What is the correlation? Check this matrix:

What does this matrix say? It says, there are three options to “deal with equity“:

- 1st Option: Here the investor has figured out that the investment will be practiced with least self-involvement. Moreover, the person also wants to keep the risk of loss to minimum. In this case the person must be contented with only low returns. In equity, low returns means 10-12% p.a. in India. How to go about it? By doing a SIP in index funds or buying index ETF’s.

- 2nd Option: Here the investor’s self-involvement will be low. But he/she is ok with taking medium risks. In this case the person can earn average returns. In equity, average returns means 12-14% p.a. in India. How to earn these returns? By doing a SIP in multi cap funds.

- 3rd Option: Here the investor has assured high involvement. Such person keeps a track of ‘stock market movements’ and ‘related news’. The person is also open to high risks. In this case the person can earn high returns. In equity, high returns means 16%+ p.a. in India. Where to invest for such returns? SIP in mid cap or small cap funds.

4.1 Stay Invested for long term

When one is dealing with equity, holding it for long term is an essential preconditions.

How long is long term in equity?

My observation is that, a minimum holding time of 4-5 years is a must in equity focused investing.

Read more about How long is long-term in equity investing?

5. The Goal, and How Achieve them…

We are talking about the best investment strategy, right?

But we are doing this to achieve what?

We are doing this to build two portfolios, which in turn will help us achieve our financial goals.

Let’s see how my flow chart explains it:

- Two Portfolios: Which are the 2 portfolios? Investment and savings portfolio. How investment portfolio is built? It is continuously by being fed by equity purchased on path #1. How savings portfolio is built? It is continuously being fed by debt plans purchased along the years on path #2.

- Financial Goals: Which are the financial goals? There are 3 is total. (i) Meeting big future expenses, (ii) Building emergency fund, and (iii) Becoming debt free.

How the two portfolios and financial goals related to each other?

Investment portfolio feeds the big future expenses.

Savings portfolio builds emergency fund, and makes loan prepayments.

Conclusion

This article highlights a simple but effective investment strategy.

Why I think it is the best? Because it can guide people to achieve their financial goals of life.

The strategy discussed here talks about both growth investing, and risk free approach to portfolio building.

What I like best about this strategy? Why it works?

Because it establishes a clear correlations between different investment-activities.

These correlations in turn makes it very visible that what are the financial goals and how to reach those goals.

I hope you like reading about the investment strategy. In case you have any views/feedback about the article, please post it in the comment section below.

Have a happy investing.

Very well written blog.. Great work! Explained in depth. Would like to share a blog about- Goal based investing for millennials.

May God Bless you….Excellence in your article…

Excellent

Very..very useful informations Mani sir,keep educating us,

Do you give personal advices on stocks and Mutual funds (even if it’s a paid subscription),if so pls let me know,i shall be contacted on 8248041454,thx and stay safe sir.

simple at its best to beginners like me

Kudos

Uday

Thanks

Extremely enlightening post here .Such an extraordinary rundown! A debt of gratitude is in order for sharing!

Hi Mani, I’m seeing many articles and forwards on the downward trend of the economy. What is going to be the impact on MFs that people have been holding for long term( > 5 years)

Economy (GDP growth as an indicator) works in cycles. Investors should not worry about cycles. They should try to take advantage of it. Know more about how economy works (& what creates these cycles).

The guide book is a useful financial tool for the people who want to invest their money to achieve future goal.

Thanks for taking time to comment.

Great post! Thanks for sharing the article and keep up the good work.

Thanks for taking time to comment.

Good one..

Thanks