This home loan prepayment calculator gave me the inspiration to become debt-free. Now, after years of painstaking focus and persistence, I am finally debt-free. It is a different life.

How I’ve reached this stage? My home loan prepayment calculator made it possible. How? It all started in the year 2012-13.

While we were developing this prepayment calculator in excel, I pledged to become “debt-free” one day. I had enough of EMI payments. It used to eat a big chunk of my take-home salary. I wanted to end my misery. Yes, that feeling of EMI deductions was miserable for me. Why? Because I used to live in fear of it.

Today, there’s no need to live in fear of “what will happen if I default on my home loan“. No automatic EMI deductions anymore. Read more about what happens if the loan is not paid.

- Utility of prepayment calculator.

- Prepayment is good, loan is bad.

Utility of Prepayment Calculator

When I was first building this calculator on my excel sheet, I sort of had this premonition that, I am working on something important. Why? Because I could gauze the potential of it.

What was the potential? Its ability to give us the visualisation of the kind of savings we can make from loan prepayments. How?

This is what we will see in this article.

But before that, a word of thanks to my brother. He was the one who helped me to convert my “excel based prepayment calculator” into an online tool. That was the time I first decided to write a blog post on home loan prepayment.

Prepayment is Good, But Loan is Bad

In my attempt to talk good about ‘loan prepayment’ I’ll not like to convey a wrong impression about ‘loans’. Loans of any type are bad. Period. But we can learn to convert a home loan into a great “asset building tool”. How?

Take home loan, buy a property. Make prepayment, and clear the loan within 4-5 years.

This thought process is necessary, as loan on its own are almost evil. How? Because loans make us buy things we can’t afford. Read more about how to identify debt trap.

One thing which makes loans dangerous is the interest burden it imposes on the borrower. Let’s know more about the interest burden? Read more about why to become debt free.

1. The Interest Burden

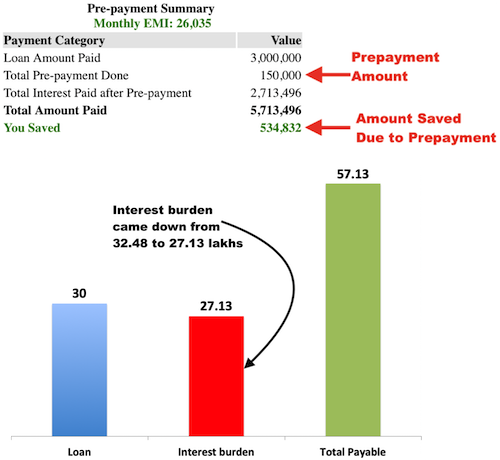

Suppose a person took home loan of Rs.30 lakhs @8.5% p.a., for 20 years. On this loan amount, what is charged as interest is a whopping Rs.32.48 lakhs. This is more than the loan amount itself. As a result, what the person has to payback to the bank? Rs.62.48 lakhs.

This is what one has to minimise – the interest burden. The lower will be the interest burden, lesser will be the overall payment made to the bank. How to minimise? By prepayment. Read more about reducing balance method of interest calculation.

2. Lowering of Burden Due to Prepayment

Consider the above case, where a person took a home loan of Rs.30 lakhs @8.5% p.a., for 20 years. Suppose this person made a prepayment of Rs.150,000 in the first 12th month. Due to this prepayment, he could save Rs.534,832 on interest. See how the interest burden is lowered from Rs.32.48L to Rs.27.13L. Read more about whether to reduce EMI or Tenure upon loan prepayment.

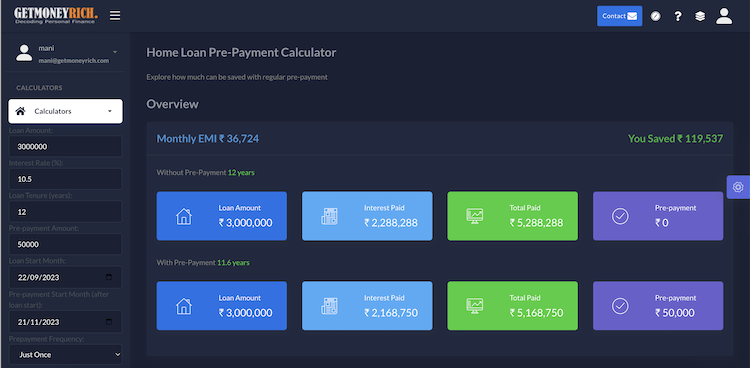

3. Visualise Savings Using The Calculator

Till now what you have seen is the ‘potential savings’ that you can make if you prepay your loan. Like in our above example, the person make a prepayment of Rs.1.5 Lakhs and saved Rs.5.34 Lakhs.

But often, it is not easy to motivate oneself to make a prepayment of Rs.1.5 Lakhs. This is where the prepayment calculators can help. After use of the prepayment calculator, the user will exactly know the following:

- How much to pay?

- When to pay?

- How much it will save?

With this kind of clarity, I am sure, the majority will opt for loan prepayment, right? You can also check my excel based home loan prepayment calculator. It is a more flexible tool than the online calculator.

4. Why Banks Do Not Encourage Prepayment?

‘Interest’ which we pay on our loans is the income for the banks. Prepayment reduces our interest out-go, which means less income for banks. Hence, banks do not proactively encourage prepayment.

In the past, banks used to impose ‘extra fees’ on prepayments amounts. Till not few years back, banks like HDFC etc had a cap on the ‘minimum prepayment amount’. They used to accept a prepayment of at least one EMI or more.

But upon intervention of RBI, penalty of loan prepayment was removed. Hence, today more people are resorting to loan prepayment than before.

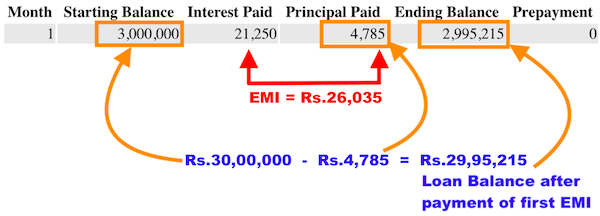

5. The Concept of Loan EMIs

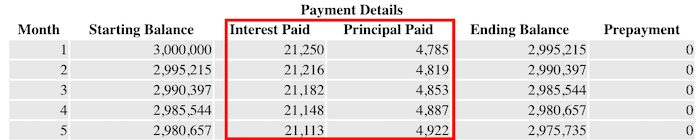

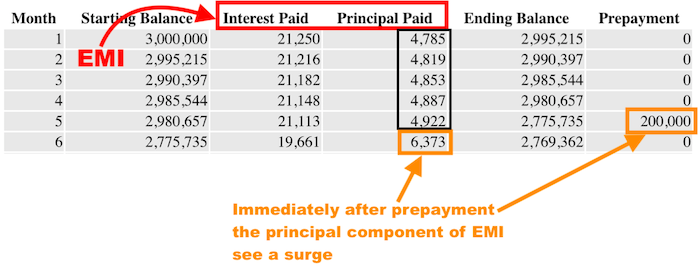

Suppose one took a Loan: Rs.30 Lakhs @8.5% Interest, for 20 years. In this case the EMI will be Rs.26,035 per month. There are two components of every EMI payment: (1) Principal component and (2) Interest component. Lets see what will be the break-up of EMI in the initial months:

- First month: the EMI of Rs.26,035 reduced the loan balance by Rs.4,785 only. Hence loan outstanding reduced from Rs.30,00,000 to Rs.29,95,215

- Second month: the EMI of Rs.26,035 reduced the loan balance by Rs.4,819. Hence loan outstanding reduced from Rs.29,95,215 to Rs.29,90,397.

- Two hundred fortieth month: the EMI of Rs.26,035 reduced the loan balance by Rs.25,852. Hence loan outstanding is reduced to zero.

[P.Note: with passage of time, principal component is increasing, and interest component is decreasing.]

One must continue to pay EMI for a loan till the loan outstanding becomes zero. In this example, the borrower must pay loan for 20 years (240 months).

6. EMI = Interest & Principal Component

EMI = Principal + Interest

What is the worst thing about interest? Even it we continue paying interest for next 100 years, the loan burden will not reduce even by one Rupee. Suppose, one decided to pay only the interest portion of the EMI, and not the principal portion. What is the interest portion in first month? Rs.21,250.

In this case, the person will pay less EMI (Rs.21,250 instead of Rs.26,035). But as no principal portion is paid, even if the person continues to pay Rs.21,250 for 100 years, the loan balance will remain as Rs.30 lakhs. So what is the point?

The point is, for us, it is important to keep reducing the principal as fast as possible. As soon as the principal becomes zero, EMIs will stop.

How to reduce principal faster? By making prepayments. Moreover, every time we will make a prepayment, there is a saving on interest as well. Hence prepayment gives double benefits in below forms:

- Prepayment reduces principal.

- Prepayment empowers our EMI.

6.1 Prepayment – Reducing Principal

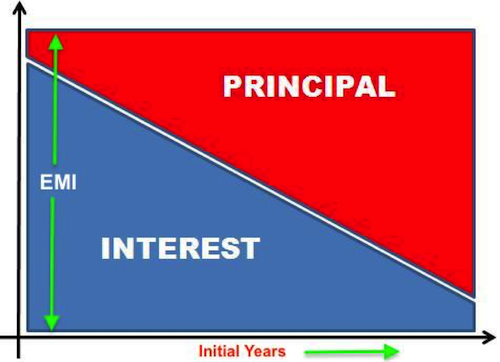

When we pay EMIs, a portion of it is principal and balance is interest. In initial months, interest component is larger than principal component. Why Because in initial months, loan outstanding is maximum.

As the loan outstanding will reduce, interest burden will also reduce. EMI payment is one method to reduce loan outstanding. But the best method of reducing loan outstanding faster, is by prepayment of loan.

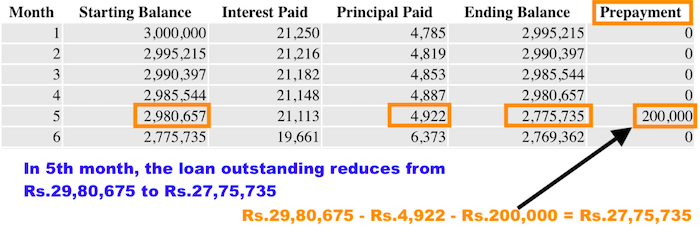

Example: Suppose one took a loan of Rs.30 Lakhs @ 8.5% interest for 20 years. This person made a prepayment of Rs.200,000 in 5th month. Lets see how his loan outstanding is effected:

- In month 1: reduced by 4,785

- In month 2: reduced by 4,819

- In month 3: reduced by 4,853

- In month 4: reduced by 4,887

- In month 5: reduced by 2,04,922

In month 5th, loan outstanding was reduced by a huge amount (due to prepayment). This is the benefit of prepayment. It drastically lowers the loan outstanding – hence finishes off the loan quicker.

If plan was to pay EMI for 20 years, prepayment can reduce the tenure from 20 to 17 years.

6.2 Prepayment – empowering EMI

Consider this, suppose your EMI is Rs.26,035. Will it not be great, had the complete Rs.26,035 portion of EMI gets used in lowering the loan outstanding? It will be great, but it doesn’t happen like this.

Instead, in initial months, only Rs.4,785 out of Rs.26,035 is used to lower the loan outstanding. How to empower the EMI? How to increase its principal component? Our EMI is empowered every time we make a prepayment. How?

In the above infographic, you can see that, after Rs.200,000 prepayment was made in 5th month, the principal portion of EMI, suddenly jumped from Rs.4,922 levels to Rs.6,373 level.

Such prepayments, can empower the EMI’s to a great extent. The bigger will be the prepayment amount, stronger will become our EMIs. Why this happens? Because of the following sequence of events:

- Prepayment reduces loan outstanding.

- Lower loan outstanding, reduces interest.

- When interest is less, principal component will become heavy.

7. Which is The Right Time For Prepayment?

Purpose of home loan prepayment is to save the interest component. Interest load is maximum in initial months. Hence loan prepayments made in initial months saves the most amount of money. The earlier we start home-loan-prepayment the better. Interest burden is maximum in initial months. Interest then gradually falls in later months.

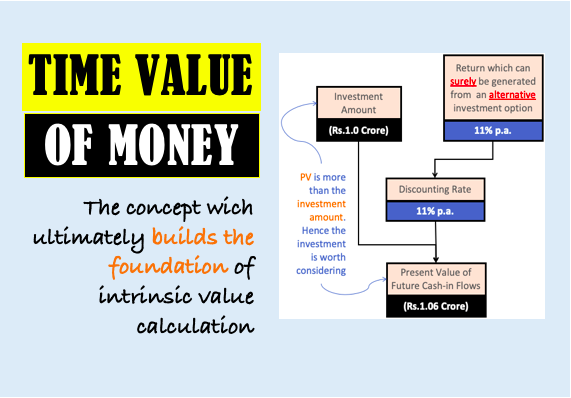

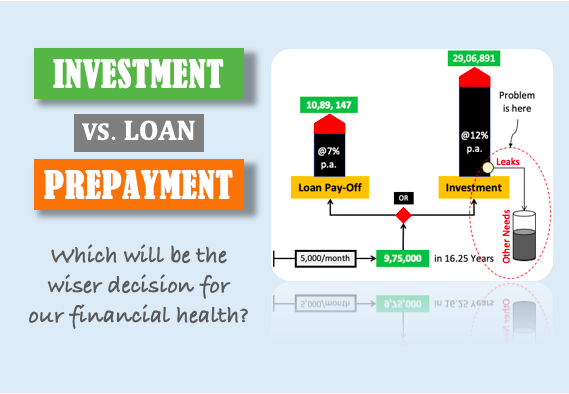

8. Prepayment is better than Investment

Do you use your spare money for investment. If one has a loan, it seems wise to use the money for prepayment. Prepayment shall always take top priority till you are not debt free. There may be other opportunities around which can give higher returns. But still, it is better for a common man to give priority to debt reduction as compared to investment.

How to decide?

- Interest saved Vs ROI: Rule says, pay your costlier debts first before making any investment. But what if you know that your investment is going to give you very high returns? If you are very sure, you can go for the investment. But the problem is, majority does not know how to analyse investments. Hence, my personal preference is always “home loan prepayment”.

Interest that we save on home loan is like an assured return. Once we make a prepayment, interest saving is assured. But if the same money in used to buy stocks, mutual funds etc, are their returns assured? No.

Expert investors may give YES as an answer. But for common men, loan prepayment is a much better alternative. For a common man, interest saving in tune of 8.5%-10% is still a phenomenal return. Read more about whether to invest or make prepayment.

9. How to plan for prepayment of home loan?

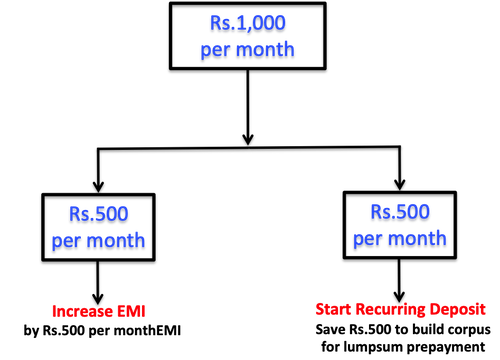

Not many of us has lump-sum cash to make a substantial prepayment of home loan. This difficulty becomes amplified when banks does not accept small amounts as prepayment.

Example: HDFC. They only accept prepayments in multiples of EMI. If ones EMI is Rs30K, he/she can make prepayment of Rs 30K or more. But making prepayment of even one EMI is not easy for common man. What is the solution?

Start a parallel saving plan like Recurring deposit (RD). Start a recurring deposit of say Rs.1,000 each month. Let this recurring deposit continue, till the accumulated amount is equivalent to one EMI. Once sufficiently big savings is build-up, break the RD and use its funds to make prepayment.

But I have a better suggestion here. Suppose you are sure that each month you can save Rs.1,000 for funding loan prepayment. Plan your prepayment schedule like this:

This is one of the easiest way to plan home loan prepayments for loan issuers like HDFC.

Conclusion

Except for home loan, banks charge a penalty of loan prepayments. Net of penalty, the benefit for loan prepayment gets reduced. But what these penalties cannot erase is the benefit of living a loan free life.

Do not believe any one who will counsel you against prepayments. Prepayment of loans is the common man’s way of achieving financial independence in shortest time.

Then why banks and few people do like prepayments? Their rational behind not prepaying loans are the following:

- If there will no home loan then how you’ll save tax under section 24.

- After paying prepayment penalty, net interest saved is minimal.

- As majority interest is already taken by banks in initial months, prepayment in later months is not effective.

- When you prepay a loan, you are actually spending your savings. These savings you can use for investing to earn better returns.

Like these, there are more reasons for NOT prepaying loans. But I’ll say – do not believe any one of them. No matter how justified they may sound, it is not comparable.

Comparable with what? Leading a debt-free life. I strongly suggest you read this article on becoming debt free. I’m sure it will motivate you to start prepaying your loans today.

[Access the prepayment calculator here]

Handpicked Articles:

Hello, Nice Article.

No other blogs talks about the PV of the future savings. They simply take the absolute value into the calculation.

I was thinking in addition to the PV(present value) of the future saving, if we also add a 2nd point that interest payment upto 2 lakhs (Indian context) is tax exempted. we will also be saving upto Rs.60,000/- (30% tax bracket). wouldn’t that make EMI reduction option even more logical?

Would love to hear your opinion on this.

Dear Mani sir, Its just because of your blog i paid my home loan of 20 yrs in just 6 yrs approx. I m planning for top up to buy another asset. My very first priority was prepayment. By using loan calc i encouraged my colleagues too. The tool was awesome! Thanks a lot for helping to become so money minded. Thanks a lot with good night.

Thank you for the valuable feedback.

Good Work,

I would like to inform you that you should provide the options of Loan Tenure in months and reduce EMI by prepayment in loan calculator.

Aargh!! Pre-payment amount appears to be invalid. It should be near loan amount & cannot be more than 400,000

The above error showsup with the calculator which is not accurate.

It is one of the limitation of this calculator. It cannot accept a prepayment value of more than Rs.400,000.

How can I help you more?

Very Nice Sir,

Thanks This to Much effective and learn some simple earning.

I can say the most valuable and informative post for anyone who is planning to apply for home loan. This is a must read.

Thank you for this amazing feedback.

SO Good Information.

Than you so much.

Very useful. Thank you sir

Very well explained. So thanks for me.

THANKS MANI FOR YOUR CALCULATOR OF PREPAID OF HOME LOAN EMI. PLEASE ALSO GIVE A CALCULATION OF PMAY HOME LOAN AND HOW SUBSIDY EFFECT HOME LOAN EMI. THANKS A LOT. KEEP GOOD WORK GOING.

Dear Mani.. I wanted a to know if giving more money as EMI beneficial or giving lump sum amount as pre payment of home loan plan.. and please explain it in similar way

Hello Mr. Mani, very nice bog. Crystal clear explanation and indeed very helpful. Thanks

Mani nice way of explaining as if the next comes in my mind and u have written it and answered it.

Good suggestion will help lot of guys

Thanks a ton Mani for sharing this wonderful calculator!!!

I am following all your blogs/articles from last 1 year and learnt a lot…..I like the way you explain the things to detailed…..Great work keep it up 🙂

I am glad that my work is paying off. Thanks for your awesome feedback.

Superb Calculator. Mani you have made our life simpler. Thanks a ton!!

Thanks for the awesome comment Akshay.

This is an amazing home loan prepayment calculator and probably the only one that has a feature to add frequency of prepayment. I wanted to know how much months it would take for me to pay off my debt if I paid a lumpsum every 12 months. And this one did it! Really helpful to plan my schedule. Thanks.

Thanks for commenting.

Hi

Good insight .

But how to guaze the net effect of interest paid after considering benefit of interest and principle paid towards EMI in tax calculation .

In other words if I take housing loan and pay EMI I get exemption in tax payment.

What will be net offect

Tax benefit of home loan is vis a vis its cost (EMI payment) is negligible.

I will suggest you to read this blog post please:

http://ourwealthinsights.com/should-you-pay-your-home-loan-early/

Thanks a lot, this article has helped me to understand about home loan prepayment clearly.

Thanks for your comment. Nice that you found the article useful.

Thank you for informative article. We will start following the steps to reduce our home loan burden.

Awesome. Thanks for posting your comment.

Thanks a lot for this wonderful calculator..

Thanks, harsha. Pleasure is all mine.