Is a Home Loan Worth It in 2025? Decoding EMI vs. Renting for Urban Indians

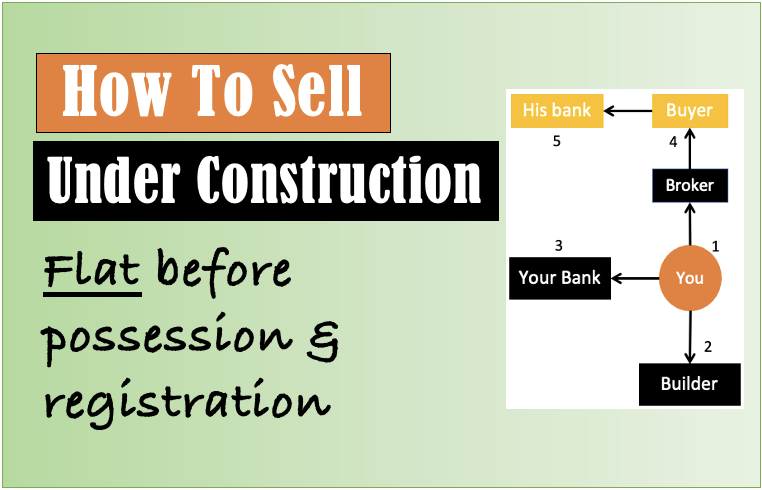

🏠 Buying Vs. Renting Calculator 1. What is your Monthly Take-Home Salary (Rs.)? Next ➡️ 2. Do you have any ongoing EMIs? (Rs./Month) + Add EMI Next ➡️ 3. What is the value of the home you wish to buy? (Rs.) Next ➡️ 4. Select the type of property you want to buy: Ready-to-moveUnder-construction Next…