In our lookout for growth stocks, we know that looking only at past returns will be grossly incomplete. Hence, we’ve learned to focus on profit growth in our analysis. But what if I tell you that profit growth is also not enough? It is also essential to check the degree of profitability of the company. Hence we need a combination of ROCE and EPS growth to identify sustainable growth stock.

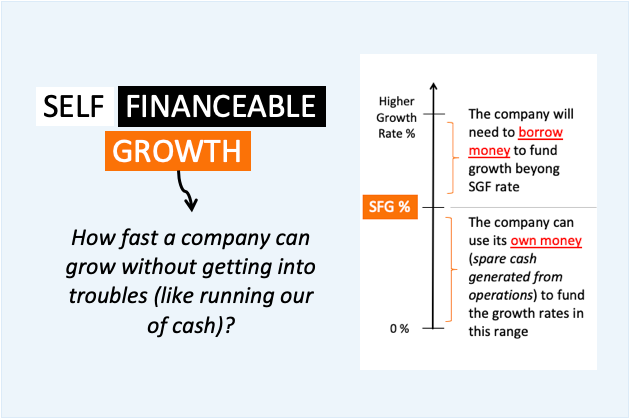

If our common understanding prevails, profit growth (EPS Growth) should be the indicator of a company’s growth. But as an investor, in our quest for growth stocks, sustainable growth must also be a priority. Read here for a sustainable growth formula.

What gives sustenance to the future growth prospects of companies? It is their ability to use the capital efficiently. Hence, a combination of ROCE and EPS Growth becomes an ideal match to identify dependable growth stocks.

Let’s know more about ROCE and EPS Growth.

Introduction

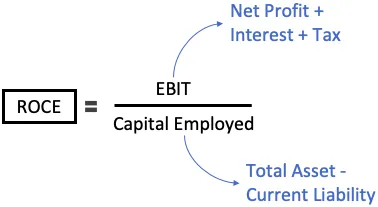

ROCE (Return on Capital Employed) measures how efficiently a company is using its capital to generate profits. EPS growth (Earnings Per Share growth) measures the rate at which a company’s profits are increasing over time.

When used in combination, these two metrics can provide investors with valuable insights into a company’s financial health, growth potential, and overall profitability.

Here is a detailed explanation of how ROCE and EPS growth can be used together to evaluate a potential stock investment:

ROCE (Return On Capital Employed)

ROCE is a measure of a company’s profitability that takes into account the capital it has invested in the business. It is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its capital employed. Capital employed includes the company’s total assets minus its current liabilities.

A high ROCE indicates that a company is using its capital efficiently to generate profits. A low ROCE, on the other hand, suggests that a company is not making the most of its invested capital.

To identify a high-quality company, a ROCE of more than 20% is considered a good indicator. A high ROCE company can be tagged as financially healthy. Read more about the financial health of a company.

Example

Let’s understand the utility of ROCE as a profitability metric using an example. Suppose there are two competing companies having similar revenues and net profits. Their EPS growth rate is also similar at about 15% per annum.

Investors who do not know about the concept of ROCE will value both the companies same. But suppose one company has achieved these numbers by employing capital worth Rs.100 crore. The other company had to employ only Rs.50 crore to report the same numbers. It means that the second company is using its capital twice the better (high ROCE) than the first company.

As the second company’s strong fundamentals are coming at a lesser cost, it is more likely to sustain the past growth compared to its peer.

[Note: It is also essential to analyze the size of the industry to gauge if the company has sufficient head room to grow in times to come. You can read more about it here]

EPS (Earning Per Share) Growth

EPS growth is a measure of how quickly a company’s profit is increasing over time.

Earning Per Share (EPS) is calculated by dividing the company’s net profits (PAT) by the number of outstanding shares. Read here about high EPS companies.

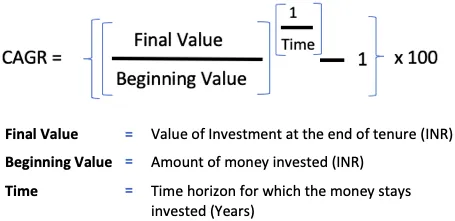

The resulting number shows the earnings per share for the given period. To calculate the EPS growth rate for a period, we shall use the EPS of the start and end periods. Once we have these two values in hand, we can use the CAGR formula to calculate the EPS growth rate.

A high EPS growth rate indicates that a company is experiencing strong earnings growth and may be a good investment opportunity.

For the sake of convenience, to identify a high-quality company, an EPS growth rate of more than 15% per annum can be considered a good indicator.

However, it’s important to note that EPS growth should be evaluated in the context of the industry and the overall economic environment. A company may have high EPS growth but still be underperforming compared to its peers.

Combination of ROCE and EPS Growth

What happens when ROCE and EPS growth (EPSG) is used together?

When evaluating a potential stock investment, it’s important to consider both ROCE and EPS growth together. A high ROCE indicates that a company is using its capital efficiently to generate profits. A high EPS growth rate suggests that the company is experiencing strong earnings growth.

However, it’s also important to look at the combined effect of these two metrics. It gives a new perspective about the company in consideration.

Combination Effect

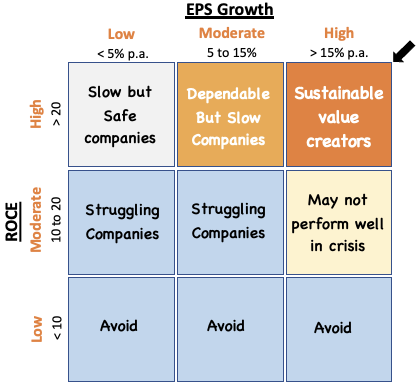

- Sustainable Value Creator: Companies with a ROCE above 20% and EPSG above 15% per annum are capable to sustain their high EPSG levels. High ROCE and high EPSG eventually result in high ROI for the shareholders. Hence we can remember such companies as sustainable value creators.

- Dependable But Slow: These companies are able to grow only moderately. The reason may be hiding in their industry size and peers’ competence (read about it here). But as their ROCE (profitability) is high, they are dependable. They are likely to hold their past EPSG numbers.

- Slow Buy Safe Companies: One such example is Colgate (India). Its average ROCE is above 70, but it still does not qualify as a sustainable value creator. It is because its EPSG over the last 5-10 years has only been average (<10%). Such a company will not lose shareholders’ money but are certainly not a growth stock.

- May Not Perform Well in Crisis: When the economy is bullish, such companies report high revenues and growth numbers. But as their profitability is moderate (ROCE <20%), they may not perform as well during the crisis. Such companies post notable falls in their EPS during tough times.

- Struggling: Companies posting ROCE numbers close to 10% and EPSG below 10% per annum are surely strugglers. There are certainly no long-term wealth builders.

- Avoidable: Low ROCE companies are utilizing capital poorly. They are more of a wealth destroyer as their ROCE will come below their WACC. Hence must be avoided.

ROCE and EPS growth are two important metrics for evaluating a potential stock investment. When used together, they provide valuable insights into a company’s financial health, growth potential, and overall profitability.

However, it’s important to consider these metrics in the context of the industry and the overall economic environment to make informed investment decisions.

Industry Size and Future Growth

We’ve already talked about the necessity of focusing on the profitability and earnings growth of companies to identify potential growth stocks. But we must also realize that there is another factor that limits a company from the outside.

We cannot forget to note the growth potential offered by industries to their constituent companies. To understand the effect of industry on the growth prospects of companies, we’ll use the farmer and farmland analogy.

Farmer and Farmland Analogy

- Large Farmer in a Large Farmland: A large farmer is symbolic of a large-cap company. Large farmland signifies a large industry. Such industries do not offer excessive competition to their companies. The companies get room to grow as much as they can. The sustainable value creators that we have seen above mostly comes from this category.

- Small Farmer in a Large Farmland: Small farmers are symbolic of start-ups that are still in the small-cap or mid-cap category. Large farmland is symbolic of an industry that offers huge growth prospects to these smaller companies. The sustainable value creators that we have seen above can also come from this category. But to be that, they must eventually compete with big farmers and build a market for themselves.

- Large Farmer in a Small Farmland: Small farmland represents an industry that is already saturated. A large farmer is a company that is already a market leader in a saturated industry. Such companies are dependable or slow cash-flow generators but can offer only slow growth prospects.

- Small Farmer in a Small Farmland: In the ROCE and EPS Growth matrix we saw above, this combination will mostly have struggling or avoidable companies. Such companies cannot be long-term wealth creators for their investors.

Industry vs The Company

As an investor, we should give more priority to industry size or the company’s fundamentals?

The company’s fundamentals, like high ROCE and EPS growth, are important. A company can be operating in an excellent sector/industry, but if its core fundamentals are weak, it cannot become a sustainable value creator for its investors. A quality company in a small sector is better placed than a weak company in a large sector.

Conclusion

ROCE and EPS growth are valuable financial metrics that can be used together to identify potential growth stocks. These metrics provide valuable insights into a company’s financial health, growth potential, and overall profitability. Together, they provide a more comprehensive view of a company’s financial health and growth potential.

ROCE helps investors evaluate a company’s profitability and efficiency, while EPS growth helps identify a company’s potential for future growth.

Example

Let’s consider the case of Titan Company. It is one of the most successful companies in the Indian stock market. Titan has consistently reported high ROCE figures (above 20%), indicating strong profitability and efficient use of its capital. Additionally, the company has consistently reported high EPS growth figures (above 15% per annum), indicating its potential for continued growth in the future. The result is that, in the last 10 years, its stock price has appreciated at a rate of 25% per annum. Plus, it has also distributed dividends in nine out of the last 10 years.

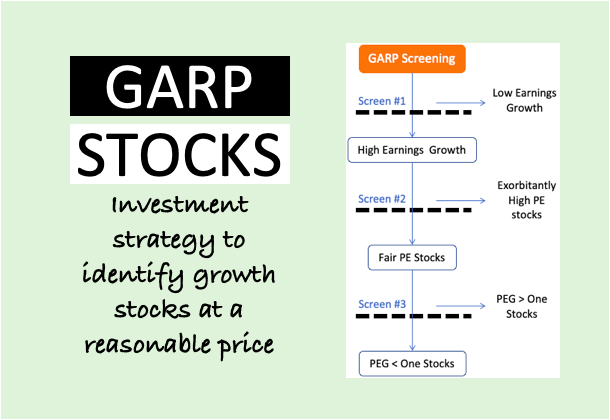

[P.Note: Even after one has considered the size of the industry, the company’s profitability, and EPS growth rates, it should not automatically trigger an investment call. Valuations at which a stock is available for purchase, cannot be ignored. The bigger idea should be to buy stocks of quality companies only when it is available at an undervalued price levels.]

Have a happy investing.