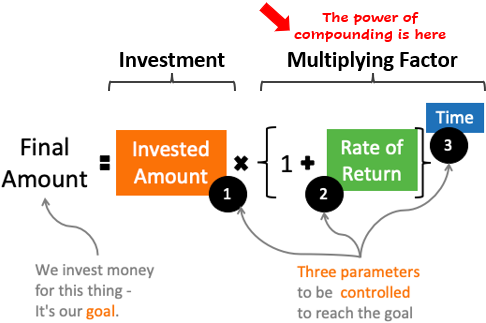

The concept of the power of compounding is based on the mathematical concept of Compound Interest. Observing the compound interest formula will highlight the factors that contribute to compounding over time.

Why this formula is referred to as compound interest? The phenomenon of compounding interest says that in the initial periods of investment, one earns interest on the principal. Then in subsequent years, our investment starts to earn interest on interest. The longer the money stays invested, the more interest on interest is earned. This is what is referred to as the compounding of interests.

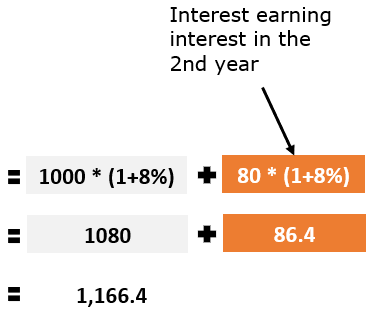

A simple example. Suppose you’ve invested Rs.1,000 in a fixed deposit for two years that earns 8% per annum interest. At the end of the first year, your principal amount (Rs.1,000) will earn an interest of Rs.80. Hence, the final amount at the end of the year will be Rs.1080 (1000+80). In the second year, the Rs.1080 becomes the principal and now it’ll earn the interest of 8%.

What will be the final amount at the end of the second year? Both, Rs.1000 and Rs.80 will earn the interest. Check this formula:

In the first year, interest earned was Rs.80. In the second year, the interest-earning was 86.4. This way, the interest income will infinitesimally grow over time. This is called the compounding of investment returns.

The Key Variables

The compound interest formula has three variables, the invested amount, rate of return, and time. But what really gives the formula the power of compounding is a combination of time and the rate of return.

[Nevertheless, the bigger will be the size of the invested amount more visible will be the effect of compounding Read more about it here.]

What we common men can learn about investing from the formula? Two critical lessons:

- Time Factor: The longer we’ll hold our investments, the bigger they will become. Here the longer time horizon is not counted in days or months, but in years and decades. For me, a couple of decades is sufficiently long. When I invest, particularly in stocks, I intend to hold them for the period. The reason I’ve kept the time factor in serial number one is because it is in the investors (our) control. Read more.

- Rate of Return: Compared to the time factor, earning the expected rate of return is less in our control. Though, investing rationally can drastically improve our chances of higher returns. This is where the concepts of fundamental analysis, price valuation, etc come in handy. Read more.

Wealth Building

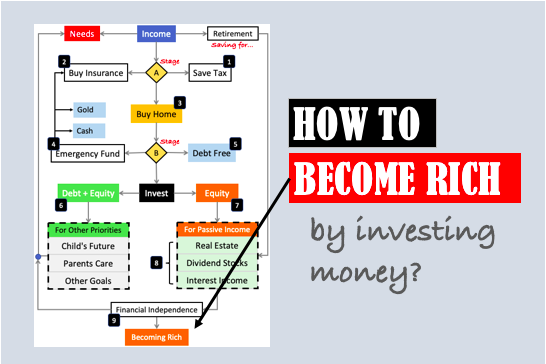

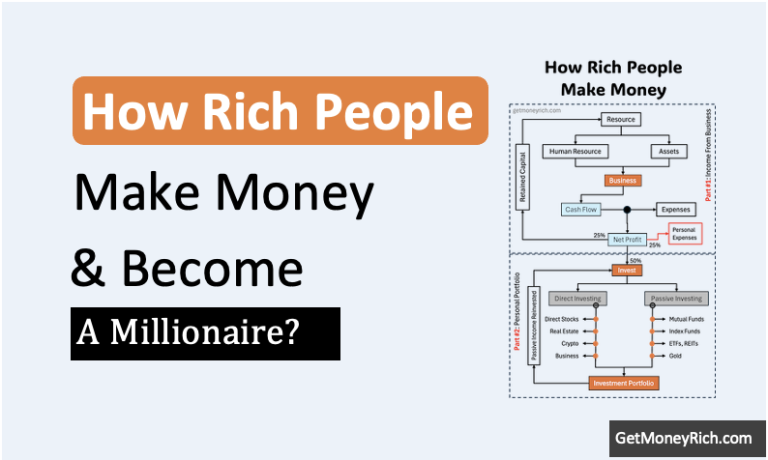

Compounding is how wealth is built. It is a secret that rich people do not talk about. They silently keep investing their monies and let it compound year after year without liquidating it.

People like Jef Bezos, Elon Musk, Warren Buffett, Bill Gates, etc have invested in their own companies. Their companies gave them the ability to earn high returns. But they still had to manage the “Time” part themselves. So what did they do? They held on to their shares forever. Suggested Reading: The idea of business & financial independence.

We, ordinary people, do not have our companies to invest in. So what we can do? We can invest in shares of good companies listed in the stock market. Mutual funds are the next best alternative if one is uncomfortable with stocks. Check This: Comparison between stocks, mutual funds, gold, FD.

Everyone who has become sustainably rich is using the power of compounding. It is our key to breaking the boredom of life and becoming financially independent.

Power of Compounding & Time

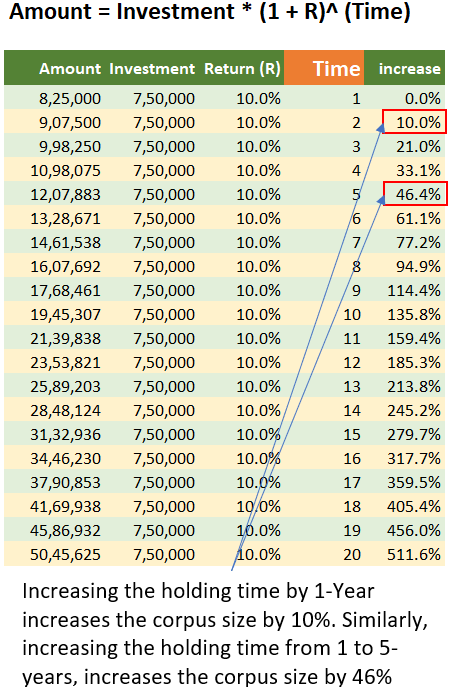

The above table shows a quantum of Rs.7,50,000 being invested at a 10% rate of return. Twenty different holding times have been shown. In the first case, when the holding time was 1-Year, the invested corpus increased from Rs.7,50,000 to Rs.8,25,000. Similarly, with a holding time of 16-Years, the corpus rose from Rs.7,50,000 to Rs.34,46,230.

The multiplying factor of our money can be considerably enhanced by increasing the holding time. The mathematical explanation of the effect of compounding is simple. So I’ll leave the maths to you. Allow me to explain the effect of time in simpler terms.

Suppose, you’ve invested Rs.7,50,000 at a 10% rate of return. You will need this money after 19-Years from today for your child’s higher education. At the end of the nineteenth year, the size of the investment would be Rs.45,86,000. Now, if you could stay invested for another 1-Year at least, your corpus size will grow from Rs,45,86,000 to 50,45,000.

Just in one year, your invested money will grow by an additional 4,59,000 (50,45,000 – 45,86,000). This amount, 4,59,000, is 61.2% of the principal amount you’ve invested (459000/750000*100 = 61.2%).

Inference: For a common man, this is the easiest trick to follow from the investment book. Just holding on to a reasonably good investment will work. Buy a good multi-cap mutual fund, and simply hold on to it for the next 20-year. Let the power of compounding work for you. A multi-cap fund yielding 16% per annum return will multiply your invested corpus by 19.5 times in 20-Years.

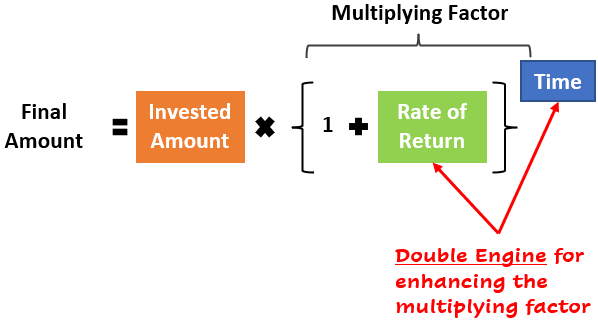

Power of Compounding & Rate of Return

A combination of a high rate of return and a long holding time creates even fantastic results. It’s like, the multiplying factor of the compound interest formula gets a double-engine.

To understand the double-engine effect, we’ll use an example where the return will be increased incrementally. We’ll then observe the effect of this increment on the investment corpus.

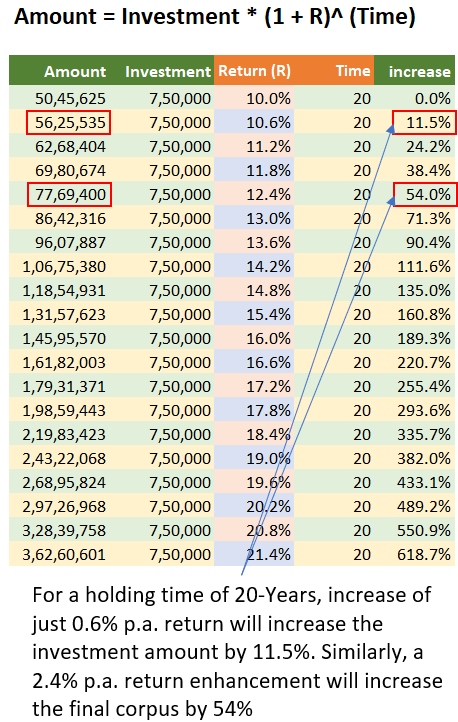

The above table shows an investment amount of Rs.7,50,000 invested for a period of 20-Years. Here the variable is the rate of return. At a 10% per annum rate of return, the invested amount will grow from Rs.7,50,000 to Rs. 50,45,625.

Now, just by earning a fractional more return of 0.6% (10.6% per annum), the invested amount will grow to Rs. 56,25,535. You can see that even a small increment of 0.6% in the rate of return, is bringing an 11.5% enhancement of the final corpus.

Similarly, an increase in investment return by 2.4% (12.4% per annum), is bringing about an enhancement of 54% in the overall investment corpus.

So, we retail investors must be on the lookout for opportunities that can yield about 2-3% higher returns than normal. Keep saving and stashing the money aside for such events. When the opportunity comes, grab it by investing a lump-sum amount.

Inference: How common men can identify an investing opportunity? Keep tracking the main indices of the market (Sensex, Nifty-50, Next Nifty-50, BSE 100, etc). These indices keep correcting themselves by about 2-3% at least once every year. In those moments of correction, make sure to buy a good index-linked ETF. Once they are bought, make sure to hold on to them for the next 20-Years. Idea is to let your return compound by keeping your money invested.

The Rate of Return & Investment Vehicle

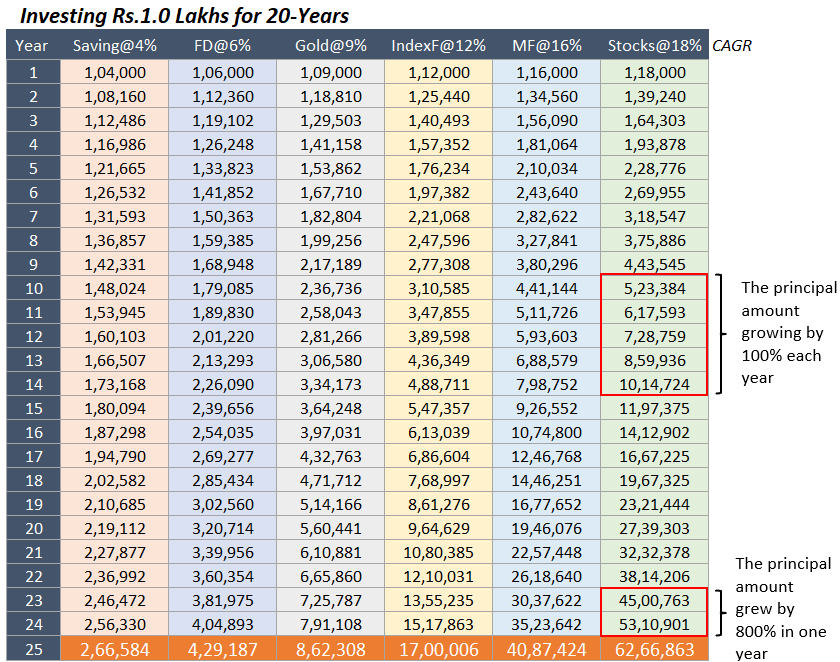

The above table shows the power of compounding in action. What makes this table more useful is that it highlights the effect of higher returns on the invested amount. It shows how the invested amount of one lakh Rupees grows over time (25-Years) when invested in stocks, mutual funds, index funds, gold, fixed deposit, and savings account.

In the initial years, the effect of compounding is not as visible. The invested money (Rs.1,00,000) multiplies at a nominal rate. But look at how fast the money starts to grow after a decade.

- Stocks: Between years 10 and 14, the invested money almost doubles itself every passing year. It means, it is growing at a rate of 100% per annum. Furthermore, between the years 24 and 25, the invested money (Rs.1.0 lakhs) grew by 800% in one year (from Rs.45 to 53 lakhs).

This is my favorite example to visualize the power of compounding. Every time I see this table, it motivates me to invest wisely (for higher returns) and stay invested for a very very long time (like 20-years or more).

Compounding of Money & Goal Management

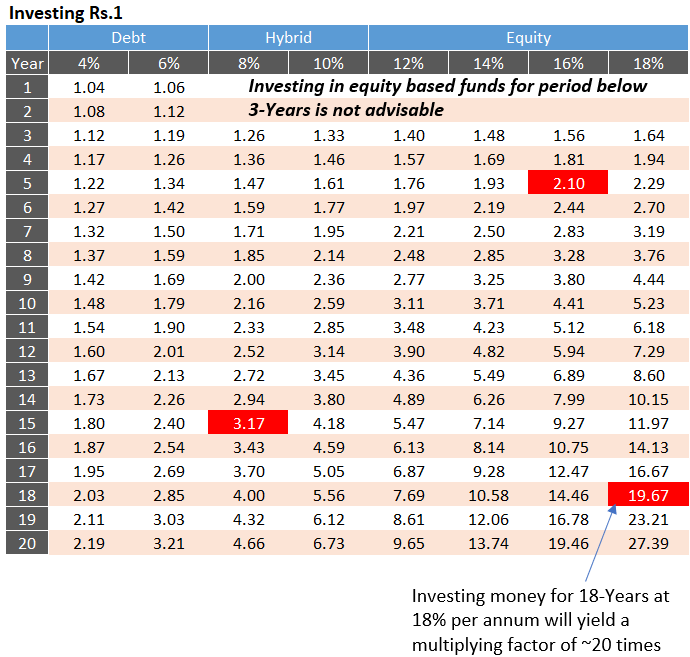

The table shown above is a tool made from the concept of the power of compounding. We can use this table to manage our financial goals. The table shows how Rs.1 multiplies itself over time at different growth rates. How it can help a layman manage goals?

- Example#1: Suppose a person will need Rs.2 lakhs after 5 years from now. What should be his/her investment plan? The above table tells him to invest Rs.1 lakhs in equity, like a mutual fund, that can earn about 16% per annum return.

- Example#2: Suppose a person will need Rs.3 lakhs. But he will need it after 15-years. As the time horizon is longer, even a smaller rate of return will work. Hence, investing in even a hybrid-based fund will work. The above table tells us to invest Rs.1 lakhs in a hybrid fund, that can earn about 8% per annum return.

- Example#3: Suppose a person wants to build a retirement corpus of Rs.2 crore in the next 18 years. Investing in a stock portfolio that compounds at 18% per annum for the next 18-Years will yield a multiplying factor of 19.67. It means, that if the person invests Rs.1 Lakhs, it grows to become Rs.19.67 lakhs in 18 years. Similarly, if the person invests Rs.10 lakhs today, it will compound to become Rs.1.97 Crore (~ 2 Cr) in 18-years.

How much you invest is also important

The power of compounding is a force to reckon with. But it will not yield the desired effect if sufficient money is not invested. For example, investing Rs.100 at 18% per annum for the next 30 years will build a corpus of only Rs.14,337.

14,337 = 100 * (1 + 18%)^30

What utility this amount will serve 30-Years from now? It will not be enough, right? So as important is the multiplying factor in the compound interest formula, the quantum of invested money is also critical.

For the whole process of investment to yield the desired result, it will start with saving money. The more is saved, the more will be available for investing. Practice the habit of saving month after month (read about the theory of paying oneself).

The saved money shall be put to work regularly. How to do it? By investing them in suitable investment vehicles. We common men cannot invest in lump-sum. Hence, for us, the process of gradual investing is well suited. What gradual investing does is to increase the quantum of the invested money without we feeling the load of it.

Now, for example, consider that over the course of the last five years, you’ve invested a corpus of 5,00,000 in an equity-based mutual fund. The fund will grow at the rate of 16% for the next 30 years. What will be the appreciated value of the investment after 30 years? It will be a minimum of Rs. 4.3 Crore.

4,29,24,938 = 5,00,000 * (1 + 16%)^30

Now this is a meaningful investment corpus, right?

This is another example that I always keep in mind, the more you’ll invest now, the bigger will be the yield in time to come. Maybe, I’ll have to cut my expenses today, but tomorrow, I can live a more abundant life.

Conclusion

What we can finally conclude from the theories and examples seen above? Following are the key takeaways:

- Start Investing Early: It helps when we increase the time factor in the compound interest formula. The longer the money stays invested, the bigger will be the final amount. But what does it mean when we say early, in the 20s, 30s? No, what we mean by early is “today.” No matter what is the age of a person who is not investing, the ideal time to start is today. Longer time means enhanced compounding.

- Systematic Investing: Most of us will never have big chunks of money available for investing. It is practically possible for us to spare only a few thousand rupees each month. Hence, investing through systematic investment plans offered by mutual funds is a good starting point. The idea is to keep increasing the quantum of invested money to a sizeable number. The effect of the power of compounding on a larger invested corpus will be more fantastic.

- Thoughtful Investing: Investing in an index fund and holding on to it for 20 years can easily yield a 12% per annum return. But thoughtful investing will help you earn a few percentage points more. Check this example, you can see, how even a small enhancement in the rate of return influences the final result.

Just by remembering the compound interest formula, we know what factors to control to see the magnificent effect of the power of compounding. The process of wealth building is not complicated, but it requires discipline. We must agree to invest thoughtfully, regularly, and hold on to it for a long time. If we can do these three things, our chances of becoming financially independent are almost certain.

[Suggested Reading: How much money do I need to retire from a job.]

![ROI Formulas: CAGR and XIRR, Meaning, Full Form, Use in Excel [Mutual Funds]](https://ourwealthinsights.com/wp-content/uploads/2018/04/How-to-measure-investment-returns-Image.jpg)

Very insightful!

Thanks

Mani it is really a excellent read!!! How can I contact you? I am Madhusudan Roy from Mumbai – 9819741979