The cost of capital is the cost that a company must bear for the funds it has raised to do the business. Doing business calls for arranging cashflows both for short and long terms.

There are two ways companies can raise money. The first is through equity. This is done by the distribution of ownership among partners or shareholders.

The second is through debt. This is done by borrowing money from banks, NBFC’s, issuing bonds, etc.

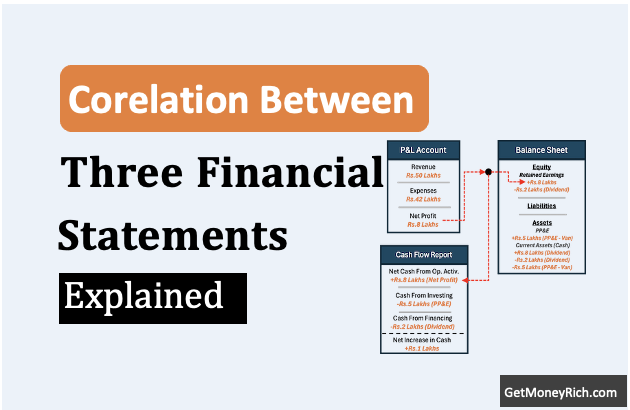

Equity and debt together fund the business, called total capital. But this capital also has a cost attached to it, called cost of capital. How to pay for this cost? By generating enough profits.

The business model must be such that its profitability numbers must take care of the cost of capital. The business must be able to generate cash flows sufficiently higher than its cost of capital.

Let’s understand more about cost of capital using simple examples.

Video: Cost of Capital Insights

Business Having a Simple Capital Structure

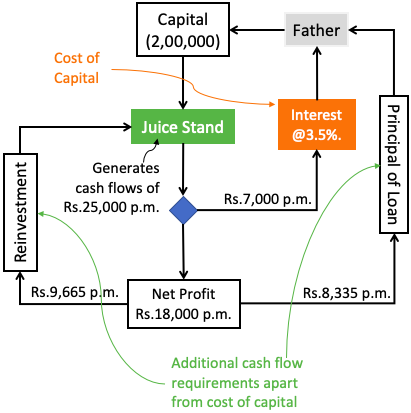

Suppose I’ve started a juice stand as a business. To start the business, I took a two-year loan of Rs.2,00,000 from my father. A promise of interest payment of 3.5% per month was also made.

Here, the capital structure consists of only debt (loan). The cost of capital of this business will be 3.5% per month. This will cause a cash out-flow of Rs.7,000 per month payable as an interest to my father.

The knowledge of the cost of capital of my business will now help me to plan my business. How?

Considering the cost of capital, my juice stand must generate at least Rs.7,000 net profit each month. I’ve also estimated that each glass of juice will fetch me Rs.10 as net profit. Considering a 30-day month, each day I must sell at least 24 glasses (24 x 10 x 30 = Rs.7,200).

But it is also important to note that taking care of only the cost of capital is not sufficient. Enough cash must also be generated to repay the loan principal and to meet the minimum reinvestment requirements.

A minimum reinvestment is necessary. Why? Because cash must be available to take care of the normal wear and tear of the equipment, furniture, utensils, etc.

Cost of Capital of a Typical Company Listed in Stock Market

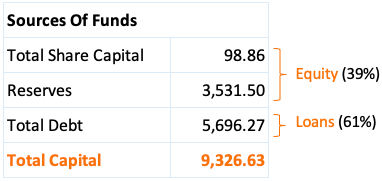

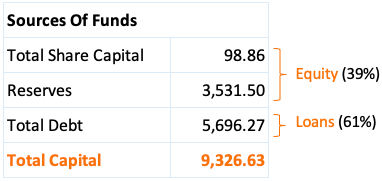

Here is a snapshot of the capital structure of a typical company listed in the stock market. By looking at its numbers, we can say that it has a debt-heavy capital structure (39% Equity and 61% Debt).

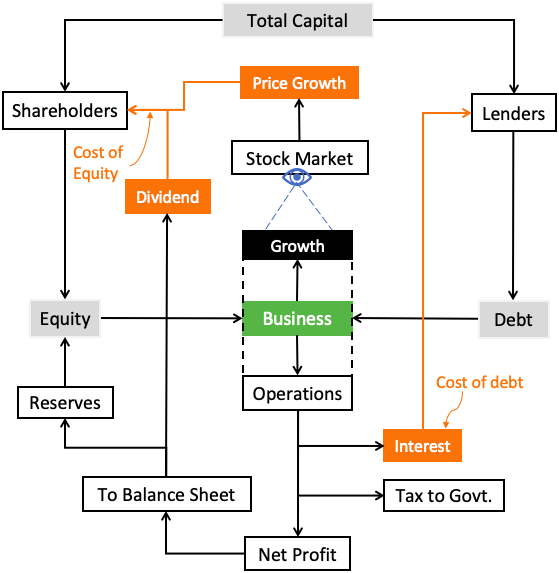

Once the capital is raised, it must also be used prudently. How? Business uses its capital in two ways.

- First, it uses a part of the capital to run its business operations. Again, there can be two types of business operations, production of goods & services, and modernization of the existing facilities.

- Secondly, it uses the balance capital to fund its growth plans. This type of expenditure is often referred to as CAPEX (Capital Expenditure). It is mainly used to buy a new property, plant, and equipment.

It is important to understand why a business must be run with two separate focuses: operations and growth.

- Focus on operations will render profits. That, in turn, is used to pay interest, taxes, and dividends and can also be retained for future use.

- Focus on growth is necessary to capture market share. The stock market has a keen eye for growing business. A growing business will see its share price appreciation in the long term.

In the above infographics, you can see how a business is done. In the scheme of things following two entities are specifically highlighted:

- #1. Cost of Equity: It consists of dividends paid to the shareholders. It also accounts for the price appreciation of the stocks seen by shareholders in the stock market.

- #2. Cost of Debt: It consists of the interest paid by the company for the money it has borrowed in the form of loans or bonds.

WACC and Cost of Capital

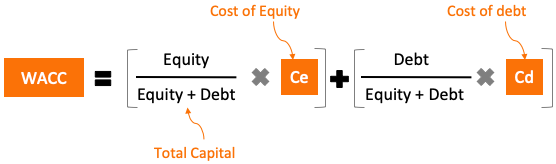

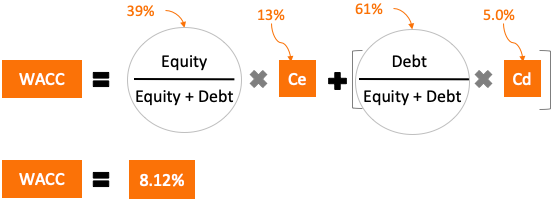

What we have seen till now is the cost of equity and the cost of debt in isolation. Somebody might believe that adding the cost of equity and cost of debt will give us the total cost of capital. But it is not the case. To know the cost of capital, we must calculate the Weighted Average Cost of Capital (WACC). In terms of formula, it will look like this:

How to Calculate the Cost of Debt (Cd)?

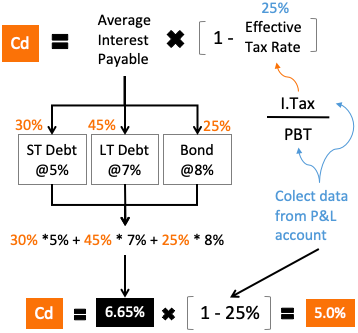

Suppose a company has a total debt of Rs.5,696 Crore. Out of the total debt, it has a short-term loan (30%) taken at 5% per annum, a Long-term loan (45%) taken at 7% per annum, and bonds (25%) issued at 8% interest rates. What will be the cost of debt of this company?

The formula for cost of debt (cd) and its calculations are shown in the above infographics. Please note the factor “effective tax rate” shown in the formula. It is the net income tax payable by the company after accounting for the interest-deductions allowed by the government.

How to Calculate the Cost of Equity (Ce)?

Cost of equity is the return that a company shall theoretically pay to its shareholders. It is like compensation paid to the shareholders for the risk they took by investing their money in the shares of the company.

Suppose there is a company listed in the Indian stock market. How much return the shareholders of this company will expect from the stock of this company?

To understand this, we must first remember a number, it is called risk free rate. Any investor has the liberty of investing in a risk-free option or in a risky option like shares. Why an investor will pick shares? He’ll pick it for higher returns.

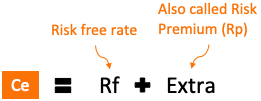

So, for sure, the shareholders will expect a return higher than the risk-free rate, and this becomes the cost of equity (Ce) for the company. Let’s write this as a formula:

More about the extra…

How much be the “extra” return as indicated in the formula? It varies from company to company. Suppose there is a company like RIL or HDFC Bank. These are the two biggest and most famous companies in the Indian stock market. Both these stocks are also included in the indices like Nifty and Sensex. Hence, on day to day basis, the price of these stocks does not fluctuate a lot. Hence has a Beta closer to one.

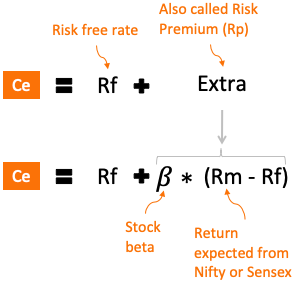

So a company that has a lower beta will give low returns. Companies with beta equal to 1 or higher, must yield higher returns. Why? Because high beta means more risk of loss for the shareholders. How to translate this theory into a formula?

This can be done using the CAPM theory. Applying the CAPM formula will give us the full formula for the cost of equity (Ce). It will look like this:

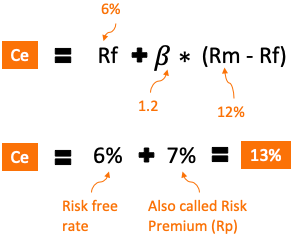

Let’s assume that the risk-free rate (Rf) in India is 6.0% per annum (Yield of 10-Yr government bond). In the next 5 years, let’s assume that the Nifty is going to grow at 12% per annum (Rm). Also, the stock in consideration has a beta of 1.2. What will be the cost of equity? Let’s apply these numbers into the formula:

How to Calculate WACC?

Let’s first recall the capital structure of the company. It’s equity weight is 39% and debt weight is 61%. Check the below numbers.

We have also calculated the individual values for the cost of equity (Ce = 13%) and the cost of debt (Cd = 5.0%). Now, let’s apply these values to our formula to get the Weighted Average Cost of Capital (WACC):

Our example company has a WACC of 8.12%. This is what we can call as total cost of capital of its business. What is the meaning of this number?

With the present capital structure in place, this company must yield a minimum return of 13% to its shareholders, and can pay an average interest rate 5.0% to its lenders.

WACC – What is the use of this number?

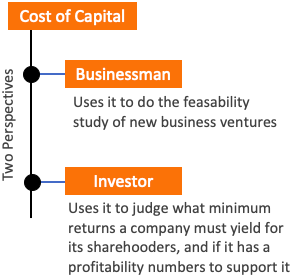

We can understand the utility of WACC from two perspectives. First, from the point of view of a businessman. Second, from the point of view of an investor. Both these people look at WACC slightly differently. Probably, most of us will see WACC from investors’ perspectives only, but it will be great to know the look-out of the other side, right?

Businessman (Top Manager of a Company)

For a businessman, WACC is the minimum return on investment (ROI) that he will expect from his new ventures. Suppose he is in a grocery retail business. He has decided to open a new outlet in a location. How to check if the investment is worth an effort? He will compare if the profitability (ROIC) of the new venture is more than his present WACC or not.

So for a businessman, WACC is that bare minimum profitability below which the venture will be a loss-making prospect for him. In fact, he should only consider investing in it if its profitability is at least 1.5 times his present WACC.

Why a businessman must think like this? Because he is concerned that the new investment should make sufficient money. What is sufficient money? The investors get their expected returns, and lenders shall get paid their dues.

Investor (Shareholders)

Investors or shareholders also refer to the WACC while making their investments. They will analyze the business behind their stocks in the following steps:

- #1. Calculate Cost of Equity: The investor will check if the stock can deliver on their return expectation. How to do it? By calculation of the cost of equity using the CAPM formula. The consideration is made after checking if the beta of the stock is acceptable or not. Some investors might reject very high beta stocks. So might not accept a beta less than one. Moreover, a guess is also made about how the overall index (Nifty or Sensex) is going to behave in the future. Check how the Cost of Equity is calculated.

- #2. Compare WACC with RoCE and ROIC: This check is essential. No matter how good is the cost of equity numbers for a stock, it is equally important to confirm if the stock can really deliver on those numbers. How to confirm? By checking if the past ROIC and RoCE numbers were higher than the WACC or not.

Value investors also use the WACC number as the discount rate to calculate the present value (PV) of future cash flows of the company. This gives them the intrinsic value of the stock/business.

very nice article with all details

Hi, been following your blog for a while. Really enjoy reading it! Keep it up with insightful articles!

The Blog is superb especially the examples provided to explain the theory.

Very nicely present the WACC and cost of capital concept.

Impressive Blog!

Thanks

Manish Jee, your articles are so informative and easy to understand. I am a regular visitor of your blog and it has helped me a lot to understand the fundamentals of capital market. God bless you. We need person like you.

Thank you

Excellent Article and attached video to explain the Cost of Capital is excellent and my sincere thanks for such an educational content.

Thank you