This blog on day trading is neither a guide nor a reference of any kind. It is just an experience sharing article on how I practice intraday trading on personal capacity.

Generally I love to buy stocks of fundamentally strong companies with intentions of holding them forever. So why I practice day trading? It will not be wrong to say that sometimes it becomes irresistible.

For a person like me, who writes blogs on investment, on stocks etc, good and bad stocks frequently meet the eye. Among them, many are such stocks which do not qualify for long term betting. But in short term their prices are mouthwatering.

This is the motivation behind trying day trading in addition to investing. Having said that, it is also true that if a strategy is not in place, day trading can lead to big losses.

Day Trading is Worth Trying?

Short answer is Yes. But it comes with lot of if’s and but’s.

For sure, if one wants to practice it as an amateur, day trading is a bad idea. But is it not applicable for any thing we do in life?

For value investors, who has to deal with free cash flows, intrinsic value, profitability ratios among other complexities, day trading comes as a pleasant relief.

I’m not trying to say that day trading is easy compared to value investing. Professional day traders does technical analysis which can be as draining as fundamental analysis. But for people who are not professional day traders, can still practice it with little risk.

How I identify my stocks? What are the rules of my game? What are my personal views about day trading? These are few question which I plan to answer in this blog.

How To Identify Stocks For Day Trading?

Not all stocks can be used to day-trade. They have their own typical characteristics. Even best of stocks of the market may fail to become a contender for day trading. But this does not mean that we can pick any penny stocks for intraday trading.

As fundamentally strong stocks has their unique characteristics, day-trading stocks also has their own attributes. To execute a profitable intraday trade the most important step is picking the right stock. If you have a right stock, 50% battle is won right at this stage itself.

Here is how I identify stocks for day trading:

- Blue Chip: When I pick my stocks for intraday, it has to be from a list of blue chip companies. This is that blue chip which is attracting attention currently. Why blue chip? Because they are among the market leaders. People know the brand name and they are more popular among other stocks.

- Trending: picking blue chips is the first filter. The second filter is, among the blue chips pick that stock which is currently making news. I see business news channels to pick names. I just note down names which are being spoken about. I then add them to my watch list. Once the list is ready I highlight the big names (blue chips).

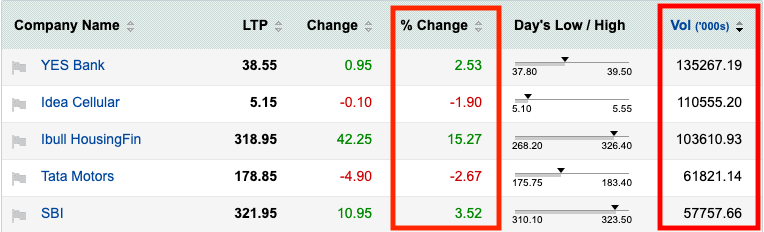

- High Volume: This is the single most important metric for stock which qualify for day trading. Low volume stocks are not good for day trading. I generally use this table to identify those stocks which are currently trading in high volumes.

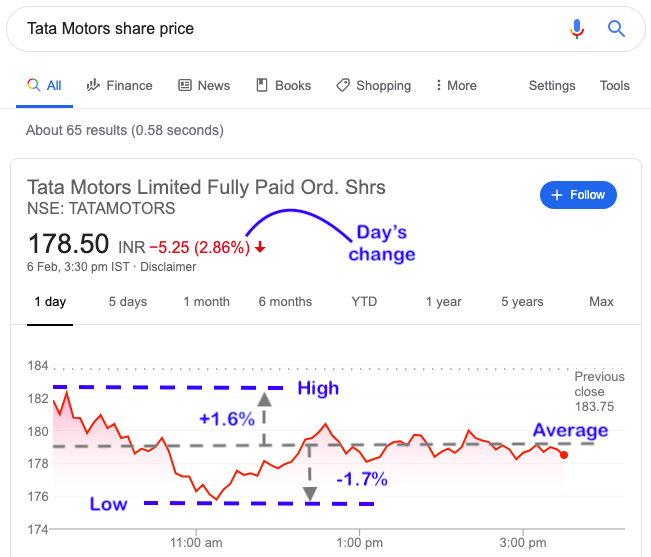

- Price Volatility: No matter how big is the company, or how high is its volume, if its price is not volatile enough it is not good for day trading. How I check price volatility? Two ways: First I check the % change (check above image). The change indicated here should be more than 1.5%. Next I double check the stock’s price volatility on google (Search: “Stock-name share price”). See the image below.

The stock which is picked for trading is essentially satisfying all of the above mentioned four (4) filter points. A combination of these four points gives me a stock which is potentially a good pick for intraday trading.

Once I’ve a stock in my finding, the next step is to start trading by applying my day trading strategy. Here are my strategies listed for you.

[P.Note: What is the characteristic of stock which is picked using the above four filters? These are stocks with big brand names, which are currently trending in news portals for some reason or the other. The news can be both positive or negative. Coupled with the current trend, the stock is also showing high volumes, and its price is remains sufficiently volatile]

Day Trading Strategy

Frankly speaking these are more self-realisations than a strategy. Over a period of time, upon repeated trades, I’ve figured out these rules which works for me. As I’m not a day trader by profession or by psychology, hence I prefer using it as defensively as possible.

Here is the strategy which I follow for day trading.

1. Goal is Fixed and Limits are Set

Why to day trade at all? Because it is profitable. But this profitability comes with its share of risks. How I manage this risk? I follow a strategy which is the core of my practice: I stick to my goals and limits, and avoids greed.

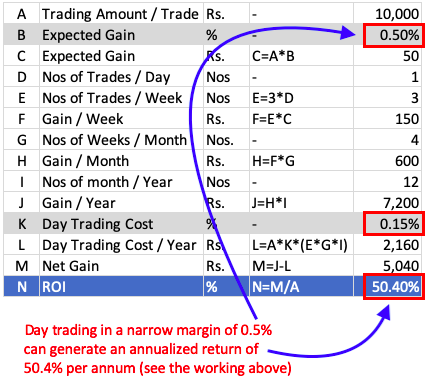

Let me give you some numbers and you’ll figure out yourself the potential of day trading. These are real numbers which is used for intraday trading. I’ve considered here that a person is day trading with Rs.10,000.

Here is the explanation of the above infographics:

- Trading amount: I prefer trading in relatively small amounts. Why? Because I’m neither a pro trader nor I’ve the appetite for big risks. Example: Ten thousand is the number which I can afford to loose. If heavens falls, and I loose all Rs.10K, it will not hurt me psychologically. For every day trader this number is different. When I started, this value was as low as Rs.1,000.

- Expected Gain: When I day-trade, my upside expectation is 0.5%. As soon as my trade reach +0.5%, I sell. I’ve realised that with my stock filters, seeing gains of 0.5% is easy. Expecting more will put my money at unprecedented risks. My Rule: Never expect gains above 0.5% in each trade.

- How Many Trades: I do not trade more than once in a day. Like “0.5% rule” this is another rule which I follow to its core. Once I book profits, I do not go back to my trading platform again in that day. I also limit trading only 3 days in a week.

- Trading Cost: On every intraday trade my overall cost is close to 0.15%. It means a 0.5% gross profit booking will yield a net profit of 0.35% (0.5%-0.15%). Note: There are other trading platforms whose overall cost is lower than 0.15%. But I prefer sticking with my broker.

- Return on Investment (ROI): I use the same amount (example Rs.10K) and go on rotating it for all of my trades. An amount of Rs.10K, over a period of 1 year can generate a net profit of Rs.5,000. This is a healthy ROI of 50%.

2. Preparation Time

If I have to day-trade, I make it a point that I do not execute it as a pastime. A good deal of research is necessary in picking the stock for day trading. If I’ve to day trade today, I spend at least 2-3 days prior to it for stock picking.

Once the stock has been picked, on the day of trading, it is essential to watch the price movements of the stock. Watching is necessary before the buy-order and during the sell-order.

It is better not to execute intraday trading passively. Complete involvement prevents big losses, and on good days can also lead to higher profits.

3. Sticking To A Stock

Even professional traders like to play the same stock day after day. On an average, for me a single shortlisted stock at least remains eligible for 4-5 trades. When we trade the same stock again and again, we tend to get a feeling of its supports and resistances.

Though it is also true that Mr.Market will outplay our feeling time and again. But if one is not greedy, knowing a stock’s price movement can make more money than losses.

Conclusion

Take your time in picking a stock for day trading. A stock which is eligible for day trading will continue to make money for several trades in future. Hence I take extra care to pick my stocks.

Once the stocks is picked, the next steps are relatively easy to follow. The first rule that I follow is, investing only that amount which I’m ready to loose.

The second important rule is limiting my gains to 0.5% per trade. I try not to get greedy and follow this rule under all conditions. But this rule in isolation will not work. It must be implemented with the “rule of 13“. What is this rule of 13?

- 1=Maximum one trade in a day.

- 3=Maximum 3 trades in a week.

Following these simple day trading strategies can fetch close to 50% returns in an year.

Have a safe day trading.

Suggested Reading:

Your writing is simple and clear. You do have a n art of writing. Can you also write more on index trading?

Thanks in advance

Hi, you really share a great piece of content and useful information for the people. Thanks for enlightening us about the day trading.

Very nice information about the Stock trading for the beginner’s level.

Looking for some more information about the same topic.

Your valuable information always helps for taking trade.

You have not mentioned about how to put a stop loss in day trading…please advice

My logic has been explained. I do no rely on stop loss.

No stoploss, sorry, WHAT?

Your writing style is amazing very easy to understand. Every stock market beginner should read this. Keep sharing such useful information.

Thanks

Day trading for beginners is like lion taming, except more expensive. It’s a risky and challenging pursuit: buying stocks and selling them again in the same day, making money off tiny fluctuations in the price of a stock over a twelve hour period. For many years the tools of day trading were not available to the average investor: real time stock results, analysis tools and access to instant trades.

Hello,

Can you please provide some insight about Mangalam Organics as a fundamental company for long term investment?