[Check Industry’s D/E Ratio] The debt to Equity Ratio (D/E) is a financial ratio that investors use to analyze the debt load of a company. As a general rule of thumb, the DE ratio above 1.5 is not considered good. But there are industries where companies resort to more debt, leading to a higher DE ratio (above 1.5). But as a general rule of thumb, if the debt to equity ratio is below 1.5, it’s considered safe.

In this article, we’ll try to touch few aspects of debt to equity ratio that is essential for us, the investors, to understand. So, let’s start with the basics.

Why Debt is Compared to Equity For Analysis?

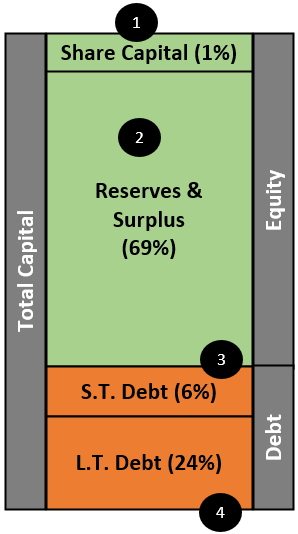

Debt and Equity are related. They are the main source of funds (total capital) for any company. These funds are used to start and run a company. The infographic that you see above is the source of funds for an example company. Allow me to explain each component of the total capital briefly:

Total Equity

- Share Capital: Our example company has 1% of its funds coming from this source. This is the capital the company has raised by selling its shares in the stock market. Learn more about share capital from here.

- Reserves & Surplus: The net profits, after dividend payment, are called retained earnings. In the balance sheet, it is recorded as Reserves and Surplus. Over time, this component of the equity becomes a major capital source for the company. Our example company has 69% of its total capital coming from here.

Total Debt

- Short Term Debt: This type of debt needs to be paid back to the lender within the next 12 months. A company might resort to it to take care of its immediate cash-flow needs, like working capital. Our example company has sourced 6% of its capital from here.

- Long Term Debt: When a company is in expansion mode, and its equity is all tied up, it will have to borrow money from banks. Again, the company will borrow only if its equity base is not able to support the cash-flow needs of the expansion plan. Our example company has sourced 24% of its capital from this source.

The company will borrow debt only if its immediate or future cash-flow needs cannot be managed through equity. So debt is a company’s second source of funds, equity is the first. Preferable, a company would like to run its business from equity. But to grow, debt is sometimes necessary.

But there must be a balance between how much debt can be allowed to creep inside the company’s balance sheets. This is where debt analysis becomes necessary. It must be analyzed by comparing it with its peer, the equity. When debt is compared to equity, one is actually establishing how much of the total capital is sourced from debt and equity.

How to create a balance between equity and debt? Please read further.

Balance Between Debt and Equity

The easiest answer is to keep the Debt Equity Ratio below the industry standards. But the mathematics side of it is slightly more complicated. First, allow me to explain the concept, then we’ll dig into the calculations.

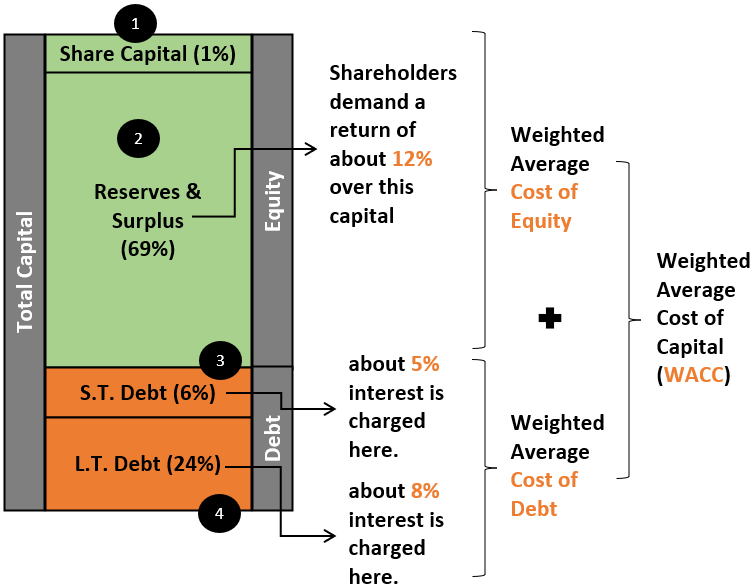

Our example company has sourced its capital through the equity and debt routes. The capital so generated is not given to the company for free. They have a cost. On equity, the shareholders expect a minimum return. The debt base needs to be paid back in principal and interest.

Mostly, the cost of equity is higher than the cost of debt. On one side, where equity holders can expect about 12% returns, the interest on the debt will be around 7%. But debt is still risky because of two aspects of it:

- Regular Cash-outflow: Genuine equity holders just demand a high return that too in long term. But lenders of debt need monthly payouts as EMIs, principal plus interest.

- Risk or Non-Payment: Moreover, if the EMIs are not paid for over 3 months, the lender may take legal action. If such actions escalate, the lender may force the company to file for bankruptcy.

Hence, though the debt is a cheaper source of capital, good companies keep it within limits. It is much easier to handle equity. But equity fund is limited. Like, debt can be raised within days from a bank or NBFC, equity sourcing is a long and tedious process. Moreover, too much equity also dilutes the earnings of a company.

This is why the BALANCE becomes so critical while dealing with debt and equity. A systematic and logical way to reach a balance is through a mathematical model.

The Balance – Basics

Let’s bring back our example company again. We’ll try to understand the concept of balance between WACC Weighted Average Cost of Capital) and DE. The idea is to establish a relationship between an increasing DE and WACC. To know how WACC is calculated check the link.

Generally speaking, as the cost of equity (Ce) is higher than the cost of debt (Cd), an increase in the DE ratio will decrease the WACC. The lower is the WACC, the better is for the company. But quality management would not allow DE to cross a prescribed limit. As a rule of thumb, the maximum limit for DE is below one (1.5).

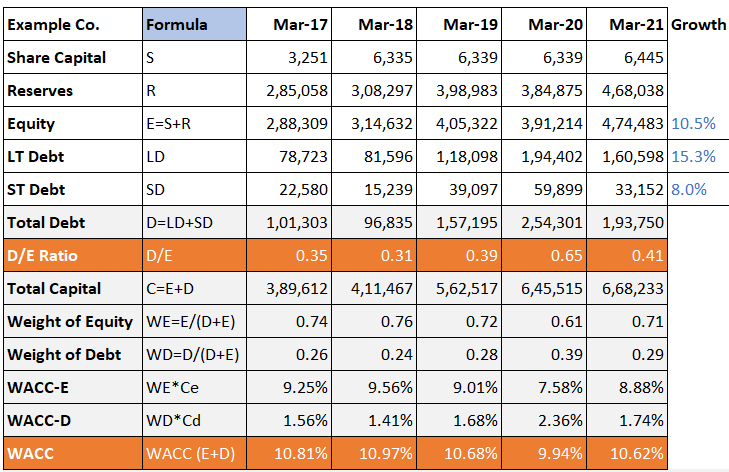

Step #1. D/E and WACC Calculation

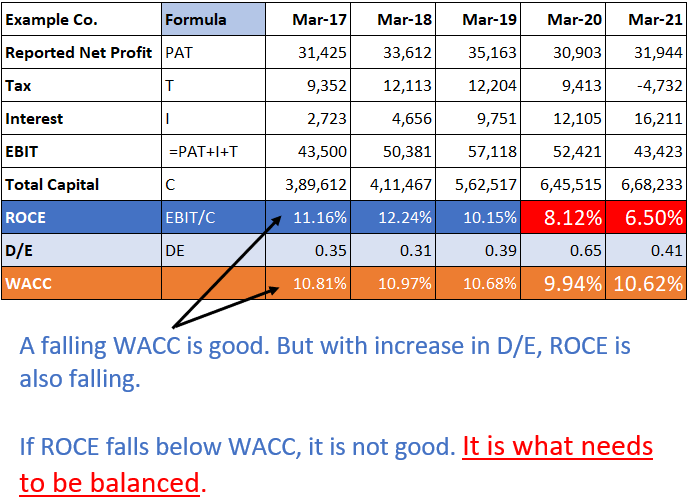

To calculate it, we must first know the quantum of equity and debt in the company’s balance sheet. I’ve downloaded the data for the last five years for our example company. Here are the DE and WACC calculations. It is done for all of the last five years. Please check the below table to know the formulas used for the calculations.

Step #2. Observe the DE and WACC Change

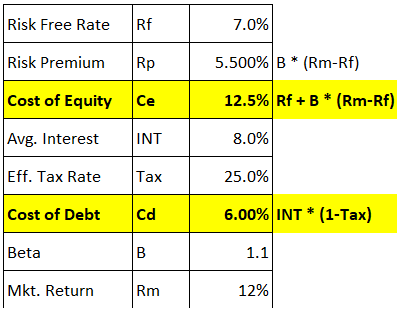

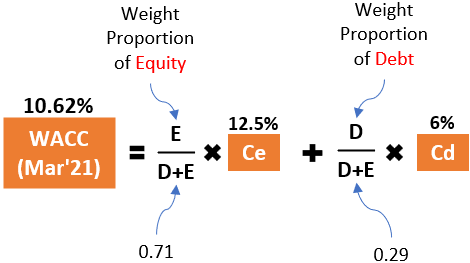

In our example, the DE ratio of the company has gradually increased from 0.35 to 0.41 levels. In the same period, the WACC decreased from 10.81% to 10.62%. Why it is so? Because the cost of debt (Ce) is lower than the cost of equity (Ce). To know how Ce and Cd have been calculated, check the below table.

As the cost of debt is only 6% and the cost of equity is 12.5%, an increase of debt in the capital structure will lower the WACC for the company. WACC for FY Mar’21 FY is shown. This pictorial representation of the formula gives a better visualization of how an increase in debt reduces WACC.

So, in the initial days, when the DE ratio of a company is zero or too low, taking more debt is not a problem. In fact, as more debt reduces one’s cost of capital (WACC), it will be a welcome move.

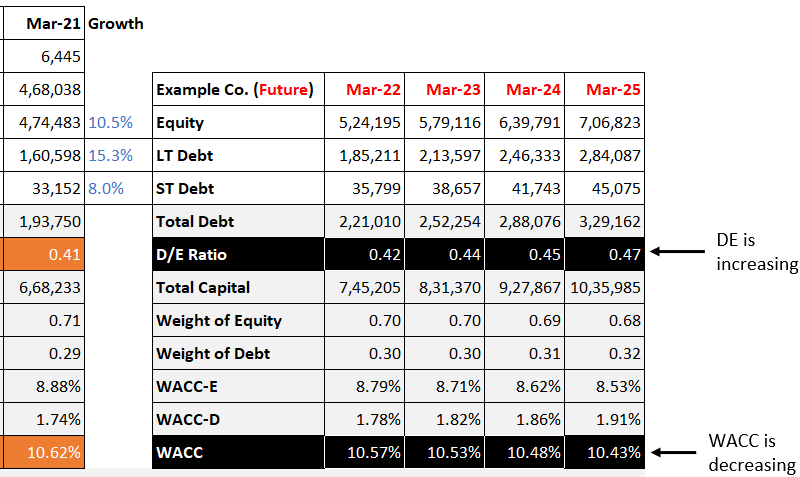

If we extrapolate this growth rate of equity and debt to the future, we can see that though the debt to equity ratio is increasing, WACC is reducing.

More capital, at a lower cost, will also increase the net profit (PAT) of the company. If PAT is increasing, return on equity (ROE) also increases. Hence, current shareholders and potential investors are also happy. It is almost like a win-win situation.

Step #3. Observe How ROCE changes with DE

But a trained eye also knows that an increasing debt to equity ratio is not good. It must be controlled. Why? Because it lowers the company’s ROCE. Ideally, a company’s ROCE shall not fall below WACC.

Check how the ROCE of our example has changed with a simultaneous change in DE and WACC.

What we see above is the following:

- Debt to Equity Ratio: Between Mar’17 and Mar’21 the DE ratio has increased from 0.35 to 0.41.

- WACC: In the same period, the cost of capital decreased from 10.81% to 10.62%. Which is a good thing.

- ROCE: When the debt load will increase, the ROCE of the company can fall. That is what must be closely observed. In our example company, between Mar’17 and Mar’21, as DE is increasing its ROCE keeps falling. In FY Mar’20 and Mar’21, ROCE has fallen below the WACC.

A falling WACC is good, but ROCE cannot fall below WACC. This is a balance that must be achieved by a company. Generally, a company knows its sweet spot (DE ratio). If it will cross that DE ratio, its ROCE will fall below the WACC. Hence, good companies try to keep control of their DE ratio. Indirectly, they are balancing ROCE and WACC.

An Optimum Debt To Equity Ratio

How a company can decide its optimum DE ratio?

We casually say that a DE ratio of below 1.5 is acceptable. But what is the logic behind it? I researched how much debt to equity ratio is good for a company. But I could not get a satisfactory answer from the internet.

Looking at the following parameters can help to decide on an optimum DE ratio:

- ICR Ratio: The ratio between EBIT and interest paid by the company is called the interest coverage ratio (ICR). Out of EBIT, the company first pays the interest on loans and then the taxes. What remains after interest and tax payment is called net profit (PAT). For a company to report a decent PAT, a safe ICR will be at least three (3).

- Working Capital: Given a chance, a company will not take loans. But if the cash flow of the company is not enough, the company will have to resort to debt. Negative working capital is a sign that the company needs external financing (debt).

Staying Debt-Free is better for companies?

Debt is not an evil, it can be a boon for high ROCE companies.

Suppose there is a company that has a high ROCE and low WACC. Such companies can use debt leverage to increase their profit numbers. But again, as discussed above, a balance must be maintained. At an optimum debt to equity ratio, the company’s ROCE will remain higher than its WACC.

Mature companies have high cash & cash equivalents. For some companies, their cash balance and forthcoming cash flows are so strong that they do not need debt financing. Such companies can handle their working capital and CAPEX needs through sound cash balance. They may not resort to debt at all.

Generally, good companies will resort to debt in case of a cash-flow deficit. In short term, a cash flow deficit may happen due to working capital shortages. The company may need long-term debt financing when it is in expansion mode (CAPEX). But if their optimum DE ratio has already been reached, more debt will not be in their shareholder’s interest. For such companies, equity financing will be better.

There are companies that are allergic to debt. For them staying debt-free is more important than future growth. Excessive debt prudence is also not good. For such companies, if a debt is providing an opportunity to increase the market share, it must be taken with open arms.

What debt to equity ratio is bad?

Generally speaking, when the DE ratio becomes greater than 1.5, it starts to become a cause of concern. But debt analysis shall not be done with a unique number. It is better to do it with industry average numbers. Suppose there is a stock whose D/E ratio is 2.5, and its industry average is 3. In this case, though the D/E of 2.5 looks high the company is doing it better than its industry peers.

I’ve tried to calculate the debt to equity ratio of industries as a whole. I’ve used the weighted average method. Within a sector, the company with the highest market cap will get more weightage than others.

D/E Ratio of Industries [Indian]

(Updated as of 05-May-2023)

| SL | Industry | Avg. Market Cap | WT. AVG. D/E |

| 1 | Defence & Aerospace | 58538.35 | 0.00 |

| 2 | Switching Equipment | 58856.07 | 0.07 |

| 3 | Paints & Varnishes | 56243.29 | 0.06 |

| 4 | Telecom Services | 54451.82 | 0.00 |

| 5 | Housing Finance | 48752.72 | 4.15 |

| 6 | Marine Port Services | 51377.41 | 0.10 |

| 7 | Coal & Lignite | 50386.29 | 0.08 |

| 8 | Two & Three Wheelers | 47689.18 | 0.00 |

| 9 | Natural Gas Utilities | 42391.16 | 0.08 |

| 10 | Oil & Gas Exploration | 38682.30 | 0.22 |

There are some industries that receive delayed credit payments from their customers. There are companies that constantly have to spend on CAPEX (expansion or modernization). Such companies would need more debt. Hence, their D/E ratio will remain higher than other.

Conclusion

Debt is an easier source of financing than equity. Moreover, its cost is also less (compared to equity). But the debt has its own drawbacks. When a company avails debt, interest and principal payments become an obligation. Whereas in the case of equity, returns to the shareholders are not mandatory.

So, as a company pile-up debt on its balance sheet, it must carefully observe its rising debt to equity ratio. The idea should be to keep the debt level optimum. Debt is not like equity. If monthly EMI’s are not paid for a few months, the lender can take the company to court. In extreme scenarios, the company may even be declared bankrupt.

A high debt-equity (DE) ratio is also not good if the company wants to borrow more. Banks may not offer the best interest rates for high DE companies. More so, if DE is too high, lenders may not offer the loan in the first place.

EXCELLENT

Love your content!