Here in Part-2 of the series of blogs on economy, we will talk about short Term debt cycles. In Part-1 we have seen what is economy, use of money in economy etc.

What’s about short term debt cycles? Ray Dalio has beautifully explained the short term debt cycles in his Youtube video. I am only trying to explain the same concepts in a phased manner. I hope my explanation makes a point for my readers.

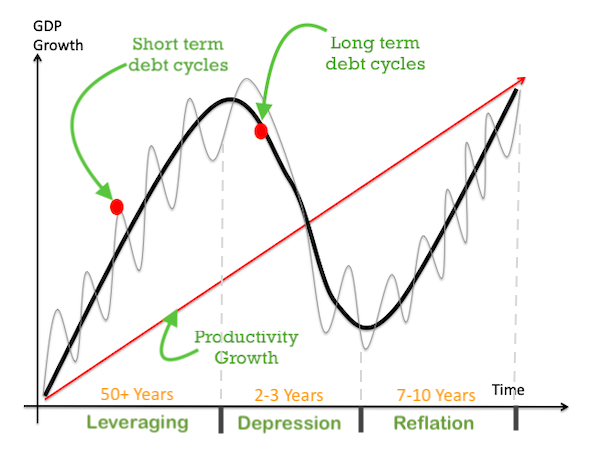

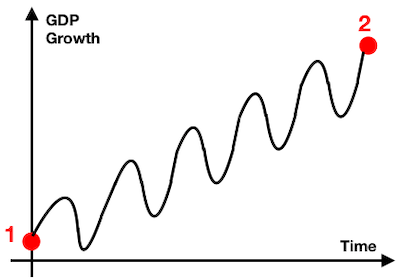

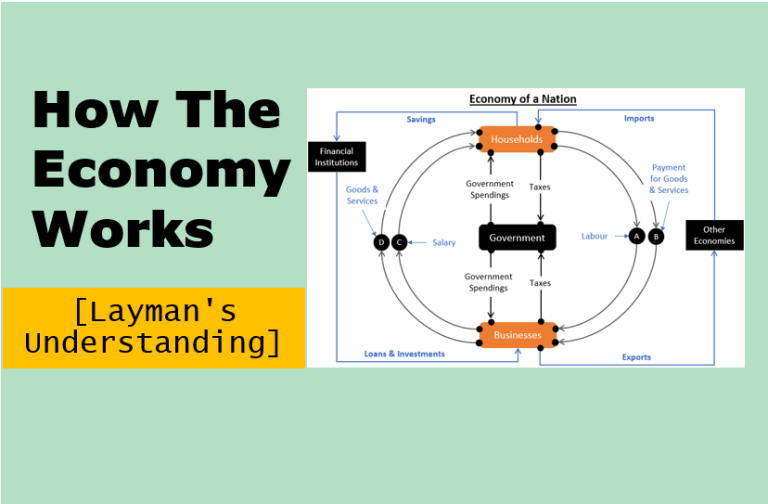

Before we plunge into the short term debt cycles, I will bring back the infographic that was published in Part-1. This infographic talks about one complete economic cycle. It consists of the following phases:

- Several short term debt cycles (lasts 6-8 years).

- Gradual rise in productivity (lasts indefinitely).

- One long term debt cycle (lasts 60-65 years).

This is a big picture of our economy. What does it say? It talks about how our economy will behave in a long time horizon such as 60-65 years. How it will behave?

- First there will be a leveraging phase. It will last 50+ years.

- Second there will be a massive fall in GDP (depression). It will last 2-3 years.

- Thirdly the economy will reconsolidate (reflation). It will take 7-8 years to do so.

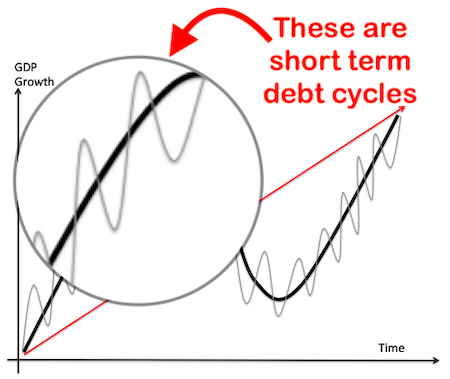

Now, where comes the short term debt cycle? Note the small waves which keep repeating itself through out the long term debt cycle. Those small waves represent the short term debt cycle.

I must appreciate Ray Dalio for representing the Macro and Micro economic view so beautifully in one stroke.

Debt Cycles…

Due to debt (credit), our economy’s progress happens in cycles. Why we are referring it as “cycles”? Because a set of events in an economy, tends to repeat itself over and over again in both long and short term.

About the short term cycles:

- What is the duration of one short term cycle? 6-8 years.

- What are the “set of events”? We will see it now…

Though we are calling these cycles as short, but its time horizon is 6-8 years. In normal reference, we treat this time horizon as long-term, right? What I am trying to say?

On one side we have reference of our investment world, where we call 3-4 years of holding time as long term. In the investment world, short-term are time horizons below 1 year.

But when it comes to debt cycles, even 6-8 years time horizon is called as short term. Important is to mark this distinction in our mind:

- In investment: even 3-4 years is treated as long term.

- In Economy (debt cycles): 6-8 years is treated as short term.

What is the point? The point is, if we get accustomed to see economic cycles (debt cycles) in short term, making considerations about investments in long term will be much easier.

Why I say so? Because we find it hard to build a long term perspective about our investments. What we want is quick returns in next 1-2 years maximum. The shorter the better, right?

But our economic machinery does not work like this. It is essential to maintain the long term perspective to see real returns dripping in.

Understanding of short term debt cycles will help in building a long term investment vision. Clever analysis of economic cycles can really boost our investment returns.

#1. Short Term Debt Cycle…

Let’s zoom-in and see what lies within one short term debt cycle…

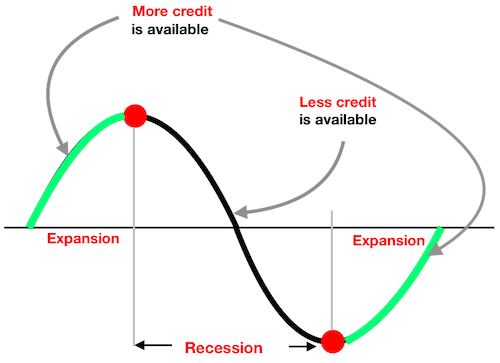

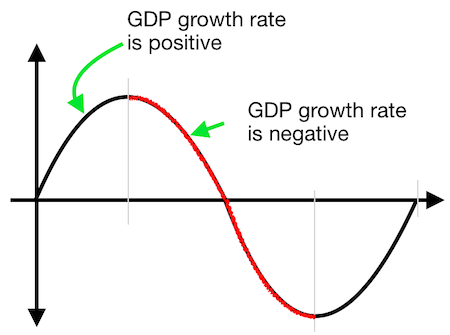

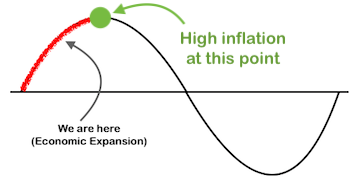

Within one short term debt cycle, there are two constituents (phases):

- Expansion (GDP growth rate positive), and

- Recession (GDP growth rate negative).

What is the cause of Expansion? Availability of more credit. People (individuals, business, government) take more debt in this phase.

What is the cause of Recession? Availability of less credit. People take less debt in this phase.

It is the credit which drives our modern economy.

#1.1 Credit in Economy

Why credit is so important in modern economy? Let’s understand this by taking example of an individual.

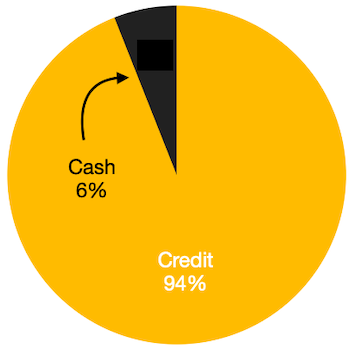

This infographic is just representation of how a typical individual finance’s his/her asset portfolio. The total capital which is used to buy assets consists of 90% credit and 10% Cash.

The financing of business operations is also not very different. Majority business ventures are done using credit financing.

In fact the dominance of credit based financing is so huge that, out of total capital available in the economy almost 94% is credit, and only 6% is cash.

We can also say it like this, what we think as money is actually 94% credit. Only 6% out of it is cash.

In our mind what we imagine as money is actually cash, right? But in modern economy, the things have changed. Most of the cash component of money has already become “digital“.

So what is the problem? The problem is, most of the digital money originates from credit.

Read more about this here…A Flaw in Banking System…

In modern economy, majority (95%) money is actually credit based, and it is “credit” which eventually leads to economic expansions and recessions. How? Read further…

#1.2 Expansion of Economy…

What it means by expansion of economy? Growing GDP.

Suppose between time 1 and time 2, there is no credit available in the economy. How will the GDP grow in this period? The GDP growth can be fuelled only by productivity enhancement. As a result, the GDP growth will only be linear, as shown in the below chart.

Suppose between time 1 and time 2, there is credit available in the economy. How will the GDP grow in this period? The GDP growth will be influenced by the use of credit. As a result the GDP’s growth will be wavy or cyclical, as shown in the below chart.

Why GDP growth happens in waves (cycles)? Because GDP is growing, and falling alternatively. Between point 1 and point 2, several times GDP growth is positive and negative alternatively. Hence the cycles.

But it must be noted that, the overall GDP growth rate in the period (between 1 & 2) remain same in both these cases:

- Case one: GDP growth without Credit.

- Case Two: GDP growth with Credit.

Now we know that GDP grows in waves when credit is available in the economy. What these waves (cycle) signify?

- In one phase of the cycle, GDP growth is positive.

- In another phase of the cycle, GDP growth is negative.

#1.3 GDP Growth Rate is Positive (Expansion)

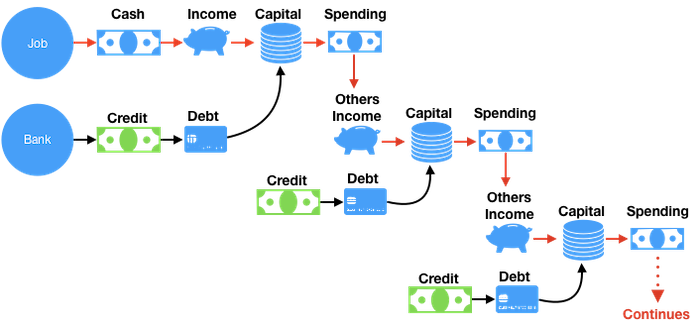

Why GDP growth is positive? Because of the increased spending, due to available credit.

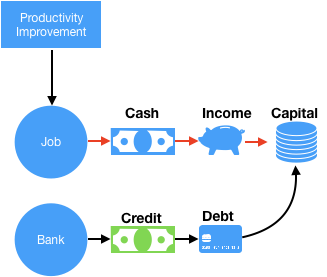

It will be interesting to visualise the impact of credit on economy, causing increased spending.

Everyone who is earning in cash (like salary from job, profit from business etc), such people are credit worthy and hence can get debt.

Debt plus income increases the available capital with people. Increased capital means, increased spending power.

When people are spending more in an economy, it’s GDP grows faster. Why?

Because one persons spending is another persons income.

When more people are spending, it means more people are also earning. This eventually creates a spending spree.

But too much spending is also not good. It leads to high inflation.

#1.4 High Inflation

Excessive spending leads to high inflation. But high inflation is not necessarily a bad thing always. But “excess credit” supported inflation is bad.

How the government deals with this credit-based high inflation? By increasing the interest rates. Why they increase the rates? Because this will make the credit (debt) costlier.

Costlier debt means, less people will opt for loans. People are less likely to take debt when debt is becoming costlier. Reduced loans means less capital available with people. Hence less spending. Less spending eventually reverses the growth cycle.

But before we discuss the reversal of growth cycle (recession), let’s understand why “credit (debt) fuelled” growth is not good for the economy in long run…

#1.4.1 Economy based on high debt is evil…

Debt is like easy money. If left to people (individuals, business, government), majority will finance all requirements of their life using debt. Why? Because it is easy money. People gets attracted towards easy money. It is human nature.

So what is the problem if people live on debt? There are two impacts of excess reliance on debt:

- Leads to high inflation (more money chasing less goods and services).

- Leads to productivity falls.

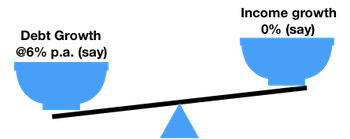

In a debt ridden economy, spending can increase exponentially. This starts pushing the inflation to dangerously high levels.

Moreover, as people are getting easy debt, they will not work harder. Hence productivity of people, in turn of the whole economy, also falls. Why we need productivity improvement?

Because productivity improvement leads to more sales, more profit, more jobs, hence more income for everyone (for all agents of economy). If productivity is not growing, eventually income will fall.

There must always be a balance between income growth and debt growth in an economy. If debt is growing faster than income, it leads to high inflation rates (like in Zimbabwe recently).

Income growth will happen only from productivity improvement. People must work hard to earn more money. But debt growth happens almost automatically. Debt increases in size at the rate of interest it charges.

Consider a case, where a nation’s income size is same as debt. But due to some problems, job market is not growing, even salary increment is weak. GDP is also not growing fast enough. What will happen to such a nation? In such a nation, the growth of “pre-accumulated debt” will be faster than income growth.

Weak income growth, compared to debt growth, eventually leads to defaults in debt repayment. More People will not be able to payback their debts (EMI’s). People will start defaulting on their loans.

Then one day, business will also start defaulting on loan payments. This is a very dangerous situation. Why? Because in our modern economy, majority of money is actually credit.

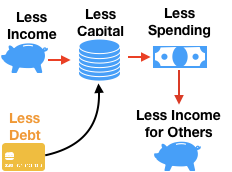

People not paying back loan, eventually means someone is losing on their income. When income falls, less people will remain credit worthy. It means, less people will get loans. Spending in the economy will fall. This will further lead to fall in income for others. This starts a vicious cycle.

Hence, government makes it sure that excess debt is not allowed to accumulate in the economy. What they do to prevent the debt accumulation?

- First, they keep a watch on inflation rate.

- Second, they increase interest rate, to lower the inflation.

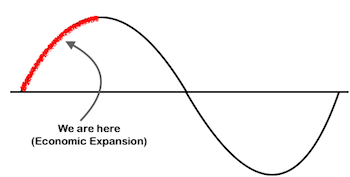

So coming back to our original discussion of short term debt cycle. In #1.3 above, we have read how credit can fuel spending and hence GDP growth. But excess spending pushes inflation up. To tune inflation, RBI increases the interest rates. What happens after interest rate is hiked?

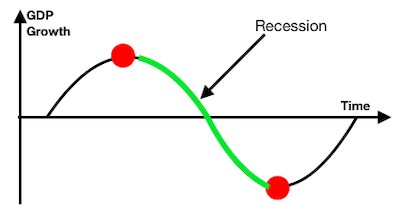

#1.5 GDP Growth is Negative (Recession)

What is recession? During this phase of short term debt cycle, the economy sees a negative GDP growth rate.

What triggers recession in modern economy? High interest rate regime induced by the government. Why the government increased interest rates? To control high inflation.

What happen due to increased interest rate? Debt becomes costlier, and the public spending decreases. Less spending means, less income for others.

How long will the recession last? Till the inflation comes down to acceptable levels.

What will happen when the inflation is normalised? RBI (central banks) will lower the interest rates again, and credit will become cheaper. People will start spending more.

This will again start the expansion cycle (back to step #1.3).

Psychology of people

Expansion Phase:

Why people tend to be more flamboyant during expansion phase? Because of following things happening around them:

- Income is growing.

- Debt is easily available.

- They can spend more.

Where people spend money? People generally spend money in two fronts:

- On Liability (Like cars, TV, Gadgets, vacations etc.)

- On Assets (Like property, stocks, mutual funds, bonds, etc.)

The flamboyance (to an extent overconfidence) creeps in when people start gathering assets. It is not the purchase of assets which gives confidence. It is the rise in value of assets which infuses overconfidence among people.

Value of assets rise steeply during economic expansion phase. People who have assets, take this as a signal of “being wealthy”. Bank’s also start offering more loans to such people. Why? Because they are taking the inflated assets as collaterals. This leads to more credit (debt) influx into the economy, means further spending.

More spending means, even more income for others (Ray Dalio says, “our spending is others income“).

This is the reason why psychology of people are very up-beat during expansion phase.

Recession Phase:

Exactly the opposite happens in recession phase. People take less debt, spending falls, asset value falls…etc

This is how the short term debt cycles works…check this flow chart which actually sums-up all that we have learnt here…

Conclusion

Short term debt cycle is caused mainly by the availability of cheaper credit. How?

When cheaper credit is available, people feel richer. Why? Because they can spend more (expansion).

As one persons spending is other persons income, the population goes on a spending spree.

When everyone is spending more, industry, business, and government also pushes itself to produce more goods and services (productivity improves).

This ultimately leads to faster GDP growth of the economy.

When less credit is available, people feel poorer. Why? Because they can spend less, also their assets are valued less in these times (recession).

As one persons spending is other persons income, the population starts cuts their spending during recession.

When everyone is buying less, industry, business, and government also slows down its production of goods and services (productivity fall).

This ultimately leads to negative GDP growth of the economy.

Finally, we can conclude two things from here:

- It is because of Credit that we have cycles in our economy.

- It is because of human nature to spend more, we resort to debt.

Such short-short debt cycles leads us to long term debt cycle. In Part-3 we will read about long term debt cycle.

The most interesting part there will be, what causes long term debt cycle and how a nation can come out of the long term debt cycle.

![How Changes in Oil Supply Affect the World and our Investments [Explained] - Thumbnail](https://ourwealthinsights.com/wp-content/uploads/2025/03/How-Changes-in-Oil-Supply-Affect-the-World-and-our-Investments-Explained-Thumbnail-768x463.png)

how can we define it in simple words like a definition

Nice article Mani. Very informative.

I have a question. Why cannot the nations simply eliminate debt/credit concept and just have linear productivity growth that does not fluctuate (i.e we can avoid expansion, recession etc) ?

Excellent question. I will not say that its a “conspiracy” but its a business model which works for banks (in broader perspective for “lenders”), and above all it satisfies our greed for overspending. So pro-credit side will say that it is a win-win situation. But….