What is Emergency Fund?

It is a saving which is built to take care of unforeseen happenings of life. Hence such a saving, which caters only to unforeseen events, is categorised as emergency fund. It is that heap of cash which is used for managing unplanned urgencies like death, hospitalisation, car break-down, house repairs, penalty, rush-travel among other things.

In this guide, I aim to promote the concept of emergency fund. I’ll talk about its need, how to plan for it, how to build it, and where to keep it.

The importance of maintaining an emergency fund is paramount. It is essential for all class of population. But it is specially needed for middle-class. Why? Because their income threshold does not permit them to handle emergencies seamlessly.

Before a person starts to invest money, it is essential to first build the emergency fund (Read: About financial health). It takes time to build the minimum emergency corpus, hence the earlier you start the better.

TOPICS:

- Need of emergency fund.

- Minimum of size of emergency fund.

- How to build emergency fund.

- Where to keep cash (emergency fund).

- Next step to emergency fund building.

Need of Emergency Fund

Consider this, suppose you face a situation where you need urgently Rs.50,000 for a cause. What do you think, from where this money will come? Salary account – which you need to pay your bills? Savings – that you are building for other priorities? Retirement fund – which you are maintaining for old age? Credit Card – which is not meant to be used for unexpected expenses?

For majority middle class, paying an unplanned Rs.50,000 in one go will be tough. Why? Because we do not plan for unforeseen events. Careful people keep a life insurance. People who are slightly more aware has motor and medical insurance – period. But this is not enough.

What about cash requirement? What about such medical needs where hospitalisation is not necessary but medical cost runs high? How about a case where you suddenly realise that your car tyres needs replacement? Read: Spending on car purchase.

Here are few expenses which will need emergency fund for its handling (my personal experiences):

- Medical Emergency: Couple of years back, I had a bad tooth. I approached my dentist and he suggested me a remedy with a cost of Rs.17,000. It required a dental procedure which would have taken two sitting of 4 hours each. No hospitalisation was required. Such medical treatments does not qualify for a medical cover. This is a typical case where emergency fund is needed.

- Vehicle Repair: After driving my car for 6 years, it was time to change its five tyres. The expense was around Rs.30,000. This was an expense which was inevitable, and was also not covered under my motor insurance policy. To meet such expenses I dig into my emergency fund balance.

- Home Repair: Time and again we need funds for our house repair works. I’ve personally drawn money from my emergency fund to repair my fridge, kitchen trolleys, sofa cleaning, repainting of walls, electrical wiring rework, seepages, among other things. Though these expenses are not so high, but at least they are budgeted in my emergency expenses. Read: Plan a property investment.

- Financial Independence: Before I transformed into a full time blogger, I was an employee in a company. The transitions from being a salaried person to a self-employed blogger was a planned step. Before I left my job it was necessary to ensure a sound financial health for self. Among other things, one of the biggest contributors which lead me to financial independence was my emergency fund corpus.

- Unplanned Travel: I remember, in year 2017 I was already living on my blogging income. Free cash situation was not as it used to be when I was a salaried employee. In such moments, twice I had to manage unplanned travels. Had emergency fund not come for my backing, such travels would have eroded my other other savings.

- Extra Income Tax: This was a common case when I used to be in job. In the final three months (Jan-Feb-Mar), my financial manager used to get berserk and was deducting almost 30% of salary to meet my income tax liability. Though a gradual deduction was better, but anyway its was understandable. In those months my emergency fund was making up for the income-deficit. Read: Personal Finance Guide.

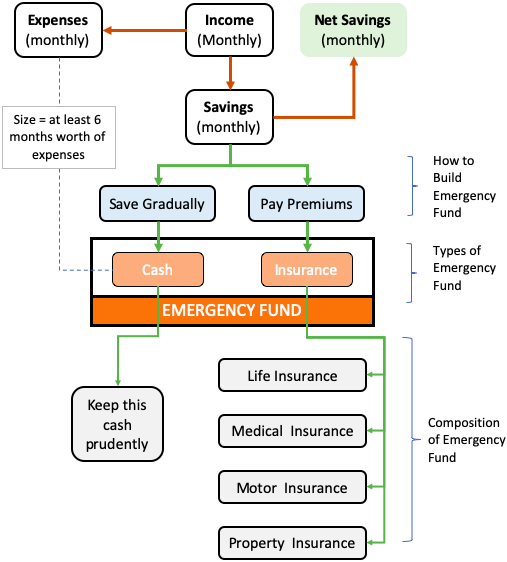

Size of Emergency Fund

Principally, the bigger is the size of emergency fund the better. But more than the size, it is the composition of emergency fund which matters. Building only cash as a part of emergency fund is not enough. Hence, a combination of insurance cover and cash is the best solution:

- #1. Liquid Cash: Not all emergencies of life can be covered through insurance. Cough-&-cold illness may cost less than Rs.1,000. Car tyre repair may cost Rs.500. Ceiling fan motor repair can costs Rs.600. Sudden travel plan can cost Rs.25,000. The point is, maintaining a minimum cash reserve, as a part of emergency fund, is essential. The minimum size must be equal to six times your monthly expense. Read: How to build savings.

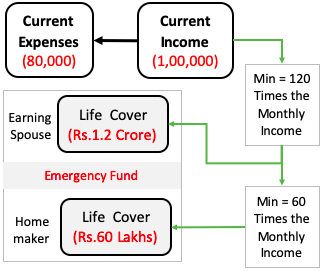

- #2. Life Insurance: It provides protection against the most unfortunate tragedy of life. This type of insurance is a must for all working adults. Here working adults can be office goers and homemaker. The minimum cover should be 120 times the present monthly income. I prefer a term insurance plan for this cause.

- #3. Medical Insurance: In this age of soaring medical bills, medical insurance is a must. For people who have a medical cover provided by the employer, must buy another one funded by self. The minimum size of medical cover must be equal to five times the present monthly income.

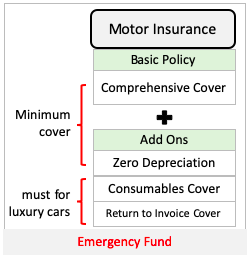

- #4. Motor Insurance: Buying a motor insurance cover is anyways compulsory for all owners. But beyond the regulations, this cover is quite utilitarian. Recently one of my family member’s SUV was hit by a truck from behind. The SUV was damaged beyond repair. Thankfully personal injury was minimal. As the vehicle was insured with “return to invoice policy“, they got full on-road price of the vehicle reimbursed by the insurance company.

- #5. Property Insurance: The minimum property insurance cover must include “fire protection”. Though it is called fire insurance but it actually covers a lot of things. It protects against risk of fire, lightning, explosion/implosion, aircraft damage, riot, strike and malicious damage, storm, cyclone etc. Read more here.

How to Build Emergency Fund?

Building emergency fund can be both easy & difficult depending on ones affordability. In the initial days, building the corpus for emergency fund can be a bit overwhelming. Why? Because the expense required to build it is not minimal. It requires some commitment and planning to build the corpus.

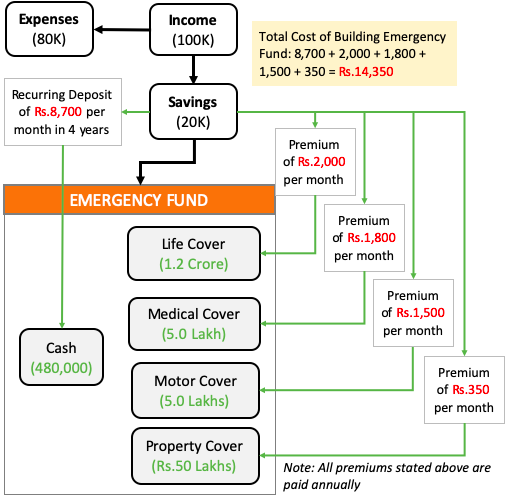

Let’s take a hypothetical example to understand what kind of cost can be associated with building an emergency corpus. Suppose a person’s monthly income is Rs.100,000 and expense is Rs.80,000. The monthly cost associated with building a minimum retirement corpus for the person will be like this:

As indicated in the above flow diagram, total cost required to build the emergency fund is Rs.14,350.

The break-up of this cost is this:

- Recurring Deposit: Rs.8,700/month is used to build the emergency cash. I’ve considered that the cash need to be built in 4 years. To bring down the monthly load, time span can be extended to 5 or more years. Read: About recurring deposit.

- Premium (Life Cover): Rs.2,000/month premium will be enough to buy a term plan cover of Rs.1.2 Crore. This I’ve considered for a middle aged person. For people who are younger, premium cost will be much lesser.

- Premium (Health Cover): Rs.1,800/month premium will be enough to buy a medical insurance cover worth 5.0 lakhs. Buying a health policy early, and paying premium for first 3 years without claim is a good strategy. It will build your credit and give you time so that the clause of pre-existing disease becomes not applicable.

- Premium (Motor Cover): Rs.1,500/month premium will be enough to buy a car cover of 5.0 lakhs. In the process of building credit on motor insurance, it is some times better to avoid car insurance claim. Idea is to keep the claims to minimum so that premium costs also remain low.

- Premium (Property Cover): Rs.350/month premium will be enough to buy a cover for your home. This cover includes damages to the structures of the property due to fire etc.

Where To Keep the Cash Portion of Emergency Fund?

Funds required to meet emergencies of life cannot be built in a day. Better approach is to start keeping aside a fixed amount of money each month. This way, over a period of time, small-small savings converts itself into a substantially big emergency corpus.

Putting aside these small sums of money may look unnecessary in the beginning. But with passage of time, when it become a big corpus, it can cover almost all unforeseen urgent costs.

One cannot confine cash emergency fund size to few months worth of expense. But to give oneself a starting goal, a 6 multiple (as explained above) is good. Ideally, the bigger is the emergency fund the better.

There is tendency to accumulate emergency funds first and then spend it on needless things at the end. But emergency fund cannot be be spend needlessly. It is a crime towards ones personal finance.

Hence, it is essential to keep aside the emergency funds so that one never gets a glimpse of it in day to day life. One can keep emergency fund in a number of ways. But no matter what way one selects, it must exhibit following parameters:

- (a) Liquidity: Emergency fund saving must be very liquid. If it takes 10-15 days to liquidate funds, it means, it is not a good option. Emergency fund should be kept in such a way that it can be withdrawn within 2-3 days.

- (b) Risk Free: Investment risk builds up due to price fluctuation. One cannot lock their emergency fund in options where prices remains volatile. When people want to draw money during emergency they must do it without any restrictions. Such situations are undesirable where the corpus size is dwindling heavily between highs and lows.

Hence, it is advisable to keep the cash portion of emergency fund in debt linked plans where volatility is small and exit is faster.

My ways of keeping the cash:

- 1. Piggy Bank (10%): Yes, the best way to keep emergency fund is in your piggy bank. Buy those clay made piggy banks which allows money to only to go-in. To take money out, one must break-open the piggy bank. No other option can match the liquidity of this option. This option is a zero return (interest) option. But this is the age old methodology which works even today.

- 2. Savings Account (20%): Keeping emergency cash in savings account is ideal. It provides liquidity and also risk-free interest. But people tend to spend money kept in saving account. What can be done to better it? Maintain a separate savings account to keep emergency funds. Return its ATM Card back to the bank. Just keep the cheque-book and use it during need.

- 3. Fixed Deposit (30%): If one does not want to open a separate savings account, fixed deposit will do. Use your existing savings account and open a FD for duration as long as say 9-10 years. Let that money stay there undisturbed for (like) forever.

- 4. Gold ETF (20%): Since ages, people treat gold as an investment heaven. Though I will not suggest to keep more than 20% of emergency fund in gold. Why gold ETF? In long term, price appreciation of gold beats inflation for sure. Even in short term, price fluctuation of gold is not too much. The ease with which one can buy and sell ETF’s is much better than physical gold. One can redeem gold ETF in one trading day.

- 5. Money Market Mutual Fund (20%): Money market funds invests only in risk free securities. The securities are either issued by government or by the banks and corporates. In a five year time horizon, a money market fund can yield 7-8% return per annum.

Next Steps Upon Building Emergency Fund…

Suppose in next few years you have built the required size of emergency fund as per your income/expense balance. Once the emergency fund is in place what should be the next step?

The next step must deal with becoming debt free and starting an investment regime. Generally people start to invest money without fulfilling the obligations of emergency fund and loans.

I think that a better strategy is to start investing only after ones emergency fund is built, and loan outstanding is zero. This investment strategy is not only simpler to practice but also has huge long term benefits.

Conclusion

As Dave Ramsey says, emergency fund can convert your “major life crisis into just a light inconvenience”. Treat yourself as a trapeze artist, and your emergency fund as your safety-net.

I’ve seen people with “zero emergency fund” worrying about stock market, economy, loan interest rates, income tax burden etc. They worry must be focused on emergency fund building.

These are same people who have heaps of debt in form of home loan, personal loans and credit card debts. They worry about where to invest money. If I would have been in their shoes, I would have diverted my attention towards emergency fund building and loan clearing.

Even before loan clearing, having sufficient savings (emergency fund) to take care of our needs in rough weathers is essential. Read: About the process to become rich.

![Income Tax Slabs: Tax Liability Comparison Between 2020 and 2019 [Calculator]](https://ourwealthinsights.com/wp-content/uploads/2020/02/Income-tax-slabs-Image.png)

Hey Mani, great post btw I am following your Blog from 2018.