Insurance planning is essential. It helps people to manage the potential risk that may come in future.

The probability of occurrence of such a risk is bleak, but if it comes it has a high cost implication.

This is why it is better to plan from a very early stage.

What risks we are talking about here?

We are talking about monetary impact due to loss of assets.

Which assets?

The assets can be a human being and it can also be physical assets like property, equipment’s etc.

Assets are useful and it also produces monetary benefits.

When an asset is lost, the monetary benefits ceases to yield.

In common man terms we call such loss of assets as a mishap.

Insurance provides monetary compensations to the beneficiary in cash of a mishap.

Let’s take few examples of assets and consequences due their loss.

Example 1:

Lead earning member of a family is an asset.

In case the person meets with a road accident, the ability of the person to generate income gets hampered.

Here the insurance compensates the person by providing monetary support during the treatment of the deceased.

Example 2:

Equipment / Machinery is a manufacturing plant is a big asset.

In case the equipment breaks down due to a hazard like a cyclone, then its potential to generate product/income gets hampered.

Here the insurance compensates the company by providing monetary support to make-up for the loss.

Above two examples indicates the potential risk to an individual or a company.

When one buys an insurance policy, he is actually transferring his risk to the insurance company.

The insurance company in turn compensates the beneficiary in case of any future loss.

But why an insurance company will do this for an individual or a company?

For sure they do not provide this service for free.

The policyholder needs to pay money to insurance company every month, quarter or annually as applicable.

The money that is paid to the insurance company are called premium.

What happens if a person is not insured?

There is no problem till no mishap occurs.

But one day or the other mishap is bound to show its face. Somebody in family may get hospitalised.

The car may meet a road accident.

Earning member of the family may meet a fatal illness etc.

These type of risks always linger above one’s head.

If there is no insurance, cost impact of such a loss has to be borne by the affected person.

Hence it is advisable to always keep oneself suitable covered with a good insurance policies.

#1. Insurance planning covers all types of risk?

The answer is no. It will not be economically viable for the insurance company to cover all types of risk.

So which risks are covered by insurance companies?

In general, any risk which satisfies the below two major preconditions can be covered under insurance:

#1.1 Precondition 1:

The risk should not be unique. Large group of people must be exposed to the same risk.

Like everybody on this mother earth is exposed to the risk of illness. Hence we have medical insurance.

Everybody is exposed to the risk of sudden death. Hence we have life insurance.

Everybody’s vehicle may break-down some day. Hence we have motor insurance.

People may lose their luggage during a journey. Hence we have travel insurance.

This way the insurance companies collects premiums (say every month) from large group of people.

This helps them to build their insurance fund.

From these large group of people, only few actually actually experiences the risk.

So, it is easy for insurance companies to cover these affected people.

In case there are no large number of premium payees, the risk cannot be insured.

It becomes inviable for insurance companies to cover such risks.

#1.2 Precondition 2:

The chance of occurrence of the said risk must be uncertain.

The risk may pose on a person only accidentally.

If the risk is made to appear intentionally by the beneficiary then such an occurrence of loss will not be covered under insurance policy.

Here one may ask that what about life insurance? Death is certain, right?

Yes, but occurrence of death is unpredictable.

No body knows what time it will strike Hence this certain-loss of human asset is covered under insurance as an exception.

#2. Insurance plans are savings or investment products?

In addition to risk cover, insurance products may also offer saving potential.

There are few insurance products (like ULIP) which companies call as investment products.

But I personally do not consider them as one.

Please note that insurance product is not an investment vehicle, they offer only savings benefits.

Term plans (life insurance) does not offer any savings benefits.

Motor insurance policy does not offer any savings benefits.

Medical insurance policy does not offer any savings benefits.

But an endowment plan (Life insurance) can provide savings benefits.

So people may also consider buying an insurance for the sake of building a savings (other than keeping money in savings account).

Moreover, insurance premiums also saves income tax in general.

#3. Start insurance planning like this…

No financial planning can be complete without including insurance planning.

So how one can do insurance planning for self?

#Step 1. Identify potential risks

Here risks are those future occurrences that may lead to loss of income. Potentially an average person is exposed to the following risks of loss which can be covered under insurance:

- Sudden/Natural death of a person

- Maintenance or replacement of equipment’s in plant

- Hospitalisation due to illness or injury

- Vehicle repair due to breakdown or damage

- Theft or destruction of property

#Step 2. Calculate insurance cover required

Why one needs insurance? To get adequately compensated in case of loss.

So how much is adequate? This calculation and estimation is part of insurance planning.

Ideally a person would like get a very high insurance coverage.

But practically this may not be possible.

The reason being the cost of premium.

The higher will be the cover, higher will be the insurance premium.

So there must be a balance established between the desired insurance cover and affordability.

#Step 3. Selection of a right insurance product

Depending on one’s insurance needs and affordability, one must select a suitable insurance product.

It is point worth mentioning here that, insurance calls for a long term commitment.

There are not like bank deposits, which can be opened today and liquidated after one year.

Early closure of insurance policy bears penalty.

Hence while selecting a insurance product, one must take extra care.

Objective should be to select a perfect product which will stay with you for the full policy term.

#Step 4. Re-evaluate insurance needs every 5 years

As people evolve with age, insurance needs also change.

Hence it is essential for people to re-evaluate their insurance needs.

I personally re-evaluate my insurance requirements every 5 years.

But why insurance needs change with age?

Lets see few such examples to understand this concept:

a) After marriage, insurance needs change.

One can opt for family insurance policy instead of continuing with an individual policy for each member.

This gives bigger cover for a lower premium.

b) Birth of child, will also change the insurance needs.

These days, in addition to life insurance, parents additionally also buy focused child insurance plans to cover other requirements of the child.

c) Loss of job or retirement from job.

d) Purchase of a motor vehicle

e) Purchase of a house property

f) Possibility of illness or deficiencies which is not certain but can comes with age.

#4. How to calculate one’s life insurance cover?

Lets take a real life example to understand how one can calculate one’s life insurance cover.

Example-1:

Suppose Raj earns an annual income of Rs.10 Lakhs.

Presently (Year 2017) he is 33 years of age.

He expects to be in job till 60 years of age (Year 2044).

Means Raj will continue generating income for next 27 years of his life.

Calculate the necessary life insurance cover that Raj’s family will need.

Here we will assume that the annual income of Raj will increase at an average rate of 5.5% per annum for next 27 years.

In case the corpus/cover amount is invested today, it will generate an average return of 7.8% per annum for next 27 years.

| Back-up Calculation | ||

| Present Annual Income of Raj | Rs. 10,00,000 | |

| Adjusted Rate (salary increment vs investment return) | 2.18% | =((1+7.8%)/(1+5.5%)) – 1 |

| Income generating years | 27 Years | 60 – 33 years = 27 Years |

| Life Cover Required | Rs.2.07 Crore | =PV(2.18%,27,-1000000,,1) |

The above calculation established that Raj’s family will need a minimum life cover of Rs.2.07 Crore.

This amount will ensure them to lead a life style without compromising their standard of living.

Please note the following about the above calculation:

(A) In case of the demise of Raj, the family will get the insurance cover amount of Rs.2.07 Crore

(B) This amount will be invested to generate returns at rate of 8% per annum

(C) At the beginning of each year the family with withdraw, from the invested corpus, the needful amount required to run their livelihood.

(D) By the year 2044, the corpus will be used up completely.

Example-2:

Suppose present total monthly expense of Raj is Rs.83,000 per month.

He currently carries an outstanding home loan balance of Rs.40,00,000.

There is also an existing life insurance cover of Rs.1.0 Crore for his family.

He also has a second residential property worth Rs.50,00,000 in his name.

He needs to buy a life cover for his wife who is currently 39 years of age.

Life cover should be sufficient to protect his wife till she is 80 years of age.

What should be the life cover he should buy more?

Here we will assume that the average inflation rate will be 5.4% per annum.

In case the corpus/cover amount is invested today, it will generate an average return of 7.8% per annum for 41 years.

| Back-up Calculation | ||

| Present Annual Expense of Raj | Rs.10,80,000 | =Rs.90,000 x 12 |

| Adjusted Rate (salary increment vs investment return) | 2.28% | =((1+7.8%)/(1+5.4%)) – 1 |

| Cover required for number of years | 41 Years | =(80 – 39) years |

| Life Cover Required | Rs.2.93 Crore | =PV(2.28%,41,-1080000,,1) |

The above life cover calculated need to be further balanced with respect to Raj’s existing assets and liabilities

| Life Cover Required | Rs.2,93,00,000 | |

| Existing Home Loan | Rs.40,00,000 | |

| Life Cover After Adjusting for Home Loan Balance | Rs.3,33,00,000 | |

| Existing Life Insurance | Rs.1,00,00,000 | |

| Life Cover After Adjusting for Existing Life Insurance Cover | Rs.2,33,00,000 | |

| Existing Property Valuation | Rs.50,00,000 | |

| Life Cover After Adjusting for the property | Rs.1,83,00,000 |

The above calculation established that Raj’s wife will need a further life cover of Rs.1.83 Crore.

This amount will ensure her to lead a life style without compromising her present standard of living till she is 80 years of age.

#5. What are the types of life insurance products available in the market?

5A) Term Insurance Plan:

This is the most economical life insurance plan.

It only covers the risk without providing any savings benefits.

It means, if the policyholder dies during the cover period, only then the deceased family will get the insurance benefits.

In case the person survives the policy term, all the premiums paid will be the cost to the policyholder.

In case of term plan investment return is 0%. But it is a pure life insurance product.

5B) Endowment Plan:

This insurance policy is costlier than term plans.

This is an insurance plan with savings benefits.

In case of the maturity of the policy term, the sum assured will be paid back to the policyholder with some additional returns.

In life insurance terms the additional returns is called “accrued bonus”.

If there is a demise of the policyholder during the policy tenure, the deceased family gets the sum assured plus bonus as applicable.

5C) Money Back Plan:

This is also a type of endowment plan.

In addition to the life cover this policy also offers cash payment at regular time periods.

These cash payments are adjusted from the sum assured.

5D) VIP and ULIP:

Both VIP and ULIP provides insurance benefits plus some additional returns.

In case of VIP, they give a guaranteed return, plus variable return depending on the type of policy.

In case of ULIP, there are no guaranteed returns as the invested amount is linked to equity based mutual funds units or stocks.

These investment products give higher rate of returns than any endowment plans.

To know more about ULIP you can check this link…

5E) Pension Plans:

This insurance plan is focused on persons retirement.

After term plan and endowment plans, perhaps this is the most seeked insurance product of all.

Pension plans give assured benefits to the policyholder.

The retirement corpus gets build with every premium payments made by the policyholder.

At the end of the tenure, the beneficiary or policyholder can withdraw 66.6% of the corpus.

Balance 33.4% will be used to buy an annuity. The annuity generates regular income for the policyholder.

5F) Loan Cover Plan:

This type of insurance policy covers the outstanding loan balance of the policyholder.

In case of sudden demise of the policyholder, the insurance company will pay back the loan to the loan issuer the outstanding balance.

The sum assured in loan cover policy reduces with time.

This policy is also like a term plan.

The policyholder gets no returns upon the maturity of the policy.

5G) Other insurance products:

5G.1) Property Insurance:

This insurance policy provides protection against fire, theft etc to the property.

Only natural and man made damages are covered under property insurance.

But it must be noted that natural wear and tear of property or wilful damages are not covered.

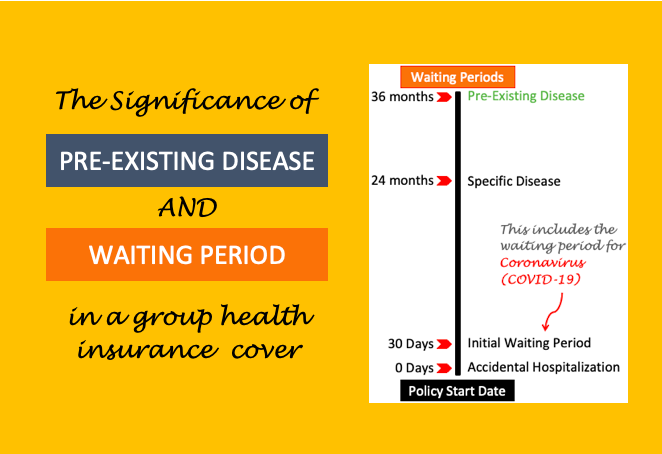

G.2) Medical Insurance:

This policy provides protection against illness or accidental injury to the policyholders.

Generally, to claim medical insurance one has to be hospitalized in the hospital for at least 24 hours.

Not all hospitalization charges are covered under medical insurance policy.

Consultation fees, treatment costs, medicine cost, charges for the bed etc are covered under the policy.

5G.3) Vehicle Insurance:

This policy provides protection against accident of the vehicle.

Damage insurance is not compulsory as per motors act, but third party liability must be taken by the vehicle owner.

This is compulsory.

5G.4) Personal Accident Insurance:

In this policy if the person becomes physically disabled due to injury caused by an accident is covered.

Both total and partial disablement is covered under this policy.

5G.5) Travel Insurance:

Protection is provided to the traveler in order to meet any emergency faced by the person while traveling.

In general, insurance companies cover the expenses arising out of:

- Medical needs,

- Delay in baggage arrival,

- Accident during travel etc.

The cover is provided to the traveler in form of reimbursement only.