One’s present personal financial health is built upon how money was handled in the past.

Better the money is handled today, healthier will be the future financial health score.

When money is spent only to buy things, it can add nothing to one’s financial health score. Instead, it affects negatively.

So, how to handle money?

Save a part of income, and then invest it to take care of the financial goals. How investing helps? It builds Net Worth.

Bigger is the net worth, healthier will be ones finances.

Topics:

- Financial health & net worth.

- How to build a robust net worth.

- Become financially healthy:

- Conclusion.

Financial Health & Net Worth

Who can be called as a financially healthy person?

A person whose net worth is robust enough to take care of all priorities of life (financial goals), can be called as financially healthy.

- Robust Net Worth: When a persons net worth is growing at a necessary pace, it can be called as robust. How to know if net worth growth rate is acceptable or not? It must grow at a pace so that it can fund the planned priorities of life (as it comes). This is a hint of suitable growth. Read: Track net worth growth.

- Priorities (Financial Goals): Listing down of all financial goals is a key step towards building a financially healthy life. If we are not doing it, we are living in ignorance. Make a precise list. Interpretation of financial health can be done with respect to the achievements of these goals. As net worth grows, it must also help in achieving these goals. Read: Goal based investing.

No matter how big is ones net worth, if it is not able to take care of the financial goals, the person is NOT financially healthy.

So, to become financially healthy, one must first identify the goals. Once they are all listed in one place (with time line and numbers), start building net worth to complement it.

How to Build a Robust Net Worth?

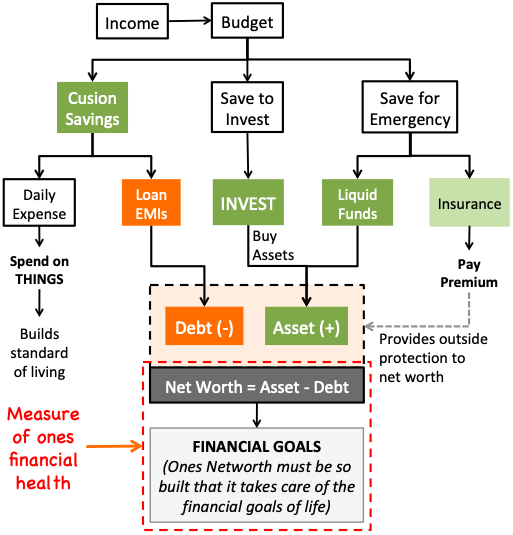

This is a schematic representation of building robust net worth. A good mix of three (3) ingredients ultimately cooks a sustainable net worth:

- Cushion Savings: It is that saving which is sufficient to take care of next 6 months expenses. If ones present monthly expense is Rs.50,000. The minimum size of cushion savings required will be Rs.300,000 (50,000 x 6). It acts as a buffer between income and spendings. Why to build this buffer? Read more about it here.

- Emergency Funds: There are two components of emergency funds. Liquid cash and insurance cover. Liquid cash comes in use when something unexpected happens in life (resulting in extra expenses). They are meant to take care of only small unexpected expenses. Insurance cover takes care of major emergencies of life. Read more here.

- Invest to Buy Assets: While investing, care must be taken to buy only quality assets. These are such assets which will yield only positive returns for its investors. Such assurance of returns can be achieved in two ways: (a) by investing in risk free assets, or (b) by investing in risky assets which are undervalued. Read more about it here.

The MAIN contributor to net worth are investments. But it does not mean that other two factors can be ignored.

To ensure that enough funds are always available for investing, ‘cushion savings’ and ’emergency funds’ must always be kept saturated.

Become Financially Healthy

How to do it? Which steps can be taken to transform one’s financial health?

Suppose you as an individual wants to become healthy (money-wise). What you must do to achieve this target?

My suggestion will be to first understand the above two infographics.

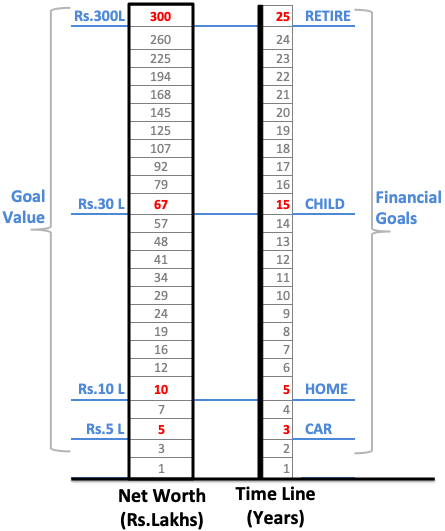

Fig.1 makes it visible so as to how the growth of net worth must complement the future financial goals of life.

[Remember: Investment adds to your net worth, but financial goals consume it (makes it lesser).]

Fig.2 explains the whole process of net worth building. It establishes a correlation between how income, savings, expenses, investment, assets. debt etc, directly or indirectly contributes in net worth building.

Once Fig.1 and Fig.2 are understood, take the following six (6) steps to start the journey of financial health transformation.

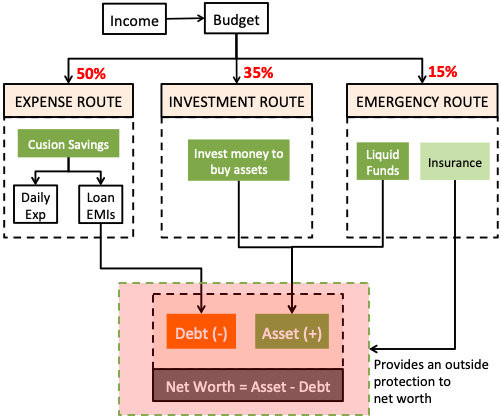

Step #1: “Budget” The Flow Of Money

Start with budgeting. Why Budgeting is required? Because we do not want all our income to be consumed by wants and needs (typical expenses).

In fact, to lead a financially healthy life, not more than 50% of income should be allowed to get expended.

Ideally: First save 50%, and then spend the balance 50%.

How to do it? This target can be achieved only if we budget our income and expenses.

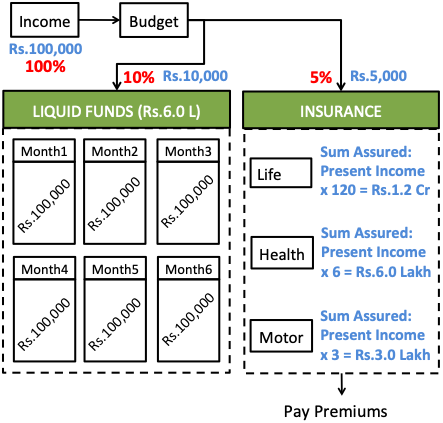

Here is a schematic representation of budgeting income to make it flow into three main routes: (a) expense route, (b) investment route, and (c) emergency route.

- Expense Route: Maximum 50% income should be allowed to go in this route. Money flowing here should be used to manage regular household expenses. But to spend it seamlessly, first build cushion savings. All bills etc must be paid from funds accumulating in cushion savings.

- Investment Route: At least 30% income should be budgeted for investment purposes. The money coming this way should be used to buy assets. These assets can be like mutual funds, shares, real estate, bonds, gold etc. Know more.

- Emergency Route: At least 15% income should be used to build emergency fund. This money is used to pay insurance premiums, and building cash reserves. This cash reserve is different from cushion savings. They get used to manage only unplanned exigencies in life. Know more.

Budgeting alone is not enough. It is also essential to track the money flowing into the three routes.

Tracking expenses is more important for expenses route. Why? Because here, one has to deal with daily household expenses.

Step #2: Build “Cushion Savings”

Cushion savings acts as a buffer between our income and expenses. Why to build this buffer? Because our urge to spend money is endless. The more we earn, more we’ll spend. Hence, to control the urge, we need to show our mind that we only have a finite savings, which can be used to manage household expenses. This eventually prevents overspending.

Expense route consumes the maximum portion of income. Moreover, the expenses happening here may be executed multiple times in a day.

Hence, it is necessary to keep a check on how money is spent here. What is the problem? The probability of people overspending in the expense route is very high.

How to prevent overspending? In two ways:

- By building cushion savings.

- By Keeping a check on Debt-Income ratio.

#2.1 Cushion Savings

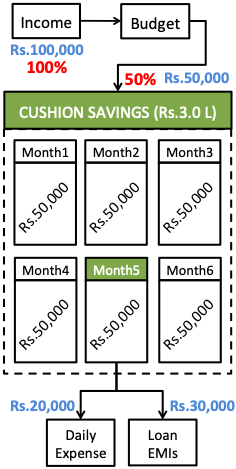

How this helps? Let’s understand this with a pictorial representation:

Cushion savings is an accumulated stack of money. The size of cushion savings is equal to 6 months expenses. It acts as a bank locker. Every time we need money to spend, we will take money out of the locker.

Two things to care about cushion savings: (a) The balance of cushion savings should not fall below the designated value (6 X Monthly expense). If it falls, compensate it in next month by spending less. (b) Every month only 50% income comes in. Hence we must withdraw only as much money from it.

How to build cushion savings?

Example. Suppose there is a person whose total monthly expense is Rs.50,000. Its break up is like this (a) Rs.30,000 (Loan EMI’s) and (b) Rs.20,000 (Other daily expenses).

The person must FIRST target to build a minimum cushion savings of Rs.3.0 Lakhs (Rs.50,000 x 6).

Till the cushion savings is built, no money should be diverted to other routes (investment or emergency). Use all money to first build cushion savings.

Once the cushion savings is built, spend each month, only as must money as you add into it (50% of income).

[P.Note: When expenses increase, make sure to top-up the cushion savings. If expense increases from Rs.50K to Rs.55K, the size of cushion savings must also increase from Rs.3.0L to Rs.3.3L.]

#2.2 Debt-Income Ratio

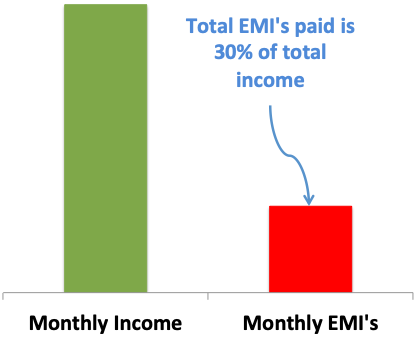

It is essential to keep debt in check. Why? Because too much debt can take our finances out of control. How to keep a check on debt? By monitoring the debt to income ratio.

Preferable, ones debt to income ratio should never go beyond 30%.

Let’s take a simple example and calculate debt-income ratio.

Suppose a person is paying following loan EMI’s: (a) Rs.100,000 – home loan, (b) Rs.30,000 – car loan, (c) Rs.35,000 – education loan. Total EMIs paid in a month is Rs.165,000. This person has an average monthly income (amount credited into bank a/c) is Rs.280,000.

What is his debt to income ratio?

- Debt Load = Rs.165,000 (EMI’s paid in a month).

- Income = Rs.280,000.

- Debt-Income Ratio = 58.9% (165000/280000).

As debt-income ratio is above 30%, the person is clearly overspending. It is a sign of bad financial health.

When debt to income ratio is above 30%, it becomes difficult to maintain the expense route running only with funds limited to 50% of income. Which eventually means, lesser money flowing for emergency and investment routes.

Step #3: Build “Emergency Fund”

Why to save for emergency?

Because if not done, emergency expenses will eventually eat into the net worth. Emergency fund keep the net worth insulated from such happening.

What are the constituents of emergency fund? Let’s understand this with a pictorial representation:

Emergency fund is a mix of “liquid funds (cash)” and “insurance covers”.

- Liquid funds (Cash): They are parked savings in form of fixed deposits. Their minimum size is equal to 6 months worth of income. These cash savings shall be used only when unforeseen expenses happen. These are such events which are not covered under insurance. Example: home repair, minor health issue, unplanned travel, surprise guests etc. Read: Earn high interest on FD’s.

- Insurance Cover: Life and medical cover is compulsory. Life cover must be of minimum amount equal to 10 years worth of present income. If present monthly income is Rs.100,000, minimum life cover should be of Rs.1.2 Crore [Rs.100,000 x (10×12)]. Minimum health cover should be equal to 6 years worth of present income. I also prefer maintaining motor insurance cover.

After the person has build “cushion savings”, the NEXT target is to build “emergency fund”. Till the emergency fund is built, use all spare money to build it.

Once the emergency fund is built, lock the “liquid funds” in a fixed deposit, or in a long term debt based mutual fund.

Once we have cushion savings and emergency fund in place, we are ready for investing.

Step #4: Finalise Financial Goals

Before this step, you have already have stack load of savings in form of “cushion savings” and “emergency fund”. Now you can call yourself “secure”.

But you are still not financially healthy. To become so, build your net worth by investing. But before starting to invest, it is essential to know why you are investing.

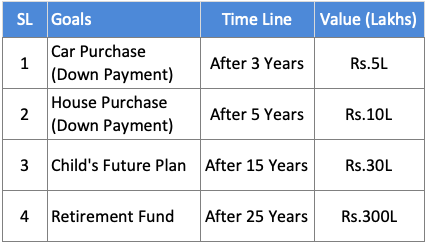

This question can be answered by finalising the financial goals. In my example, I’ve considered four (4) typical financial goals.

It is the financial goals for whose achievement one must invest money, and build net worth.

Once the goals are defined, the person is ready to go for investing and accumulating assets in full throttle.

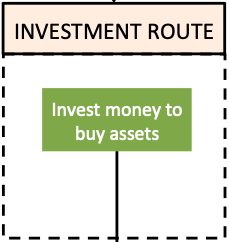

Step #5: Invest To Accumulate Assets

This is the most important step. All of the other four (4) steps works as a precursor to investing. All the hard work done till now, was to facilitate oneself to invest freely.

While investing, the focus must be on accumulating quality assets. Which are quality assets? They can be broadly categorized into two types:

- Fixed Income Assets: These are risk free assets. Their quality is dependent on their yield and credit rating. A combination of high yield and high credit rating makes a high quality asset. The downside of such asset is that their yield is low (compared to equity). In India, risk free instruments are currently yielding 3.5% to 8% returns. Examples of such assets are: annuity, tax saving instruments, fixed deposits, bonds, debt funds, rental properties etc. Read: Earn risk free high returns.

- Capital Appreciating Assets: These are assets whose value appreciates FASTER with time. Their value appreciation is faster than yield of risk free assets. The quality of such assets are dependent on their price valuation and strength of their underlying business. Equity based investments like shares, and equity funds are best example of capital appreciating assets. In India, return from equity can range between 8%-25%+ p.a. Read: Invest to earn capital growth.

If a person has no investment idea, better will be to stick to fixed income assets. In such assets, the return is guaranteed. There is virtually no risk of loss.

But if desire is to earn higher returns, equity is the route to follow. How to invest in equity?

- Novice: Follow the E.L.S path. What is ELS path? “E” stands for Equity Mutual Funds. “L” stands for long term holding. “S” stands for Systematic Investment Plan. ELS is suitable for novice investors. This is a no brainer investment strategy. Select a high Crisil Rated Equity Mutual Fund. Buy units of this mutual fund, systematically, for at least next 7 years. On an average, return of ELS can range between 12%-18% p.a.

- Expert: Direct equity path (stocks/shares) is most suitable for experts. The care that needs to taken here is to ensure purchase of only undervalued stocks which represent a fundamentally strong company. On an average, return of from direct stocks can range between 8%-25%+ p.a.

Need For Investment Diversification

Looking at the potential returns from equity based investments, majority prefers equity.

But when it comes to equity, it must be dealt with care. We have seen above how a novice and expert should deal with equity.

There is another investment RULE which must be followed as a part of “equity risk management”. This rules ask investors NOT to put all eggs in one basket.

What does it mean? It means, no matter how lucrative is equity, one must never park all money in equity. Read: How defensive investors can diversify investment.

Investment must be distributed between Equity, Debt (risk free), Real Estate & Gold.

But if you do not want to diversify so broadly, follow this equation:

Equity = 100 – Debt

- Debt = Your Age.

Suppose your age is 35 years. Your investment must be distributed in this proportion: Equity (65%) & Debt (35%).

[Tip: If your age is 35 years, select a hybrid mutual fund, whose asset composition is 35% debt and 65% equity. Read: The best investment strategy]

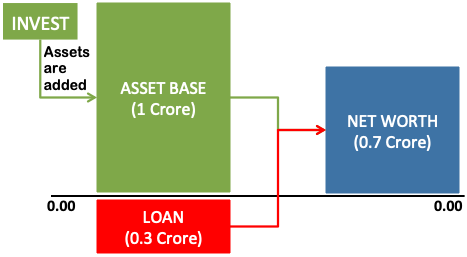

Step #6: Determine Net Worth

True measure of financial health is “net worth” and not the “size of asset base”. Read: How to build assets.

To become financially healthy, one must focus on two things, (a) increasing size of asset base, and (b) reducing loan balance.

When we can say a persons financial position is healthy?

It is healthy when net worth is positive and is growing at a speed higher than inflation.

What we can consider as assets?

- Money in savings account.

- Fixed deposits.

- Bonds.

- Annuity.

- Debt based mutual funds.

- Equity based mutual funds.

- Undervalued stocks.

- Real estate property.

- Precious metals (gold, silver) etc.

What type of loans can be consider as liability in personal finance?

- Credit card balance.

- Mortgage (home loan).

- Car loan.

- Education loan.

- Personal loan etc.

Example: Let’s take a simple example of an improving financial health.

In the above example, net worth was negative (-10.0 Lakhs) five years back. Today the net worth has turned positive (3.98 lakhs). This transformation was caused due to appreciation in value of assets (FD, share, & MF’s), and depreciation in loan outstanding.

Net worth is turning from negative to positive is a clear sign of an improving financial health.

Conclusion

A person may have an investment portfolio of size say Rs.10 Million. But this number gives only half the picture of his financial health.

To determine the REAL financial position of the person, knowledge of the size of liability (loan balance) is also essential.

If the above person has loan balance of say Rs.12 Million. In this case, net worth of the person is in negative (-0.2 Million). It is an indication of bad financial health.

You must have heard the term HNI’s. It is an acronym for “high net worth individuals”. These are people who has very high net worth.

Few example of such people can be Jeff Bezos, Bill Gates, Warren Buffett, Mukesh Ambani etc.

These people are an epitome of prime “financial health”.

They have become so, by maintaining a clever balance between their liabilities and assets (high net worth).

5 Quick Tips to lead a financially healthier life:

- Track Net Worth: Never look at your investments alone. Look at it from the perspective of current loan balance. How to do it? By tracking net worth growth. How to make it grow, buy quality assets or prepay your debts.

- Become Debt Free: Debt is the main hinderance to leading a financially healthier life. Take a pledge, and start taking steps to become debt free from today.

- Pay Yourself First: Before you spend a penny, pay yourself first. This is a concept which enhances ones ability to save money without fail. Try to pay yourself at least 50% of your income. Then, utilise this fund for investing and building emergency savings. Read: How to pay yourself first.

- Live Frugally: Start tracking your expenses from today. The objective shall be to list down all expense line items with its values. Once the list is ready, categorise them into necessary and unnecessary heads. To live a frugal life, reduce the unnecessary expenses by at least 50%. Over time, idea should be to bring unnecessary expense to zero. Read: About expense tracking.

- Invest Systematically: Even if you know nothing about investing, you can still invest effectively. How? By taking the mutual fund route. Even if you are a defensive investor, invest in a hybrid mutual funds. They has a mixed exposure in equity and debt. Start a SIP in such funds, and stay invested for long term (7+ years). But if you can digest some volatility in short term, try multi cap & mid cap funds.

Financial health can be built faster if money is spent in a disciplined way. Develop the habit of budgeting and expense tracking. This step itself will take you miles ahead in your financial health journey.

Anything which you can sell tomorrow for cash is your asset (your home is not an asset). Market value of such items can be used to quantify their size. Make a list of such assets and find its total value. Deduct the size of your loan balance from the total asset value. This is your net worth. Read more about net worth growth.

Hi Mani,

I and my family have benefited a lot from your blogs.So,thank you.

With regards to the cushion savings,you suggest that one should build savings towards this head which is equivalent to 6 months of expenses(regular + loans).So my question is this,once the 6 month period is over the funds parked for this head gets over,so should one start bulding again for another 6 months.If yes,then i may as well just set aside every month from my salary this money instead of building it for 6 months.

Do hope i am fairly clear with my clarifications.

Request your feedback.

Thanks again.

Warm Regards

Malcolm

Hi, every penny consumed from cushion savings shall be replenished immediately.

Thanks for the query.

Where to keep cushion savings for easy access and growth?

The easiest option: in savings account (bank)

Very Nice information on financial health and beautiful way of explaining but how is the income managed in a early age as a fresh joinee how can i progress in income with 2L every year?

Estimate your max affordability to save money and then proceed.

Very Right, But how to distribute corpus in Regular Income & proportionate for future Growth.??

Analyze your risk profile. The easier way to do it is based on your age. If you are 30, invest 30% in ‘fixed return instruments’ and 70% in equity. Fixed return plans will generate fixed returns (in form of dividend, interest, or price growth). Equity will ensure fast capital appreciation. The proportion between “fixed return” investments and equity will change with your age. One can follow the age formula for asset allocation till retirement. After retirement, investment style must change..

I am retire Govt.employee, with corpus of 2 Crs.

But unable to manage it. Will you pls help/guide me.?

How to manage corpus for Regular Income & Groth….

I’ll suggest you to read this post on how to invest money after retirement:

http://ourwealthinsights.com/invest-retirement-money-india/