Let me tell you a story of the Chaiwala, the Software Engineer, and the Secret of Free Cash Flow. So, a few years ago, I was sipping chai at my regular spot near my office – you know, that tiny little stall run by Sharmaji, who makes the best ginger chai in the area. I overheard a conversation between Sharmaji and a young software engineer, Rohan, who was a regular there too.

Rohan was excited. He’d just bought shares in this hot new tech company everyone was talking about. Sharmaji, ever curious, asked him, “Beta, what does this company do? Will they last?“

Rohan started rattling off about disruptive technology, market share, and user growth. Sharmaji looked utterly lost. Finally, he said, “Okay, okay… But beta, are they making money? Can they pay their bills? Can they save some money after all that?”

That’s when it hit me. Sharmaji, this simple chaiwala, had unknowingly hit upon the core of what matters in investing: Free Cash Flow. Meanwhile, Rohan was just focused on the hype. But Sharmaji instinctively understood that a business needs to generate real, usable cash to survive and thrive.

See, that “saving money after paying the bills” that Sharmaji talked about is what Free Cash Flow (FCF) essentially tells you. It’s the cash a company generates that’s actually available to reinvest in the business. This money can be used to pay down debt, or even return to shareholders like you and me.

Later that day, I actually talked to Rohan about it. He admitted he hadn’t even looked at the company’s cash flow statement. He only say the revenue growth projections. Unfortunately, that company eventually fizzled out because, while it was growing fast, it was burning through cash even faster.

Sharmaji, on the other hand, continues to serve the best chai and quietly saves up. He was probably a better investor than Rohan was back then.

The moral of the story? Don’t be like young Rohan. As long-term investors, we need to look beyond the buzz and understand the real engine of a company’s success: its ability to generate free cash flow.

In this post, I’ll break down what Free Cash Flow is, why it’s so important, and how you can calculate it yourself. Let’s get started, shall we?

Free Cash Flow Calculator

Free Cash Flow Calculator

Table of Contents

1. What is Free Cash Flow: The Meaning?

Imagine you run a small business, say, a mithai shop (sweet shop) – because who doesn’t love jalebis and ladoos, right? You sell sweets, you pay for ingredients, electricity, your helper’s salary, and all the other expenses. Now, after all that, the money you have left over is what you can use to expand your shop, buy a new kadhai (big frying pan), or even take a little bit home for yourself.

Free Cash Flow is basically the same concept, but for a big company.

In simple terms, Free Cash Flow (FCF) is the cash a company generates from its operations, after accounting for all the money it spends on maintaining or expanding its asset base.

Think of it as the “real profit” a company makes. It’s the money that’s truly available to be used for things that benefit shareholders, like:

- Reinvesting in the Business: This could be anything from building a new factory to developing a new product. Think of Reliance expanding into new sectors or TCS investing in AI research.

- Paying Down Debt: Reducing debt makes the company more financially stable and less risky.

- Paying Dividends: Giving a portion of the profits back to shareholders. It’s like getting a little bonus for owning the stock.

- Buying Back Shares: This reduces the number of outstanding shares, which can increase the value of the remaining shares.

Why is it called “Free”?

The “free” in Free Cash Flow means that this cash is free from obligations. The company has already paid for everything it needs to run its business and maintain its assets. This leftover cash is now available for management to use as they see fit to create value for shareholders.

The opposite of FCF: A company that doesn’t have enough free cash flow might need to borrow money or sell assets just to keep the lights on. That’s a red flag!

So, remember Sharmaji’s question: “Are they making money?” Free Cash Flow is a much better answer to that question than just looking at revenue or net income. It tells you if the company is actually generating cash that it can use to grow and reward its investors.

Now that we know what it is, let’s see why Free Cash Flow is so important. That’s what we’ll cover in the next section.

2. Free Cash Flow is Not Net Profit

Okay, listen up! This is a crucial point to understand. What you have read above about free cash flow might sound like Net Profit (PAT), but it’s not.

In Free Cash Flow, what we are dealing with are actual cash flows (ins and outs) and not

Many new investors get confused between net profit and free cash flow. They are not the same thing! Thinking they are the same could seriously mess up your investment decisions.

Imagine you’re running a small kirana store (a neighborhood grocery store). You sell groceries worth Rs.10,000 in a day. Your cost of goods (the stuff you sold) is Rs.6,000, and your other expenses (rent, electricity, etc.) are Rs.2,000.

So, your net profit (what’s left after deducting all expenses) is Rs.10,000 – Rs.6,000 – Rs.2,000 = Rs.2,000. Not bad, right?

But what if, to expand your store, you bought a new refrigerator for Rs.3,000 (Capex)? That’s a big expense! While it helps your business, that expense wasn’t deducted to calculate you net profit.

Now, even though your net profit says you made Rs.2,000, you actually spent more cash than you earned. You’re short Rs.1,000. That’s the difference!

Example

When a company spends money on capital expenditures (Capex), such as buying machines or constructing a building, the entire cash outflow does not appear in the Profit and Loss (P&L) account. Instead, these assets are recorded in the balance sheet under fixed assets. The cost of these assets is then gradually allocated over their useful life through depreciation. This means that only a small portion of the total expenditure is recorded as an expense in the P&L each year, rather than the full amount spent upfront.

Because of this accounting treatment, a company can show positive net profit in its P&L while actually experiencing negative free cash flow (FCF). This happens because the cash has already been spent on acquiring assets, but the expense is recognized in small portions over several years.

Investors who only look at net profit might assume the company is financially strong, while in reality, its cash reserves could be shrinking due to heavy capital spending.

3. The Utility of Free Cash Flow

Think of Free Cash Flow as the lifeblood of a company. Just like we need blood to survive and thrive, companies need FCF to grow and create value for their shareholders.

Here’s why it’s so useful:

- A Sign of Financial Health: A consistently positive and growing FCF indicates a company is financially healthy. It means the company is generating more cash than it’s spending, which is a good thing! Companies with strong free cash flow generation are better equipped to weather economic storms, invest in growth opportunities, and reward shareholders. Think of companies like Asian Paints or HDFC Bank; they consistently generate strong FCF.

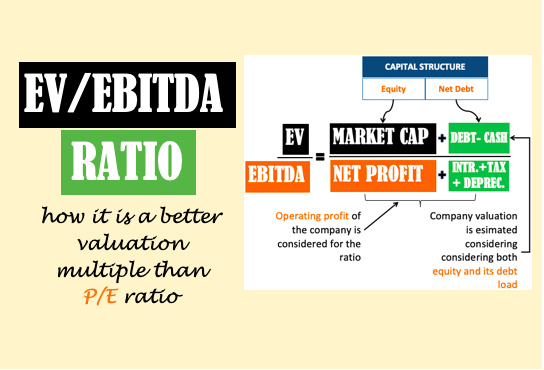

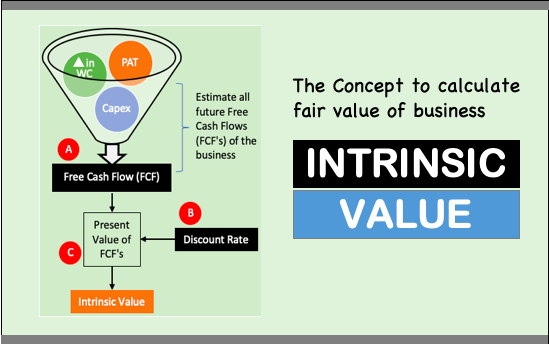

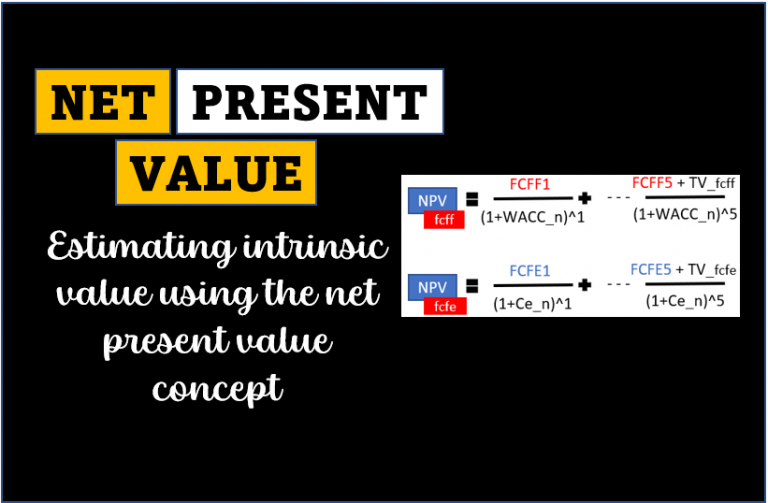

- Valuation: FCF is a key input in many valuation models, particularly Discounted Cash Flow (DCF) analysis. We’ll talk more about this later. DCF is a method of valuing a company is based on the concept of the time value of money. All future cash flows are estimated and discounted to give their present values (PVs). The sum of all future cash flows discounted gives the net present value (NPV), which gives a fair valuation of the company. The higher the free cash flow, the higher the company valuation.

- Predicting Future Growth: By analyzing a company’s FCF, you can get a sense of its ability to fund future growth. If a company has a lot of FCF, it can invest in new projects, acquire other companies, or expand into new markets. This can lead to higher revenues and profits in the future.

- Assessing Dividend Sustainability: If a company pays dividends, you want to make sure those dividends are sustainable. A company with strong FCF is more likely to be able to continue paying dividends, even during tough times. A company paying dividend out of debt is not a very good sign.

- Identifying Investment Opportunities: Companies with high FCF relative to their market capitalization may be undervalued by the market. This could be a sign that the stock is a good investment. Sometimes market becomes too pessimistic about a stock. At that time, the stock price may go down a lot. However, if the company keeps generating free cash flow, the stock might be a good investment.

Example:

Let’s say there are two companies in the same industry.

- Company A has consistent revenue growth but consistently negative free cash flow because it’s spending so much on expansion and marketing.

- Company B has slower revenue growth but consistently positive and growing free cash flow. Which one is the better investment?

While Company A might seem more exciting because of its rapid growth, Company B is likely the more sustainable and less risky investment. It’s actually generating cash that it can use to fund future growth and reward shareholders.

Let me make it more clear…

Imagine you have two friends. One friend earns a lot of money but spends it all and is always in debt. The other friend earns less but saves a significant portion of their income. Which friend is in a better financial position? The friend who saves, right? It’s the same with companies and Free Cash Flow.

So, next time you’re analyzing a stock, don’t just look at the revenue growth or net profit. Dig deeper and see how much Free Cash Flow the company is generating. It’s one of the most important indicators of a company’s long-term financial health and its ability to create value for its shareholders.

Now that we know its utility, let’s dive into the different ways to calculate Free Cash Flow.

4. Free Cash Flow Calculation

There are two main ways to calculate Free Cash Flow:

- Using Net Peofit (PAT): This is the more common approach, as it starts with a company’s reported net income.

- Using Cash from Operations: This method focuses on the actual cash inflows and outflows from a company’s core business activities.

We’ll focus on the Indirect Method because it’s more readily available in most company financial statements.

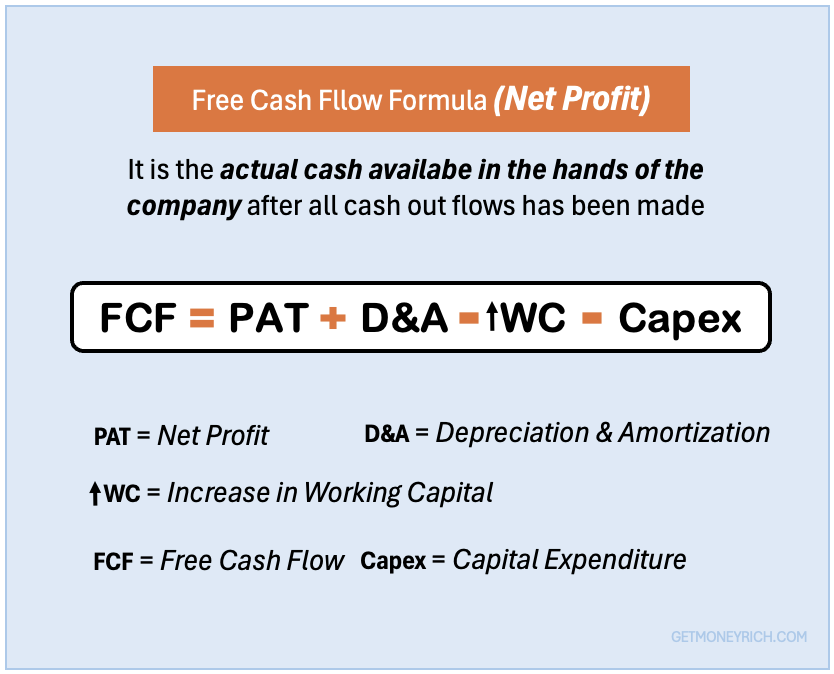

4.1 Free Cash Flow Formula #1 (Net Profit)

The basic formula is:

Free Cash Flow (FCF) = Net Income + Depreciation & Amortization – Changes in Working Capital – Capital Expenditures (CAPEX)

Let’s break down each of these components:

4.1.1 Net Income

As we discussed before, this is the company’s profit after all expenses, taxes, and interest have been paid. You’ll find this on the company’s income statement.

4.1.2 D&A (Depreciation and Amortization)

These is a type of expense that is not involve in an actual cash outflow. Depreciation is the reduction in the value of an asset over time (like machinery or equipment). Amortization is similar but for intangible assets (like patents or trademarks). Since these expenses reduce net income but don’t involve a cash outflow, we can add them back to net income to compute FCF.

Why add it back? Imagine you bought a small cargo truck for your kirana store. You paid in cash (say Rs.14 Lakhs). Now, you need to show this expense it in your P&L account. Here, you need not book all expense you paid in one go. Suppose, the useful of the truck is say 7 years. You can book Rs.2 Lakhs (=14/7) each year for the next 7 years. This is how it is done in the P&L account hence Net Profit comes out higher even though the actual cash expense has already happened.

4.1.3 Changes in Working Capital

Working capital is the difference between a company’s current assets (like cash, accounts receivable, and inventory) and its current liabilities (like accounts payable). Changes in working capital can impact a company’s cash flow.

- Increase in Current Assets (Other Than Cash): If a company’s accounts receivable (money owed to them by customers) or inventory increases, it means they’ve used cash to finance those increases. So, we subtract this increase from net income.

- Increase in Current Liabilities: If a company’s accounts payable (money they owe to suppliers) increases, it means they’ve delayed paying cash. So, we add this increase to net income.

- Example for Working Capital: Imagine your kirana store extends more credit to customers (accounts receivable increases). That’s great for sales, but it also means you’re waiting longer to get paid. This ties up your cash, reducing your free cash flow.

4.1.4 Capital Expenditures (CAPEX)

These are investments in fixed assets like property, plant, and equipment (PP&E). CAPEX represents cash that the company has spent to maintain or expand its business. So, we subtract CAPEX from net income. Example for CAPEX: Building a new factory, buying new machinery, or upgrading equipment all fall under CAPEX.

Putting it all together:

Let’s say a company has the following financial information:

- Net Income: Rs.500 crore

- Depreciation & Amortization: Rs.100 crore

- Increase in Accounts Receivable: Rs.50 crore

- Increase in Accounts Payable: Rs.20 crore

- Capital Expenditures: Rs.150 crore

Then, its Free Cash Flow would be:

FCF = 500 crore + 100 crore – 50 crore + 20 crore – 150 crore = ₹420 crore

Where to Find the Numbers:

- Net Income: Income Statement

- Depreciation & Amortization: Income Statement or Cash Flow Statement

- Changes in Working Capital: Balance Sheet (compare current assets and liabilities from one year to the next)

- Capital Expenditures: Cash Flow Statement (under “Investing Activities”)

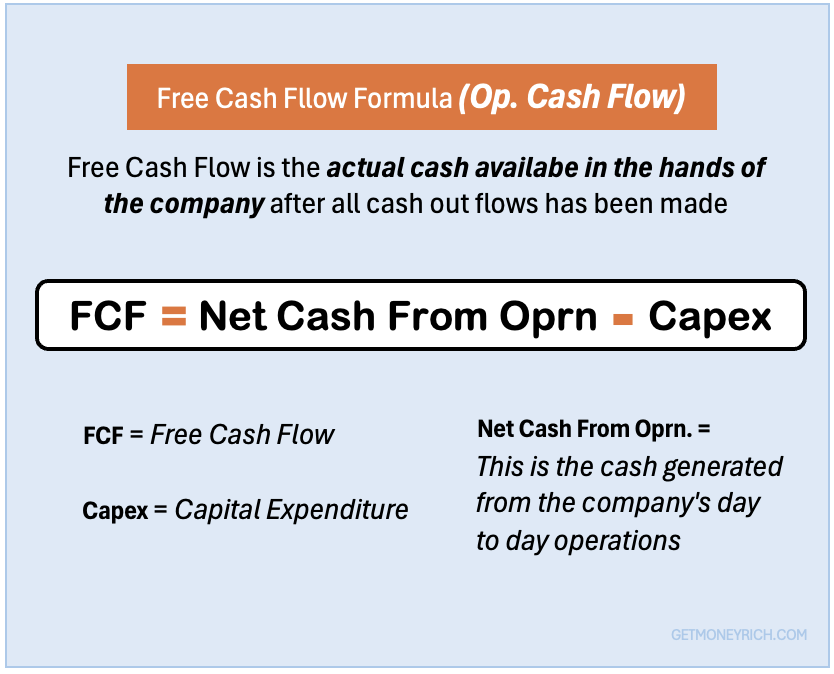

4.2 Free Cash Flow Formula #2 (Net Operating Cash Flow)

Alright, let’s talk about a slightly simplified way to calculate Free Cash Flow. We’ll be focusing on using the “Net Cash Flow from Operating Activities” figure.

Fortunately, most companies provide a summary figure: Net Cash Flow from Operating Activities. This already takes into account the cash generated from the company’s core business, adjusted for changes in working capital and other operating items. Hence, it becomes a good starting point for Free Cash Flow calculation.

The basic formula is:

Free Cash Flow (FCF) = Net Cash Flow From Operating Activities – Capital Expenditures (CAPEX)

Simple, right? Let’s break down each part:

- Net Cash Flow From Operating Activities: This is the cash generated from the company’s day-to-day business operations. It’s the result of all the cash inflows (like sales) and outflows (like expenses) related to running the business. You’ll find this number directly on the Cash Flow Statement.

- Capital Expenditures (CAPEX): As we discussed before, these are investments in fixed assets like property, plant, and equipment (PP&E). CAPEX represents cash that the company has spent to maintain or expand its business. Since it’s an outflow of cash, we subtract CAPEX from Net Cash Flow From Operating Activities.

- Why is CAPEX important? Imagine you run a textile mill. You might have great cash flow from selling fabric (Net Cash Flow From Operating Activities). However, if you need to spend a large amount to upgrade your old machinery (CAPEX), your actual free cash flow will be much lower.

Finding CAPEX When It’s Not Directly Listed:

You mentioned that your Cash Flow Report doesn’t always explicitly list CAPEX. That’s a common issue. Here’s how you can estimate it using information from the Balance Sheet and Depreciation:

CAPEX = Fixed Assets (Ending Period) – Fixed Assets (Starting Period) + Depreciation

Let’s understand what’s happening here.

- Fixed Assets (Ending Period) – Fixed Assets (Starting Period): This tells you the net change in the company’s fixed assets during the year. If the number is positive, it means the company acquired more assets than it sold. If it’s negative, it means they sold off some assets.

- + Depreciation: We add back depreciation because depreciation is a non-cash expense. It reduces the value of fixed assets on the balance sheet, but it doesn’t involve an actual cash outflow. Adding it back helps us isolate the actual cash spent on new assets (CAPEX).

- Analogy: Consider that you bought a car last year. The value of the car decreased this year because of depreciation. However, the depreciation expense does not mean that you paid any money this year. So, when we are calculating free cash flow, we add it back.

Putting it all together (with the CAPEX Estimation):

Let’s say a company has the following:

- Net Cash Flow From Operating Activities: Rs.800 crore

- Fixed Assets (Ending Period): Rs.1200 crore

- Fixed Assets (Starting Period): Rs.1000 crore

- Depreciation: Rs.80 crore

First, calculate CAPEX and then calculate Free Cash Flow:

- CAPEX = 1200 crore – 1000 crore + 80 crore = 280 crore

- FCF = 800 crore – 280 crore = 520 crore

Now that we’ve covered the basics of calculating Free Cash Flow, let’s move on to understanding the nuances of Free Cash Flow to Equity (FCFE) and Free Cash Flow to Firm (FCFF).

Okay, time to get a little more specific. We’ve talked about Free Cash Flow in general, but now let’s focus on Free Cash Flow to Equity (FCFE). This is a super useful metric for us as equity investors – meaning, those of us who own shares in a company.

Conclusion

So, we’ve covered a lot of ground today. From Sharmaji’s chai stall to calculating the actual cash a company generates, we’ve explored the crucial concept of Free Cash Flow (FCF).

Remember, FCF is more than just a number on a financial statement. It’s a window into the real financial health and sustainability of a business. It tells you whether a company is truly generating cash that it can use to grow, innovate, and reward its investors.

Here’s a quick recap of why FCF matters and the main formula we discussed:

- FCF is the cash a company generates after paying for all its expenses and investments. It’s the “free” cash available to reinvest in the business, pay down debt, or return to shareholders.

- The Simplified Formula: When you’re looking at the Cash Flow Statement, a practical formula is:Free Cash Flow (FCF) = Net Cash Flow From Operating Activities – Capital Expenditures (CAPEX).

As an investor, never underestimate the power of Free Cash Flow. In a world filled with hype and misleading metrics, FCF provides a dose of reality. Focus on companies with consistently positive and growing FCF.

These are the businesses that are built to last and are more likely to deliver long-term value to you, the shareholder. Don’t get swayed by fancy stories of growth alone; always check if the company can back it up with real, tangible cash.

Just like Sharmaji checks if his shop can pay its bills and still save a little, you should check if the companies you invest in are generating real cash flow.

You can also read the following: