Generally speaking, good news about a company can take its stock price up, and bad news can take the price down.

In real world, lots of news keeps floating about companies. Some news are good and some may be bad. Hence the struggle of price moving up or down is happening every second.

But what really determines the stock price in short run is, how the investor community perceives all the news.

If investors think that, the collective effect of all the news is positive, the likelihood of stock price going up is high. Similarly the likelihood of stock price going down will be high, if all news is creating a negative sentiment about the company.

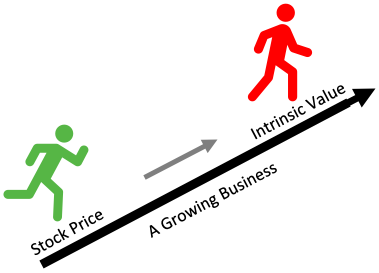

What is described above is how stock price is determined in short term. But in long term, stock price follows the fundamentals of its underlying business.

We will know more about it in this article. Before that, let’s ask a very basic question…

Topics:

- What is stock price?

- Price trend

- Stock price & its demand-supply

- Cash flows in a company

- Concept of free cash flow

- Type of Investors

- Intrinsic value of stocks

- FCF, intrinsic value and market price

- Why free cash flow is important?

- Conclusion

What is stock price?

Before we go into the details of knowing how news and business fundamentals determine stock price, allow me to tell you a small thing about what is actually represented by a stock price.

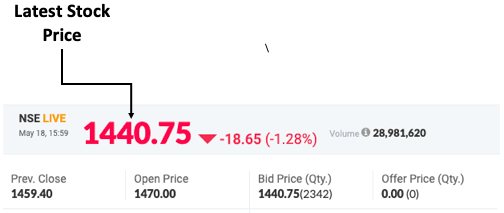

What we see in stock tickers and stock quotes is the latest stock price. But what does this price represent? It represents the “price of the latest transaction“.

For a popular stock, hundreds of transactions (buying and selling) can take place within a minute. At a given point in time, the stock price quoted on internet or live-TV is that price at which the last buy-sell order has been executed.

Suppose at 3:30PM on 20-May’20, price of RIL was showing at 1440.75. It means, at this price, someone bought the shares of RIL from another shareholder.

Price Trend: In Short and Long Term

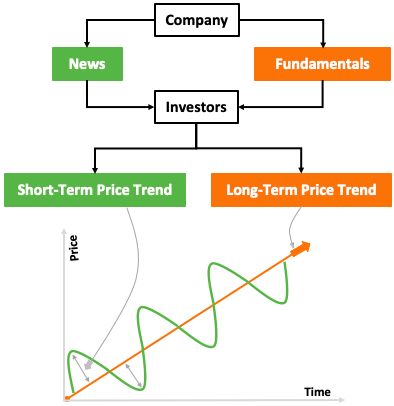

The above infographics highlights the effect of news and fundamentals on a company’s stock price.

- News: What news does to stocks is to give them its price volatility. In short term, price moves rampantly. The reason behind this price change is news (small and big). Investors, who want to do trading, use these news patterns to pre-judge stock movement. Hence they either sell or buy stocks – giving stocks its volatility.

- Fundamentals: When fundamentals are strong the company will make more profits. But change in profits does not happen in short-term. Companies report once every quarter, and also issue a detailed report once at the end of FY. Study of multiple such FY reports builds the fundamentals of a stock. When fundamentals are strong, stock price moves up irrespective of short-term price volatility.

What is important for we small investors to note is that, price of a good company will go up with time. We should not be deterred with short-term price volatility. Having said that, it is also true that we must also be aware of stock’s estimated intrinsic value. We will know more about it later in this article.

Before that, let’s understand another basic theory related to stock price?

Stock Price: Its Demand & Supply

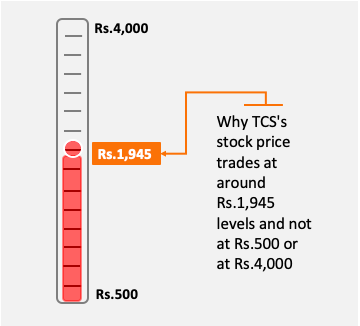

As on today, TCS’s stock price is trading at Rs.1,945 per share. You must be wondering why its stock price trades only at these levels – why not at Rs.500 or at Rs.4,000 per share?

If you would research that “who sets stock price”, the most visible answer will be, “it is set by the stock’s demand and supply“.

It is a perfect answer, no problem. But what sets the stock’s demand and supply? If we can figure-out what determines the demand and supply of stocks we will know how its price is set.

- Demand: What we mean when we say demand for the stock is high? It simply means, relatively, more people are willing to buy that stock than the people who wants to sell it.

- Supply: What we mean when we say supply for the stock is high? It simply means, relatively, more people are willing to sell that stock than the people who wants to buy it.

Cash Flows in a company

To understand what determines stock’s demand and supply, we must understand the basics of how a business handles its cash flows.

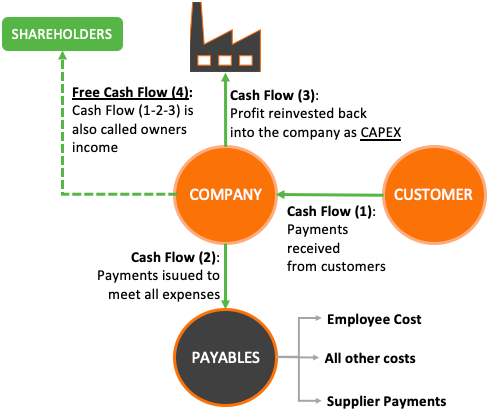

Generally speaking, there are four types of cash flows in a business:

- Cash Flow #1: It’s a cash flow between the company and its customers. Here the company supply its good/services to its customers. The customers in turn, as per contract, pays the due amount to the company. In common terms we call this cash flow as “payment received from customers” (the income).

- Cash Flow #2: It’s a cash flow which the company is managing to take care of all its payables. Here the cash is only flowing out of the company’s pockets. Common payables are like employee salaries, loan payments, bills, supplier payments, taxes etc.

- Cash Flow #3: After all the cash flow happens in #1 and #2 above, what is left in the hands of the company is the cash-profit. A part of this profit is reinvested back into the company in the form of CAPEX. The decision of reinvestment is taken by the company’s Board of Directors. CAPEX is necessary for future growth of the company.

- Cash Flow #4: This is also called “Free Cash Flow“. After meeting all the obligations of the company (payment to suppliers, Capex, salaries etc), what is left in the hands of the company is actually the “owners income“. This is the money which can actually add-value for the owners.

There are companies which does not generate positive free cash flow. These companies are either cash starved or is operating in intense competitive environment. Hence their margins are very low. Low profit margins, and slow cash-flows often leads to negative free cash flow. Suggested reading: MOAT companies in India.

Free cash flow is the “real profit” of the owners of the company. Also, the companies which generates positive free cash flow are the ones which interest the investors. Why? Because it is the free cash flow which indirectly determines the demand and supply of stocks over time.

The Concept of Free Cash Flow

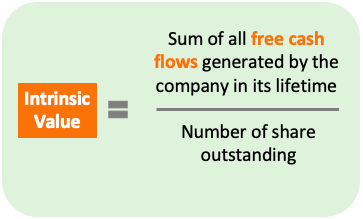

Suppose there is a company which is going to generate Rs.10,000 Crore free cash flow for its shareholders in its life time. [Please note, Rs.10,000 crore is the cumulative free cash that the company is generating in its life time]. Read: how to estimate free cash flow of a company.

As on date, the company has 1,000 crore number shares outstanding in the market. What will be the company’s intrinsic value? The intrinsic value will be Rs.10 per share (Rs.10000 / 1000). Read: About DCF model to convert FCF into intrinsic value.

What is the use of knowing a stock’s intrinsic value? It is the intrinsic value which directly determines the demand and supply of its stocks. Let’s read more about the relationship between demand/supply, intrinsic value and its stock price.

Demand & Supply

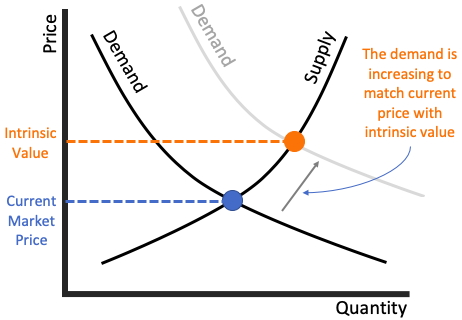

In the above demand-supply curve, the point of intersection of demand & supply lines sets the current price. Now suppose a stock’s estimated intrinsic value is higher than the stock’s current price. This is the case of stock being undervalued.

In this case, investors will become interested in buying that stock. This will increase the demand of the stock in the market. Increase demand will push the price up, till it matches the intrinsic value. This also sets a new intersection point of the demand-supply curve.

P.Note: When market price is moving towards the intrinsic value, the momentum may even take it above the intrinsic value. This is a case of stock being overvalued. Common men should be wary of overvalued stocks. Read more about value investing.

Type of Investors & Their Influence on Stock Price

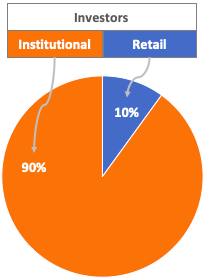

The above infographics shows the influence, an investor-type has, on a stock’s market price. Generally speaking, retail investors can impact a stock price by only like 10%. But institutional investors can have like 90% impact. The numbers (10% & 90%) is just a symbolic representation of the influence.

What important I’m trying to highlight is that, it is the institutional investors which often drives the stock price. If they are buying a stock, its price will go up. If they are selling, the stock price will fall.

So, if we small investors (retail investors) can take a clue about investing from institutional pros, we can probably know what actually determines the stock price. What clue we shall take?

Institutional investors compulsorily rely on intrinsic value of stocks to take their buy or sell decisions. How they base their decisions? It is simple, for a good company, if its intrinsic value is above its current price, they buy its stocks. Read: How Warren Buffett Thinks about stock?

So the trick is to learn to estimate stock’s intrinsic value and then take the buy decision.

Behaviour of Retail Vs Institutional Investors

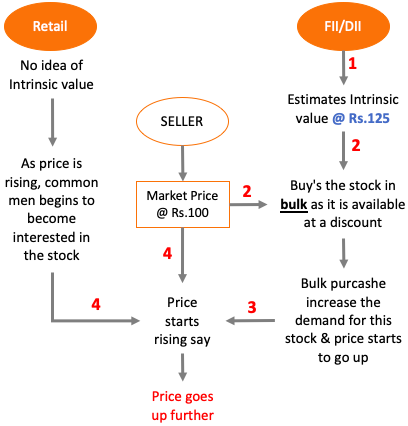

There is a difference between how retail investors (we) participate in the stock market and how institutional investors participate. The main difference lies in the awareness about intrinsic value. Retail investors invest almost ignoring intrinsic value, while institutional investor’s decision-making starts with intrinsic value.

Let’s try to understand this using an example. Suppose, stocks of a company ABC was selling at at Rs.100. An institutional investor did the stock research of ABC and found that the stock’s intrinsic value is Rs.125.

As the stock was undervalued, the institutional investors started buying stocks of ABC before anyone else got attracted towards it. The stock was purchased in bulk deals. As a result, the stock price started rising.

As the price was rising, retail investors also got attracted towards it. Hence, even though the institutional investor stopped buying ABC, its stock price continued rising.

Soon a time came when the institutional investor decides to book profits. It sells its holdings. The stock price of ABC comes crashing down. If the fundamentals of ABC is strong, another investor, who is aware of the stock’s intrinsic value, will initiate the hole cycle again.

So you can see who benefits from the volatility of the stock prices? Institutional investors are the beneficiary. Why? Because they are aware of the concept of intrinsic value of stocks. Read DCF method to calculate intrinsic value.

Stock Price Follows Intrinsic Value

Good companies generates lots of free cash flows over a period of time. The free cash flow so generated builds what is called the intrinsic value of company.

For a growing company, the size of free cash flow estimated after (say) 3 years will be more than what we will estimate today. The higher is the free cash flow, higher will be the estimated intrinsic value. As intrinsic value grows, it will also pull the stock price up with it.

We can say that there are two dominant forces which determines the stock price, it is called free cash flow and intrinsic value. P.Note: Intrinsic value is a product of free cash flow.

Application of Free Cash Flow, Intrinsic Value, & Market Price To Value Shares

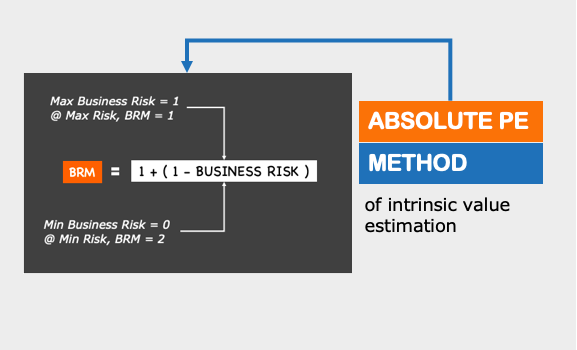

Free cash flow on its own cannot determine the future stock prices. It needs to converted into intrinsic value. Let me explain this with a hypothetical example.

Suppose there is a company which is estimated to generate Rs.10,000 Crore worth of free cash flow over its lifetime. Number of shares outstanding for the company is say 1,000 crore numbers. In this case, the estimated intrinsic value will Rs.10 per share (10,000/1000)

Suppose, currently the shares of this company is trading at Rs.7 per share. You as an investor assumes that it’ll take three years for this share to rise from Rs.7/share to Rs.10 per share.

There are few things to know in the above infographics:

- Free Cash Flow: Here it represents the present value of all future free cash flows that’ll be generated by the company. I generally predict future five year cash flows and then add it to the terminal value. It gives all future free cash flows. Read about DCF model to know more.

- Future value: Future value represents the expected price that a stock would achieve in course of time. How to estimate future price? By calculating intrinsic value. If the computed intrinsic value (future value) is less than current price, stock is undervalued. Price undervalued stock appreciates with time to match intrinsic value.

- Holding Time: Suppose a stock is priced at Rs.7 today. It will not become Rs.10 in next days or months. An investor must be ready to hold the stock for a minimum period, and give it the time to grow. This is called “holding time”. In our example we have considered a holding time of 3 years. Read: Long term investment strategy.

- Growth Rate: It is the expected growth rate at which the present stock price will grow to match the future value (intrinsic value). In our example, the expected growth rate is 15% p.a. If this stock grows at 15% p.a., in 3 years, its price will from Rs.7 to Rs.10. Double-check, if the computed growth rate matches your expectation. If growth rate sounds good, this stock can be a good buy for you.

[P.Note: Suppose my expected return from a stock is 15% per annum. But upon evaluation (as shown above), I found that the stock will grow only at a rate of 12% per annum. In this case it will be my call if I would still like to buy this stock at 12% returns]

Why Free Cash Flow is Important for Shareholders?

Till now we have seen that free cash flow is that essential ingredient which determines stock’s price in long term. But why free cash flow is so important?

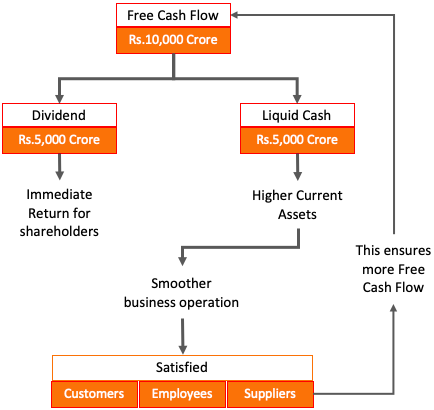

The above flow chart explains why free cash flow is critical for owners & shareholders. We can divide free cash flow in two portions:

- Dividend: A portion of free cash flow (FCF) is used to pay dividends to the owners & shareholders of the company. Higher is the FCF more will be the dividend earning. Read: About dividend yield formula.

- Liquid Cash: Cash is very crucial for any company. The higher will be cash balance of the company, easier it will be for the company to handle its current liabilities. This eventually means smoother business operations, resulting in satisfied customer, employees and suppliers. A combination of all these is an ingredient of higher future free cash flow. Read: About retained earnings of a company.

Conclusion

How is a company’s stock price determined? The algorithm of stock price is coded in its demand and supply. A share transaction takes place between a buyer and a seller at a price. The price at which the transaction is executed sets the stock price.

But the bigger question is, what makes a person sell stocks at a price, and another person buy it at the same price? This activity can be triggered by two things: (a) News and (b) business fundamental of the underlying company.

In short term, good and bad news about a company can trigger its share purchase or selling. But in long term, share buy/sell decision is mostly driven by the company free cash flow (owners profits).

Suggested Reading: How to invest in Share Market [This is a common mans guide about stock investing. If you are a beginner, I’ll suggest you to give this article a try].

Thank You much for sharing this you explained very well.

Thanks

Thsi article contain many imformative things about stockmarket and its safely usage and mostly in Retail sectores these article made me aware of the changes thank you for such a informative article.

Well explained article, thank you!

Thank you so much woth crystal clear well defined analysis and well understood educational tool.

Thanks

IT IS FIRST TIME I HAVE READ SUCH A NICE ARTICLE EXPLAINING ABOUT STOCK PRICE AND ITS INTRINSIC VALUE RELATION.SUCH ARTICLE WILL GIVE MORE KNOWLEDGE TO RETAIL INVESTORS ABOUT SHARE MARKET FUNCTIONING.

Thanks for posting your comment.