People who are hunting for bargains in the stock market may fall prey to the value trap. A stock whose price is falling or is trading at a low PE ratio may prove to be a trap instead of an investment.

Fans of Warren Buffett would love to emulate his investment style. But his style is not only about picking stocks of good companies. It is also about avoiding the bad ones. To practice 360-degree value investing, we must also learn to identify the value trap.

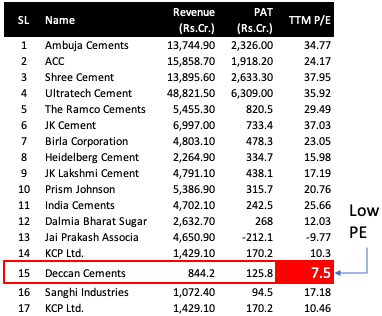

I’ll share an example. Here is a list of a few cement manufacturing companies. The company that attracts attention is Deccan Cements because of its low PE ratio.

The largest cement manufacturer is Ultratech cement. Its PE ratio is 35.92. Compared to Ultratech, Deccan Cement’s PE is less than one-fourth of it. Looking at its PE and this comparison, it is grossly undervalued.

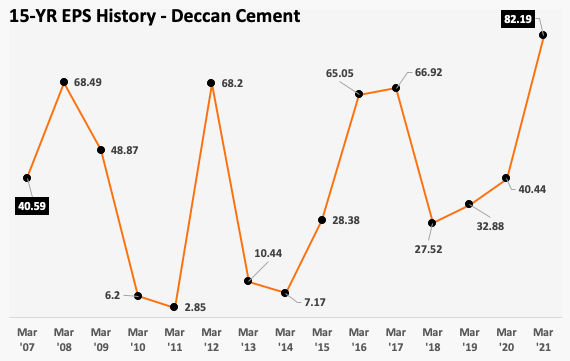

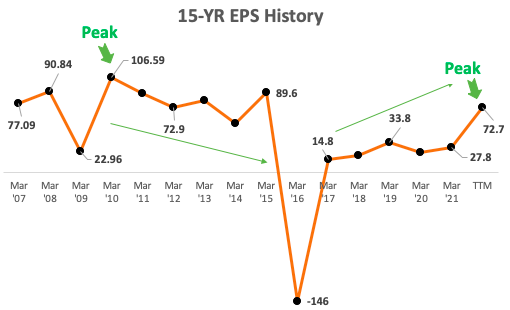

I decided to do a bit more digging. Hence I crosscheck how its EPS (Earning Per Share) performed in the past 15-Years. Below is the EPS trend.

The EPS has only doubled in the last 15-years (Rs.40.59 to Rs.82.19). It is a CAGR of only 4.82% per annum. It does not even beat the returns offered by the fixed deposits. Moreover, by looking at the fluctuations in the EPS, it does not invoke confidence.

Though the PE is low compared to its peers, EPS numbers hint towards a value trap.

It is also true that the stock belongs to a cyclical company. Buying such a share at the bottom of their EPS numbers might fetch better returns. For sure, the current EPS of Rs.82.19 looks like a peak. I’ll avoid buying such stock without doing a deeper analysis.

Topics

What is a Value Trap?

They are investments (stocks) that might look like a bargain at first sight. But they do not perform as per expectations over time. The main reason behind their lackluster performance is sluggish growth.

Shareholders expect a company to improve its top and bottom line over time.

Generally, the expansion happens at the cost of margins. It is understandable. But if the sales, profits, or profitability numbers do not meet the expectations, investors start avoiding it. Such stocks neither give the expected capital appreciation nor dividend yield. They eventually become a value trap.

How To Identify A Potential Value Trap?

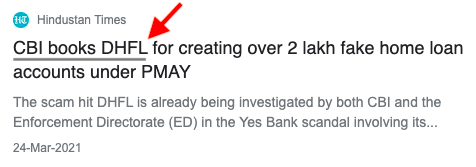

If one knows how to identify a value trap, avoiding is possible. I’ve seen people stuck with stocks of companies like Zee media, DHFL, Future Retail, etc. They bought these shares simply because their prices fell through the roof. In some other cases, their PE-multiples were at mouth-watering levels.

A combination of falling price and low PE often get people lured into buying a potential value trap.

Let’s look at a few practical points knowing which, one can identify and avoid falling prey to the trap.

#1. Negative News

It is advisable to read the news about the company before buying its shares. Investors must look to invest in stocks of trouble-free companies.

We can avoid investing in companies in the news for bankruptcy, cheating, legal issues, tax avoidance, political inclinations, etc.

Subscribe to daily google alerts and read the news of a company for at least 7 to 10-days before buying its shares. If you are reading repetitive negative announcements about it, avoid investing in it.

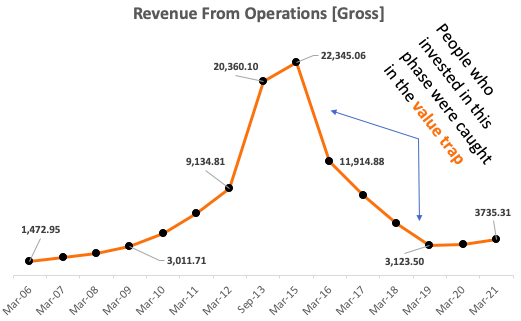

#2. Falling Turnover/Sales

It is a sign of fading market share. It will happen when new and better competitors enter the sector. Such action will force bad quality companies to make way for the new ones.

But we cannot judge based on only a few years of data. At least ten to fifteen years of data is required. It is also necessary to look at the revenue from operation instead of total income. Why? Because we would like to omit the contributions of income from other sources.

A company that has reported a prolonged fall in the “revenue from operation” numbers is a value trap.

Suggested Reading: What is an economic moat?

#3. Peak Earnings (EPS)

Value investors avoid investing at peak earnings (EPS). It is especially true for cyclical stocks like steel, cement, auto, etc. What is the problem of peak EPS?

Earnings of cyclical companies move between highs and lows. Within a span of a few years, these companies report large variations in EPS. At the high EPS levels, their PE ratio falls. It lures the investors into buying their stocks.

For cyclical stocks, the EPS begins to fall as it peaks. During this time, the demand for such stocks starts falling, and hence the stock price.

The best time to buy cyclical stocks is when they are deadbeat, nobody is buying them. This phase may continue for 3-4 years. Investors must be patient and prepared to hold it.

Not buying cyclical stocks at their peak EPS levels is one way of avoiding the value trap.

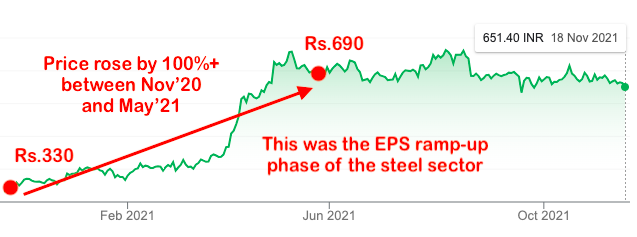

If one is interested in accumulating cyclical stocks, the best is to do it when EPS is at rock bottom. For cyclical stocks, when the EPS ramps up, the stock price also jumps. We have recently seen such a surge in the price of steel and cement stocks between Nov’20 and May’21.

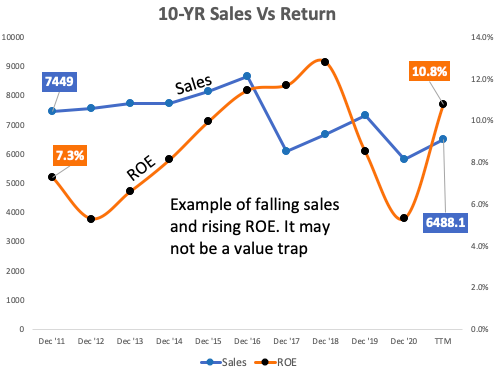

#4. Falling Returns (ROE) with Fall in Sales

The point is similar to what we have discussed in #2 above. But a combination of falling ROE and falling sales offers stronger proof.

The condition of rising sales and falling returns is understandable. Here the company is compromising margins to retain the market share. But when sales and ROE both are falling, the company is losing its competitive edge. The customers are moving to other products. It is a challenging phase for any company. Only ones with quality management can survive it unscathed.

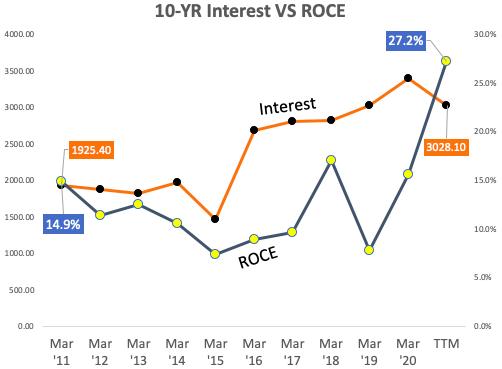

#5. Cost of Capital Vs Return Analysis

Companies need capital (Equity and Debt) to run their business. But it has a cost. If the employed capital is generating higher returns than its cost, the company is doing well. But a falling return (ROE, ROCE, ROA, etc) over time is an indicator for a company becoming a value trap in times to come.

I prefer doing this analysis using the metric called ROCE.

A company whose both the metrics are rising, interest expense and ROCE, cannot be a value trap. One such example is a company called Tata Steel.

As a rule of thumb, ROCE above 12% is a safe number.

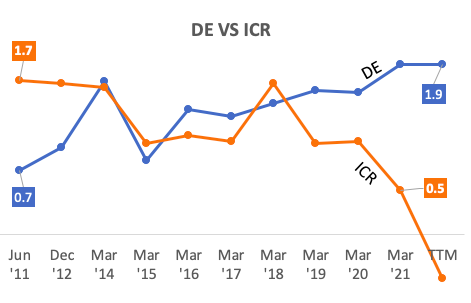

#6. Interest Coverage Ratio (ICR)

In the past, we have seen some big brand names fall apart. One of the reasons for their downfall is bankruptcy. When the companies are not able to pay back their loans any longer, they opt for bankruptcy. Such companies are a sure sort candidate of being a value trap. How to identify them? By looking at their ICR trend. It is a ratio between the company’s EBIT and Interest.

The rising debt to equity ratio (D/E) and falling ICR is a warning signal.

#7. Steep Price Fall in a Short Duration

It is one of the most visible signs of a value trap. Though people might buy into such stocks thinking of it as a bargain, it is a mistake. When prices fall so steeply, it is because of a reason. A price correction of 5-6% can happen, but a steep fall is a warning. In case the price is crashing, a deeper analysis is necessary. One example of it is Jet Airways stock in the year 2018.

Conclusion

Value investors who are at the beginning of their investment journey might fall into a value trap. What we have discussed above are the ways to identify it.

People who are more concerned about falling into these traps can take the alternative investment route. Such people can use index-based ETFs to invest in quality stocks. It is one of the safest ways of avoiding the value trap.

I hope you enjoyed reading this article. If you want to add to the above list of the ways of identifying a value trap, please suggest in the comment section below.

Please keep reading and have a happy investing.

Suggested Reading: All about stock market distractions.

I take it from this piece that certain ratios can easily help us avoid all the wrong stocks and in turn can mean that we are able to win the game of stock rejection and pick winners. Thanks for writing this down.

Hi Mani,

Informative article, as always!

I was going through my EPF account details recently. And I came to know About Pension Scheme.

It says that I will get the pension amount calculated by a specific formula after the age of 60 and EPS scheme gives 0% interest rate!! Can you believe it !!

I was trying to weigh this on the concept of Future Value. I would get pension of ~4000INR/Month which is like peanuts in mouth of elephant after 30 years down the line! Then what is the sense of pension scheme at all ! Better way would be to invest the same amount into to growth stock.

Could you please make blog on this topic. I feel pretty cheated by pension scheme by GoI.