Consider this article as a resource that can unlock the wealth-building potential of the stock market. If you’ve ever wondered how to make your money work for you, you’re in the right place. We’ll discuss the art and science of investing in the stock market. Remember, the stock market is where fortunes can be built and if done correctly legacies are secured.

Picture this about an investor. Three decades ago, he ventured into the world of stocks. He had no experience in stock investing. He was only armed with a hunger for knowledge and a passion for smart investing. Today, his stock portfolio size is about Rs. 250 crore. How did he get here? It wasn’t luck; it was a disciplined approach, strategic decision-making, and an unwavering belief in the power of the stock market.

There are countless individuals who, through wise stock investments, have rewritten their financial success stories. Consider Rakesh Jhunjhunwala, who started investing in 1985 by borrowing Rs.5,000. When he died in August 2022, his Net Worth was close to Rs.46,000 crores.

Jhunjhunwala is a very big name. There are also everyday individuals who, armed with the right knowledge and strategy, transform a small capital into a substantial nest egg. These stories aren’t anomalies; they’re testimonies to the incredible potential of the stock market. People who can play the stock market game wisely with maturity become successful.

The stock market is not a casino; it’s a dynamic marketplace where informed decisions pave the way for wealth creation. People who are informed and wise make money and others lose money. This is how the whole dynamics of the stock market work.

Let’s explore a roadmap that can help one make money in the stock market.

Point #1 Understanding the Stock Market

Alright, let’s start at the very beginning. Think of the stock market as a busy and crowded marketplace. It is a hub of economic activity where businesses, big and small, come to raise funds and grow. Companies sell their shares to investors in their IPOs. The money that they get from this IPO is used to make their business grow over time. People who buy shares get on board with the company. They are like co-owners of the company who benefit from the rise in the share prices.

How did the share price rise? It grows as the company’s revenue and profits grow. Share of such companies has more buyers than sellers. This demand-supply dynamics of shares also plays its part in the share price growth. Some shares can grow faster than others, this behavior is driven by a combination of business fundamentals and the share’s demand.

Now, you might have heard the chatter about stocks being risky. Let me demystify that notion for you.

1.1 Equity, Shares, and Ownership

Companies harness growth by dividing their ownership into smaller, manageable units known as shares. When you own these shares, you essentially hold a fractional stake in the company – this is your equity.

Think of it as having a seat at the table of a prosperous business without the complexities of day-to-day management. Your ownership, represented by these shares, entitles you to a portion of the company’s profits and voting rights in major decisions.

It’s akin to being a co-owner of a company and also sharing in its successes and setbacks.

So, when we mention ‘equity,’ envision the privilege of ownership. When the term ‘shares’ arises, consider them as your tangible ownership units. Each share represents a fragment of a larger, thriving business.

Understanding this fundamental concept lays the groundwork for going deeper into the stock market with confidence and purpose. To understand the basics of the stock market in more detail, you can read this article.

1.2 The Misconception of Risk

Let’s delve deeper into the often misunderstood concept of risk in the stock market. Yes, stocks are often labeled as risky, but the essence of that risk lies not within the stocks themselves, but in the decisions that surround them.

Consider a car analogy. Is the car inherently risky? Not so, right? It is how it’s driven that determines its safety. Similarly, stocks are financial tools, mostly neutral until handled by an over-aggressive and ill-informed investor.

The misconception about stock market risk stems from tales of individuals making impulsive decisions. It is similar to entering a chess match without comprehending how the pieces move. However, the truth is that informed decision-making acts as the seatbelt of the stock market.

Yes, investing in the stock market is like playing a game of chess. Looking ahead, playing informed and calculated moves anticipating the moves of the market (opponent) serves as a protective shield against unnecessary risks. Investing like this can help us navigate market fluctuations and unforeseen challenges.

In the vast arena of investing, knowledge is the compass that directs decisions. Knowledge about the company in consideration, and its associated economic environment is the key. This type of understanding can transform risk from a daunting specter into a calculated and manageable element.

We as investors must navigate the stock market not as a gamble but as a strategic journey. Here, our risks are understood, anticipated, and harnessed for wealth creation.

In essence, it’s not the stocks that are inherently risky; it’s the absence of necessary knowledge that creates the illusion of peril. Arm yourself with understanding and thoughtful choices, you can transform perceived risks into opportunities for financial growth. Read this article and do your risk-profile assessment by yourself.

1.3 Importance of Informed Decision-Making

In the world of investing, knowledge is power. Making money in stocks isn’t a gamble; it’s a strategic game where knowledge and information are your greatest asset. Before you press that ‘buy’ button, understand the company—its business model, financial health, and growth prospects.

Informed decisions stem from due diligence.

One cannot build a Rs.100 crore portfolio by playing roulette with stocks. It can be done by understanding what we are investing in. When it comes to stocks it is also paramount to stay committed to a long-term vision.

Stocks are like puzzle pieces, and the more you understand how they fit together, the clearer the picture becomes.

In our journey to wealth creation, consider the stock market not as a gamble, but as fine art that has been carefully sculpted through imagination, patience, and artistry out of a big chunk of stone.

Now that we’ve understood the basics, let’s dive deeper into the practical tips that can shape our path to financial success.

Point #2. Setting Realistic Expectations: Nurturing Wealth with Patience

Let’s talk about a fundamental pillar of successful stock market navigation—setting realistic expectations. In my three-decade journey, I’ve witnessed the power of patience and the pitfalls of impractical dreams. Here’s the scoop: envisioning the stock market as a get-rich-quick scheme is akin to planting a sapling and expecting a mighty oak overnight.

2.1 The Dissection of People Losing Money in The Stock Market

One of the most visible and followed stock market indices of India is Sensex. In the last 38 years, Sensex has grown at a rate of 13.41% p.a. We can decipher two things from this data:

2.1.1 Index Vs Direct Stocks

On average, our index (Sensex) grew at a rate close to 13% per annum. So people who bought the index and did nothing after that would have made a return of 13% on their investment.

If it is so, why do many people who invest in stocks directly (instead of an index), lose money?

This is because they bought the wrong stocks. What are wrong stock? Stocks of bad business, or ones bought at the wrong price.

How to deal with this ambiguity? We will know more about it in this article.

2.1.2 How not to lose money in stocks

Risk-averse investors, who want to invest in the stock market, can simply buy an index fund and stay invested for a very long term. There is almost a 99% chance that they will not make a loss. Know more about index funds.

Risk-taking investors’ way of not losing money is to follow the blue-chip strategy. These investors invest only in blue-chip stocks and stay invested for a very long time (like 20 years). Investing in such stocks can fetch a return of close to 15% per annum. Buying such stocks whenever they have corrected by about 4-5% from their peaks is a good idea.

Direct stock investors must ensure that their investment portfolio stays sufficiently diversified. A carefully diversified portfolio generally does not go in red even during the worst of times.

The keywords here are index investing, long-term holding, quality stocks, and portfolio diversification.

2.2 The Long-Term Perspective

Experience investors of the stock market will attest that true wealth isn’t a sprint; it’s a marathon. Here’s the essence: envision the stock market as a vast, ever-changing landscape, to take benefit and enjoy the ride through the market, take slow and calculated strides time after time.

- Avoiding Short-Term Missteps: Do not view the stock market through a short-term lens. It’s like expecting a sapling to transform into a tree overnight. Instead, think of your investments as seeds planted in the fertile soil of the market. Patiently wait for the seeds to grow into mighty trees.

- Cultivating a Long-Term Perspective: The stock market has a dynamic ecosystem. Your investments will experience seasons of depression, growth, and stability. Wise investors embrace these changes with open arms. They understand that their investments (stocks) will weather the storm and flourish over the years. Seasoned investors see the downturns in the market as an opportunity to buy more of quality stocks.

- The Power of Patience: Patience is our ally in the world of stock investing. Imagine your portfolio as a garden and each investment as a carefully tended plant. By patiently nurturing and allowing time for growth, we are paving the way for a healthy garden. Successful investors understand that the true fruits of the market are reaped over decades, not days.

Wear the lens of the long-term. It’s a perspective that acknowledges the cyclical nature of markets and positions your investments accordingly.

2.3. Avoiding Get-Rich-Quick Schemes

In the stock market, the notion of becoming rich-quick often leads to hasty decisions. The stock market should NOT be treated as an income-generating resource. Instead, it is an avenue where substantial wealth can be built over time. Think of it as building a majestic castle—one brick at a time, patiently, and with a vision that extends beyond immediate gains.

Embrace the power of patience, set realistic expectations, and watch your wealth flourish organically over longer time horizons.

Point #3. Different Approaches to Investing in The Stock Market

Let’s explore the diverse strategies to make money in the stock market. We’ll try to draw inspiration and experience from the wisdom of seasoned investors who have already built substantial wealth from the market.

In the expanse of investment choices, two distinct approaches stand out: index funds and direct stock investments. Let’s explore how we retail investors can combine the two strategies to carve a niche of our own.

3.1 Invest in a Portfolio: The Low-Risk Steady Route

For those who prefer a low-risk, steady return journey, entering the realm of equity mutual funds will be better.

Think of mutual funds investing as a way of leaving your investments on financial autopilots. When we buy mutual fund units, we are buying a small portion of its portfolio. The portfolio of mutual funds is managed by trained and expert fund managers who are pro-in stock picking. These pro-investors build and maintain the portfolio of a mutual fund very carefully.

Picture mutual funds as financial navigators. They can offer diversified portfolios that echo various market indices. These funds present an uncomplicated approach, liberating you from the complexities of handpicking individual stocks. Tailored for the risk-averse investor, equity mutual funds bring stability. They closely mirror the comprehensive performance of the market without the tumultuous ride associated with direct stock investments.

There exists a spectrum of portfolio options catering to diverse investor preferences. For instance, index funds replicate the composition of renowned indices like Nifty 50, Sensex, or Nifty Next 50, providing a mirror image of these benchmarks. Similarly, value funds adopt a distinct portfolio strategy, focusing on undervalued stocks to harness potential growth. The mutual fund universe extends to encompass various other portfolio types, each designed to align with specific investment objectives.

By opting for equity mutual funds, you engage in a form of portfolio investing, allowing you to access a curated mix of stocks managed by experienced fund managers.

This diversified approach mitigates the risk associated with individual stock selection while offering reasonably high returns.

3.2 Direct Stock Investments: A Quest for Higher Returns:

Now, direct stock investments — this is where one can achieve a fast capital compounding. From the perspective of a mutual fund investor, stock investors are akin to sports car drivers aiming to strike the top speed.

People who invest in stocks directly mainly do it to earn higher returns. These investors handpick stocks, envisioning each as a growth opportunity. It’s a journey laden with research, strategic decisions, and the occasional roller-coaster ride.

While the returns from direct stocks can be enticing, they require a keen eye, time investment, and a stomach for market fluctuations.

3.3 The Balancing Act

Both paths have merits. For those seeking a no-hassle investment, mutual funds (like index funds or index ETFs) are a stable choice. They embody the principle of ‘slow and steady wins the race.’ On the flip side, direct stock investments offer the potential for higher returns but demand a higher level of engagement.

The key lies in finding the right balance based on our risk tolerance, time commitment, stock analysis skills, understanding of the market, and financial goals.

Whether we opt for the index fund highway or the winding roads of direct stock investments, it’s about aligning the strategy with our financial objectives.

The ideal approach varies from person to person. But for the majority, a clever mix of both mutual funds would work.

A point to remember. The mutual fund is an indirect way to make money in the stock market. But when we buy/sell stocks, we are making money directly from the stock market. Both stocks and mutual funds are regulated by SEBI.

Point #4. Risk Management Strategies

Let’s try to learn to tackle the often risky waters of directly investing in the stock market. While the allure of potential high returns exists, it’s crucial to acknowledge and mitigate the associated risks. Here are a few risk management strategies that I’ve learned from my last one-and-a-half decade of experience in the market. These few rules have helped me to steer my investment ship through the unpredictable seas.

4.1 Stay Diversified

In the unpredictable world of the stock market, I think of diversification as the guardian of my financial fortress. Imagine your portfolio as a ship navigating through the unpredictable seas of market volatility. The winds will change, and the waves will rise. In such situations, diversification will serve as our guard against the risks of potential losses.

By spreading our investments across various sectors, industries, and asset types, we’re essentially distributing the risk. If one sector faces turbulence, the impact on our entire portfolio is mitigated. It’s a strategic move that cushions our investments against the unpredictable nature of the market.

Consider it like having multiple sails on your investment ship. Each sail represents a different sector or industry, and when one sail faces headwinds, the others can catch favorable breezes. This way, your ship keeps sailing steadily even when certain segments of the market experience turbulence.

Envision having investments in various sectors — maybe technology, healthcare, energy, and finance. If one sector encounters challenges, the positive performance of the others can offset potential losses.

Diversification isn’t about avoiding volatility; it’s about navigating it strategically. It’s acknowledging that markets are dynamic, and risks are inherent. However, by diversifying, we’re essentially making your portfolio resilient, enabling it to weather market storms with greater stability.

Diversification is an essential aspect of an investment philosophy. It’s the shield that guards our wealth. It ensures that the impact of market volatility is diffused.

4.2 Stay Informed

In stock investing, we must consider knowledge as our helm. It is our resource that can steer us through the intricate waters of the stock market. Picture yourself as the captain of your investment ship, and staying informed is your compass, that will guide your ship safely to the shores.

Immerse yourself in understanding the companies in your portfolio. Know their ins and outs, comprehend their industry trends, and grasp the broader economic landscape. This isn’t a one-time affair; it’s a continuous process of learning and adaptation.

Regularly review financial reports, a critical database of any company. Numbers tell a story about the company. By deciphering these reports, we can gain insights into a company’s financial health, its growth trajectory, and potential challenges. It’s like studying the weather report before climbing Mount Everest.

Monitoring news is another crucial aspect of staying informed. Market conditions can change swiftly based on global events, economic indicators, or geopolitical shifts. Being informed can help us anticipate changes. Updated news about our companies gives us the ability to adjust proactively.

Think of staying informed as having a 360-degree bird’s eye view. It empowers us to make informed decisions, grab opportunities, and protect ourselves from potential losses. away from potential pitfalls.

4.3 Be Patient

We must envision patience as our North Star. It is our guiding light sea is rough and our emotions are in turmoil. Over the past one-and-decade in the stock market, I’ve learned that successful investing requires us to stay committed to the long-term journey.

Patience is not just a virtue; it’s the cornerstone of wealth creation in the stock market.

Recognize that markets will have their natural ups and downs. Resist the urge for quick gains and impulsive decisions. Instead, anchor your strategy in a long-term vision. It’s similar to embarking on a voyage, knowing that the destination is on the horizon. But this kind of journey is often encountered with unpredictable weather.

Short-term storms are inevitable. Prices will fluctuate, and the market will experience turbulence. Yet, history confirms that markets tend to rebound after downturns. Your role as an investor is not to predict every wave but to navigate them with resilience.

Consider the analogy of planting a tree. It takes time to grow, facing seasons of both sunshine and storms. Similarly, your investments need the nurturing of time to flourish. Impatience might prompt you to uproot the sapling, missing the potential shade of a robust tree in the future.

As an investor, you’re not sprinting; you’re engaged in a marathon. The ability to weather exhaustion with unwavering patience positions you for the marathon’s success.

4.4 Practice Goal-Based Investing

We must consider tailoring our portfolio allocation based on our financial goals. I see my investment portfolio with perspective. The first perspective is that of a person who is watching the portfolio grow from a distance. Here, I see all of the money investment money compounding year after year.

But when I get closer to my investment portfolio, I see multiple sections inside it. Each section has been built to meet a specific long-term goal. If I will dissect my investment portfolio I will see multiple portfolios inside it. If one is catering to my goal of financial independence then the other is for my child’s future needs.

Direct stock investing will feel unnerving at times. It is in these times that panic decisions are made and money is lost. The above-discussed four risk management strategies keep me glued to my goals all the time. It helps me to think rationally when the situation is forcing me to take panic actions.

I can tell you, that there have been multiple incidents in the last 15 years when I’ve bought some stocks impulsively. Most of the time I’ve regretted it. Similarly, there have been cases where I’ve sold some good stocks because of some absurd news that made less sense. But my impulses got the better of me and I sold and lost fantastic compounding opportunities.

Point #5. Process of Investing in the Stock Market

Let it be stock market investing or any work in life, it is essential to first understand the overall ‘process’ of doing it. It is also important to keep it simple. What this process does is, it defines the start and end, and also identifies the essential intermediate steps. Following a process is an essential ingredient of success in life.

What should be the process of investing in the stock market?

These are the five steps:

- Research: No matter how confident we are about a stock, it cannot be bought without research. The idea is, that even if Warren Buffett asks you to buy a stock, do not buy it without researching it yourself. Once you have researched and are feeling confident about it, buy it. Read more about how to do stock research.

- Track Performance: One cannot buy stocks and forget about them. What shall be done is to track one’s stock holdings. Why to track? Tracking helps to identify more buy opportunities in times to come. It is also done to time the exit perfectly. Know about how to track stock’s performance.

- Goal Setting: Without a goal, we eventually end up selling our stock holdings. We may sell to buy an iPhone, smart TV, nice vacation, medical emergency, etc. But were these the goals why we bought the stocks in the first place? No. Attaching a goal to your investments will help misselling. Read about goal-based investing.

- Selling: It is equally important to sell the stocks at the right time. In our investment portfolio, there are some blue-chip stocks that we can hold for decades. But there will always be some stocks that we sell once their targets are reached. There will also be some stocks whose fundamentals are not strong anymore, we can sell them too. Read about when to sell stocks at a loss.

- Reinvest: This is an important step. Let’s understand it with an example. Suppose we have a micro-cap stock in our portfolio. We sold it after it had reached 5x. What to do with this money? One must reinvest this money to increase the holdings of the blue chips. Increasing the invested corpus base will magnify the power of compounding returns.

Point #6. DIY Learning of Stock Market

There is no other way to make money in the stock market, one must first learn the basics. To learn the basics one cannot simply go to a training school and become an expert. What must be done? Follow the DIY strategy (Do-It-Yourself) to learn stock investing. When it comes to stock investing, DIY is the only alternative. Why?

Because on one side we have people for whom the share market is like an alien world. On the other side, some people earn money in stocks as if it is an easy job. There has always been this divide prevailing among people, and this divide is only growing. Why?

Because, people who do not understand shares, treat it as a roulette table. And people who know how to earn money from the stock market, prefer to keep their knowledge a secret. So how we retail investors can learn and make money in the stock market? The answer is simple…DIY (Do it yourself).

Point to note: Be ready to give time, to learn & master the skills relevant to stock market investing. It is not a skill that can be learned in a few months. Reading and investing year after after is the way to go forward.

Allow me to share a step-by-step guide that has helped me to make money in the stock market and build wealth over the last 15 years.

6.1 Ask The Right Questions About Stocks

This is one of the most important steps in stock investing. What is stock investing for investors? “Buying good stocks at the right price, and then holding it for the long term“.

Hence, to earn money in the stock market, a person needs to answer the following three questions:

- Is this business good? How to know if the business is good or not? One must do a fundamental analysis of the business. Here, one evaluates the size of its business, future growth prospects, financial health, etc.

- What is the right price to pay for this stock? What is the right price for a stock? A share price that is also supported by its underlying fundamentals. In stock investing parlance we call it estimating the intrinsic value (fair price). If the current price is below the intrinsic value, it is the right price to buy a stock.

- How long should I hold it? Generally speaking, a good stock can be held for decades together. Why? Because there is no point selling a wealth compounder just because you’ve held it for five years together. For beginners, holding a good stock for a least 5 years must be a thumb-rule to follow. Read about FMCG stock as long-term compounders.

If one can answer the above 3 questions correctly, I will say that 99% job is done. The balance 1% is attributable to luck.

To get a better feel of these three questions, allow me to add more details here.

6.1.1 Focus On The Business

In stock investing, the foundational question is akin to peering into the soul of a company — Is this business good? The answer lies in the realm of fundamental analysis. It is a compass that has guided all big stock investors for decades.

Fundamental analysis isn’t about deciphering stock prices; it’s about understanding the heartbeat of a business. Imagine it as an X-ray for companies, revealing their internal health and future prognosis.

One vital parameter under the analyst’s microscope is the size of the business. It’s not just about revenue figures; it’s about the company’s footprint in the industry. Is it a niche player or a market leader? Understanding the size contextualizes its potential for growth and market influence.

Future growth prospects are the heartbeat of any investment. Like planting seeds, you want a business with fertile ground for expansion. Fundamental analysis dives deep into a company’s strategic plans, innovations, and market positioning, unveiling the roadmap for future prosperity.

Financial health is the spine of the business. How robust are the financials? Is the company burdened with debt, or does it stand on a solid financial foundation? Fundamental analysis dissects balance sheets, income statements, and cash flow statements, offering a holistic view of a company’s fiscal wellness.

Evaluating business quality demands a comprehensive analysis. It’s not just numbers; it’s about understanding the narrative that financials weave.

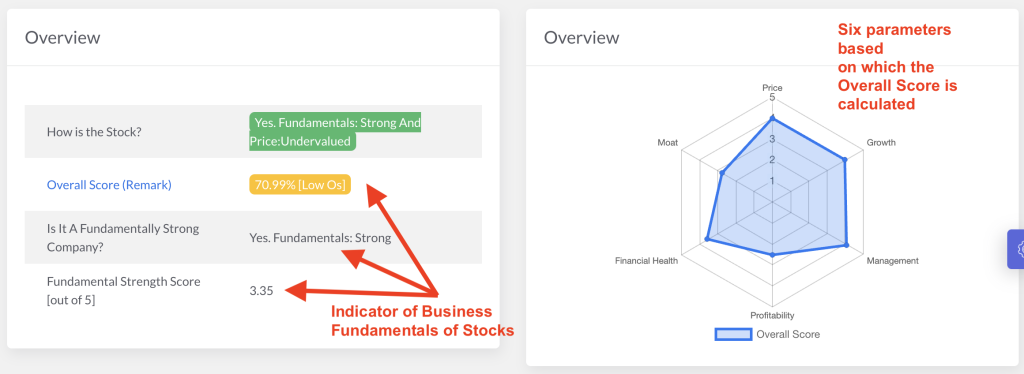

Successful investors master the language of fundamental analysis. This way they can decipher the stories that balance sheets tell. They use this method to handpick businesses poised for sustained growth. I’ve coded the algorithm of my stock engine to do a similar task for me.

6.1.2 Estimating Right Price For Stocks

In the stock market, recognizing the rhythm of bullish trends becomes crucial for investors aiming to build a substantial portfolio. For long-term investors, the only way to do it is by learning to estimate the right price of stocks and their intrinsic value.

Speculators thrive on the adrenaline of price momentum. They try to seize the chance to ride the upward surge. On the other hand, investors, keep their focus on a more calculated approach, the price valuation.

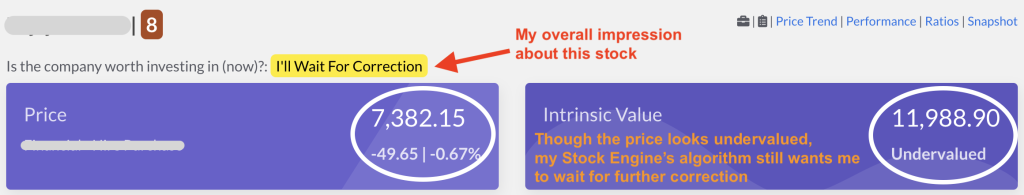

Why the emphasis on price valuation is necessary? It’s a strategic move grounded in the reality that stocks, often trade at overvalued levels. When the stocks are overvalued, it is a moment to book profits and not to buy. This is the first step of stock investing, an identification if the stock in consideration is over or undervalued. How do expert investors do it? By estimating the intrinsic value of stocks. Check this intrinsic value formula.

Price valuation is the tool that guides investors through the market exuberance. The intrinsic value of a stock represents its true worth. It is devoid of the temporary euphoria influencing market prices. Successful investors hone the skill of intrinsic value estimation. They do this by dissecting financial reports, scrutinizing growth prospects, and understanding the underlying narrative of a company.

My Stock Engine algorithm has been coded to estimate the intrinsic value of its stocks.

6.1.3 Practice Long-term Investing

Warren Buffett exemplifies the power of holding stocks forever. When I venture into the stock market, I embrace a similar mindset — buying stocks with the intention of a decade-long companionship. While not every stock aligns with a perpetual holding strategy, a practical assumption of 3-5 years can serve as a guiding principle.

In the pursuit of timeless stocks, we can consider stalwarts like TCS, Nestle, Britannia, etc as our reference stocks. These are pillars of reliability in the changing landscape of the stock market. When we introduce such stocks into our investment portfolio, let them rest, undisturbed, for decades together. This is the way we can take benefit of the power of compounding.

The idea behind long-term investing is akin to planting seeds and patiently tending to the garden as it blossoms. It’s about cultivating a portfolio that weathers short-term storms. Knowing that the intrinsic strength of the businesses will prevail in the long run. So, when we embark on the stock market journey, we must envisage it as a marathon rather than a sprint.

Each stock purchase will contribute to our ultimate goal of financial independence. But to make it happen, buy the right stocks and let it compound for decades.

6.2 Do a detailed stock analysis

To earn money in the stock market, it is important to learn at least basic stock analysis. Stocks need to be evaluated in terms of their fundamental strengths and also in terms of their price valuations.

People often skip the step of stock analysis, and straight away jump into buying stocks. But this is the wrong way of investing in shares. It is almost impossible to earn money in the share market like this.

Before committing to any stock, investors must ensure that the stock is not overvalued. Out of 10 stocks that we want to buy, 9 stocks will either have weak fundamentals or will be training at overvalued price levels. Hence, stock analysis becomes mandatory. Our goal is to buy fundamentally strong stocks at an undervalued price.

Let’s see these key steps of investing in the stock market:

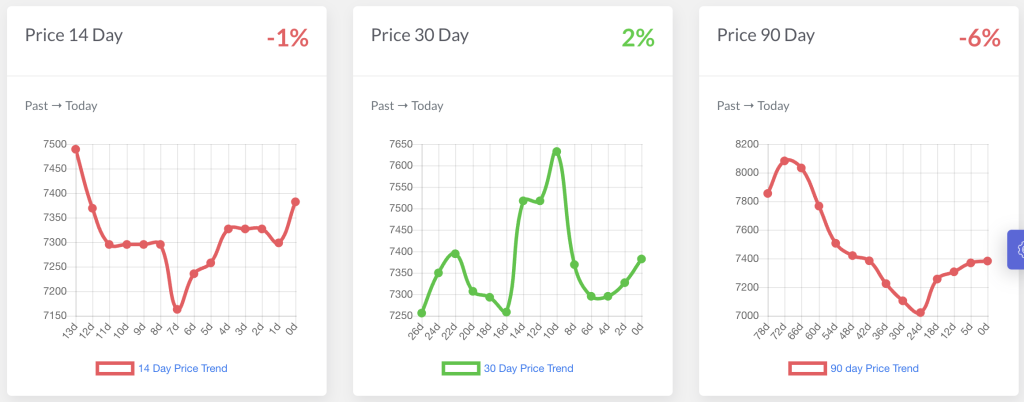

- Step #1 – Check Price Trend: Open the price chart of the last few months. See how the stock price has changed in the past 90 days. Just note the price trajectory and identify the trend (appreciating or depreciating). If the price trend is falling, it presents a possible entry point. A blue-chip stock falling by 10% or around can be a potential good stock to get into our watchlist. But before concluding, we must go to step #2.

- Step #2 – Check business fundamentals: What we have done in step #1 is, shortlisting a stock whose price is falling. The next step is to identify its business fundamentals. How to do it? It is can be done by analyzing its growth prospects, quality of management, profitability of business, financial health, and competitive moat. My Stock Engine’s algorithm does these number crunching for me. Check the

- Step #3 – Check Price Valuation: In step #2 above what we have done is to evaluate if the business fundamentals of the stock are strong or not. There is one more checkpoint. It is also essential to check if the price is undervalued or overvalued. How to do it? By estimating its intrinsic value. One can also guess price valuation by using financial ratios.

Point #7. Investment Mindset and Discipline

Discipline is the rudder that keeps our financial ship on course. It’s about adhering to a well-thought-out strategy, even when market tides are unpredictable. Successful investors understand that emotions are part of the journey. Like waves, they come and go. What matters is how you navigate them.

Consider market fluctuations as the changing winds. A disciplined investor doesn’t let momentary gusts dictate the entire voyage. They stay anchored to their investment plan, adjusting the sails when needed but never veering off course. Patience becomes their silent ally, allowing them to ride out the storms with an unwavering belief in the eventual sunrise.

Managing emotions during market fluctuations is an art. Fear and greed, the twin forces shaping market sentiment, can lead to hasty decisions. Embrace a rational approach, acknowledge emotions but do not let them steer the ship. Follow a clear-headed strategy that withstands the test of both euphoria and panic.

Point #8. Buy stocks as if you are buying the whole business

How does it make a difference? Let’s take an example to understand the difference. We all know about the problems Airline companies like Kingfisher, Jet Airways, Go First, etc have faced in the past few years. Some chances are there that Jet Airways and Go First may also go down the Kingfisher Airlines way. But there is a small hope.

In this scenario suppose, your friend advises you to buy a few stocks of Jet Airways (say worth Rs.10,000). Would you buy it? You may take the risk. Why? Because if things go well, you may see a windfall gain. If not, then the loss will only be of Rs.10,000.

Now, consider another scenario. Suppose you are the owner of another airline company. You are interested in taking a majority stake in Jet Airways. How would you go about it?

Would you buy the ownership just because your friend is saying to do so? Never. Instead, you will do your detailed research and then take the next step. This is the right mindset.

This should be our approach even if we are going to buy only a couple of stocks in any company. This type of mindset can make millions – if you want to invest successfully in the stock market.

This approach will force you to follow all the steps specified in point #6.1 above (Ask the right questions about stocks….).

Conclusion

In this article, I aim to provide you not just with insights that can help my readers navigate the intricacies of financial growth. This isn’t just theoretical writing; it’s a compilation of practices that have forged my wealth-building journey.

The keys to prosperous investing are embedded in the simplicity of long-term commitment. Stock investors must be dedicated to fundamentally robust companies. They must also carry an investor’s mindset that steers clear of speculative whims.

In the fluctuating stock market, the ability to estimate intrinsic value or comprehend financial ratios will go a long way. They are the instruments through which we build a resilient and thriving investment portfolio.

We must distance ourselves from the allure of speculation. Instead, let’s gravitate towards stocks that stand the test of time. This isn’t just about making money; it’s about crafting a legacy of financial prosperity. So, as we venture into the stock market, may our investments flourish. Our journey must be adorned with the fruits of patient and informed decision-making.

Have a happy investing.

Suggested Reading:

Insightful guide on making money in the Indian stock market in 2022! Your tips provide practical advice for navigating the complexities of stock trading. Appreciate the timely insights!

Investing in the Stock market can be very helpful in your investment decision. This article will help you understand how you can make money in the stock market in India.

The clarity in your post is just great. Thanks a million and please carry on the gratifying work.

Dear Mr. Mani

You are rendering a great service to all those who want to enter investing in stocks.

Your simple yet effective method of teaching the beginner is superb. God bless you.

Your blog in my opinion is one of the best. Keep writing Sir.

I wish you every success in achieving your goals in life. Goddess Lakshmi will

surely visit where Ma Saraswati is honored and worshiped with sincerity and dedication.

Best Regards.

Thank you Sir. It means a lot. Keep reading.

nice information thank you

Hi very nice article thank you so much for explaining so deeply

Good information

Thanks

This is an interesting blog . A lot of information is filled in this blog.Thank you for sharing. Great work and keep it up.

Very helpful article for stock market beginners.

Thank you very much. All the facts explained by you are very simple and easy. If you want to know about Stock Market channel in India or if you want to open a demat account in the country’s best brokerage firms, then contact us.

I totally agree with the points you have made here. Great article. I am new to stock market investment and blogs like these are really helpful on understand how things work. It’s a must-read for beginners like me. Thanks for sharing.

Congratulations and thanks for the nice informative article on investment. There are different strategies for different types of investors. An investor must choose the right investment strategy to avoid small and regular mistakes. Here is a useful website for Indian Stock Market Investors. It is important for young people to learn about investment at the right age to benefit in their life. Please share it with others and help them to understand the easy and right way to make profit from stock market investment.

Best blog for the layman as it generates positivity about the stock markets. This article portray the true image of the stock market. It also states that there are no shortcuts and quick tips for investing. It explains that stock market is charming but it comes with risk.You accurately pointed out the essentials to master in stock investing which builds confidence among the common people.The information here is accurate and precise which can be easily understood by a layman.

Good info.pls keep writing.

Thank you for posting your comment.