How we make money in our day to day life? We work, which in turn earns us money, right? We do a job and make money.

But what if I tell you that there is an easier way to make money. How it’s easier? Because one can make money like this ‘without work’.

Do no worry, I’m not going to suggest you any Ponzi scheme. What I’m going to tell you is throughly genuine strategies of money management. So what is my suggestion?

“Do not work for money. Let your money work for you.”

Sounds simple, right? But how to do it? Before that, let’s build some basics about why to ‘make money work for us’ in first place…

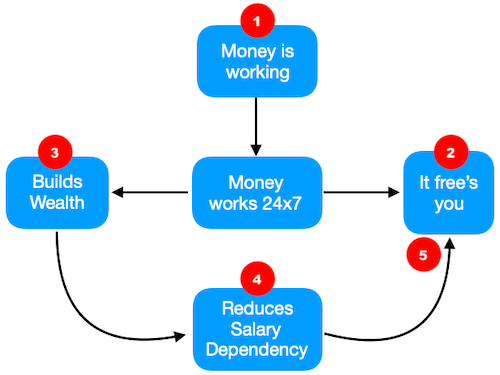

Why to make your money work for you?

- It will free you up.

- Unlike us, money can work 24×7.

- It will reduce your salary dependency.

- You will build wealth over time.

Why we do a job? To earn money. What happens when we need more money than we are already earning? We expect a pay-rise.

As the years go by, our expenses go up due to inflation. Moreover, it’s also human psychology to have desire to improve once standard of living. It means, expecting pay-rise in job is inevitable.

This is where the problem begins to become bigger. The more money we need for ourselves, the more we are becoming dependent on our jobs.

If you are one of those people who love their job, there is no problem. You will work harder, and the expected pay-rise will eventually come.

But if you are like ones who do not like their job much, expecting a pay-rise is like falling more into the clutches of the company. It’s like a distress conditions.

For such people who do not want to give more time to their “non likeable job”, they must learn to make money work for themselves. Why? Because it will make them less dependent on the income from job. I call it becoming financially independent.

The harder the money works for you, more free you become from job. Moreover, money-working in parallel to your job can also build tremendous wealth for you.

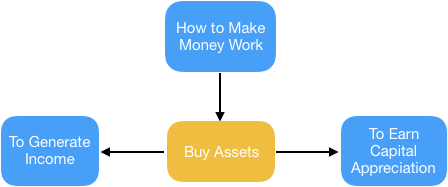

How to make money work for you?

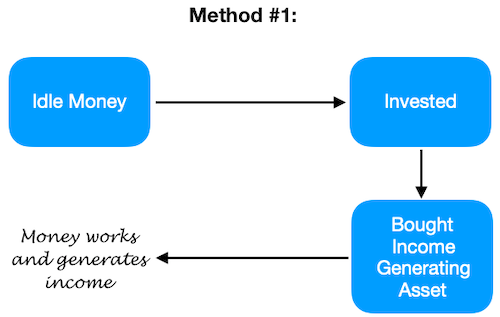

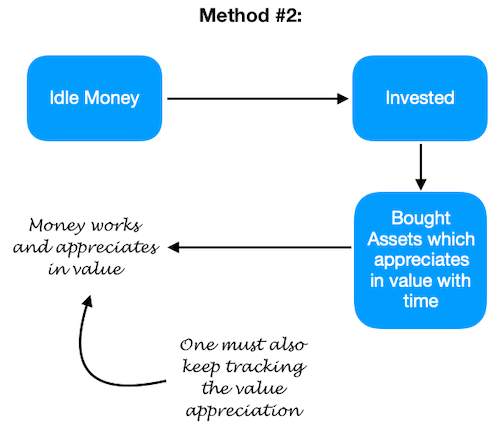

There are only two ways to make money work:

- Buy assets – which generates income.

- Buy assets – whose value appreciates with time.

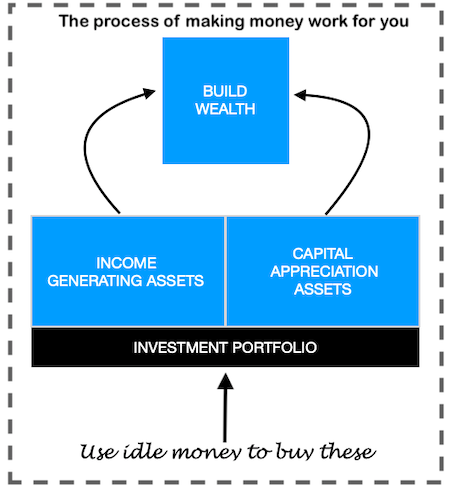

In both the cases you will note that one has to “buy assets” to make money work.

How the money works? By generating an alternative income source, or by making the invested capital appreciate with time.

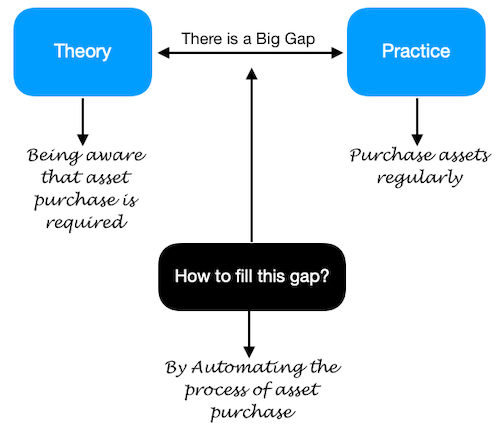

But this is not anything new, right? ‘Income generation’ and ‘capital appreciation’ are concepts which we all know. But knowing the concept is not enough. Probably this is the reason why less people can claim that “they know how to make money work for them”.

Where is the problem, why even after knowing the concept people are not able to make their money work for themselves?

Beyond the concept…

Why knowing beyond the boundaries of concept is necessary? Because a concept is only a theory. In money management, only theories never works. It is also essential to convert the theories into “regular practices“.

Why people fail to regularly practice the theory of ‘making money work’? Because one can regularly practice only that thing which is done as a habit.

So the key here is to start buying assets as a habit.

How to develop this habit? In the world of money, asset buying can be automated. Even better than habit, right?

How to automate the process of asset purchase? In todays world automation is not so difficult. Once we know the following, the rest become rather simple.

- Which asset to buy for income generation?

- Which asset to buy for capital appreciation?

Method #1: Which assets to buy for income generation?

I will list down few assets which can generate income. For me, when it comes to making money work for me, these are the options that comes to mind first. Why? Because I like investing more for income generation than for capital appreciation.

- Annuity: It can generate guaranteed income after retirement. How one can automate the process of annuity purchase? By investing each month in a pension plan (like LIC Jeevan Akshay).

- Fixed Deposit: Fixed deposits can also generate monthly income. Start with a recurring deposit (RD), and keep contributing till (say) Rs.1.0 Lakhs is built. After this, break the RD and put the money in FD, with a standing instruction of crediting the interest in savings account each month.

- POMIS: It is Post Office Monthly Income Scheme. Here as well, start with a recurring deposit (RD), and keep contributing till (say) Rs.4.5 Lakhs is built. After this, break the RD and put this money in POMIS account in your nearest post office.

- Mutual Fund MIP: These are monthly income plans offered by mutual funds. One such mutual fund is ICICI PRU MIP 25. Start a SIP in a MIP fund and keep contributing till eternity. Once the minimum threshold is crossed, these funds can pay monthly/quarterly/annual dividends as directed.

- Real Estate Property: As on date, automating the process of investment in real estate sector (for income generation) is not there. But soon REIT’s mutual funds will be launched in India for common men. REITS funds can generate regular income. One can start a SIP in REIT’s and keep contributing.

Method #2: Which assets to buy for capital appreciation?

When one is already making money work by income generation, why to adopt capital appreciation method?

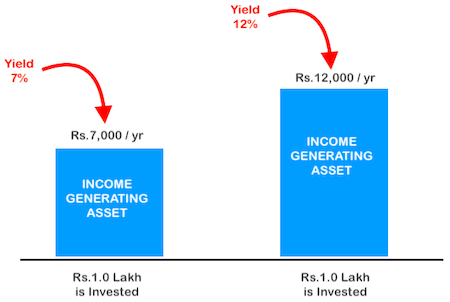

Frankly speaking it is not essential. But going for the capital appreciation approach has its own benefits. What is the benefit? It’s yield is higher.

Why the yield matters? Because if the yield is more, the asset will make the money work harder. In normal words, the the asset will give higher returns.

But my advice is that, when the idea is to make the money work for you – start with income generating options. Why? Because those options are almost risk free.

The risk of loss in capital appreciation assets are higher. For a beginner who has just started investing, better will be to first get the feet wet in income based assets. When one becomes more accustomed with investing, then trying hands with risky assets will be better.

These are the assets which one can buy regularly for capita appreciation.

- Gold: Value of gold (and silver) appreciates with time. For longer time horizons (like 10+ years) gold price appreciation rate can beat inflation. One can start a SIP in gold based ETF’s or mutual funds and keep contributing till long term. Read more about e-gold here.

- Provident Fund Scheme: There is no investment option which can appreciate money faster than EPF. How? Because here the employee and employer both are contributing in tandem. Moreover, the EPF fund also earns a decent interest rate. EPF contributions are anyways automated as its gets deducted even before the salary is credited into the employee’s bank account.

- Pay off your debt: How paying-off debt can generate capital appreciation? Actually it cannot. But what it does is perhaps better than capital appreciation. Paying off debt slows down the rate of growth of our debt. This bigger and costlier will be the debt, more will be the associated expense. By paying off such debts, the expense can be drastically reduced. Read more about loan prepayment & about becoming debt free here.

- Invest in Multi-Cap Mutual Funds: These are mutual funds which has a good portfolio diversification (low risk), and can generate above average returns when held for long term (like 10+ years). Start a SIP in such a mutual fund and keep contributing till eternity. Read more about mutual funds here.

Conclusion

In order to make money work for your, start with saving a big chunk of your income. Read more about paying yourself first…

Once enough saving is accumulated, follow the automation process explained above. Do this to start accumulating more and more assets.

These assets in turn will generate income, or will fast-appreciate in value.

Income plus capital appreciation is turn will build wealth. This is the most practical version of making money work for you.

Have a happy investing.

ஐயா உங்கள் கருத்துக்கள் மிகவும் உண்மையே. படிப்பதற்கு எளிமையாகவும் புரிந்து கொள்ளும்படியும் இருந்தது. மிக்க நன்றி

மிக்க நன்றி

The more I read your blog, the more I get addicted to. It is so nice yet easily understandable and the best part is you are not trying to boast about anything but giving reasonable explanations.

wonderful depiction of terminology of investment in smaller and route the money to build asset and cash flow,best part nobody say is to pay off debts,which i appreciate you have touched,,,

great piece of knowledge mr mani sir……

Thank you sir for the feedback

Thank you. You have also explained the small things in a great way. If you need financial information then you can contact us as well as we make you aware about the best stock broker in india 2019.

I like your work Sir..

A VERY NICE BLOG,IF ONE UNDERSTAND THIS BLOG PROPERLY THERE WILL BE NO FINANCIAL ILLITERACY,THANK YOU MANI SIR GREAT JOB

Such comments can make a bloggers day. Super thanks…