When I first asked myself ‘how to stop overspending money’, I did not realise that answering this question will be so difficult. [What helped: My financial planning calculator].

Why its answer was ‘difficult’? Because it required some ‘deep thinking’. Why?Because overspending is caused more due to psychological limitations.

When we spend more, it is kind of a ‘personal choice‘. Because if we do not want to do it, nobody can force us to overspend.

The tough part is how “not want to overspend”.

We all like to spend money to buy things. It is kind of a ‘natural instinct’ for us. This is why overspending happens almost naturally, without a credible resistance.

So how to stop it? It will require mind training. Let’s know more.

Mind Training Using Financial Calculator

Mind training is done to align thoughts in a particular direction. If mind thinks in a way, it will rarely do otherwise.

To tackle overspending, we’ve to make our mind first realise that it is overspending. How to do it? By use of a financial planning calculator.

This calculator can curb ones habit of overspending. How? Because it highlights ones money deficit. How?

Suppose your current monthly savings is Rs.5,000 per month. But you are expected to invest Rs.17,000 per month for future goals. The gap between the actual and expected is the deficit (Rs.12,000).

In this example you are saving less than required. This realisation, about deficit, will help you to “not want to overspend”.

Knowing Oneself Better

We all have overspent on our days of enthusiasm, right? But this is particularly worrying for people who are impulsive in purchasing. Why? Because they indulge in overspending more often.

Even impulsive spenders have a pattern. Understanding ones “pattern of overspending” is a good point to start.

Everyone has their own typical behaviour when it comes to overspending. Different people tend to overspend on different things. People mostly overspend on the following:

- Food,

- Clothes/Accessories,

- Gadgets,

- Automobiles,

- Real Estate Property,

- Entertainment, &

- Vacation.

Why people overspend on these things? Because they are tempting. Foodie people spend frequently on foods. Travellers spends on vacations. Auto lovers tend to overspend on cars/bikes. Why? Because they love it.

These people justify their spendings for the love of it. But in monetary terms, they are overspending. Becoming aware of ones area of temptation is important. More often than not people overspend in this “area”.

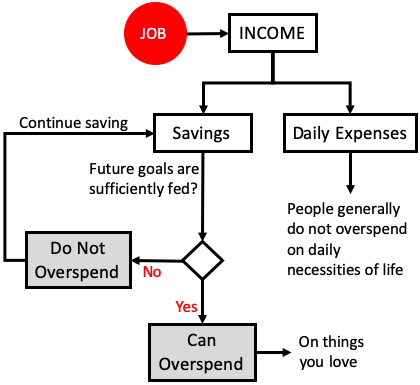

How to prevent it? By diverting savings to first fulfil the “future Goals“. These goals are our priorities. Once the goals are fed sufficiently, only then one can overspend.

How To Plan for Overspending?

Planning for overspending? This statement may sound counterintuitive. But actually it is not. Why? Because we all will overspend, better is to be prepared for it. How? For this we’ll have to define what is overspending.

Over-spender’s actually oversteps their boundaries of affordability. Spending beyond ones affordability is called overspending.

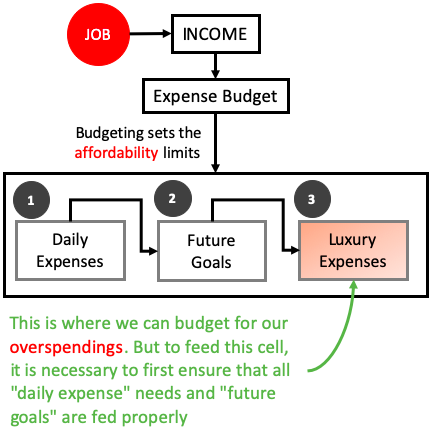

How to establish ones affordability? By budgeting for it. How? List down all expenses. Categorise them in three (3) parts: as “daily expenses”, “future goals”, and “luxury expenses”.

- Daily Expenses: Give top most priority to this expense head. This is where you pay your bills, buy groceries, pay fees etc. These are basically those expenses which are kind of unavoidable ones. Budget for this expense head first. Read: Benefits of budgeting.

- Future Goals: Once you’ve managed daily expenses needs, the next priority should be future goals”. Whatever money is left after managing daily expenses, feed them here. How much to feed? You will know this by using a financial planning calculator. This calculator will highlight how much you must invest each month to meet you future goals.

- Luxury Expenses: To fund luxury expense head ‘actual savings’ should be more than “required investment’. If actual savings is Rs.20,000 and required investment is Rs.15,000, it means the differential (Rs.2,000) is your “overspending budget”.

Utility of Financial Planning Calculator

In this article our focus is ‘how to stop overspending’. But why to stop overspending in first place? Because when we are overspending, we are actually compromising elsewhere.

Where is this ‘elsewhere’? More often than not it is the future financial goals that gets compromised. Why? Because these are not our immediate needs. Daily expense needs never gets compromised, right? Why, because they are today’s needs.

Hence, there must be a trick which will make future financial goals appear as critical to us as “daily expenses”.

This trick can be played by using a financial planning calculator as often as possible. Let’s see how this calculator works.

Example:

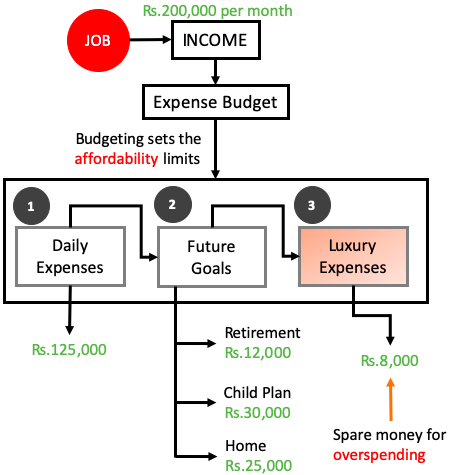

Raj’s age is 34 years. His net take home salary is Rs.200,000 per month. His daily expenses are Rs.125,000 per month.

Generally speaking, this is a good take-home package. In India, with this salary-expense balance, one can afford some overspending, right? But Raj is still not able to overspend a lot. Let’s see why…

Raj has prepared an expense budget which looks like this:

So now we have the following data in our hand:

- Income: Rs.2,00,000 per month.

- Daily Expense: Rs.125,000 per month.

- Future Goals: Rs.67,000 per month.

- Balance for overspending: Rs.8,000 per month

Though Raj is earning a decent income of Rs.200,000 per month, but still he is not able to overspend a lot. Why? Because the load of his savings is getting consumed by “future goals”.

This is what happens when we try to gauge our spendings in perspective of “future goals (priorities)”.

About Future Goals

I’ve considered three typical future goals in my financial calculator, (1) retirement, (2) child’s future, and (3) Home for self occupation. I personally feel that, if a common man can manage these three priorities, life will be mostly sorted.

I know someone may question that these three (3) priorities are not enough. may be true that they are not enough. But for me these are 3 bare minimum future needs of an average Indian family.

Moreover, I am considering ‘only them‘ as an assumption to prove a point. How I’m planning to prove a point? By presenting a financial planning calculator.

What is the point? We will not overspend if we know that the money is required elsewhere for more essential things (future goals). And use of a financial calculator will help us realise it.

Why this calculator will work?

The financial calculator helps us to quantify our future financial goals. How? It tells us how much we must save and invest each month to reach the goals.

This realisation will work like an inner voice. It will ask us to stop overspending. Generally people do not ignore their inner voice when it is speaking in ‘hard quantified numbers‘.

We fall prey to our temptations. But when inner voice is speaking loud, no temptation can deter us from listening and following it.

Regular use of this calculator can help us to channelize our inner voice and make it louder.

How To Use Financial Planning Calculator

What questions this calculator will answer?

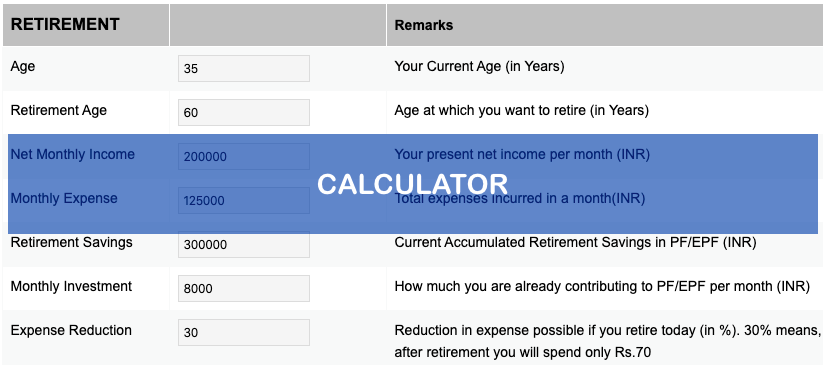

About Savings: The calculator will highlight, how much is ones current savings. It will also compare present savings with the expected investment needs. The investment needs are judged based on ones expected ‘future goals’. This calculator considers the following as future financial goals:

- Retirement: Out of all future goals, number one priority is given to building a retirement corpus. So the question this calculator will answer is this: “How much to invest each month to build the necessary retirement corpus“.

- Child’s Future: In India, immediate financial needs of a grown-up child are taken care by parents. These needs can be ‘higher education fees’ and ‘marriage expenses’. So the question this calculator will answer is this: “How much to invest each month to build the necessary corpus for child“.

- Home: As important it is to plan for retirement, it is equally important to buy a home as early in life as possible. So the question this calculator will answer is this: “How much to invest each month to build the corpus for downpayment of a home“. Read: Rent vs buy a home.

Let’s see the calculator more closely. Let me give you two steps of using this financial calculator:

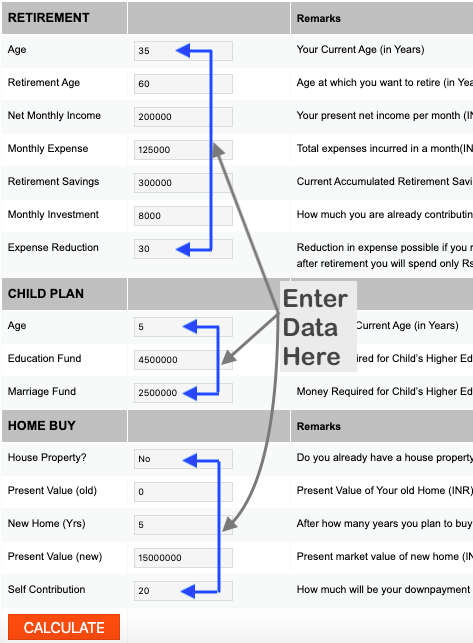

Step #1 – Feed Data:

Just type in some values in the fields of the calculator. Once the data is fed, it will generate the results on click of the button.

The data that needs to entered is related to your income, expenses, retirement corpus, goals for child, home purchase etc.

It will not take more than 5/6 minutes to feed the data. The instructions about data feeding is also given in the remarks column.

Step 2: Check Results

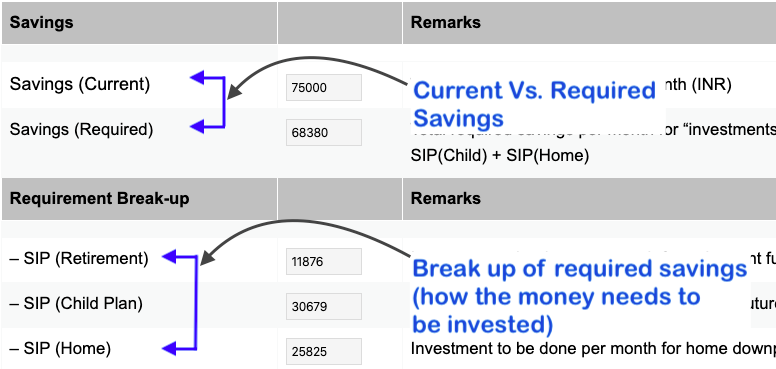

What is seen as a result of the financial calculator? It will be a combination of two numbers:

- Current Savings: Based on the data entry, the calculator will calculate the “current savings”. Current net income minus total expenses will be current savings. This is the number which will be used to comparator. Read: Alternative to savings a/c.

- Required Savings: Required savings is computed based on the ‘future goals’ data fed by the user. The calculator tries to estimate how much money needs to invested each month to generate the required corpus. The break-up of requirement is also provided by the calculator. What break-up? How the money needs to be invested to build the corpus for the three goals. Read: Best investment strategy.

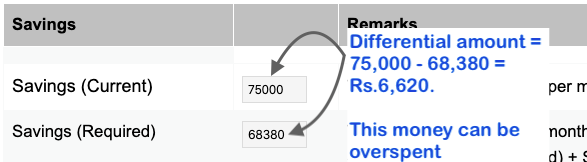

Comparison between ‘current savings” and required investments’ is the key. How? It will give the clarity that, if the person can afford to overspend or not.

If current savings is less than required, overspending cannot be done. If current savings is more than what is required for investing, the differential amount can be overspent.

Other Simpler Tricks to Stop Overspending

One of best ways to eliminate overspending is to become aware of the future financial goals and its requirements. But there are other hacks which can also help the case.

- Budget & Track Expenses: Preparing an expense budget will give you an idea of how much you are allowed to spend on an activity. One you have set this limits, the next step to start tracking all expenses. This is one exercise which can work like wonder to minimise overspending. Read: About expense tracking.

- Pay Yourself First: This is again a trick which can divert a majority portion of your income aside. The result is that, what is left with you for spending is only limited. A combination of budgeting and ‘paying self first’ can eliminate overspending once and for all. Read: About paying yourself first.

- Pay with Cash: We have a tendency to overspend when we use plastic. Start paying for things in cash. Psychologically, it creates a resistance in our mind (for spending). Why? Because we can see & feel our wallet becomes lighter. Read: About how to save money.

- Stop Credit Card Usage: There is tendency for people to overspend when they pay using a credit card. Why? Because credit cards allow us to pay for our purchases later (not immediately). Hence psychologically, it is more comforting to use a credit card (instead of debit card or cash). Read: Why not to use credit card.

- Delay by 48 Hours: This is the trick to delay gratifications. Impulsive spendings can be curbed this way. Suppose you’ve suddenly decided to buy a smart phone. You also have the money in savings. But do not go out and buy yet. Give yourself a 48 hours cooling time. Once this time is lapsed and you still feel the need for it, do it. More often than not, after cool over time, the urge to spend vanishes.

- Pay Yourself A Tip: Every time you spend, pay yourself a tip (5%). This tip is like a self-imposed fine on for spending. Suppose you’ve spent Rs.1,000 to buy movie tickets. Once the transaction is done pay your self Rs.50 (5% of 1,000) as a tip. Our mind behaves differently when it has to tackle fines (punishments). How? It will try to spend mess.

- Avoid Personal Loans: Except for home loans, all other loans helps in overspending. If we can afford a TV worth Rs.25,000, we buy a Rs.50,000 one using personal loan. Why? Because our friends have such TV’s. We overspend just to display an exaggerated standard of living. So the trick is to avoid personal loans at all cost. Read: Need to become debt free.

Conclusion

How to stop overspending? If this question comes in your mind you exactly know what to do, right? Ok, let me summarise the whole thing again in conclusion.

Overspending is caused due to our psychological weakness towards spending in excess. Hence, preventing self from overspending, require mind control. How to control mind?

By making the mind aware that there are more important expenses that needs to be managed first (future financial goals). How to make the mind aware of it?

By using a financial calculator that will help to quantify the future goals. Once the future goals are quantified, the mind exactly know how much money needs to invested each month.

If he requirement is more than what one is currently savings, it is a sign that overspending cannot be done. Once the mind becomes aware of this limitation, it will not allow you to overspend.

What if you are saving more than what is required? A person who has enough free cash (after feeding all future investment requirements) can afford to delve into the luxury of overspending.

I wish you are among those people who can afford overspending. For the rest, I will say, focus on your future goals. Quantify your goals of life. This will eventually help you to stop overspending. You can use this financial planning calculator.

Have a happy financial planning.

Net income means salary after tax, or ppe or before paying tax and ppf. You have not mentioned about Medicaid and insurance cover?