If I can learn to emulate how Warren Buffett thinks, it’ll pave a path for success in all aspects of life. Who is Warren Buffett?

Warren Buffett is not just a name. It has become a brand-name for investment. Almost everyone has heard this brand.

As a person, Warren Buffett is Chairman and CEO of Berkshire Hathaway. I’ll tell your two unique things about Warren Buffett:

- One share of Berkshire Hathaway sells at a price of $310,000 (Rs.2.2 Crore)

- Net worth of Warren Buffett is $82 Billion (Mukesh Ambani’s net worth is $50.9 Billion).

Why I’m talking about these numbers? Because, if you do not know Buffett, henceforth he’ll never get ignored.

These are two ways most people remember Warren Buffett. (1) As a chairman of an extraordinary company. (2) As a brilliant stock picker who has become a billionaire.

How Buffett Thinks (about investing)

When people call Warren Buffett as a brilliant stock picker, in a way it undermines the Brand. Why?

Because Warren Buffett never pick stock, he buys companies. What does it mean?

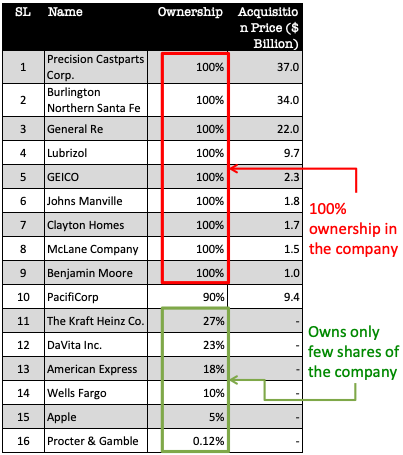

To understand this, let me give you names of few companies which Warren Buffett (Berkhire Hathaway) hold’s in its portfolio:

There are two types of shares listed the above table:

- Type 1: These are those companies which Berkshire Hathaway has acquired completely. Means, they have 100% ownership of these companies. These are wholly owned subsidiaries of Berkshire Hathaway.

- Type 2: These are those companies in which Berkshire Hathaway has a limited ownership. Example in Kraft Heinz it owns 27%, and in P&G it owns just 0.12%. Hence these companies cannot be literally called as Berkshire Hathaway companies.

I’ve said that “Buffett is a master in picking companies, not shares”.

It means, whether Warren Buffett is buying Type 1 or Type 2 shares, he will consider as if he is buying the whole company.

How does it make a difference?

When one is buying a whole company, he/she will make sure that the underlying business is super strong.

How we behave differently from Buffett?

We tend to get careless while we are buying only couple of shares. We do not check the business fundamentals as diligently.

According to Warren Buffett, while buying shares we must think like a Business Analyst and not just like a security or market analyst.

Be a business analyst, not a stock picker

How to think like a business analyst? To think like them, we must first treat shares as “companies”.

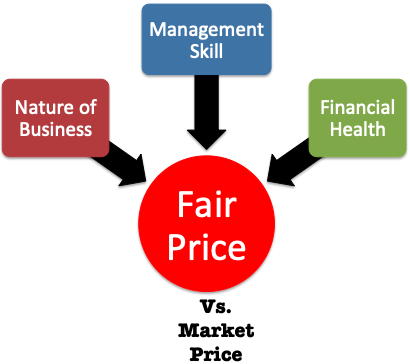

Secondly, it is necessary to break down whole company (share) into the following four components:

- Nature of Business: There are few businesses which are inherently profitable. This type of business is designed to make more money for its owners. These are typically low risk, and easy to understand businesses. Buffett calls them “good business”. Know more.

- Quality of Management: A good business, run by skilful managers makes it more profitable. Warren Buffett will never buy a company run by poor managers (specially senior managers). These managers must display three few key skills. Know more.

- Financial Health: There are four parameters based on which he will judge financial health of a company. No company will pass his scrutiny till it fares well on these four parameters. Actually these parameters are an ultimate reflection of “good business” & “skilful management”. Know more.

- Fair Price: A good business, its manager’s skill, and its financial health – builds its fair value. It is in investors domain to estimate fair price a company. Comparing the estimated fair price with current market price will decide if the company is a good buy or not. Know more.

Let’s know more about the above four components of a company.

The idea is to start seeing companies like business analysts so as to pick good stocks.

1. Nature of Business

Warren Buffett would like to understand the business model of company before buying its shares.

To ascertain facts, he will double check the following about the nature of its business:

#1.1 Simple & Understandable Business:

Warren Buffett will not buy even one share of a company if he is not able to understand its business. Why this understanding is necessary?

To judge if the company will perform well in future. How to judge this?

Investors must feel confident about the capability of the company to generate future profits. Such confidence will only come when the investor can understand how the company operates.

How to build this understanding? By trying to answer the following questions about the company:

- Revenue: How the company generates revenue?

- Expenses: Where the company is spending most of its money?

- Cash Flow: How the company is managing its short term cash needs?

- Pricing: How sensitive are the company’s sales with respect to the price of its product or services.

- Use of Retained Earnings: How the company uses its retained earnings has profound effect on long term returns of its shareholders. A company must allocate its retained earnings in such a way so as to maximise the shareholders returns. Good company can use its earnings to pay dividends or use funds to pay debt, buy new acquisitions, buyback shares, spend on expansion and modernisations of facility etc.

- Manpower Management: How happy and satisfied are the employee and suppliers of the company? No company can perform well till its employees, and suppliers are feeling reasonably good about it.

Getting answers to the above questions about the company will build the investors “circle of competence“.

Know about the underlying business of your shares as if you are the owner of the company. Why to take so much headache?

Because it will help you to judge if your company is treading on the right path or going down the drain. It will help you to make a right buy/sell decision.

#1.2 Consistency in Performance

A business which has done consistent business in the past, is likely to repeat its performance in future.

Warren Buffett gives a high rating to consistent companies? Why? Because predicting future success of such company’s is easier.

Warren Buffett loves companies who does not have to undergo massive changes to maintain their sales and profit. Why?

Because massive changes comes at a cost. This reduces company’s profitability in times to come.

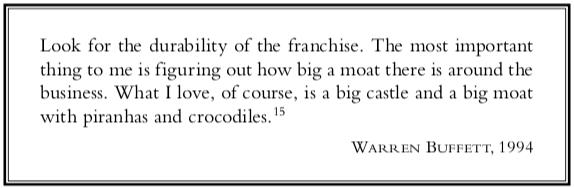

#1.3 Has a Wide Moat

It is important to understand the meaning of the word “Moat”. Read more about moat companies.

Wide Moat companies are such companies whose future remains safe/guarded.

They enjoy a “competitive advantage” that makes them unreachable for their competitors.

Which are such companies? Such companies has the following traits of its products and services:

- Demand: Companies whose products and services are in good demand. People like to own them. In some cases, people would like to own these products no matter whatever is their price (example: luxury brands).

- Unique: These are such products and services which cannot be replicated by it’s competitors. They are protected by patent right, or its technology is unique.

- Unregulated: Price of commodities and services like Oil, Steel, Airlines etc are closely monitored and controlled by governments. Companies which does business in such items are not liked by Buffett. Why? Because such companies has a diminished pricing power.

How these typical characteristics helps the companies to do business?

Their benefits are multifold:

- They can increase price anytime they like.

- Their return on invested capital (RoCE) is above average.

- Such companies owners earnings can beat inflation in long term.

2. Quality of Management

Warren Buffett gives high importance to the “quality of management” governing a company.

In fact he disliked the thought of his name being associated with “managers who lack admirable qualities“. He once also referred to such managers as a bad person.

Warren Buffett has his own ways of judging the quality of management of a company.

Generally speaking, he likes those senior managers who “behaves and thinks like an owner of the company“. Why? Because such people never lose focus on the ultimate goal of “increasing shareholders value”.

So, Buffett will mainly judge managers of a company based on their steps taken to enhance shareholders value.

How he does it? By checking on the following:

#2.1 Rational Use of Capital:

It is in senior managers domain to utilise the “retained earnings” of the company wisely. A wise act here will ultimate build shareholders value in long term.

There are two ways in which retained earnings of company can be used:

- Reinvesting it back into the business, or

- Returning money to the shareholders.

For new companies, which are growing faster, reinvesting looks like a more rational decision.

But for matured companies, which is not growing as fast, but is generating huge piles of cash, for them reinvesting may not be as wise.

In this case, returning money to shareholders may be an easy-way-out for the managers.

Warren Buffett looks deeply into how such matured company is utilising its capital.

It gives him a lot of insights into the character/honesty of the senior managers of that company.

There are few simple rules of capital allocation:

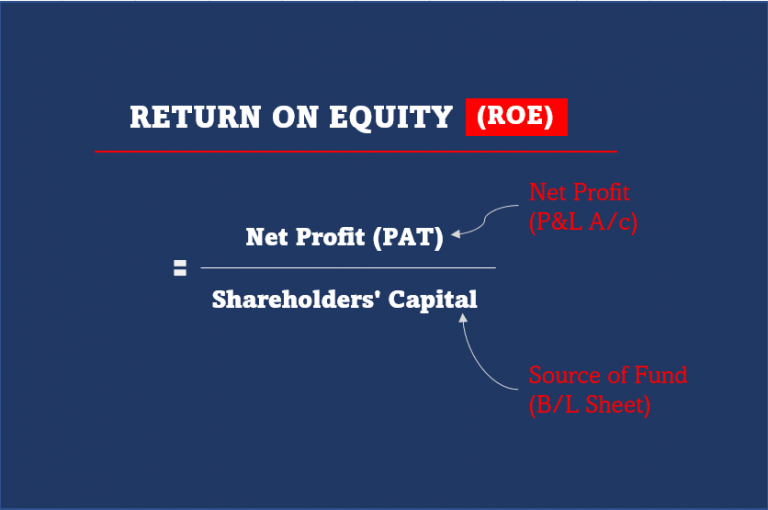

- When Reinvesting is wise : When ROE (Return on Equity) of a company is higher that its WACC (weighted average cost of capital). In this case, the company must retain all profits and reinvest in the company. [Example: Berkshire Hathaway pays no dividends. Now you can judge why.]

- When Reinvesting is not wise: When ROE is less than WACC, company must not reinvest. What such a company can do? (a) They must use its capital to “buy growth”. How? By acquisitions etc. Though Buffett does not like companies which has to buy growth. (b) If this is not possible for the moment, returning money to shareholders is a better alternative. How to return the money? By way of share buy-back or dividend payment.

There are times, when managers keep reinvesting the money even if the ROE is less than WACC. Buffett keeps a note of this.

If the company has been reinvesting for a long time without following the above rule, it is a big negative for Buffett. Why?

Because he thinks, either the managers are ignorant, or they are trying to fool the investors (and stakeholders) by falsely posing as a profitable company.

In both these cases, Buffett would like to stay away from shares of such companies.

#2.2 Frank Reporting of Results.

As a part of doing business with integrity and honesty, frank reporting of companies results goes a long way.

In the corporate world, genuine reporting of results is not so common. But for companies who practice it, Warren Buffett gives them a high regard.

How he identifies such companies? Frankly speaking, it is not as difficult.

For a trained eye like Buffett, a closer look in the Annual Reports of the company will make it evident.

Candid talk by the Chairman, Managing Director (CEO), Chief Financial Officer (CFO) in the annual report will be the first hint.

When company’s senior managers also discusses the failures in the report, it is another big leap towards frank reporting.

Warren Buffett becomes sceptical when he reads reports of companies which too much optimism at display.

#2.3 Not Imitating Others

Every company face stiff competition from its rivals. To remain alive, one must keep an eye on what others are doing.

But when “keeping an eye” starts to trigger imitations, then it becomes a problem.

Warren Buffett says that, companies run by hard-working Manages who has very high IQs fail. Why? Because of “mindless imitation of peers”.

Why Managers imitate? It’s human nature.

Taking “unconventional” business decisions does not come naturally to people. But it is only such decision which can give company the much needed “moat”.

Unconventional decisions are not easy to take. The biggest hurdle comes from the “company’s owners”. If they people who likes imitation (instead of innovation), Managers will eventually follow their course.

But all the blames cannot be put on the owners alone. Generally speaking, senior managers of top companies are often resistant to “fundamental changes”.

How Warren Buffett identifies companies which are not imitating? Read his views on this…

3. Financial Health

To judge company’s financial health, Warren Buffett prefers to keep it simple and logical.

To start with, Buffett prefers to see five-year averages than yearly results.

Secondly, Buffett prefers to look at those numbers which are hard to fake in the companies financial reports.

Following the numbers which are Buffett’s favourite:

#3.1 Return on Equity (ROE)

High ROE and Low D/E ratio

People love to see a growing EPS. But for Buffett, EPS is not so interesting. He prefers return on equity (ROE). Read more: How to calculate ROE?

In addition to ROE, the company must also be low in debt (Low D/E ratio).

Buffett never says how much debt is low. Why? It can vary from company to company.

Like, companies with fact cash flow can handle more debt and vice versa.

The point that Buffett try’s to make is, good business doesn’t need debt leverage to earn higher earnings.

#3.2 Owner Earnings

A trend of growing owners earnings is what Warren Buffett prefers to see. What is owners earning?

Owner Earnings = [Net Profit + Depreciation] – [Capital Expenditure + Increase in Working Capital]

Instead of relying in net profits, earning per share, or operating cash flows, Buffett prefers “Owners Earnings”.

Owners earning is that MONEY which remains in the hands of the owner after the necessary expenses has been adjusted.

Why owners earnings is important? Because it that portion of the net profit which can actually be used to “gain competitive edge (moat)”.

Why so? To understand this, lets understand each component of the Owners Earning’s formula:

- Net Profit: Net profit is total net cash receivable by the company after all expenses and taxes are adjusted from the total sales. This is what Buffett often refers as “earning”.

- Depreciation: What is depreciation? It is a non cash expense. Companies do not actually spend this money. It is just an accounting adjustment in GAAP. This is why Buffett adds depreciation to the Net Profit to estimate total cash available (receivable + depreciation) in the hands of the company.

- Capital Expenditure (CAPEX): What must be the minimum capital expenditure? A company can decide to spend zero money here. But if it follows this rule, eventually it will loose its competitive advantage. A rule of thumb says, a company must spend in (in Capex) at least equal to its depreciation each year.

- Increase in Min WC: Minimum Working capital (WC) = Current Liability. This minimum WC takes care of the company’s day to day expenses like salary payment, vendor payment, debt repayment etc (total current liability). A company must ensure a steady flow of current assets (account receivables, short term debt etc) to pay all of its current liabilities. Suppose every year the company’s account payable has been growing at 15% per annum. It means, increase in working capital of the company will be 15% of last years current liability.

Learning to calculate company’s “owners earnings” is an integral part of being a business analyst. One must learn how to do it to pick good stocks.

#3.3 Profit Margin

For a given business, for every dollar of sales there is an appropriate level of expenses.

Till the company remains below its “appropriate levels” it is doing great.

But as soon as it crosses its “appropriate level” is needs to correct (immediately).

How it can be done? By cutting down unnecessary expenses.

It requires a great deal of Managerial skill to distinguish between necessary and unnecessary expenses”.

This form of management can happen only when the company is sensitive to its “profit margins”, and clear understanding of the core operations of the business.

Generally speaking, Warren Buffett loves buying shares of companies having pretax margin above 20%.

#3.4 Minimum Market Value

A “good company” run by able “managers” will eventually be complemented by a proportional increase in its market value.

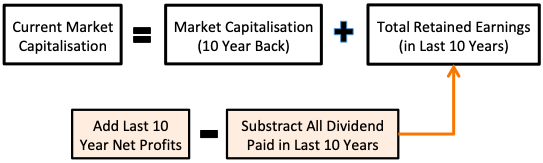

How much should be the increase? It must follow this formula:

What is the logic?

Company’s retain their profits for a reason (future growth). Here Buffett is quantifying future growth in terms of growth in market capitalisation.

Every dollar of retained capital must be able to grow the company’s market value by at least a dollar (over a span of 10 years). If this is not the case, the company’s managers are not doing enough.

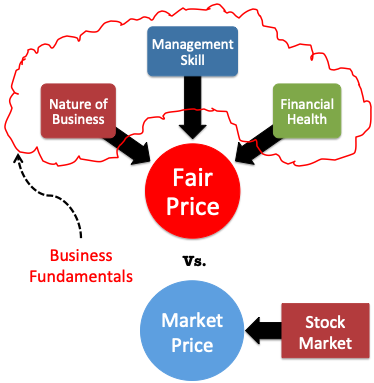

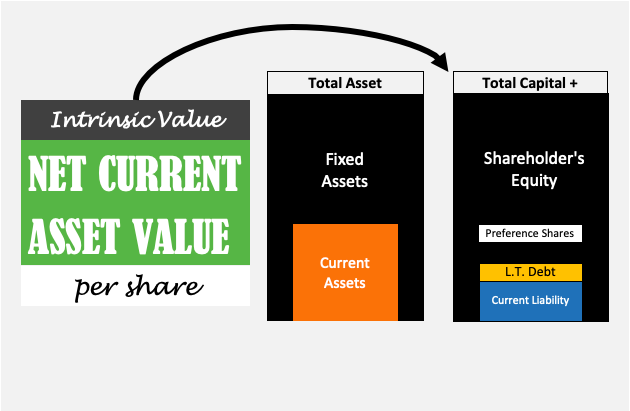

4. Fair Price (Value)

All the qualities of the company described above (nature of business, quality of management, and financial health), ultimately builds its fair value.

The stronger are the qualities, the higher will be the resultant fair value.

Comparison of fair value with current market price can answer the ultimate question of stock investing, “whether to buy or not buy“.

Why fair price and market price are different? Because market price is built by the sentiments of the stock market, and fair price is an estimate of an investor.

How an investor estimates fair price? By reading and interpreting the companies business fundamentals.

But converting business fundamentals into a “fair price” is a challenge. Not everybody has interest to practice this mathematics.

This is where my stock analysis worksheet becomes useful. It uses a company’s last 10 years data to estimate its fair value (intrinsic value).

Final Words

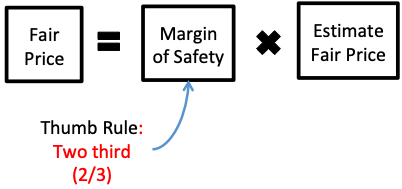

This is why how Warren Buffett thinks about stocks and its underlying business. But even Buffett knows that he can go wrong.

No matter how confident one is about ones fair price estimation, there’s always a chance of getting it wrong. Why so?

Because fair price calculation is not as easy as one plus one. Neither, it has a specific formula’s with values.

Fir price is an estimate and not a confirmed number.

When learned people like Warren Buffett estimate fair price of a company, chances of going wrong is small.

But when common people is doing this math, the chances of miscalculation is high.

So, how to take care of this gap? Margin of safety…

Note: This is my interpretation of the Warren Buffett way of stock picking. But be reminded that Buffett would not like himself to be called as stock picker. He is not a stock analyst. He is a business analyst, who picks good business.

best blog ever read on investing. i must say you are taking great effort. carry on…

plzz write a blog on how to find fair valve by buffett way.

it will be really helpful

one of the best blogs on investing ever written thanks for this looking forword to start investing in business …also can you please write an article relating to how to calculate the intrinsic value according to you not because not all can afford to buy your course this is a special req cheers!

Hi:Thanks to your blogs,find them to be very,very helpful.When using your stock analysis sheet i got the intrinsic value as follows .

Stock Intrinsic value Expected return Confidence Current price

Seshayee Paper boards: 787.6 12% 50% 148.5

Sadhana Nitro Chem : 128.5 12% 100% 33.5

Auro Laboratries : 70.5 12% 75% 60.0

My question is.The gap between the current price and intrinsic value is quiet huge.So is there any mistake that i making while working on the sheet or is this correct.

Request your feedback.

Warren Buffett is a legend person of stock market, his thinking make unique him to all others.

if you are investors or Stock tips provider so you have to read about him and follow him.

Great information in this article. Thank you

One of the best blogs I have ever come across….

Thanks for liking the work