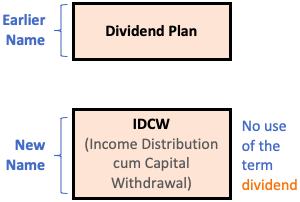

What is IDCW in Mutual Funds? IDCW is an abbreviation for “Income Distribution cum Capital Withdrawal.” As per SEBI Circular no: SEBI/HO/IMD/DF3/CIR/P/2020/194, dated October 05, 2020, all dividend plans must be renamed. These days, the term dividend does not appear in the scheme names. The change of name was effective since 01-Apr’2021.

Currently, the fund houses offer three types of dividend plans. Their names must be changed as shown below:

| SL | Plans (Existing) | Renamed As |

| 1 | Dividend Payout | Payout of IDCW option |

| 2 | Dividend Re-investment | Reinvestment of IDCW option |

| 3 | Dividend Transfer Plan | Transfer of IDCW plan |

Why SEBI is taking the trouble of renaming the mutual fund’s schemes? What was the need? Is it worth the effort?

Dividends Paid By Mutual Funds Are Not Dividends

Suppose you bought mutual fund units at a NAV of Rs.50. After one year from now, the NAV goes up by 20% (Rs.60). It is a capital appreciation of 20%. Now, suppose this scheme is one that pays out dividends. Hence you’ve received cash of Rs.2 per unit (Dividend Yield of 4%).

So, what a retail investor will think about the above returns? They will correlate it with stocks and conclude. In stock investing, capital appreciation plus dividend income builds the total return.

Retail investors will assume that his mutual fund scheme has yielded 24% returns (20% capital appreciation plus 4% dividend income).

But it’ll be a wrong assumption. The dividend of 4% is a part of the 20% capital appreciation displayed by the scheme. If the concept is not clear, I’ll explain it using a better example.

But before that, let’s realize that the dividends paid by mutual funds are not dividends. They are a part of the capital appreciation (NAV growth).

When mutual fund houses use the term dividend in the scheme’s name, it’s a misleading title. In the past, SEBI received feedbacks about how the term “dividend” is creating a false sense among the unitholders. Hence, SEBI decided to remove the word “dividend” from the scheme’s name. Now, what all funds houses can use is “Income Distribution cum Capital Withdrawal or IDCW.”

Example: A IDCW Scheme

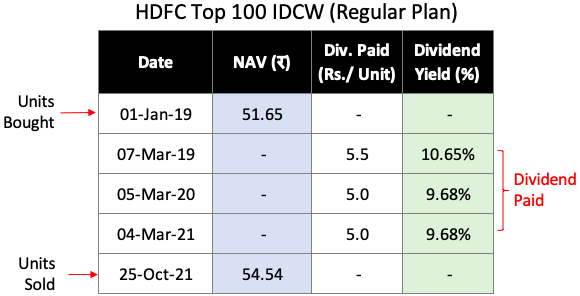

There is a famous mutual fund scheme called HDFC Top 100 Fund – Regular Plan. It comes with growth and IDCW-Payout option.

We’ll take the IDCW option for an explanation.

Suppose a person bought units in the above scheme. The date of purchase was 01-Jan’19 at a NAV of Rs.51.65. He held on to it for 34-months and sold them on 25-Oct’20 at a NAV of Rs.54.54. During this period, the scheme paid dividends thrice. See below:

There are three instances of dividend payment to the unitholders. Allow me to show you what happens to the scheme’s NAV every time the dividend is declared. We will take the case of 07-Mar’19.

Fall in NAV of IDCW Scheme

ON 07-Mar’19, the NAV of the scheme was at Rs.52.2 levels. After the dividend of Rs.5.5/unit was declared, the NAV fell to Rs.43.6 levels.

What does it mean for the unitholders? Though they earned cash of Rs.5.5/unit, there was also a fall in NAV soon after the dividend declaration. Why does the NAV fall? Because the cash distribution happens by liquidating the assets of the fund. So it means that on one side, there is a gain of Rs.5.5/unit, but on the other side, NAV has become weaker (generally in the same proportion).

So dividend was not an extra payout. Its payment lowered the NAV of the scheme. So if one is buying a dividend scheme of a mutual fund, there is no additional benefit.

[P. Note: Unlike in mutual funds, dividend declaration for a stock causes its price to go up. Investors treat dividends as an extra earning in addition to capital appreciation. Hence the stock’s demands pick up upon such an event.]

In the past, many investors committed to dividend schemes without realizing a fact. Every time the dividend is paid, the scheme’s NAV falls. Why? Because in mutual funds, dividend are not dividens (see above). Hence, SEBI decided to change the name of these schemes to IDCW. The main idea was to replace the term “dividend” as it was causing erroneous interpretation.

Calculation of Returns for Dividend Schemes

Online financial portals also contribute to the wrong interpretation of dividend schemes. How? They publish numbers that do not reflect the correct quantum of returns. Hence, if investors themselves can calculate the ROI of dividend-payout schemes, the issue of wrong interpretation will fade away.

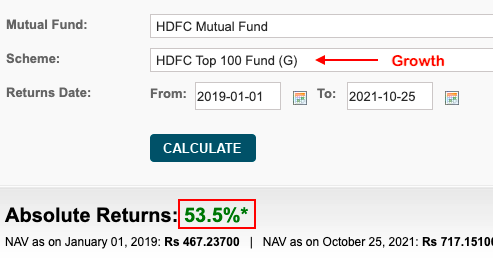

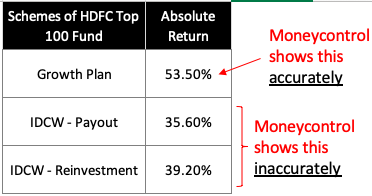

First, allow me to show you the return numbers shown by ‘Monecontrol’ for a scheme called “HDFC Top 100 Fund – Growth and Dividend plan (IDCW).”

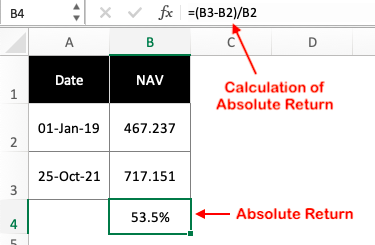

Growth Plan – Return

The absolute return shown by Moneycontrol for the growth plan is correct. On the date of purchase, the NAV of the scheme was Rs. 467.237. On the date of sale, the NAV was Rs. 717.151. Hence its absolute return is calculated like below:

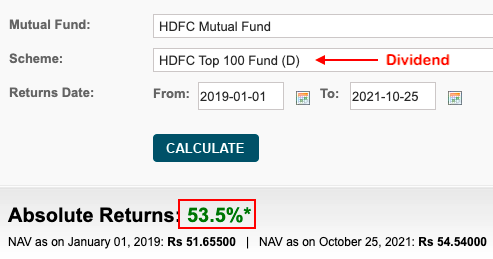

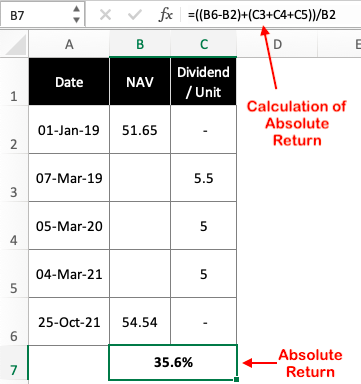

IDCW Payout Plan – Return

Now, let’s calculate the return of the IDCW-Payout scheme. What is an IDCW-Payout scheme? They pay in cash the dividend amount to the unitholders. The amount gets credited into the bank account of the investors.

On the date of purchase, the NAV was Rs.51.75. On the date of sale, the NAV was Rs.54.54. Between these two dates, the dividend was paid in cash thrice to the unitholders. Now, let’s calculate the absolute return for this scheme.

As per our calculation, the absolute return of this scheme is 35.6%. But the Moneycontrol website is displaying it as 53.5%. I’m not sure how moneycontrol has calculated the return. For sure, there is an error somewhere.

Maybe, they are displaying the return numbers of the IDCW-Reinvestment plan instead of the IDCW-Payout. So let’s go ahead and do the calculation for the IDCW-Reinvestment plan.

IDCW Reinvestment Plan – Return

To double-check, I also tried calculating the return of the IDCW-Reinvestment scheme. Here the dividends are not paid out as cash. They are used for buying more units for the investors.

So, on the date of dividend disbursement, the number of Units increases for the investors. Below are the numbers based on which I’ve done the return calculation

As per our calculation, the absolute return of this scheme is also 39.2% (and not 53.5% as displayed on the Moneycontrol website.

As per our calculations, each plan yields a unique return number.

Why I’m calling out this mistake? The problem is that the investors are already interpreting the dividend schemes incorrectly. When reliable websites like moneycontrol also start showing wrong values, it adds to the confusion.

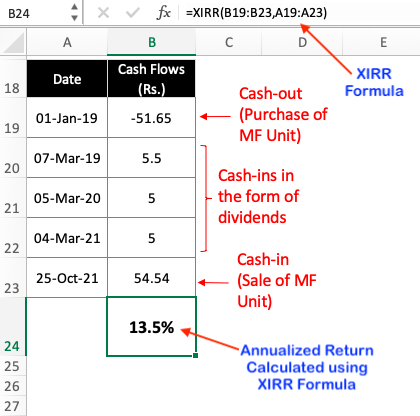

I use the XIRR formula to calculate the returns of my investment. In most cases, I avoid the use of absolute returns. It is especially true for such investment that has multiple cash flows, like IDCW-Payout plans.

XIRR Formula To Calculate Returns

XIRR formula calculates annualized returns emanating out of an investment. It is equivalent to CAGR (Compound Annual Growth Rate). I mostly rely on XIRR numbers for the performance evaluation of my investment.

Dividend Yield (Cash Yield) of Mutual Funds in India

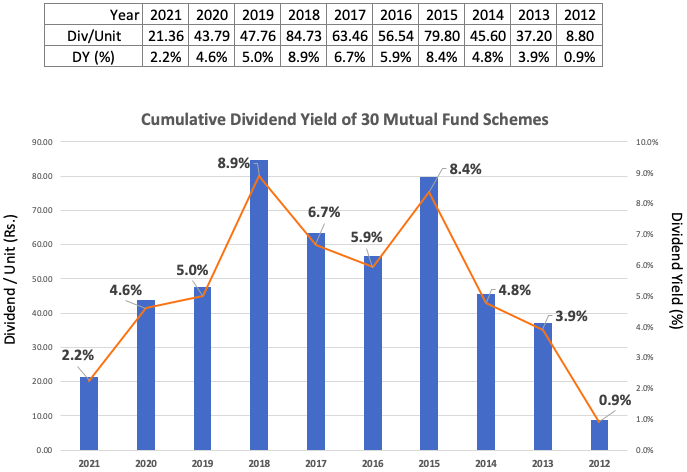

I wanted to know the level of dividend yield mutual fund schemes. Hence, I randomly picked 30 mutual funds from large-cap and multi-cap space. I noted the dividends they have paid between the years 2012 and 2021. Based on their dividend payout numbers, I calculated their dividend yields.

Why I’ve chosen only large-cap and multi-cap funds? Because these types of funds generally pay dividends (distribute cash) most consistently.

Please check the below chart:

If you want to know the details of the above numbers, here is the 10-Yr data presented in a tabulated form.

Conclusion

Changing the name of dividend-paying mutual funds was necessary. Why? Because the term dividend was causing wrong interpretations among the investors. Hence, the introduction of the term IDCW in mutual funds was implemented. Thanks to SEBI.

Experts say that it will take some time for the investors to unlearn the term “dividend” and realize the meaning of “Income Distribution cum Capital Withdrawal (IDCW).” But I’ll say, it is better late than never.

I’ve also indicated in the article how online portals are also contributing (possibly unknowingly) to the confusion. They are publishing an incorrect return number of the IDCW schemes.

Dividend-paying mutual funds have always attracted investors. Hence, finance bloggers like me used to write a lot about it. But since the last 4-5 years, experts have come hard on the dividend schemes.

Some even wanted the dividend plans to be banned. But SEBI has acted only by asking fund houses to rename their schemes. It is a wise step I suppose banning the scheme would have eliminated one investment option from our basket.

I hope you liked the article. Please post your feedback/comments in the comment section below.

Have a happy investing.

Suggested Reading:

which are the high IDCW paying mutual funds? Can you provide me the names? I wish to invest a lumpsum amount

Mani

How do I get a hold of you?.

My email is [email protected], I invest in India but live in the USA

I need to learn more about the IDCW options with Mutual Funds