Once a person said, I have a fixed deposit of 65 lakhs in a bank. He asked if a bank closes what happens to the deposits? The answer is in the term called “Deposit Insurance & Credit Guarantee Corporation [DICGC]”.

We will discuss about DICGC in this article.

In a comparatively extravagant world of cryptocurrencies and the stock market, the fixed deposits (FD) have maintained their niche. There are people who still prefer saving money in FDs over investing.

The most visible example is the senior citizens. They tend to keep a majority portion of their retirement savings in FDs.

Another example can be people like me. We keep our uninvested money in FD, till a good investment opportunity comes. I also prefer keeping my emergency fund parked in FDs. Though there are other viable debt plans available in the market, my first pick is always FD.

Considering these examples, I can assume that there is a group of people who keep a substantial amount of their money parked in FD. Why? They have a perception that in FDs, their money is both safe and growing.

But if a bank closes what happens to the deposits? The money parked in the saving account and fixed deposits safe?

This is where the role of Deposit Insurance & Credit Guarantee Corporation [DICGC] comes into play.

Suggested Reading: India’s Bitcoin (Digital Currency)

#1. What is DICGC?

It is a wholly-owned subsidiary of the Reserve Bank of India (RBI). It provides the insurance cover for the following types of bank deposits:

- Deposits in Savings Account,

- Fixed Deposits (FDs),

- Current Account Deposits,

- Recurring Deposits, etc.

Exception: Generally speaking, the deposits of foreign governments, central government, state governments, and Inter-bank deposits are not covered by DICGC

#2. What is the size of the insurance cover?

Each customer can avail an insurance cover of Rs.5.0 Lakhs only.

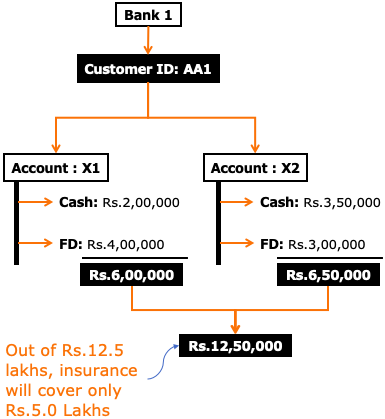

Suppose you are a customer of a bank and have a unique customer ID (AA1). Under this customer ID, you have two savings accounts (X1 and X2). In each savings account, you have kept deposits of Rs.6.0 Lakhs and Rs.6.5 Lakhs as shown below.

In this example, the total money parked under one customer ID is Rs.12.5 Lakhs.

If a bank closes what happens to the deposits worth Rs.12.5 Lakhs?

Out of the total Rs.12.5 Lakhs, the insurance cover provided by the DICGC will protect only Rs.5.0 Lakhs.

The balance Rs.7.5 lakhs may be lost in case the bank close down its operations.

There is a way to protect the full deposit. We will discuss it later in this article. But before that, let’s know few more basics about this “Bank Deposit Insurance Scheme.”

Another Example:

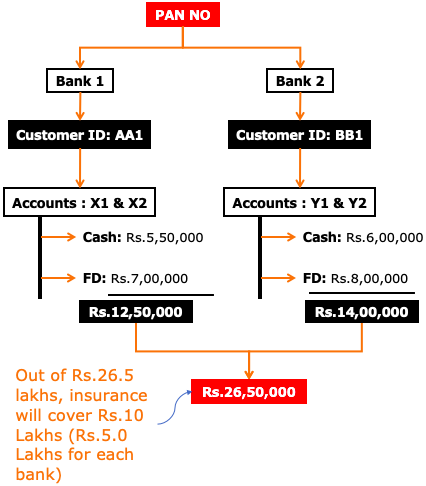

Suppose you are a customer of two different banks. In each bank, you have kept deposits of Rs.12.5 Lakhs and Rs.14.0 Lakhs as shown below.

In this example, the total money parked under one PAN number is Rs.26.5 Lakhs.

If these two banks close down at tandem, what happens to the deposits?

Insurance provided by DICGC covers each bank individually. Hence, the total protection that can be availed in this case will be Rs.10 Lakhs.

So, the first lesson we can learn from this example is, if the deposit amount is large, better to spread it in multiple banks.

Anyways, if you do not want to handle multiple banks, in the same bank a bigger cover can be availed. We will discuss it later in this article.

#3. Do all banks come under the ambit of DICGC?

Generally speaking, all banks which are controlled by RBI will be covered by DICGC.

All commercial banks, including the foreign banks having branches in India, and co-operative banks are covered by DICGC.

In case you want to see the list of banks covered by DICGC, you can check this link.

#4. Insurance cover is only for the principal?

Insurance will cover both principal and interest with the maximum limit of Rs.5.0 Lakhs.

Let’s understand this with an example.

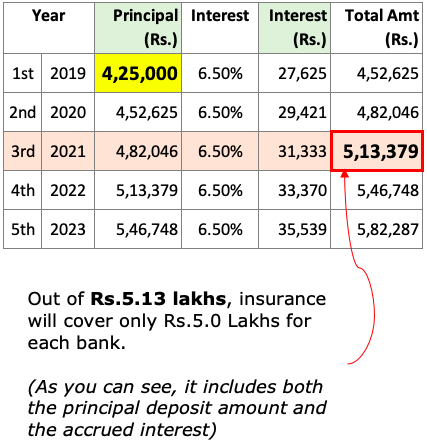

Suppose you have a fixed deposit of Rs.4.25 Lakhs in a bank. The FD was taken for 5 years, at a 6.5% rate of interest. In the year 2021, you have already complete 3 years of tenure. Now suppose in Yr-2021, the bank declares closure due to some reasons.

As your deposit is covered by DICGC, the money will not be lost. Moreover, the size of the deposit is Rs.4.25 (less than 5.0 lakhs), hence the principal is protected for sure.

But in the course of last three years, the size of the principal has increased from Rs.4.25 lakhs to Rs.5.13 Lakhs (4.25 + Interest). So, the DICGC will cover the interest portion as well?

Yes both the principal and interest component is covered by the insurance claim. But the only rider is that the upper limit of the cover is Rs.5.0 Lakhs.

In our example, the principal plus interest was Rs.5.13 lakhs. Hence, the depositor will get only Rs.5.00 lakhs by the way of insurance cover (if the bank fails).

#5. There is a way to get the insurance cover of more than five Lakhs?

Yes, it is possible. But it is slightly complicated. Hence, allow me to explain it using an example.

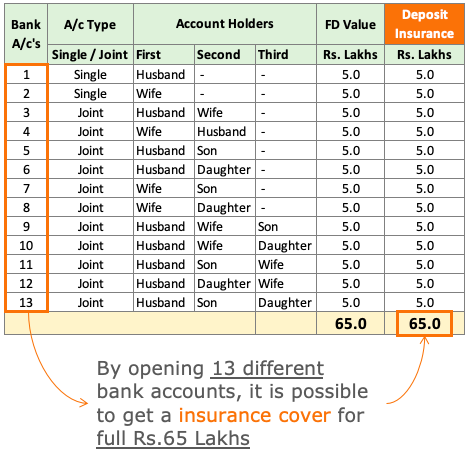

Suppose there is a family of four people: husband, wife, son (minor), and daughter (minor). This family has total cash of Rs.65 lakhs lying idle in a bank.

To earn a slightly better interest rate, the family decides to lock the money in a fixed deposit.

But they are bothered about the DICGC’s insurance cover limit of only Rs.5.0 lakhs. What they can do to bring the whole corpus under the insurance cover?

They will have to open 13 number bank accounts and spread the money in these accounts, as shown below.

Each bank accounts as shown above is treated as “unique ownership.” Hence each account becomes eligible for a DICGC cover of Rs.5.0 lakhs. This way the total principal of Rs.65 lakhs can be protected.

#6. Under what conditions DICGC claim comes into effect?

DICGC claim comes into effect when the bank ceases to operate. Few reasons that may cause a bank to close its operations are listed below:

- Closure of bank due to bankruptcy.

- Closure of bank due to merger/amalgamation with other banks.

- Cancellation of the license of the bank by RBI, etc.

When a bank ceases to operate, DICGC pays the due amount, of each account holder, to the liquidator. The liquidator is an officer appointed when a bank is being closed. The person can be a civil servant like a deputy registrar etc. The due amount is paid by the DICGC to the liquidator within two months from the receipt of the claim list.

Who is supposed to prepare and submit the claim list to DICGC? The liquidator prepares the list and sends it to DICGC for scrutiny and payment.

Generally, the claim amount of this nature is very large. For example, between the years 1992-94, the Bank of Karad was closed. The total amount released by DICGC to the liquidator was about Rs.37,000 crore. The money was released in 3 stages.

As soon as the liquidator gets the money from the DICGC, he starts to disburse the claim amount to depositors as per the claim list.

Conclusion

In Mar’2020, RBI imposed a 30-Day moratorium on Yes Bank. The withdrawals were limited to Rs.50,000 per person. When this happened, Yes Bank was among the biggest banks in India. If you want to know about the Yes Bank crisis, check this link.

When a bank becomes as big as Yes Bank, they carry huge reserves of deposits. These deposits mainly come from people like me and you. When news like a moratorium hits the headlines, small depositors can panic.

Try to imagine the case of retired senior citizens. If a bank closes what happens to the deposits of such people? It is just not sufficient to pay them just Rs.5.0 lakhs.

Hence government steps in and protects the banks from closure.

I will assume that, when banks are as big as SBI’s, HDFC’s, ICICI’s, Kotak’s, PNB’s, etc, the government will never allow them to close. One such example is Yes Bank.

From our side, we must also take precautions. If the deposit corpus is large, better will be to spread it across multiple banks. Moreover, within a bank itself, one can open multiple ownership accounts (as explained here), to keep the deposits insured.

The insurance is provided by “Deposit Insurance & Credit Guarantee Corporation [DICGC]”. Each individual ownership account has an insurance cover of Rs.5.0 lakhs.

Suggested Reading:

Respected Sir,

The most valuable and important information one should know about the Banking practices regarding the safety of Hard Earned Deposits in the Bank.

Thank you & obliged…!

Regards…

Thank You

Dear Mr. Mani(sh),

Well written article. What about those with HNI’s who have more than 65L in Deposits? Also how an family of only 2 members cover their corpus.

Regards,

In your above illustration you have mentioned about 13 accounts to be opened. In stead of that if one opens FD with a bank in this 13 combinations as explained by you without opening 13 savings account will he get 65Linsurance? Many banks open fd without savings account and transfer interest on line to savings account even in a different bank.I have such facility with Karnataka bank.

Interest withdrawal from one savings account will be more convenient.

You are right, 13 combinations of FD’s for the bank account is a better idea.

what is the likelyhood of SBI,HDFC bank and ICICI going bust?

Very unlikely.

Respected Sir,

The most valuable and important informations one should know about the Banking practices regarding the safety of Hard Earned Deposits in the Bank.

Thank you & obliged…!

Regards…

Thank you for the comment.