I saw this question on Quora and thought to answer this question as a short blog post. To address this question, let’s dive into a detailed analysis of Yes Bank’s business and fundamentals, considering various aspects that could impact its stock performance. First, we’ll look at Yes Bank’s Profit & Loss Accounts, Balance Sheets, and its current situation in deep. By doing this we’ll try to find the answer to this probing question.

Current State

Yes Bank has faced significant challenges in recent years, including governance issues, asset quality concerns, and liquidity crises. However, under the new management led by CEO Prashant Kumar, the bank has been working to address these issues and stabilize its operations.

Under the guidance of CEO Prashant Kumar, Yes Bank has made significant strides in strengthening its governance structure and risk management practices. The bank has implemented various measures to enhance transparency, accountability, and oversight. It is thereby restoring investor confidence gradually.

Furthermore, Yes Bank has taken decisive steps to improve its asset quality by recognizing and providing for stressed assets. It has been augmenting its provisions for potential losses thereby reducing its Net NPA’s.

Yes Bank has also focused on revitalizing its business growth while maintaining a cautious approach to risk. The bank has launched several initiatives to enhance customer experience, expand its digital offerings, and diversify its loan portfolio. With a renewed emphasis on prudence and sustainability, Yes Bank is poised to emerge from its recent challenges.

Yes Bank’s Recent Past

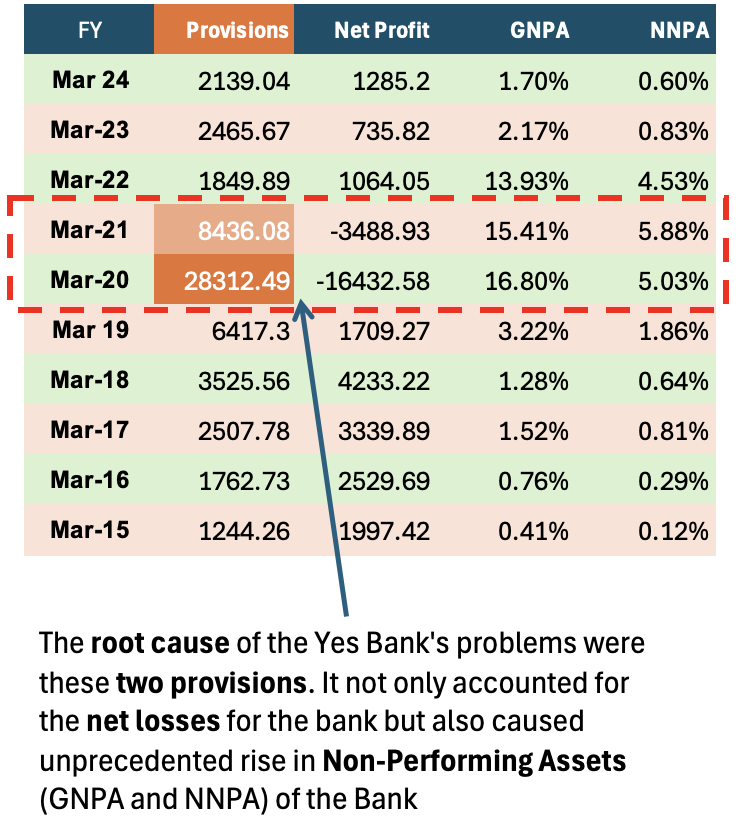

In March 2020, Yes Bank reported an unusually high provision of Rs.28,312 crores under “Total Provisions and Contingencies.” This was due to a severe financial crisis that led to regulatory intervention. In March 2021 as well, Yes Bank was forced to keep a very high provisions of Rs.8436 crores to manage its Gross Non-Performing Assets (GNPA).

Between March 2019 and March 2020, Yes Bank experienced a dramatic increase in its GNPA from 3.22% to 16.8% and its NNPA from 1.86% to 5.03%. This sharp rise was due to several interconnected factors that severely impacted the bank’s asset quality.

The Following is the story behind the high NPA numbers of Yes Bank:

- Risky Lending Practices: Yes Bank aggressively expanded its loan book under its former CEO, Rana Kapoor. His focus was high-risk lending, including large exposures to stressed sectors like real estate, infrastructure, and NBFCs. The bank’s credit risk management practices were weak. It lead to substantial exposure to high-risk borrowers.

- Hidden Stress in the Loan Portfolio: Many of the bank’s large corporate borrowers were already under financial stress. Still, Yes Bank continued to lend to these entities. The Bank was restructured their loans to avoid classifying them as NPAs. This approach masked the true extent of asset quality issues until they became unmanageable.

- Regulatory Scrutiny: When RBI began a deeper investigation into Yes Bank’s books, it uncovered severe lapses in asset recognition and provisioning. The RBI found that the bank had under-reported NPAs and had inadequate provisioning against stressed assets. This lead to a forced reclassification of several accounts as NPAs.

- Credit Rating Downgrades: As the extent of Yes Bank’s bad loans became clearer, credit rating agencies downgraded the bank’s debt instruments. This not only affected the bank’s borrowing costs but also eroded investors and depositors confidence. This eventually lead to to a liquidity crunch.

- CEO Transition and Governance Issues: In early 2019, the RBI forced Rana Kapoor to step down as CEO. The transition in leadership further destabilized the bank.

- Depositor Panic and Withdrawals: As news of the bank’s troubles spread, depositors began withdrawing funds, exacerbating the liquidity crisis. This panic was compounded by the RBI’s imposition of a moratorium in March 2020. It included restrictions on withdrawals, causing further anxiety among depositors and investors.

- Massive Provisions and Losses: To address the bad loans and stabilize the balance sheet, Yes Bank had to recognize a significant portion of its stressed assets as NPAs, leading to a massive jump in GNPA and NNPA ratios. The bank made huge provisions to cover potential losses, which severely impacted its profitability.

The rapid deterioration in asset quality led to the need for a bailout. RBI implemented a reconstruction scheme to rescue the bank. A consortium led by State Bank of India (SBI) and other private banks infused capital to stabilize Yes Bank.

Positive Factors For Yes Bank As of Today

- Improved Governance: The bank has strengthened its board and management. Now it aligns with regulatory requirements and best practices.

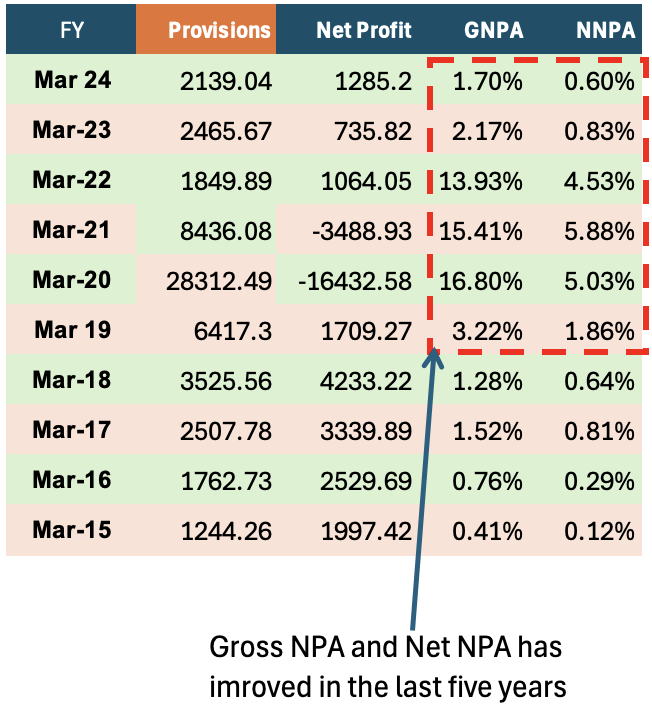

- Asset Quality: Yes Bank has made progress in reducing its stressed assets and improving provisioning coverage. As on Mar’20, its NNPA was 5% compares to Mar’24 of 0.6%.

- Liquidity: The bank has enhanced its liquidity profile, with a comfortable liquidity coverage ratio.

- Digital Transformation: Yes Bank has been investing in digital initiatives. This way it has enhanced the customer experience and operational efficiency.

- Government Support: Yes Bank received a bailout package from the government and the State Bank of India (SBI) in 2020 (probably the bank was too big to fail). It provided the bank its lifeline during a critical period.

Challenges and Concerns For Yes Bank As of Today

- Asset Quality Risks: Yes Bank still has a higher proportion of stressed assets compared to peers. It poses risks to its profitability going forward. As of today, NNPA of Axis Bank is 0.31% compared to 0.6% for Yes Bank.

- Competition: The Indian banking sector is highly competitive. We’ve established players and new entrants vying for market share.

- Regulatory Scrutiny: Yes Bank remains under regulatory watch. Any missteps could impact its reputation and stock performance further.

- Economic Uncertainty: India’s economic growth and banking sector performance are susceptible to global and domestic economic uncertainties. Like, what happened in USA in 2008 debt crisis also had serious effects on Indian banks.

Growth Prospects

- Retail Banking: Yes Bank has been focusing on expanding its retail banking franchise. Such an exposure offers higher margins and stability.

- Digital Banking: The bank’s digital initiatives can drive growth in transaction banking, payments, and other fee-based services.

- Corporate Banking: Yes Bank has a strong corporate banking franchise. It can benefit from India’s economic growth and infrastructure development. But exposure to corporates also have its own risks.

Valuation

Yes Bank’s current valuation multiples are:

- Price-to-Book (P/B) ratio: around 1.8

- Price-to-Earnings (P/E) ratio: around 52

| Banks | Price | MCap(Cr) | TTM PE | P/B |

| Yes Bank | 24.02 | 75,288.36 | 52.22 | 1.8 |

| HDFC Bank | 1,636.60 | 12,46,987.50 | 18.29 | 2.75 |

| ICICI Bank | 1,221.80 | 8,60,491.57 | 18.56 | 3.19 |

| Axis Bank | 1,171.40 | 3,62,189.73 | 13.55 | 2.32 |

| Kotak Mahindra | 1,798.00 | 3,57,463.98 | 16.62 | 2.75 |

The P/E multiples is relatively low compared to peers, indicating potential upside if the bank delivers on its growth plans and improves its fundamentals. But the P/E ratio is very high. Generally, P/E ratio of private bank stocks in India trades within the range of 16 and 20. The P/E of Yes Bank is too high indicating that the current price levels at Rs.24 may not be sustainable.

Return Expectations

Before the 2019 saga, Yes Bank’s Net NPA’s were at 0.2% and net profit (PAT) was at Rs.2,500 crore levels. I expect that, if the current positive trend continues, in next 3 years, the banks NPA and PAT could go back to these levels.

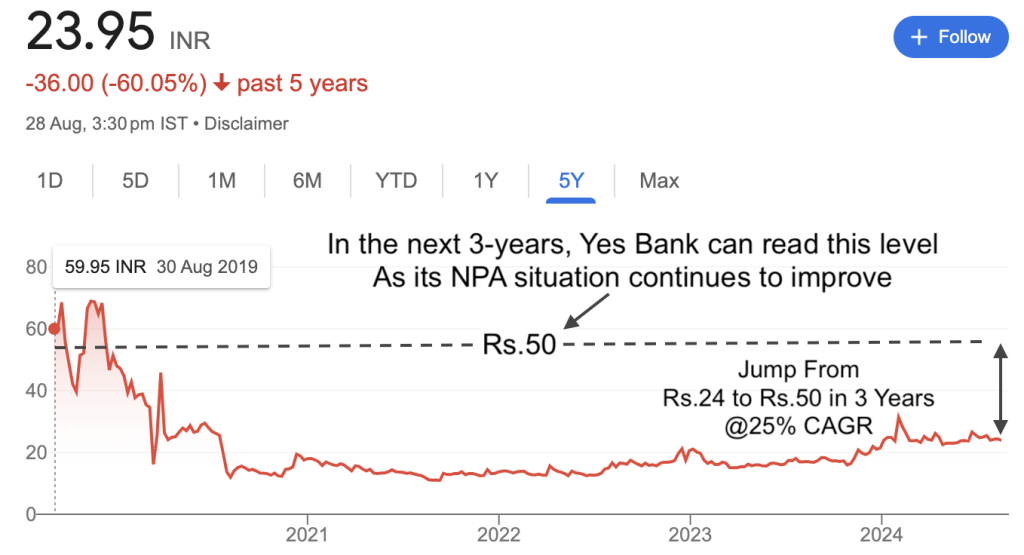

Considering the above factors, a 500% return in the next 3 years is very ambitious and challenging. 500% Absolute returns means the stock must grow by 6 times (reaching price levels of Rs.145 at 80% per annum CAGR). I think, in the next 3 years, Yes Bank shares will grow so fast.

My estimate is that, in the next 3 years, if Yes Bank can follow the below guidelines, it can reach the price band of Rs.45-50 per share. Even to reach this level it will have to grow at a rate of 25% CAGR.

Concerns Which Will Continue To Drag Valuation

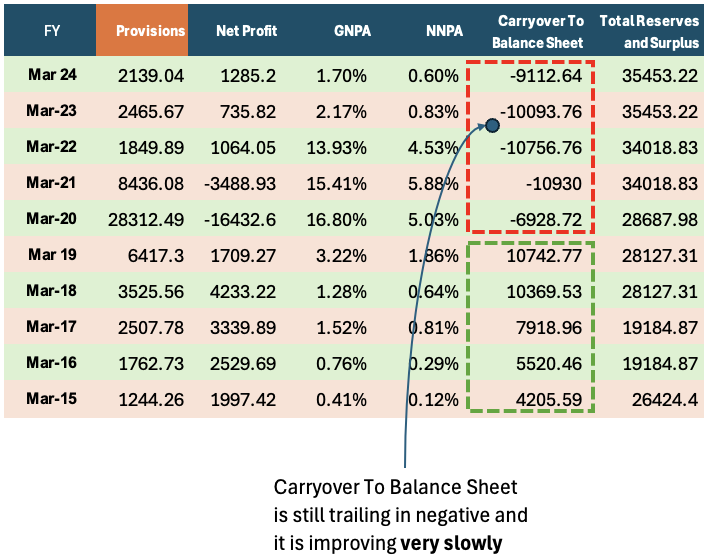

Net profit and NPAs are improving. But what is not improving is the line item called “carryover to balance sheet.” What is it?

It represents the accumulated profits or losses that are transferred from the Profit and Loss (P&L) statement to the balance sheet. When this carryover is negative, it indicates that the company has accumulated losses over time. A negative “Balance Carried Over to Balance Sheet” weakens the bank’s financial foundation. It also constrains its ability to grow, and may necessitate further capital infusions or restructuring efforts to restore stability.

This is the main thing that will limit the steep rise of Yes Bank’s share price in times to come (next 3 years). Even though its Net Profits and NPAs have now appreciated considerably, this negative metric can limit its surge.

PE Ratio

Another concern that Yes Bank shares may not breach the Rs.50 mark in next 3 years is that, at Rs.24 levels (today), its PE is already at PE-50 levels. Bank stocks do no trade at such high PE multiples.

To achieve this return, Yes Bank would need to:

- Sustainably improve its asset quality, with a significant reduction in stressed assets.

- Demonstrate strong revenue growth, driven by retail and digital banking expansion.

- Enhance its profitability, with improved margins and cost efficiency.

- Maintain a stable liquidity profile and robust governance practices.

If Yes Bank delivers on these aspects, its stock price could potentially double in the next 3 years.

But to reach that levels, it will need re-ratings of its valuation multiples and earnings growth.

Conclusion

While Yes Bank has made significant progress in addressing its challenges and stabilizing its operations, a 500% return in the next 3 years is highly ambitious and unlikely.

The bank still faces risks related to asset quality, competition, regulatory scrutiny, and economic uncertainty. However, with a renewed focus on prudence, sustainability, and growth, Yes Bank has the potential to deliver a more modest yet respectable return.

Achieving a price target of Rs.45-50 per share in the next 3 years, representing a 25% CAGR, is a more realistic expectation.

This would require the bank to sustainably improve its asset quality, drive strong revenue growth, enhance profitability, and maintain stable liquidity and governance practices.

If Yes Bank delivers on these aspects, it could potentially double its stock price in the next 3 years, making it a worthwhile investment opportunity for those with a medium-term perspective.

Have a happy investing.

Suggested Reading: