The formula which is used to calculate dividend yield is simple. Dividend yield equals dividend per share divided by price. But what makes the dividend yield formula interesting is the “price” placed in the denominator. How?

What we generally consider ‘price’ is actually “current market price” of stock, right? But pro stock investors generally consider ‘purchased price” in calculation of dividend yield. What is the difference?

Though it might sound very simple, but for investors it makes a lot of difference. Even for common people like me, purchased price is the most interesting aspect of dividend focused investing. How?

Let’s read more…

Dividend yield formula

Dividend Yield = (Dividend per Share) / Price

- When to use current price: Suppose you are an investor who wants to buy a new stock. Before buying, you would like to know its dividend yield – just to understand its price valuation. In this case your must use the “current market price”.

- When to use purchased price: Suppose you are an investor who already has few stocks in his portfolio. If you want to know the dividend yield of your holding stock, you must use the “purchased price” (and not current price).

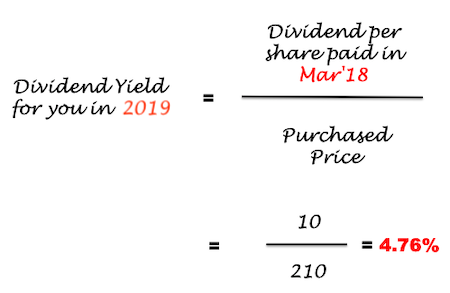

Let me explain this with an example. Suppose Tata Steel in that stock which is already in your portfolio. You bough stocks of Tata Steel on Feb’2016 at Rs.210 per share.

On Mar’18 you wanted to recheck the dividend yield of this stock. You got Rs.10 per share credited into your bank account as dividend of Tata Steel. How you will do it?

| Year | Year 2016 | Year 2019 |

| Purchase Price | Rs.210 / Share | Rs.210 / Share |

| Dividend Per Share | Rs.8 / Share (Mar’16) | Rs.10 / Share (Mar’18) |

| Dividend Yield | 3.80% | 4.76% |

What is the takeaway from this calculation?

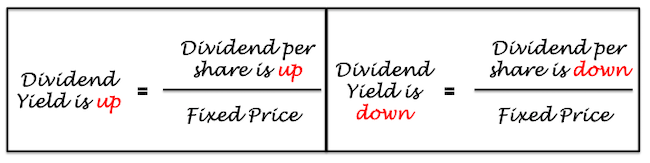

Dividend yield of a stock and its price has a negative correlation. How? When market price will go up, dividend yield will fall and vice versa.

But this negative correlation is valid only till one has purchased the stock. Once the stock is purchased, the price factor in the denominator of dividend yield formula becomes constant.

After this, the dividend yield is totally dependent on dividend per share paid by the company to its shareholders.

Dividend yield when price is falling

This is again a very interesting case. Let’s try to understand this with a real life example of Tata Steel.

Suppose you bought stock of Tata Steel in Jan’18 when its market price was at Rs.730 per share.

On Mar’18 this company paid dividends at Rs.10 per share. It means its dividend yield for you in Mar’18 was 1.36% (10/730).

But post Mar’18, the stock price started falling. Today in Mar’19 its market price is down to Rs.514 per share.

If Tata Steel again pays a dividend of Rs.10 per share in Mar’19, its current yield will be different than yours. Let’s see how much…

| Description | Dividend Yield for You | Current Yield Situation |

| Purchase Price | Rs.730 / Share (Jan’18) | Rs.514 / Share (Mar’19) |

| Dividend Per Share | Rs.10 / Share (Mar’18) | Rs.10 / Share (Mar’19) |

| Dividend Yield | 1.36% | 1.95% |

What does it mean? It means, current investors will make a dividend yield of 1.95%, but for you the yield will remain at 1.36%.

How to see dividend yield as a pro?

We all see dividend yield almost in same light. But pro investors take yield’s understanding to more depths. How?

Suppose there is an investor who wants to buy stocks of Tata Steel at Mar’19 price levels. What will be his yield? It will be 1.95% (10 / 514).

- Dividend paid: Rs.10 per share (say).

- Current Price: Rs.514 per share.

Till this point, the investor is seeing the dividend yield no different than us. But he takes his thinking a bit further. He is saying to himself this…

“…if I buy this stock at Rs.514 levels, my yield will be at least 1.95% in times to come…”.

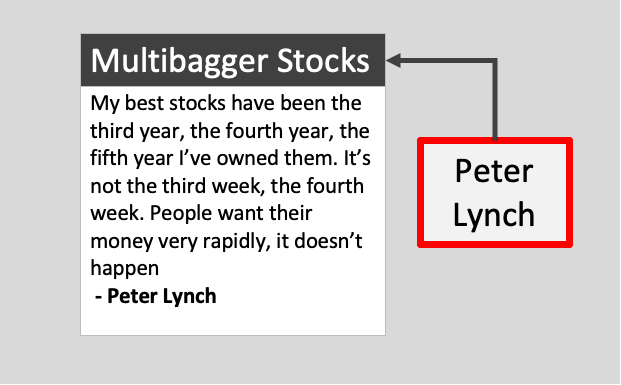

What is the logic? Good companies keep their existing shareholders interested by paying more dividends in years to comes.

Hence a quality company like Tata Steel will give more dividends and keep their shareholders glued to their stocks.

How pro-investors are thinking at this point? They are thinking…

“no matter what happens to the share market, if the stock is bought at Rs.514 levels, it will continue to yield 1.96% dividend till eternity”.

Consider this, had the same investor bought Tata Steel in Feb’2016 (at Rs.210 levels), no matter how bad is the stock market’s performance in future, he will continue to earn dividend at 4.76% yield forever.

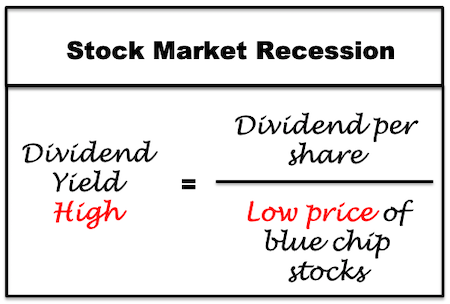

What is the right time to earn high dividend yield?

The best time to pick stocks trading at their best dividend yields is during recession.

This is the time when blue chip stocks (which pays consistent dividends) trade at low market price levels.

For investors who love dividend, they wait for stock market recessions. And when it comes they see nowhere else. They just buy blue chip stocks which pay regular dividends.

Let me give you an example. Which was the recent major recession in our stock market? Year 2008-09. At that time stocks of Tata Steel was trading at Rs.150 levels.

During those days the whole stock market fell (Sensex) from 16,000 to 9,000 levels (fall by -40%). Stocks like Tata Steel fell from Rs.800 to Rs.150 levels (-80%).

As an investor who bought stocks of Tata Steel in 2008-09 at Rs.150 levels, and held it till today, must be earning earn a dividend yield of at least 6.7% p.a..

In times to come, this dividend yield will only improve.

Added benefits of buying stocks at low price

- Stocks become your FD: Like fixed deposit can earn a fixed interest rate of say 7%, a blue chip stock at low price can yield similar level of returns as dividends.

- Price Appreciation: After recession, ‘dividend stocks’ tend see a faster price appreciation than other stocks. Hence in addition to high dividend yield, investors can also make windfall gains as capital appreciation.

High Dividend yield is not always reliable?

If you are getting too optimistic about buying stock which is yielding high dividends, allow me to dampen your spirits. Why? Because it is necessary…

All high dividend yielding stocks are not an “automatic buy“. Why? Because these may be those stocks which paid high dividend yesterday, and will pay only peanuts tomorrow.

There are examples where company fool investors in thinking that the company is profitable. How they do it? By paying high dividends. But in reality, there are internally rotting – going towards bankruptcy.

So what is important to remember is this…

“Buy high dividend yielding stocks of only fundamentally strong companies“

Such strong companies continue to pay more dividends per share with passage of time. This way the investor’s dividend yield keeps on increasing.

Conclusion

If you are interested in stock, you cannot miss to give importance to the dividend yield formula.

But the problem is, blue chip stocks which pay good dividends generally trade at high price points. Hence in normal times their dividend yield is very low.

So what you should do, wait for the recession? Most of the pro-investors do just that. Why to wait? Because major recession comes only once is a decade (sometimes even later).

Let me give you more data about the impact of recession on dividend yield.

Currently Sensex is at 38,000 levels. At this point Sensex portfolio is yielding dividend at 1.13%. let’s see how this yield changes when price falls:

| Fall | Sensex | Yield | Remark |

| N/A | 38,000 | 1.13% | Current |

| -10% | 34,200 | 1.25% | – |

| -20% | 30,400 | 1.40% | – |

| -30% | 26,600 | 1.60% | – |

| -40% | 22,800 | 1.88% | – |

| -50% | 19,000 | 2.26% | – |

Hence in times when stock market is bleeding, it is better to recall the dividend yield formula. What should be the objective? To figure out if this is the right time to buy a nice dividend paying stock.

Have a happy investing.

I am preparing to be an investor, looking forward to financial freedom. Just came across this winderful educative article. I have learned a great point today. Many thanks Mani.

Thank you

Interesting perspective.

Only issue is having to wait for the next recession 🙂

Ha ha…such value stocks do become undervalued even on non-recession days.

GREAT! ARTICLE ABOUT FORMULAS AND TOOLS IMPRESSIVE CONTENT AND IT’S SIMPLE TO UNDERSTAND AND SWEET .