What is the intrinsic value? It is the inherent value of an asset (business, enterprise, etc.). The essential nature of the asset gives it its intrinsic value. The value is not dependent on external circumstances. We can also understand intrinsic value as a true value of an asset.

From an investment point of view, it is the price that an investor shall pay to buy an asset. Purchases made at this price level are more likely to generate profits in times to come.

The concept of intrinsic value comes from a theory called value investing. People who practice value investing are called value investors. These investors aim to buy assets (stocks, etc.) at a price below its intrinsic value. Such an Asset is called an undervalued asset.

Benjamin Graham is the inventor of value investing. He has written at length about it in his book called The Intelligent Investor. The concept of buying stocks below its intrinsic value was later made more popular by Graham’s student Warren Buffett.

See Video: Calculate Intrinsic Value

The need for Intrinsic Value

What you see above is a list of the top 5 Indian stocks in terms of their net profit (PAT). They are the highest profit-making companies. It is easy to screen and find such a list on the internet.

So, why not one can go ahead and buy one of these stocks at their current price?

Buying stocks of companies which has high sales, high net profit, or high dividend payout is not going to work. Not that these stocks are bad, but it is also essential to do a further check.

What needs to be checked? When the idea is long-term investing, people must buy assets (real estate property, stocks, etc.) at a price below its intrinsic value. So what also needs to be checked is the intrinsic value.

But intrinsic value number is not as readily available as the current price. People must learn the art of calculating it themselves. Why? Because that is what will make them stand out from the other herd-mentality investors.

What is an art in fair value calculation? The art lies in the way value investors screen good stocks from the plethora of average-stocks. The trick is to understand what are good stocks.

Which Stocks are Good?

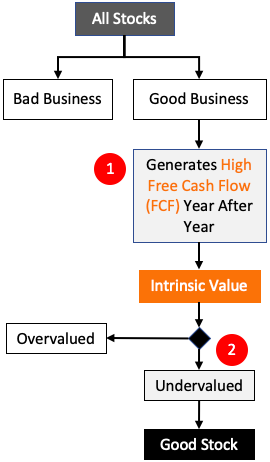

There is all kind of stocks in the market. The above representation is one of the most confirmative ways to analyze good stocks. There are two layers of this analysis: (1) identification of good business, and (2) establishing if the stock is undervalued or overvalued.

- Good business: There can be many alternative ways in which investors can establish the quality of a business. For value investors, the ability of the company to generate high future free cash flows (FCF) is the best guide. Read: About free cash flow estimation.

- Undervalued Price: The idea behind the estimation of future free cash flows is to use it to calculate intrinsic value. If the intrinsic value of a stock is more than its current price, it is said to be undervalued.

A business that can generate high free cash flow becomes a good business. If stocks of such a business are available at undervalued price levels, it becomes a good stock. Check this online free cash flow calculator.

So what is the takeaway from here? Look for stocks that can generate high free cash flow (FCF).

How to calculate intrinsic value?

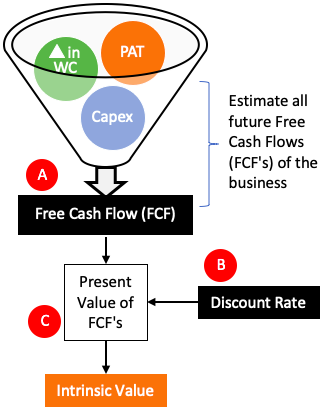

Before we get into the math part of intrinsic value, let’s know about the ingredients required to estimate the intrinsic value. The calculation can be done in three steps:

#A. Free Cash Flow Calculation

Free Cash Flow (FCF) must be positive for a stock. If not, then its intrinsic value will also go in negative. How to calculate FCF? The free cash flow formula is like this:

- PAT: Open the cash flow report. Note the first line in the report. It will be indicated as Net Profit or Net Profit After Tax (PAT).

- Net CAPEX: Net Capex is Capex minus Depreciation and Amortization (D&A). Capex Value you will get from Cash Flow Report. D&A numbers will be in the P&L account.

- Increase in Working Capital (WC): We’ve to calculate working capital increase YOY. How to do it? Calculate WC for Mar’20 and Mar’19. An increase in WC will be equal to WC(mar’20) minus WC(mar’19). What is WC? WC = Current Asset – Current Liability.

- New Debt: Only long term (LT) debt is considered. Check LT Debt for Mar’20 & Mar’19. New Debt = Debt(mar’20) – Debt (mar’19).

Gather these values in your excel sheet and calculate the free cash flow (FCF) as indicated below. Note the ‘Formula‘ column. This way, one can arrive at ‘free cash flow‘ numbers for a stock.

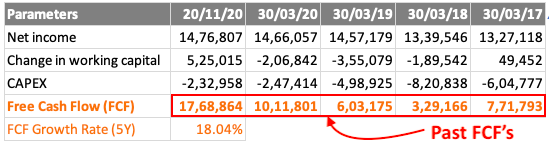

FCF Growth Rate & Future FCF’s

In the above step, we have estimated the FCF of a stock from its past year. Now we must estimate the expected rate at which the above FCF will grow in the future.

There are two ways to do it, easy way and the difficult way.

- The easy way: Assume it to be 8%. In India, the average inflation over the last 10-Yr is close to 7.5% per annum. Over some time, a good company will make sure that its Free Cash Flow (FCF) growth must beat the inflation rate.

- Difficult way: Calculate the FCF for the last 5-Yr. See the trend and then make a safe assumption of the growth rate for the future. Check this video for specific instructions.

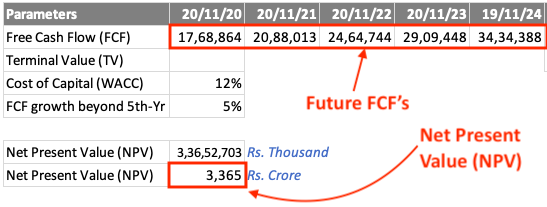

Now we have two numbers in our hands: (1) current year FCF, and (2) FCF growth rate in last five years. We can use these two numbers to extrapolate FCF numbers for the next five years.

But why stop at five years? A good company will not stop its operations after five years! So what to do? We have to calculate the terminal value. The terminal value is nothing but all FCF’s of the company starting from the sixth year till its existence. Though it is a wild guess, it works.

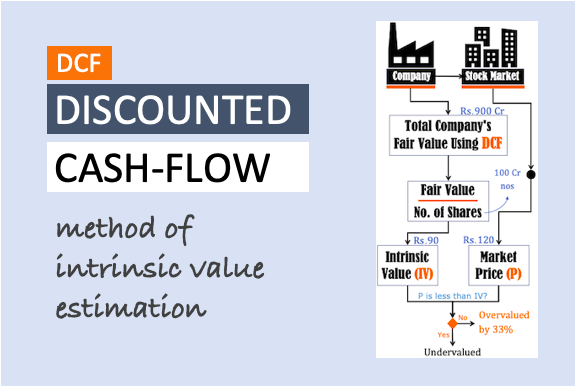

Suggested Reading: DCF Method of Intrinsic Value Calculation.

This way, what we have are all future cash flows that a company can generate in its lifetime.

#B Discount Rate

Estimation of Discount Rate is perhaps the second most tricky part in overall intrinsic value calculation. First, was future cash flow estimation. The second is the discount rate estimation.

I’ve written a separate blog post on the topic of the discount rate. It will tell the readers how to pick a near accurate discount rate number.

We can estimate the discount rate from two perspectives. One is from the eye of an investor. The second is from a businessman’s perspective. In the former, the discount rate will be one’s expected rate of return. In the latter case, the Weighted Average Cost of Capital (WACC) will be the discounting rate.

Please go ahead and check my article on the discount rate. It also has a video that will walk you through the various steps required for a near-accurate discount rate estimation.

#C. Calculation Present value

In step #A, we have calculated all future cash flows of the business. In step #B, we have assumed a suitable discount rate. Using these two metrics we can calculate the present value (PV) of future cash flows.

The sum of present values of all future cash flows is what we call intrinsic value.

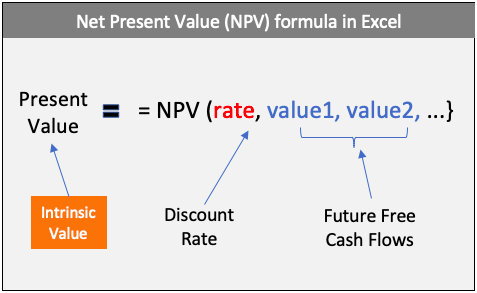

The formula to calculate the present value is easy. Use the NPV (Net Present Value) Formula of Excel to get the job done easily. The NPV formula in Excel looks like this:

Conclusion

There are 5,000+ stocks currently trading in the Indian stock market (BSE). Out of these, only a handful are worth investing in at a moment in time. Why? Because either most of them have a weak business or are overvalued.

What is the solution? The solution lies in first estimating future free cash flows of the company and then calculating its intrinsic value.

If you think that intrinsic value estimation is too much of an effort for you, you can also check my stock analysis worksheet. It has been specifically coded to calculate the intrinsic value of good stocks.

I’d love to know what are your thoughts about this article. Please consider leaving your comments below.

Suggested Reading:

What a valuable blog !! Explanations are so nice and diagrams are cherry on top !

sir, Is your excel can be installed in mac book or not

Yes but must has MS OFFICE installed.

i purchased your work sheet v3 version. But how to check NPV in your sheet. It only shows intrisic value only. It doesn’t calculate future cash flow… Please advise me.

What is seen by users in the final report. Detailed calculations are protected.

Regarding your product share some detail this one time purchase? will it this sheets can be open on mobile phone too kindly confirm me by email.

Sandeep

Hi,

Thank you for this wonderful article! Recently I read a article that Warren Buffet now recommends investing in ETFs than stocks. What do you say on this?

ETF is a great product. Individual stock investing is a time taking work. Sometimes it takes months for investors like Warren Buffett to make an investment call. We common men neither have that patience nor the knowledge. Hence for us, ETF is the nearest alternative to individual stocks. But please please note that in the US, there are many more thematic ETFs that we have in India.