How equity investment during COVID-19 Pandemic can be planned? It is easy for expert investors. Why? Because they have a right mindset to handle money during such times. But for we common men, equity investing may not be as smooth.

Whenever there is global crisis (like 2008-09 debt crisis, Brexit, Dot-Com bubble etc), a class of people see this as an opportunity to invest money.

These are people who believe in value investing and follow the rules of Warren Buffett.

As Warren Buffett says “Be Fearful When Others Are Greedy, and Greedy When Others Are Fearful”.

This is a moment when majority across the globe is afraid of the consequences of COVID-19 pandemic. So, yes as per Buffet’s rule, this is an opportunity to be greedy and invest in equity.

Topics

How it is an opportunity?

Stock market is falling. In last few days, S&P BSE 500 Index has seen one of the steepest falls of its times. Hence, this is the time to take a plunge into the stock market, right?

But for a common man, is this a right precondition to start buying stocks or equity funds? No, why?

Because it is important to first prepare oneself before handling equity. We will talk about this later, but first let’s see a basic rule.

First rule is, “never enter the stock market unprepared”. Second rule is, “do everything to prepare yourself before entering the stock market”.

How to prepare oneself for a full-on stock market investing? By first strengthening ones personal financial health. How to do it?

Here are few personal finance tips to follow before venturing into equity. This is specially important in situations like COVID-19 pandemic.

Why it is essential? Because this preparation will work like a back-up. Stock market is volatile. Prices fall and then rise. But when prices fall, it might scare you. This preparation will work as your support during such times.

Planing for Equity Investment During COVID-19 Crisis

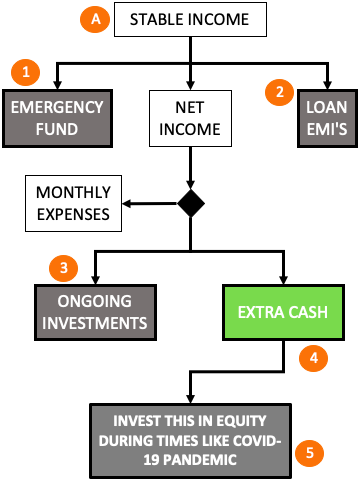

The above flow chart represents a plan to invest in equity for a common man. In times like COVID-19 crisis such planning builds a right mindset for investing. The steps of planning are shown below:

- #A. Stable Income: Income stability comes from doing a job in which one is free from the worries of job loss, income deflation etc. When income is stable, more portion of it can be used to invest in equity. Judging ones income stability is step one.

- #1. Emergency Fund: For people whose income is stable, they can have a smaller emergency fund. For people with varying income, a bigger fund must be built. Ensuring a sufficiently big emergency fund before investing in equity, specially in times like COVID-19 is a key.

- #2. Loan EMI’s: Debts like home loan, personal loan, credit card overdue etc demands regular payouts. A portion of income goes into paying the EMI’s. The bigger is the loan balance, less money is left for onward spending and investing. Before investing in equity, a provision must be made which takes care of all loan related payments on time.

- #3. Monthly Expenses: After taking care of emergency savings, loan EMI’s etc, what’s left is utilised for managing daily expenses of life. These expenses can be on foods, bills etc. Before investing, it is essential to confirm that monthly expenses are not compromised. Read: About consumer spending in India.

- #4. Ongoing Investments: In times like COVID-19 crisis it is essential to continue with ones ongoing investments like SIP’s in mutual funds, retirement fund contribution etc. Ensuring that funds are not diverted from ongoing investments, a dedicated provision must be made for them.

- #5. Extra Cash: This net-saving we can call as free or extra cash. We can afford to invest free cash in risky assets like equity. All steps shown above are taken to ensure that some free cash is generated. This free cash can then be used for investing in equity.

Now let’s see some of the above steps in more detail:

A. Stable Income

More assured is one about their monthly paycheques, more he/she will spend and invest.

Imagine yourself not being sure of your monthly income. This creates confusion and uncertainty in ones mind. In this uncertain mindset, people often spend less and invest even lesser.

In crisis moments like COVID-19, even people with fully secured job/income stops their spending and investments. So, in order to convince oneself to invest during crisis, one must at least have a stable income.

People having job security will find their income more stable. People doing business, are often aware of the minimum income their business will generate even in difficult times. This is their stable income.

Judging ones quantum of income-stability will allow you to divert a right quantity of money into equity. Try to give yourself a score in the scale of 1-100. The higher you’ll score, more you can invest.

Read: About monthly income generation from investment.

Read: How to achieve financial independence.

1. Emergency Fund

A common man should not try to enter the stock market, in times like COVID-19, without building emergency fund. Why? Because if things goes south, this fund will be the saviour.

Why things will go south? Simply because a common man, who is not trained to handle stocks, might take a wrong pick.

Example: In last 30 days, almost all stock have seen a beating. So, with this understanding people may end up buying prime stocks of FMCG space. This will be a mistake. Why? Because those prices still looks overvalued. Read about undervalued stocks.

Buying overvalued stocks may lead to losses. As a common man does not have a big appetite for loss, he/she may resort to emergency funds in case of loss, to sooth the nerves. For new investors, it is not a bad idea. This gives a psychological support to a newbie to try again next time (with more caution).

But to give oneself such a liberty, one must first build a sufficiently big emergency fund. How big should be the fund? It depends on how stable is ones income. But as a rule of thumb, 6 months worth of expenses should be enough. Read more on Emergency Fund Guide.

2. Loan EMI’s

Nothing can trouble a common man more than non-payment of monthly EMI’s of loans or outstanding credit card bills. So, before starting to invest in equity, it is essential to ensure that, even if investment do not go as planned, monthly payments on loans go as required.

How to ensure this? By investing only the available “extra cash” in equity. This is specially applicable in moments like COVID-19 pandemic. Everyone around seems to taking a hit at stocks. This is like a herd mentality. Better not to follow others.

But one also do not want to miss the opportunity. So how to proceed? By first making a provision for loan payments from ones income. Never diver this portion of money in stock market.

Read: How to become debt free in life.

3. Ongoing Investments

When stock market falls, people often start questioning their ongoing investments. If one is investing in an equity mutual fund through SIP, he/she might wonder whether to stop the SIP.

Why they will think like this? Because when they see their invested money down-in-value by -25% to -30%, they panic. To prevent further downside, a reflex reaction is to stop the SIP.

But this action is not justified. Why? There are two point of view related to this action:

- Stopping SIP: SIP will fetch best returns when units are bought in a falling market. Buy units when market is falling, and then hold. Hold till the market index is up again by 20%+. This is the time you can think of selling your units. But what happen if market does not bounce back? This has never happened. Historically, even the worst of recession has not lasted for more than 18-24 months at a stretch. In 2008-09, the market bounced back after 12-14 months. Read about how our economy and market moves in cycles.

- Unpreparedness: As an equity investor, one must always be prepared for a market crash. Why? Because this is inevitable – as market moves in cycles (Up, down and back-up). On one hand you see an opportunity to buy stocks during times like COVID-19, and on other hand you are stopping SIP’s. Is this not contradictory? So what is right? Let you old investments proceed as it is. Once you are sure that your existing investments are through, diver extra cash to new equity (new stocks or equity mutual funds).

4. Extra Cash

What is extra cash? This is the money left in the savings account, after managing all necessary savings, investments, expenses and loan payments.

In other words we can say, this is that money which if even lost will not hurt you so much. A common man should invest this extra cash in equity.

But what if the person finds our that there is no money left as extra cash? There is always free cash. But as we do not budget our expenses, we are not aware of it.

So in order to know about the quantum of your extra cash – learn to budget and track expense first. This is a vital step for getting prepared for equity investment, when market is crashing. This will certainly help to quantify how much free cash is available for investing in equity.

5. Invest in Equity

Some people might be desperately wanting to buy best stocks (as on Mar-Apr’20). But I think, if this is not a temporary correction, it is better not to hurry. This looks like a bear market which is going to continue. The world economy is inching towards a recession.

So if this is a recession, this period might stretch to at least next 8-10 months. The prices will continue to remain this volatile, with more pressure for down-side movements.

Apr’2020 is just the start of second month of this possible recession (triggered by COVID-19). This is going to extend further. So let’s not consume all our resources in the beginning itself.

If you do not want to play a waiting game, start a SIP in a good Value Focused Mutual Fund and sit tight. It can give you equally good returns. The only condition is, hold the units for next 2-3 years.

Read: (1) Mutual Fund Calculator. (2) About ETF’s.

Conclusion

We have talked about the available opportunity to practice equity investment during COVID-19 crisis. We can buy some good stocks at great price levels.

But I personally feel that the index has still not seen the bottom. The levels we saw on 23rd-Mar’20 was close to the bottow. But I think it will go below it.

Hence I’ve prepared a watchlist of my potential stocks. Based on my stock analysis and judgement, I’ve tracking my watchlist. The present price levels are already close to last 2 years lows. But we should be careful while committing to a stock. We are still not out of the COVID-19 woods.

COVID–19 like crisis has no precedence. I once heard in a news channel which said “this might me a Pearl Harbour moment for USA”. The same is true for the whole world. The present crisis might equal the worst of what this world has seen in last one century.

So be careful while buying any stocks or mutual funds. Track their prices, and buy them only when you think is undervalued. To make a fair judgement of price valuation, I use my stock analysis worksheet.

Have a happy investing. Be safe and stay at your home. Read about updates of on covid here.

Hi Mani,

Thank you so much for the topic you choose at this hard times.It really gives me a clarity what to do now.Highly Appreciated!

Thank you for reading and appreciating.

Hi Mani,You indeed make the subject so interesting,easily comprehensible…and therefore simple.Having accidently stumbled at”http://ourwealthinsights.com/investment-during-covid-19/…yesterday,I genuinely took interest in the article,read it twice,again and again,and was highly impressed.Wish to use your guiding principles henceforth,rather than reading articles on financial channels/magazines.Request and Hope for your permission.Warm Regards.Dr.Namdas.(retd.Sr.Citizen,doctor)

A demat account is like a locker where your shares are in electronic forms. It is essential for all those interested in investing/ trading in the stock markets to have a demat & trading account. On opening a demat & trading account with a stock broker, an individual can carry our investing and trading activities hassles-free. To know more, click here.

Hey Mani, thanks for the wonderful article. Really appreciate your efforts in making us understand personal finance as a seemingly simple topic. Looking forward to your next article.

Thanks for the awesome feedback.

One more request.

Please write a post on how to analyse/short list a Mutual Fund scheme from data provided on moneyconrol.com/Value Research. How to analyse the graphs?

Thanks again,

Mani I always look forward for your posts. The way you explain the things is really easily understandable to a novice like me.

Only request keep posting frequently.

Thanks & Regards,

Mani, I think investors should buy in such a manner that if nifty 50 came down to Rs 7000 in short term, they should be able to accumulate their stocks at that time also. If lockdown extended, some companies may get impacted very badly from this. However, at this point of time when coronavirus is spreading with a speed of 500+ new cases per day in nation, I think ending lockdown from whole country in next week will not be a good decision. What do you think Mani?

Thanks for your comment.