Savings + Investment Portfolio + Philosophy = Wealth Accumulation

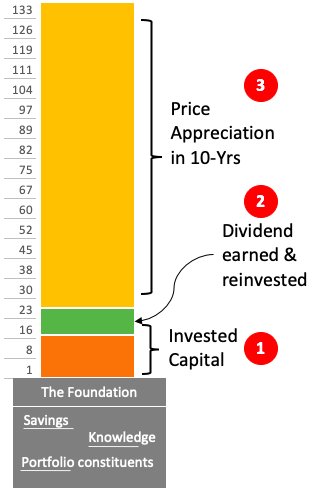

A high-rise building stands on a strong foundation. If wealth is like a high-rise building, then what is its foundation? There are three constituents: (a) savings, (b) investment portfolio, and (c) knowledge of the philosophy of wealth building.

It is a common belief that high income can make one wealthy. But to accumulate wealth, high income means nothing. If the income is not getting translated into savings, it is of no use.

We are aware of this term, investment portfolio. When we say it, what comes to mind first? Collection of stocks, mutual funds, gold, real estate, among others. The notion is right. But a portfolio must be build and handled in a certain way. Else, the goal cannot be reached.

A portfolio alone cannot make its owner wealthy. It must also follow a philosophy. Great investors, like Warren Buffett, are known for their investments. They are the brains behind their portfolios. They followed a philosophy and hence became really rich.

In this article, we will focus on the philosophy of converting savings into a portfolio that can make a person wealthy over time.

The Philosphy of Investment Portfolio Building

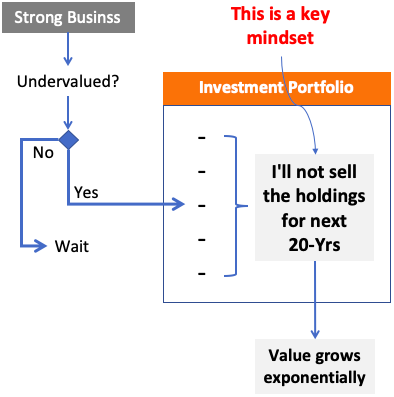

Do not spend money in the name of investing. Do it for building a strong investment portfolio. The constituents of the portfolio must be stocks of strong businesses bought at a undervalued prices. Generally speaking, add such stocks which can lay idle and grow for the next 20 years.

Nothing said in this investment philosophy is new, right? But the intent to hold on to the constituents for long terms, like 20 years, is what makes the difference. Yes, the philosophy is that simple.

Allow me to highlight the critical factors of the philosophy:

- #1 What to buy: Equity in the portfolio ensures fast long-term growth. While dealing with direct stocks, care must also be taken to buy stock of only fundamentaly strong business at a right price. When one is investing in equity through mutual funds, best is to buy units during price corrections. Read: Low NAV funds are undervalued?

- #2 When to sell: Equity bought in #1 above, shall be such that one never intends to sell them. Warren Buffett holds his stocks for decades together. It might sound like a cliche, but it’s a fact. Imagine yourself being the owner of Microsoft, when would you sell your stake. Never, right?

The point is, stock of good business can make us rich over time. The basic philosophy is to buy and hold. Now, what to buy is critical (see #1). Moreover, after what has been bought, when to sell (see #2).

Treating Portfolio As A “Business”

This is the way I see my investment portfolio.

I treat my portfolio as a company. While building it from a scratch, I used to imagine it as a start-up venture. Hence, I was prepared that in the initial days I might have to see some losses.

The focus was mainly on establishing the company. Buying the right land, building, machines, manpower, raw materials, sales, logistics, etc. Every stock I included in the portfolio was like a resource of the company. Extra care was taken to include new members. This way, over a period of time, majority inclusions rendered the desired results.

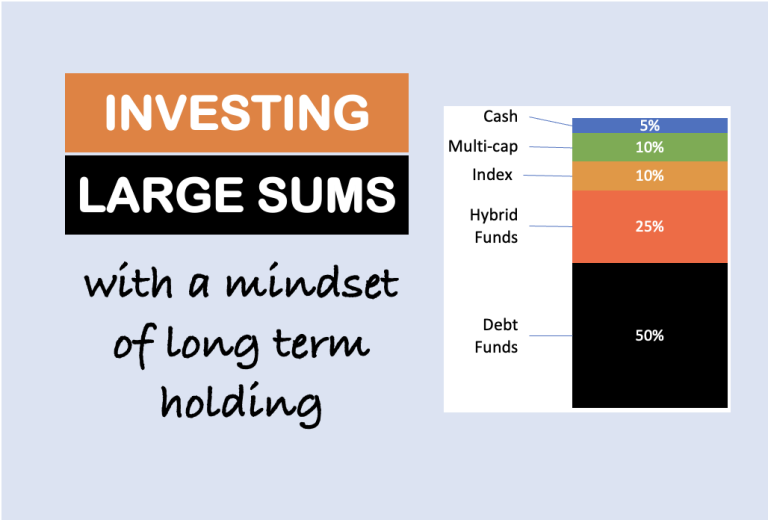

An Example Portfolio & Its Philosophy

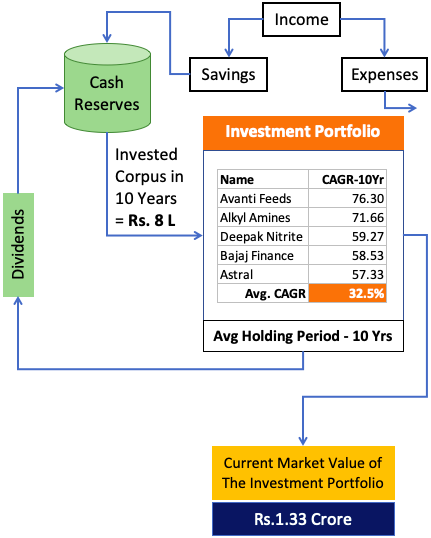

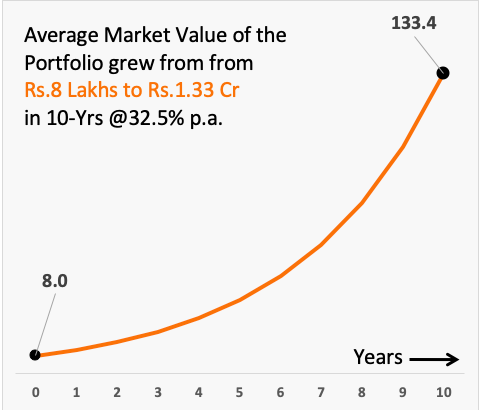

Let’s visualize a typical investment portfolio & its philosophy:

We must learn to divert our focus from “booking profits” (selling holdings) to portfolio building. The bigger will be the size of the portfolio, faster its corpus will compound over time. How to increase the size? There are three ways:

- #1. Add Stocks/Fund Units: Take example of the portfolio shown in the above. List of five stocks was identified. Eight lakh rupees was invested gradually over time in these stock. Idea was to pick more of these stocks everytime there was a dip in price. During the holding period, focus was on buying and not on selling.

- #2. Reinvesting Dividends: The stock holding of the portfolio was also earning cash dividends. The incoming cash are kept alongside the cash reserves built by savings (see flow chart). The combined cash reserve was used to buy more stocks whenever the opportunity struck.

- #3. Price Appreciation: The majority appreciation happens in the portfolio due to the mathematical phenomenon called compound interest. The better is the company selected, and more it is undervalued, faster and surer will be rate of compounding. Needless to say that, effect of #1 above, is felt here in long term.

Conclusion

To know more about the whole process of becoming rich, I’ll suggest you to read my another article. It provides a more holistic take on how to reach that goal.

In this article, the emphasis was more on the philosophy of portfolio building. It is necessary to include equity in our investment portfolio. Without equity, growth will not be as fast. Further more, a specific type of equity must be bought. Buying any stocks/mutual funds in the name of investing will not do.

If one is buying stocks, buying fundamentally strong stocks at undervalued price is necessary (read about value investing). If one is investing in equity through mutual funds, make sure to buy the units whenever the market is showing the signs of correction.

Have a happy investing.

How many stocks should be kept in a portfolio as your example…..more the better or fewer the better. If we diversify much can we get many stocks performing well and also we get regular dividend and other corporate action benefit. Having a few concentrated stocks which HAVE to perform is difficult. Please throw some light on this.

Thanks for insights, can we do a SIP in the fundamentally strong stocks as, they commend premium most of the time

yes.. its ever opener..as stocks that sold with profit of 30% are now multibagger..

useful

Yup

The prescription is so clear and fantastic.

Very easy to understand and become a successful investor.

I just loved reading it

Thanks