If you are a beginner who wants to start a mutual fund investment, you have landed on the right page. In this mutual fund guide, we will try to cover all basics related to investment in general and about mutual funds.

Who should read this article? This piece is for anyone who wants to start serious investing but does not know where to begin. This article can give the necessary outlook.

It is a comprehensive guide that aims to answer everything about mutual fund investment. In fact, it starts with answering the most basic question of all, why invest money at all?

The flow of topics is so arranged that it starts with simple concepts and ends with decluttering complicated topics related to mutual funds.

This is about 5,000 words article. I’m sure not many of you would like to read it all at once. Hence I’ll suggest you do it in two phases. First, read about the investment basics section. Second, read to know about mutual fund basics.

- Investment Basics.

- Mutual Fund Basics.

- Conclusion.

1. Why Invest Money?

This is perhaps one of the most basic question that must be answered about investment. Understanding this question will make the whole investment journey feel more rewarding.

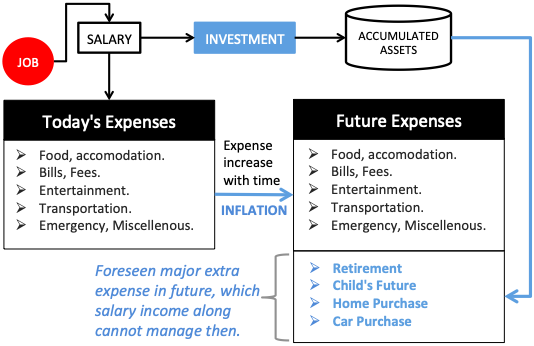

There are two main reasons why investment is necessary:

- Future Expense Management: There are few major expenses which will strike only in future. Example: retirement fund, child’s education, marriage, home financing etc. It is essential to start planning for these expense from today. Why? Because their values are very big. It will take time to build those funds. Saving money to build the fund is one alternative. But investment is a better choice. Why? It helps to reach the goal with less effort. Read: Goal based investing.

- Inflation: It causes items to become costlier with time. Suppose you need a retirement fund of Rs.50 Lakhs, if you retire today. But you are not retiring today. Say you’ll retire after 25 years. After 25 years, due to inflation (@5% p.a.), your cost of retirement will grow from Rs.50 lakhs to Rs.1.69 Crore. Investment will help to take care of the surge in cost due to inflation. Read: History of inflation.

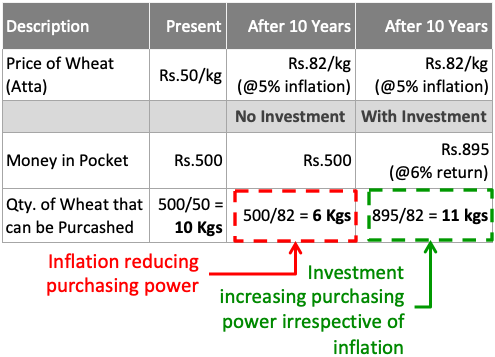

Examples: To understand the effect of inflation & investment.

- Effect of Inflation on Price: Suppose wheat (Atta) costs Rs.50/kg today. You have Rs.500 in your pocket. How much wheat you can buy? 500/50 = 10Kgs. Suppose in next 10 years, the average rate of inflation of Atta will be 5% p.a. At this rate, after 10 years same wheat will cost Rs.82/Kg. How must wheat you can buy with Rs.500 then? 500/81 = 6kgs. So you can see, same Rs.500 is able to buy 4kg less wheat after 10 years. Your purchasing power has reduced.

- Effect of Investment on Purchasing Power: Suppose you decided to invest Rs.500 in a bank deposit @6% interest rate. After 10 years, Rs.500 will grow to become Rs.895. Using these Rs.895, how much wheat (@Rs.82/kg)) you can buy after 10 years? 895/82 = 11Kg. So you can see, same Rs.500 when invested, is able to buy 11 kgs (1kg more) wheat. Your purchasing power has increased. How? Because of investment. Read: Investment basics for beginner.

1.1 A Different Perspective To Understand The Need of Investment

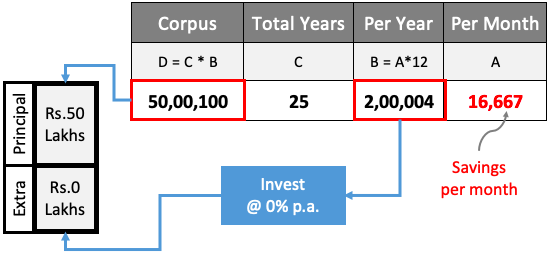

Investment can also “ease our load of wealth building”. To understand this, let’s take an example. We will reach the conclusion by seeing this example in 3 phases. Read: Create wealth from nothing.

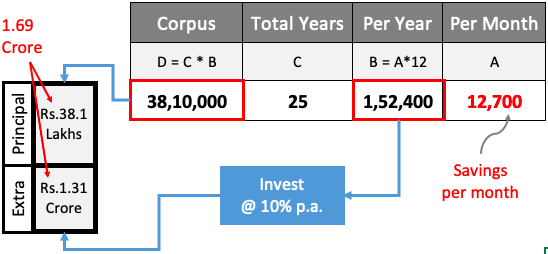

- Phase #1 (No Inflation, No Investment): Suppose you have calculated that, to retire, you must have at least Rs.50Lakhs in your savings. You have 25 more years to retire. So how you will build the corpus? You can save Rs.16,667/month for next 25 years, to accumulate Rs.50 Lakhs.

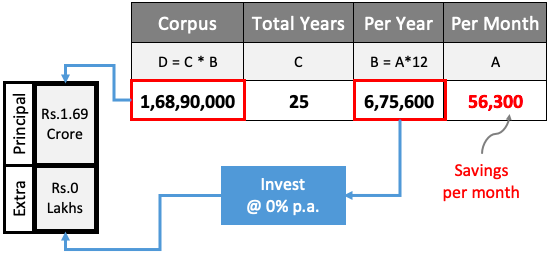

- Phase #2 (Inflation@5%, No Investment): Rs.50Lakhs is required for retirement. But due to inflation (@5% p.a.), after 25 years, Rs.50 lakh will become Rs.1.69 Crore. So how you will build the corpus? You can save Rs.56,300/month for next 25 years, to accumulate Rs.1.69 Crore

- Phase #3 (Inflation@5%, Investment@10%): Rs.1.69 Crore required for retirement in next 25 years. How you will build the corpus? By investing money in a mutual fund which yield a return of 10% p.a.. This way, by investing Rs.12,700/month for next 25 years, will accumulate Rs.1.69 Crore

What we can conclude from this example?

Building a retirement corpus of Rs.50 lakhs in 25 years was anyways difficult. How? Savings Rs.16.667 per month is not easy, right?

But this task was made almost impossible, by inflation. The size of retirement corpus got inflated to Rs.1.69 Crore. Why impossible? Because it was asking for saving in tune of Rs.56,300 per month.

Then came investment for the rescue. It was not only able to build the inflated corpus of Rs.1.69 Crore, but in lesser monthly contribution of Rs.12,700 per month.

This explains why, investment makes the activity of wealth building “easier”.

2. Investment Style

There is no “unique” way of investing money. It can be practised in a variety of ways.

Everyone should have their own unique investment style. You should invest in a way that suits you.

Over a period of time I’ve realised that, I can deal with not more than 50% exposure to “equity”. But this does not mean that I like parking my money as “cash” in savings account.

So this is my way. What about you? Get a hint from here. I’ll categorise all people (who likes to invest), into four categories (based on investment styles):

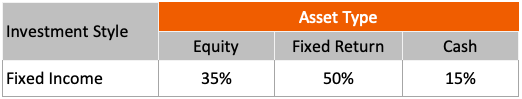

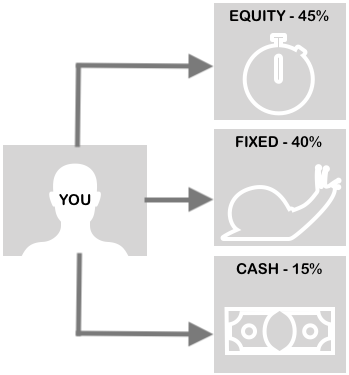

- #2.1 Fixed Income: These are people who invest their money to generate regular income. These investors are not lured by high returns or fancy biases. Their main focus is “income”. Any investment that generated regular income for them, they will go for it. So, where such types of investors should invest money? Their asset allocation should be Equity (35%), Fixed Return (50%), and Cash (15%).

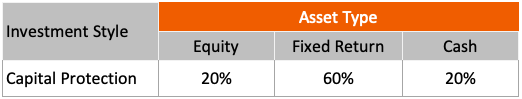

- #2.2 Capital Protection: These are people who invest money to protect it from the wrath of inflation. They are ok if their investment can just beat inflation. Their main focus is, their money value should not erode with time. So, where such types of investors should invest money? Their asset allocation should be Equity (20%), Fixed Return (60%), and Cash (20%).

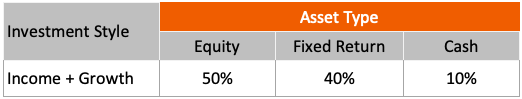

- #2.3 Income + Growth: These are people who want to enjoy the best of both worlds. They want to earn a regular income, and also want to enjoy the benefit of “growth” (beating inflation). Most people in this world fall into this category. So, where such types of investors should invest money? Their asset allocation should be Equity (50%), Fixed Return (40%), and Cash (10%). Read Foolproof investing.

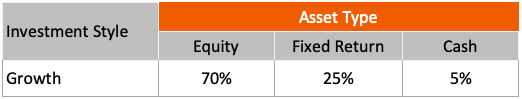

- #2.4 Growth: These are people who are ready to deal with the short-term volatility of their invested money. They want to invest money to beat inflation. If the assumed inflation rate in India, for the next 5 years is 7% p.a. (say), then these people would like to earn a return higher than 7%. So, where such types of investors should invest money? Their asset allocation should be Equity (20%), Fixed Return (60%), and Cash (20%).

Knowledge of these investment styles can help a person in two ways:

- Profile Yourself: It help you realise which type of investor profile suits you the most. The idea is not to categorise yourself into any of the four types. Target should be to establish which combination of equity, fixed return investments, and cash – suits you the most. You can also add real estate and gold to the above three asset types. Read: Thought process of investing.

- Which Mutual Fund: The variety of mutual funds available in the market is huge. Generally we only talk about equity and fixed income funds. But when it comes to type of funds, based on their asset allocation, the list is endless. Hence, based on your “profile”, you can then select a suitable mutual fund for yourself. Moreover, experts also advice people to follow different investment styles for different goals.

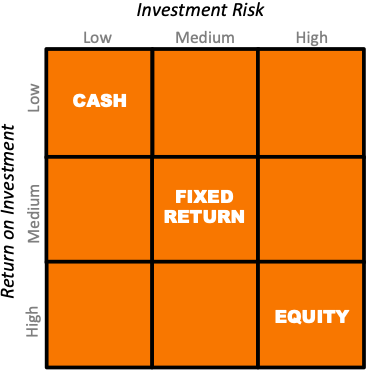

3. Risk Return Balance

Beginners might wonder that what is the difference between equity, fixed return investments, and cash. Each of these three components has their own benefits and drawbacks.

We can understand them more clearly if we see it through the “prism” of Risk and Return.

- Cash: It is an asset class which is most liquid. The ease with which it can be used to buy things is maximum. Here the term “cash” is used for money parked in savings accounts, liquid mutual funds, money market funds etc. Assets which provides most liquidity, yields lowest risk and low returns. Cash is the safest investment vehicle. So, if you want to invest, but cannot compromise on liquidity, and do not want to take risk at all, then you must go for investing in “cash”. Read: Risk free high returns.

- Fixed Return: This asset class has medium liquidity. Unlike cash, fixed return investment needs time to grow. If redeemed to soon, there is a penalty (fee). So the investor must agree to compromise a bit on liquidity. Though fixed return investment are fairly safe (predictable returns), but they are not as safe as cash. Hence, yield of fixed return instruments are more than that of cash.

- Equity: While investing in equity, one must agree to stay invested for long term. If you want to buy and sell equity in short term, possibility of loss is very high. In this way, equity based investments are not liquid at all. Though it must also be mentioned that, there are no external restriction or penalties imposed for early redemption. So if you want to sell tomorrow, you can do it. But if you an investor who is ready to stay invested for long term, ignoring the short term volatility (risk of loss), equity can give maximum returns.

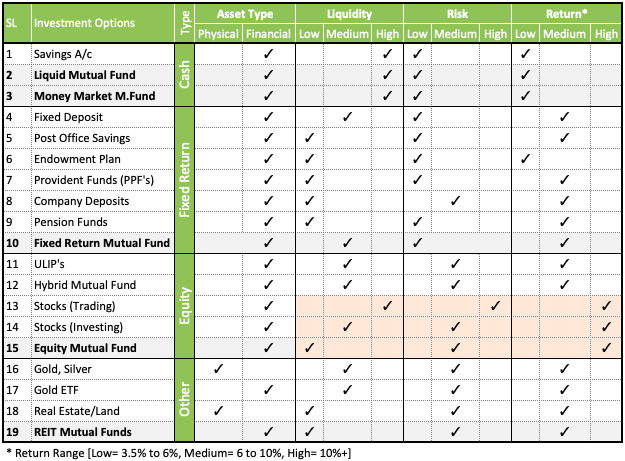

4. Investment Options Available

Understanding the relationship between an assets liquidity, risk, and return balance is important. Why? Because it gives a very clear picture of what one can expect from an investment.

Example: (a) We cannot expect high returns from a highly liquid asset. (b) To earn even moderate returns, we must at least compromise on liquidity. (c) High risk investments will yield high returns. (d) A combination of low liquidity & high risk will yield high returns.

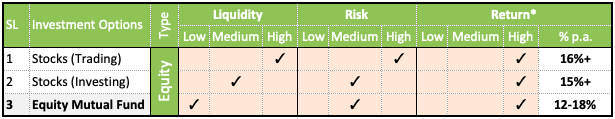

Here is a table prepared for nineteen (19) investment vehicle. The matrix prepared will give you an idea of their liquidity, risk, and return balance.

5. Equity And High Returns

In the above matrix, you can see that equity has potential to generate high returns.

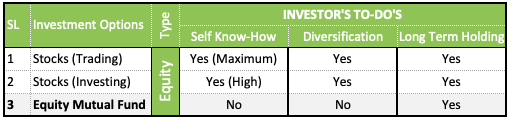

Generally, common men has three ways of investing in equity: (a) stock trading, (b) stock investing, and (c) through equity based mutual funds.

Out of these three investment options, equity mutual funds offers the least risk to its investors. How? Let’s understand this…

In equity investing, there are only three ways to deal with the risk of loss:

- Investors Knowledge: Your own know-how of the asset you are buying is key. If you are trading in stocks, knowledge of technical analysis if paramount. When you are investing in stocks, knowledge of business fundamentals and price valuation of stocks is critical. If you are investing in stocks through mutual funds, self knowledge required is minimal. Just pick and high rated mutual fund, and you are through.

- Diversification: This is an investment strategy which ask investors to spread their money in not one, but in “many” stocks. If price of few stocks falls, their loss will be compensated by rise in price of other stocks. When you are dealing with stocks directly (trading or investing), you have to take care of portfolio diversification yourself. But in mutual funds, diversification is not your worry. Mutual fund manager will take care of this priority.

- Long Term Holding: In short term, price of stocks or mutual funds remain volatile. Volatility is maximum in stock trading. Hence it offers maximum risk. But there is a way to deal with this price volatility. How? By buying equity and holding it for long term (say at least next 5+ years). Buying equity for long term holding is called investing. Both in case of stocks and mutual funds, long term holding is essential.

So, what does this mean? It means that, for a common man, equity mutual funds are best. Just buy a good equity mutual fund, and simply hold it for long term. High returns will automatically follow. You need not worry about anything else.

Till now we have seen that investment is necessary, and mutual fund is a good investment vehicle for common men. Why? Because it can offer high returns with minimum risk. Let’s know more about basics of mutual fund investment.

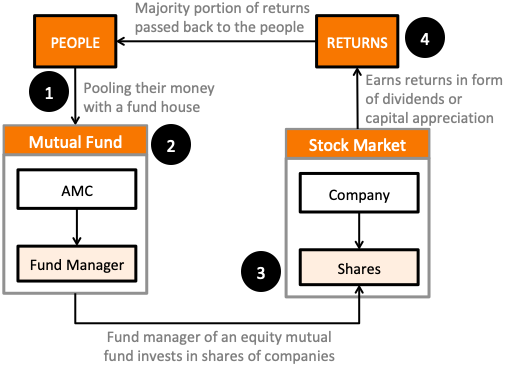

6. What are mutual funds?

Mutual fund is a “common pool” of money collected from “large number of investors” for investing in different type of securities.

When the pooled money is predominantly invested in equity (security type), it is called an equity mutual fund.

When the money is predominantly invested in cash or risk free options, it is called liquid or fixed return mutual funds respectively.

Who should invest in mutual funds? People whose objective is high future capital appreciation while ensuring enough liquidity, should consider investing in mutual funds.

7. Advantage of Mutual Fund

Here are the nine benefits of investing in mutual funds:

- Expert Services: A common man cannot individually afford services of an expert portfolio manager. But several investors can pool their money and pay for such a service. These managers refrain us from the responsibility of taking tough investment decisions. These decisions can be like: security research, diversification, buy time, redemption etc.

- Liquidity of Investment: Investors can sell their units anytime they want. This gives full redemption flexibility to the investors. In this way the investment remains fully liquid. [But it must also be remembered that in short term equity redemption is very risky].

- Benefit of Diversification: Best diversification is provided by hybrid mutual funds. Why? Because they invest in multiple asset class like debt, equity, money market, bonds etc. Even when the portfolio is loaded in equity, a combination of several stocks, averages out the probability of big losses.

- Low Cost: Mutual funds generally trade in bulk quantities. This substantially reduces their cost of transaction. Buying 100,000 shares is cheaper than buying 10 shares of a company. Moreover, the cost of running a mutual fund house gets evenly distributed among millions of investors. Hence, mutual funds becomes very cost effective for each investor. As an investor, one can choose those funds which has minimum expense ratio.

- Small or Lump-Sum Investing: Whether you want to invest Rs.500 to Rs.500,000 in one go, mutual fund can support all. From investors point of view, there is no discrimination between a large and small investors. Read: About investing ten lakhs.

- High Returns: As mutual fund investments are managed by experts, hence future return potential is high. Moreover, the cost benefit advantage, and diversification benefits – minimises the downside risk as well.

- Income Tax Benefit: One can invest in tax saver mutual funds (close ended and ELSS funds) and can claim a max tax deduction of 1.5 lakhs (80C). Long term returns (LTCG) generated from open ended funds are also tax free till Rs.1.0 Lakhs.

- Secure from Scams: Mutual funds operate under strict regulations set by SEBI. Hence the probability of scams and frauds happening in mutual fund business is remote. A common man can invest in mutual funds without worry.

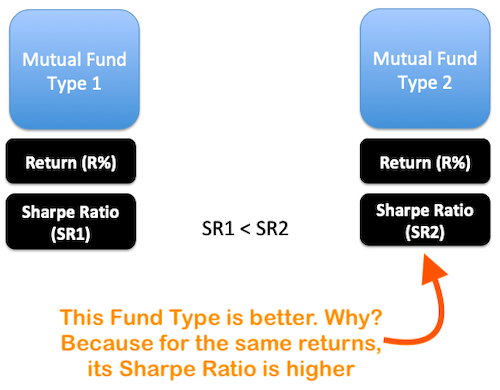

8. Sharpe Ratio

Why I am abruptly bringing the topic of “Sharpe Ratio” here? It is not abrupt. In fact the concept of Sharpe Ratio fits perfectly here.

Sharpe Ratio is a measure of return generated by a mutual fund, per unit risk taken. The higher is the Sharpe Ratio, the better. Read more about it here.

What does it mean? Two considerations first: (1) The higher the returns, the better, right? Yes. (b) The lower the risk, the better, right? Yes. Read: About total return index (TRI).

Suppose there is an index fund (X) which is generating returns of R%. But to generate this high returns it is taking unprecedentedly high risks (Sd1). Such a mutual fund will have a lower Sharpe Ratio.

Sharpe Ratio = Return (R%) / High Risk (Sd1) = Low Sharpe Ratio.

Similarly, there is another index fund (Y) which is generating same returns as X (R%). But to generate this high returns it is taking lower risks (Sd2) [Sd2 is less than Sd1]. Such a mutual fund will have a higher Sharpe Ratio.

Sharpe Ratio = Return (R%) / Lower Risk (Sd2) = Higher Sharpe Ratio.

What we can conclude about X & Y? Both of them are same type of mutual funds, but as Y’s sharpe ratio is more than X’s, then Y will be a better pick.

For the same level of returns, the mutual fund type which has higher Sharpe Ratio is better. One cannot compare Sharpe Ratio of Equity based funds with Debt based funds.

Example: Sharpe Ratio of Debt Based Funds

| Sharpe Ratio | 1Y | 3Y | 5Y | 10Y |

| Money Market Funds | 7.95 | 5.82 | 5.27 | 3.92 |

| Liquid Funds | 10.81 | 7.14 | 6.12 | 4.80 |

| GILT Funds | 0.66 | 0.73 | 0.87 | 0.24 |

| Credit Risk Funds | 0.89 | 1.65 | 1.89 | 1.12 |

| Floating Rate Fund | 2.82 | 2.87 | 2.83 | 2.54 |

| FMP – Ultrashort Term Bond | 8.24 | 5.48 | 5.48 | 4.08 |

| FMP – Short Term Bond | 3.29 | 3.19 | 3.45 | 2.50 |

| FMP – Intermediate Term Bond | 2.27 | 2.13 | 2.56 | – |

Note: Liquid Funds have yielding best Sharpe Ratio in 1Y, 3Y, 5Y & 10Y time horizons. It must also be noted that Sharpe Ratio of debt funds are high compared to equity based funds. But does this make debt funds more likeable. Yes and No. Yes, because higher sharpe ratio means higher returns per unit risk taken. No, because even though sharpe ratio of debt funds are high, but these funds can never beat inflation (like equity) in long term.

9. Types of Mutual Funds

Here are the few common type of mutual funds and their risk return relationship.

Cash & Fixed Return Funds (Debt Based Funds)

Debt based fund’s have a portfolio loaded with debt instruments. Debt based funds can be further divided into two types: (1) CASH FUNDS (Short Term Debt). (2) FIXED RETURN FUNDS (Long Term Debt).

Debt based funds are safe than equity funds. Their returns are assured. But on down side, their returns are low (below inflation). Returns of few debt funds are as below:

| Returns % | 1Y | 3Y | 5Y | 10Y |

| Money Market Funds | 7.05 | 7.20 | 7.79 | 7.55 |

| Liquid Funds | 6.89 | 6.87 | 7.53 | 7.46 |

| GILT Funds | 6.28 | 8.08 | 9.57 | 6.06 |

| Credit Risk Funds | 5.53 | 7.75 | 8.68 | 7.57 |

| Floating Rate Fund | 6.93 | 7.51 | 8.00 | 7.58 |

CASH FUNDS

- LIQUID FUNDS: They also invest in money market instruments like T-Bills, Repos, Certificate of Deposits, commercial papers etc. In portfolio composition, they are same as money market funds. But the objective of liquid fund is to emulate the bank’s savings a/c. For us, liquid funds is an alternative of savings a/c. These funds can also offer services like Debit Cards etc. Read: Alternative to saving account.

- MONEY MARKET FUND: It is suitable for investors whose holding time is one year or less. The savings parked here is as safe as fixed deposits. How? Because these funds invests primarily in T-Bills, Repos, Certificate of Deposits, commercial papers etc. The income earned by these fund’s portfolio is mainly in the form of “interest”.

FIXED RETURN FUNDS

- GILT FUNDS: In terms of quality of portfolio, GILT funds are best. Why? Because the credit rating of a GILT fund portfolio is all AAA and above. How? Because they only invest in high quality government bonds. What does it mean for the investors. Almost negligible chance of default even in long term. It provides risk free capital protection even in long term. Their returns are not like equity, but are more safer.

- FLOATING RATE FUNDS: This fund is not for everybody. Why? It invests in those debt instruments which has floating interest rates (like bank loans, bonds etc). So, when interest rate falls, interest paid by these funds also falls and vice versa. They give better returns only in rising interest rate regime. Read: Earn high interest in FD.

- FMP’s: Fixed Maturity Plans closely resemble fixed deposits. But they are not the same – their returns are not fixed. Pros: Over a period of time they can give returns like FD’s. But net of tax returns of FMPs will be better. How? Because they provide indexation benefits. Cons: Their NAV’s change every day (volatility). It Means, at end of the period FMPs may yield below par returns. Another down side is, FMPs comes with a lock-in period (low liquidity).

EQUITY FUNDS

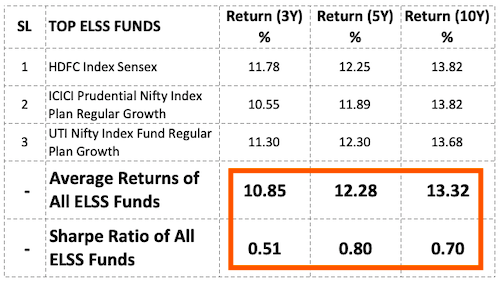

- ELSS: Equity Linked Savings Scheme are similar to multi cap funds in terms of portfolio composition. But it differ in two ways with multi-cap funds: (a) It can save tax u/s 80C, (b) it has a lock-in period of 3 years. Top 3 ELSS funds are listed below. Their returns are almost similar. So, which fund is better? The one with highest sharpe ratio. Also, ELSS perform well when held for a 5 year period (maximum sharpe ratio).

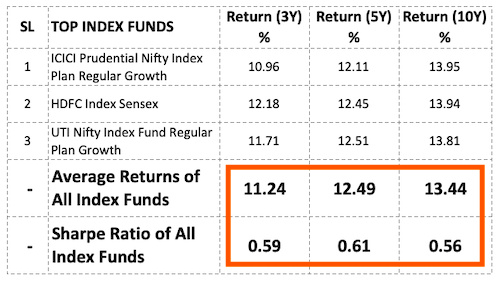

- INDEX FUNDS: They invest only in those companies which are part of a particular index. Shares of companies are included in same proportion as their weightage in the index. They are the best diversified funds. Please note the sharpe ratio of 3 index funds in below table. The best sharpe ratio is yielding for 5Y periods. Hence we can broadly say that, index funds perform well when held for a 5 year period.

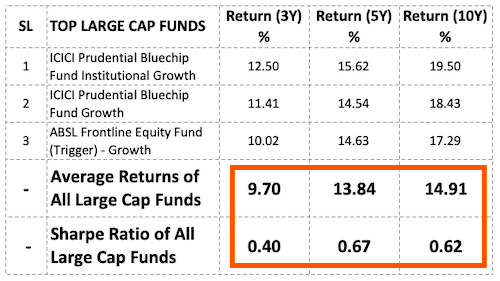

- LARGE CAP FUNDS: They invest mainly in Large, Blue chip stocks. The significance of these stocks is that, they represent stable business with predictable future earnings. Top 3 large cap funds are listed in below table. These funds yields best sharpe ratio for a time horizon of 5 years. Read: Large cap stocks.

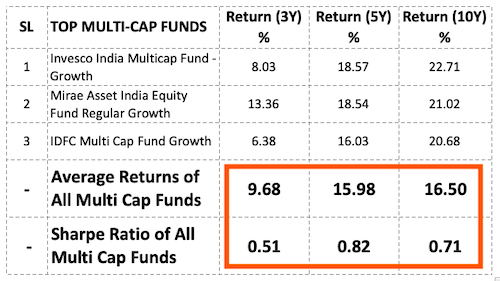

- MULTI CAP FUNDS: This type of equity based mutual fund covers maximum range of stocks. They can basically invest in all type of stocks. Neither sector nor the size of companies is a barrier for them. Top 3 multi cap funds are listed below. These funds yields best sharpe ratio for a time horizon of 5 years. Read: Where to invest Rs.5000 per month.

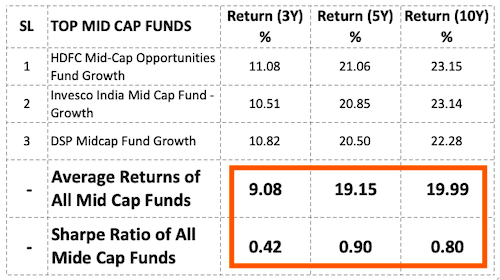

- MID CAP FUNDS: These funds invests in relatively smaller companies. These companies are neither too big nor too small. Hence they offer potential future growth. But on down side, these companies are relatively riskier than large cap stocks. Top 3 mid cap funds are listed below. These funds yields best sharpe ratio for a time horizon of 5 years.

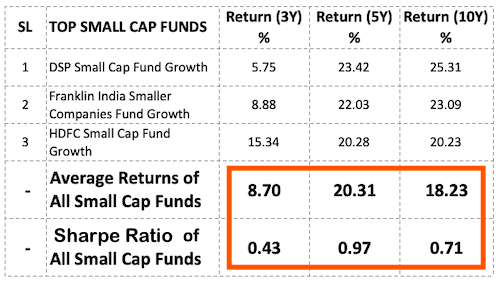

- SMALL CAP FUNDS: These funds invests in smaller companies. These companies are small, hence can grow faster than others. But they also pose significant risk of loss as well. It is in this category that we find penny stocks. Top 3 small cap funds are listed below. These funds yields best sharpe ratio for a time horizon of 5 years.

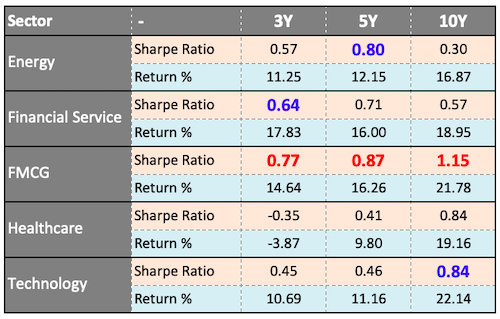

- SECTOR FUNDS: They are funds which invest in specific sectors. For example, Technology based sector fund will buy stocks of only tech companies. Best time to start investing in these funds is when the sector is in beaten down state. Like Auto sector is currently. Data of few sector funds are listed below. You can see that FMCG sector yields best sharpe ratio in 5 Year (5Y) time horizon.

A consolidated comparison between index, multi-cap, large cap, mid-cap, small cap, Sector, and ELSS funds in terms of their sharpe ratio pans out like this:

| Sharpe Ratio | 3Y | 5Y | 10Y |

| Index Funds | 0.59 | 0.61 | 0.56 |

| Multi Cap Funds | 0.51 | 0.82 | 0.71 |

| Large Cap Funds | 0.4 | 0.67 | 0.62 |

| Mid-Cap Funds | 0.42 | 0.90 | 0.80 |

| Small-Cap Funds | 0.43 | 0.97 | 0.71 |

| Sector Funds (FMCG) | 0.77 | 0.87 | 1.15 |

| Sector Funds (Fin Serv) | 0.64 | 0.71 | 0.57 |

| Sector Funds (Tech) | 0.45 | 0.46 | 0.84 |

| ELSS | 0.51 | 0.80 | 0.70 |

What we can conclude from this:

- 3 year Horizon: When investment time horizon is 3 years, it is best to invest in index funds, or funds linked to FMCG sector stocks.

- 5 year Horizon: When investment time horizon is 5 years, it is best to invest in small and mid cap funds.

- 10 year Horizon: When investment time horizon is 10 years or more, it is best to invest in sector funds.

10. Systematic Investment Plan (SIP)

SIP is a method of investing in securities through mutual funds. It allows people to invest in small amounts regularly.

People who are not able to invest because they do not have money to spare, can take the SIP route. How? Because SIP allows one to invest in mutual funds with as little money as Rs.500 per month.

Moreover, regular investing through SIP also reduces the risk of loss. How? Because no matter if the price is rising or falling, good SIP’s will make positive returns for its investors. There is only one condition, just keep investing for long term (like for 3 to 5 years). Read more about SIP’s here.

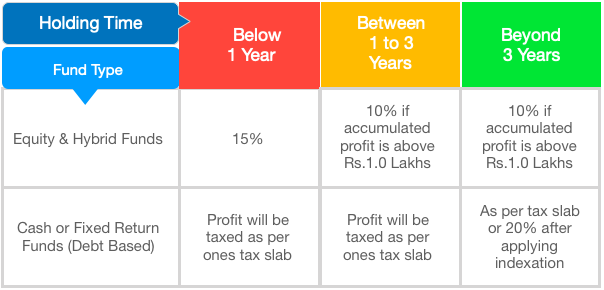

11. Income Tax benefits

People who invest in mutual funds, do so primarily for the sake of earning capital appreciation (growth). But mutual funds can save tax as well.

Equity Funds

Investing in ELSS funds provides a standard deduction of upto 1.5L u/s 80C. These are mainly closed-ended funds with minimum lock in period of 3 years. After redemption, if the net gain is below Rs.1.0 Lakhs, no tax is payable. But beyond 1.0 Lakhs, a flat 10% LTCG tax is applicable (for profits beyond 1.0 lakh).

In normal equity funds (open ended), STCG tax is applicable when units are sold for profit before 12 months holding time. LTCG will be applicable same as discussed in ELSS above.

Hybrid funds which has portfolio composition above 65% in equity are taxed like any equity funds.

How SIP is equity funds are taxed? Each SIP is considered as a new investment. Suppose you’ve started a SIP of Rs.5,000 on 01-Jan’19. The units bought in Jan’19 was say 25 nos. This SIP will be tax free if your sell those 25 nos units after 01-Jan’20. Similarly, units purchased in Feb’19 will be tax free when sold after Feb’20.

Debt Funds

Debt funds are taxed differently than equity funds. Profit yielding from debt funds, in short term, are treated as “income”. They get added to ones salary from job. Hence, they are taxed as per ones applicable tax slabs.

In case debt funds are held for long term (beyond 3 years), indexation benefits are applicable. In this case the person should pay only 20% after indexation. This substantially reduces the tax payable.

12. How to Invest in Mutual Funds?

The easiest way to buy mutual funds, is using online trading platforms (like ICICI Direct, HDFC Security, Axis Direct etc). These days, this facility is provided by default by all major trading platforms

One can also buy mutual fund units directly from fund house website. Mutual fund can be bought from websites by making payments using online banking.

Web portals like scripbox and FundsIndia has revolutionise the way mutual funds are bought and sold. These portals are recommended for beginners.

Steps to follow before and after buying mutual funds:

- Step #1: Finalise investment goal. Start with the purpose. Ask yourself “why you are investing”. Then estimate, how much holding time you can allow for your investment.

- Step #2: Select a mutual fund. If holding time is below 6 months, go for cash funds. If holding time is below 3 years, fixed return funds will be good. For longer time horizons, equity funds are better. If target is to save tax, go for ELSS.

- Step #3: Where to Buy? Online portals/Apps like scripbox or fundsindia can be sued to buy units. Register yourself on these apps. To register, you will need documents like PAN No, Bank account, and Aadhar. In some cases they may also ask you to fill a short application form.

- Step #4: Buy units online. Once the account is live, you can place order to buy mutual fund units. Once the units are purchased, statement will be sent to the registered email ID and phone number. Holding details will also be available online.

- Step #5: When to sell? As soon as the finalised goal is reached, sell the units. The held units can be sold in the same process as it was bought.

- Step #6: Earn Returns. After the units are sold, the sale proceeds will be credited into your bank account.

Read about Direct Plans in mutual funds and how they can yield better returns.

Conclusion

There are several types of mutual fund schemes available. The range is so huge that all type of investment goals can find a matching fund.

If you are a person who is completely risk averse, you can find a suitable mutual fund. If you are someone who wants to continue investing systematically for next 10 years, you will get a matching fund.

If you are only aware of the type of mutual funds, and you understand your goals, success in mutual fund investing is almost guaranteed.

Investing in debt funds can ensure positive returns at all times. Hybrid funds, over a period of 3 years or more, will give positive returns. Good equity-based funds, when held for 5 years or more, its return will beat inflation.

The trick is to be aware of your financial goals. Then select a suitable mutual fund (debt, hybrid or equity) that complements your goal. While selecting a mutual fund scheme, take note of its Sharpe ratio.

I hope this article has given your insights into mutual fund investment. If you have some observations or queries, please post them in the comment section below. It will be my pleasure to read and reply to them. Thanks and have a happy investing.

Suggested Reading:

![Why Not All Mutual Funds Are Affected by the IndusInd Bank Stock Crash [Nilesh Shah Explains] - Thumbnail](https://ourwealthinsights.com/wp-content/uploads/2025/03/Why-Not-All-Mutual-Funds-Are-Affected-by-the-IndusInd-Bank-Stock-Crash-Nilesh-Shah-Explains-Thumbnail-768x463.png)

Thanks for giving such a informative knowledge on Mutual funds.

It always inspires me as investment advisor.

It will be better if you guide on how to select a Mutual fund which will give good returns in future

Thanks a lot, Mani, wonderful article, and helps beginners like me.

Thanks a lot for this wonderful article.

Wow Mani! Keep doing the good work!

Thanks. Please keep reading.

What an in-depth article!

Even a layman can understand this.

How much time did you spend writing this?

Thanks. Writing is fairly quick but research takes time.

yes 🙂

Dear Mani ,

Kindly share your views on International equity funds like Motilal Oswal Nasdaque100 fund .

Investing in such funds is really beneficial for small inevestors?

Mutual funds are a great investment option for beginners who want to start investing in the market. In the start, an investor should invest in large-cap mutual funds that are less risky and can help them to get the experience of the investment.

The second step here in this article is very important. The selection of mutual funds can be a major reason for your profit or loss in the investment. You can select blue-chip funds that have a good track record of returns. If you have an investment agency handling your investments, then you can ask professionals there or read blogs online about how to select a mutual fund.

Whether I make any profit or not, reading your website makes me feel like I’m going to a finance school after 35 years!.

What would be the right age to start introducing the topic of finance/investments to kids?

Great Article and wonderful analysis. Are you writing anything for NRI investment as well.

Thanks. Regarding NRI investment, read this article please: https://bit.ly/2X2owUw

The great article clearly explaining how to invest money for our future life.

Thanks