National Pension System (NPS) is a ‘retirement savings scheme’ which anyone can use to build retirement corpus. Yes, NPS is a corpus builder. In itself, NPS cannot generate income after retirement.

Why I’m highlighting this fact? Because as an investor we must be aware that only NPS-investing will take us through. More needs to be done once our NPS becomes mature (after retirement).

But one can use the retirement corpus built in National Pension System (NPS) to buy annuity. The purchased annuity in turn can generate guaranteed monthly income. Read: Everything about annuity.

But not all money needs to be used to buy annuity. A part of NPS corpus can also be withdrawn as lump-sum money.

Topics:

- National Pension System (NPS).

- How NPS functions.

- Investing in NPS.

- Benefits of NPS.

- Tax Benefits of NPS.

- Conclusion.

1. National Pension System (NPS)

NPS is a “contributory pension system”. It is different from what was existing earlier. Earlier (before 2004), retired people who served as government employees used to get pension (monthly income). Pension was their extra benefit after retirement.

But in the contributory regime (post 2004), people must contribute a part of their income and build a retirement corpus themselves. The extra benefit in form of pension (funded by government) is gone.

From 2004 to 2009, NPS was available only for government employees. But from 1st-May’09 even non-government employees & self-employed people could invest in NPS on a voluntary basis.

The accumulated pension funds in NPS is invested in stock market as well to earn better returns.

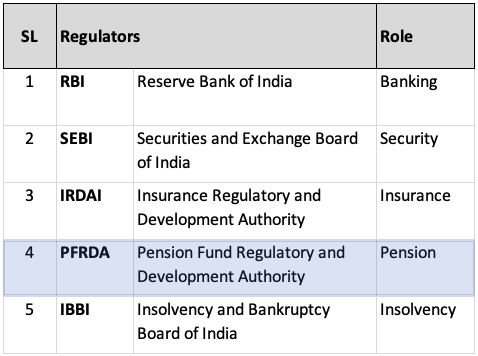

Who regulates NPS? PFRDA (Pension Fund Regulatory & Development Authority) is the regulator. It is a Government of India statutory body. It comes under the ‘Department of Financial Services‘.

Key points about National Pension System

- Voluntary & Defined: The contribution made to NPS are voluntary and defined. It means, one can voluntarily opt to contribute to NPS. Moreover, the size and frequency of contribution is also defined by the subscribers themselves. Read: About retirement planning.

- Retirement Savings Scheme: NPS is more of a savings scheme than an investment option. But as the NPS money is also invested in equity, return from NPS is much higher than other pension plans like (PPF, EPF, Gratuity etc). Read: Money required for retirement.

- Systematic Savings: Subscribers can also use NPS to save systematically (in Tier-I a/c). Instead of saving their money in bank, fixed deposit, PPF etc, retirement linked money can be saved in NPS. Why NPS? Because it can generate higher returns (due to equity component). Read: About systematic transfer plan (STP).

- Retirement Income: A key characteristic of a good retirement income is that, it should be ‘guaranteed’. The corpus built through NPS can be used to buy annuity, which generates assured income.

2. How NPS Functions?

There is a pension fund. In this pension fund, money of all subscribers are pooled in.

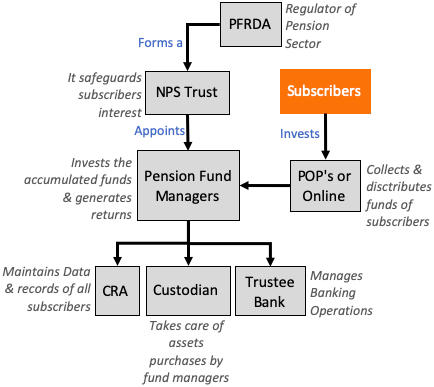

PFRDA (NPS Trust) is entrusted with the handling the pension fund in the interest of the subscribers. It is the main regulatory body of pension sector.

As per PFRDA’s directives, it is the NPS Trust which takes care of the overall management of National Pension System.

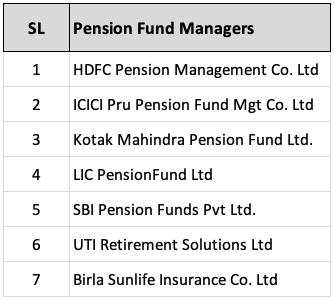

Pension Fund Managers (PFM’s) are appointed by PFRDA & NPS Trust. These fund managers are professionals of the investment business. PFM’s in turn invest the pooled money in a way to build a diversified portfolio (equity shares, corporate bonds, government securities).

These investments in turn grow with time, thereby increasing the value of the pension fund. The faster the pension fund will grow, the higher will be the return for the individual NPS subscribers.

Central Record Keeping Agency (CRA) is the body which maintains all subscribers data and records. We can say that CRA acts as the main data base for NPS. NSDL & Karvy acts as CRA for NPS.

Subscribers can use Point of Presence (POP’s) or Online mechanism to deposit or withdraw their money to and from NPS. POP’s are basically Public and Private Sector Banks, NBFC’s etc. Subscribers can use POP’s to invest Offline. For online investment, there is a web app and mobile app.

Stock Holding Corporation of India acts as a custodian and Axis Bank acts as a Trustee Bank for the NPS.

3. Investing in NPS

3.1 Who can be the ‘subscriber’ of NPS?

Any Indian citizen can subscribe to NPS. It can be a government employee, private sector employee, self employed person etc.

The limitation is only on the age. The age of the subscriber must be between 18-60 years. The subscriber must also be KYC compliant.

3.2 How to subscribe to NPS?

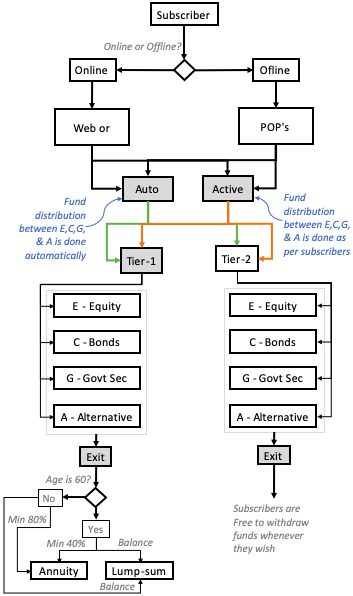

There are two ways to subscribe to NPS: Online and offline.

- Offline: First download the subscriber registration form (here). Then submit the filled up form in your nearest POP. Along with the form, the KYC documents (identity proof, and address proof must also be submitted). There is a fee of Rs.500 for registration which must be paid at the time of form submission. Once the documents are approved a PRAN number is generated. A welcome kit along with PRAN number and other details will be sent at the registered address.

- Online: One can fill the form online by visiting enps.nsdl.com. Then click National Pension System > Registration. Online form filling will take about 15-20 minutes. Keeping a passport size photo, scanned copy of signature, cancelled cheque ready is necessary. Also keep at hand your bank’s a/c number and it’s IFSC code. During form filling, the session often expires. Hence, keep saving the entered data. After expiry, you can still access your last entered data by entering your enrolment number.

3.3 What is Auto Choice in NPS?

Suppose there is a novice investor whose knowledge of investment is minimal. He wants to open a NPS account. For such a person NPS account running under “Auto Choice” is better.

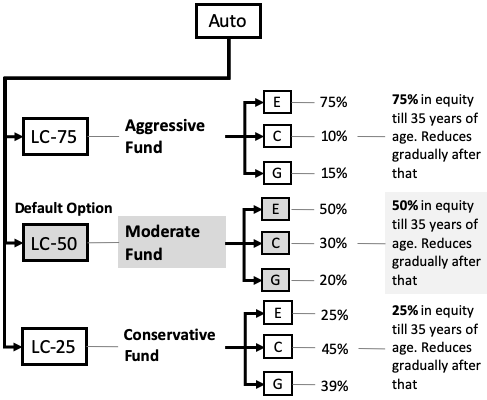

Even in auto choice, there are three alternatives available for subscribers.

- LC-50 (Default): If the subscriber decides to select nothing from his side, the NPS’s default pick is LC-50 life cycle fund. In this fund, 50% of money is invested in shares till the person is 35 years of age. After 35, the weight of equity is gradually reduced and weight of corporate bond and government security is increased.

- LC-75: In this life cycle fund, the subscriber has a choice to have an equity heavy portfolio. A subscriber can voluntarily chose LC-75 instead of the default LC-50. In long term (20-25 years), LC-75 will surely yield higher returns than LC-50 & LC-25.

- LC-25: In this life cycle fund, the subscriber has a choice to have an equity light portfolio. A subscriber can voluntarily chose LC-25 instead of the default LC-50. This fund is for such subscribers who are risk averse.

Check this link to know how portfolio composition of LC-75, LC-50 and LC-25 life cycle funds change with age.

3.4 What is Active Choice in NPS?

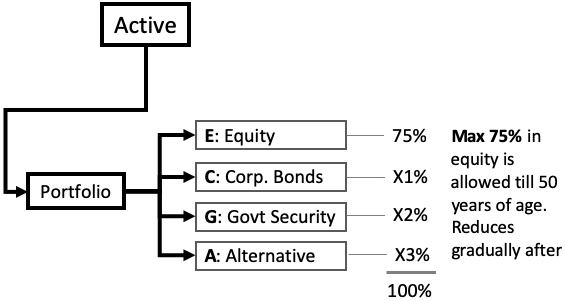

Under active choice, a subscriber can self-decide the overall composition of his/her investment portfolio. This way, it is on the subscribers discretion that how much he/she is willing to diversify the portfolio.

In active choice there are four asset classes to choose from. The subscriber must distribute his/her funds (by self) between these asset classes. If the subscriber does not want to do it, they must go for the auto choice instead.

In active choice, there are very few restrictions. I’ll highlight the ones which are most visible:

- Equity Weight (Till 50): One can select a maximum of 75% equity weight in the portfolio till 50 years of age. The balance 25% must be distributed between C, G & A. Example: E:75%, C:0%, G:20%, A:5%.

- Alternative: One can invest a maximum of 5% in asset class A. Under alternative investment money is invested in Mortgage Backed Security, REITs, INVITs etc.

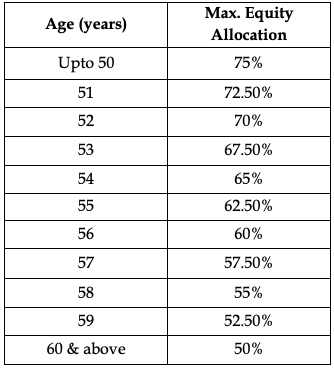

- Equity Weight (After 50): According to PFRDA limitations, weight of equity in NPS portfolio after 50 years of age is restricted as shown below. The below table shows the maximum equity weight an active portfolio can carry beyond 50 years of age.

3.5 What are Tier-I and Tier-II account in NPS?

While opening a NPS account, Tier-I account is opened by default. A subscriber may optionally open Tier-II account along with Tier-I. Having a Tier-I account is mandatory. One cannot maintain a Tier-II account without an active Tier-I account.

- Tier-I A/c: This is the main account where the retirement corpus is getting built. This is a restricted account because withdrawals from this account is restricted. Also, a subscriber can claim tax benefits only on money invested in Tier-I account.

- Tier-II A/c: This account is like an additional investment account. In Tier-I a/c retirement fund is accumulating. In Tier-II a/c one can park money for other personal financial needs of life (like home purchase, child’s future etc). This is a non restricted account from which money can be withdrawn any time. There are no tax benefits of Tier-II a/c.

[P.Note: Government of India will not make any contribution either in Tier-I or Tier-II account. Both the accounts are funded by ones self-contributions]

3.6 Contributions in NPS

As subscribers can contribute voluntarily in NPS, hence the minimum limits in NPS has been kept low. This has been done with the objective to motivate more people to subscribe to NPS scheme.

Following are the contribution-rules for Tier-I and tier-II accounts:

- Contribution to Tier-I:

- On Account Opening: Rs.500 lump sum.

- Minimum One Time Contribution: Rs.500.

- Minimum One Year Contribution: Rs.1,000.

- At least one contribution must be made each year.

- Contribution to Tier-II:

- On Account Opening: Rs.1,000 lump sum.

- Minimum One Time Contribution: Rs.250.

- Minimum One Year Contribution: N/A.

- Cap on Maximum Contribution: N/A.

If a subscriber contributes less than Rs.1,000 in a year (in Tier-I), the account will be frozen by the CRA. But upon minimum contribution of Rs.500, the account can be reactivated.

The contributions can be made using cash, cheque, ECS in offline mode.

In Online mode, net banking, debit card, and credit card can be used for making contributions. There will be a nominal payment gateway charges when payment is made online.

3.7 Rules to withdraw money from NPS

There are restrictions and limitation on how money can be withdrawn from NPS fund. But these restrictions are limited only to Tier-I account. From Tier-II account one can withdraw money anytime.

There can be three broad conditions where a subscriber can decide to exit from NPS. Such subscribers must be aware of the rules.

- Exit at 60: A person can start the process of withdrawal of NPS funds 6 months prior to retirement.

- NPS Corpus < 2 Lakhs: Full amount can be withdrawn as a lump-sum amount.

- NPS Corpus > 2 Lakhs: Minimum 40% corpus must be used to purchase an annuity. List of Annuity providers is available here. Balance amount will be paid in lump-sum.

- Defer: A subscriber can defer the withdrawal till 70 years of age. He may also continue contributing to NPS fund till 70 years of age. But the decision of deferment of NPS withdrawal must be conveyed to NPS at least 15 days before retirement.

- Exit Before 60: Person must contribute to NPS fund for at least 10 years before claiming withdrawal.

- NPS Corpus < 1 Lakhs: Full amount can be withdrawn as a lump-sum amount.

- NPS Corpus > 1 Lakhs: Minimum 80% must be used to purchase an annuity. Balance amount will be paid in lump-sum.

- Death Before 60: The nominee can get 100% of NPS fund in lump-sum.

There is a special NPS Claim Processing Cell (NPS-CPC) which deals with all activities related to NPS withdrawal, exits and payment after early death.

The procedure to withdraw NPS funds online can be learnt from this video. Withdrawal can also be made offline. Check this link for the procedure.

Benefits of National Pension System

There are other ways to build retirement corpus in India. One of the better ways of corpus building (by taking 80C Tax benefits) is through Equity Linked Savings Scheme (ELSS). Compared to other methods like EPF, PPF, etc, I find NPS more advantageous.

Let’s see some of the benefits of NPS

- Control of Subscriber: Subscriber has the control on the portfolio composition of their NPS fund using Auto choice and Active choice. For people who know investing, this is a big positive compared to EPF, PPF etc.

- Faster Growth: While building retirement corpus using NPS, one can opt for a portfolio which is equity heavy. As holdings in NPS can be for very long term (like 15-20 years), going equity heavy can be preferred. This will make the portfolio grow faster over time.

- Clarity on Pension: If you a private sector employee, you and your company must be contributing 12% to EPF, right? Out of the employers contribution 8.33% goes into EPS (Employee Pension Scheme). At retirement, the money parked in EPS is used to buy annuity while EPF can be withdrawn in lump-sum. The split between EPF and EPS is confusing for many. In NPS, the split is simple. First build the total corpus and then use at least 40% of it to buy annuity.

- Voluntary Contributions: Any Indian citizen (few exceptions) can open a NPS account. The contribution to NPS fund is voluntary. The subscriber has to just satisfy few basic minimum thresholds. Moreover, there is a flexibility of investing any amount – month after month. There are no fixed commitments (like 12% of basic salary etc).

- Funds Tracking: It is possible for subscribers to track the current valuation of their retirement funds. It can be done by logging into the NPS a/c. The return generated by the individual scheme can also be tracked using NPS Trust’s website (here).

- One Stop Shop: A subscriber can use Tier-I account to build retirement corpus. Similarly, Tier-II account can be used as an investment vehicle for other financial goals of life. It means, at one place (NPS account) all ‘financial future priorities’ of life can be handled.

- Tier-II Account is a Freebie: There are no additional charges for maintaining a Tier-II a/c. Moreover, one can withdraw money from Tier-II account anytime. There are no charges or penalty for any withdrawals from Tier-II a/c.

- Advantage over Pension Funds: There are pension funds available in India. Like NPS, they can also be used to build retirement corpus. But in pension funds, you are obliged to use at least 66.67% of the corpus to buy Annuity. Moreover, you are also obliged to buy annuity from the same fund house (where you’ve pension fund). This is disadvantageous if the annuity of said fund house is yielding lower returns. In case of NPS, only 40% of corpus can be used to purchase annuity of any company.

- Income Tax Benefits: Contributions to NPS Tier-I account is also eligible for 80C deductions. Read more on tax benefits of NPS here.

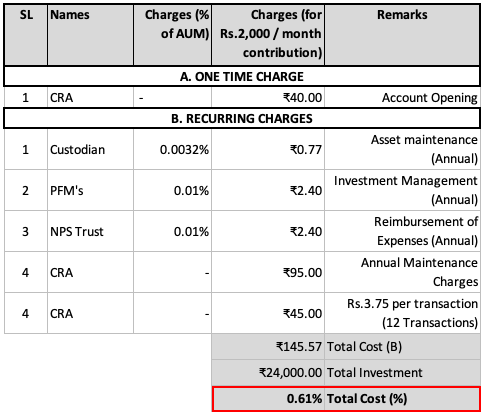

- Low Cost: Compared to other retirement linked savings options, the cost of maintaining a NPS account is lowest. The cost break-up is shown below. This cost is perhaps even lower than expense ratios claimed by equity mutual fund schemes. The higher will be the monthly contribution, lower will be the cost. Cost can also be reduced by making lump-sum contribution each year.

Tax Benefits of NPS

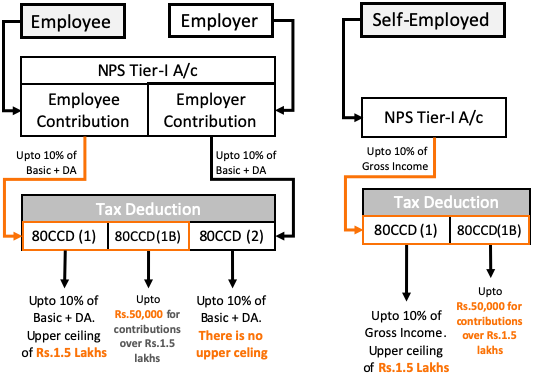

Whether you are a government or private sector employee, self-contributions made to NPS Tier-I account is eligible for tax deductions u/s 80C. Even self-employed people can claim tax deductions by investing in NPS.

NPS provides more tax benefits to employees whose employer is also contributing to NPS account.

- 80CCD (1): Here, ones own contribution to NPS account (Tier-I only) is considered for 80C deduction. There are two limitations here:

- Deduction claimed under sec 80CCD (1) should be less than 10% of Basic + DA.

- Maximum deduction allowable here is Rs.1.5 Lakhs. If one has no other 80C savings, full Rs.1.5 lakhs deduction can be claimed on basis of NPS contribution only. [Note: To claim Rs.1.5 lakhs deduction, ones monthly contribution to NPS should be Rs.12,500].

- 80CCD (1B): If one has contributed say Rs.200,000 in NPS’s account (Tier-1 only). In this case Rs.1.5 lakh deduction can be claimed u/s 80CCD (1), and balance Rs.50,000 can be claimed u/s 80CCD (1B). The upper limit u/s 80CCD (1B) is Rs.50K.

- 80CCD (2): Here, ones employers contribution can also be considered for income tax deduction. The total amount that the employer has contributed in a FY can be claimed as deduction. There is no upper ceiling (like Rs.1.5L in case of 80CCD (1). But there is a condition:

- Deduction claimed under sec 80CCD (2) should be less than 10% of Basic + DA.

Total Deduction Possible: Rs.1,50,000 + Rs.50,000 + Employer Contribution (Lower than 10% of Basic + DA)

For self employed people, tax benefits are as shown below:

- 80CCD (1) & (1B): Like salaried people, self-employed can also take income tax deduction under this section. But there are few limitations:

- Deduction claimed under sec 80CCD (1) should be less than 10% of ones gross income.

- Maximum deduction allowable here is Rs.1.5 Lakhs.

- If one is investing more than Rs.1.5 lakh in NPS, additional amount can be claimed as deduction u/s 80CCD (1B). The upper ceiling here is of Rs.50,000

Total Deduction Possible: Rs.1,50,000 + Rs.50,000

Conclusion

Opening a NPS account can be done from the comfort of home.

- The process has been made easy as everything can be done online. If you are a Aadhar Card holder, even the facility of e-signature is available. It means no handling of hard copies.

- Scanned copy of your signature, photograph and a cancelled cheque will do the job. If you have your Aadhar card linked to your bank account, KYC verification will be done through your bank account.

Investing in NPS has been super easy as well.

- Default contributions coming from your salary (yours + employers) gets credited into the NPS account automatically. You can also separately add additional funds into your Tier-I account. Just login into your cra-nsdl.com account and contribute online.

- You can also use Tier-II account to invest for other personal financial goals. Money invested in Tier-II account can be withdrawn anytime. There is no penalty.

Invested money remains well diversified.

- If you are investing in Auto choice mode, money remains well diversified as per your age. Read: Auto choice.

- If you are investing in Active choice mode, diversification can be set based on your requirements. Read: Active choice.

According to me, National Pension System (NPS) is one of best investment vehicles which offers a COMPREHENSIVE SOLUTION to the citizens of India in managing their retirement needs.

Have a happy investing.

![Income Tax Slabs: Tax Liability Comparison Between 2020 and 2019 [Calculator]](https://ourwealthinsights.com/wp-content/uploads/2020/02/Income-tax-slabs-Image.png)

Hi sir,

Whether the pension amount generated after retirement will beat inflation.. the query the pension amount is fixed or floating

Hii Mani your article really helped me in knowing about NPS. All the points are detailed & upto the mark. I look forward to doing an investmentz in NPS soon.

Hi Mani,

If one has 80C contributions via Insurance, EPF, mutual funds and want to make additional 50k contribution under 80CCD (B) only, Is this allowed?

very informative

Thank you

Can you move from auto choice to active choice once you have already started NPS investing? Say, after 2 years we want to move to active choice. Is it possible?

Yes it is possible to change the option.

Good article with chart about the retirement pension plan.