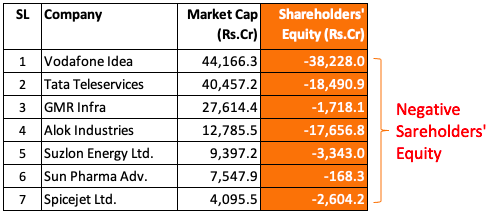

Recently I was reviewing a list of stocks from the BSE-500 index. I found some stocks showing negative shareholders’ equity. I wondered, what caused the negativity? The companies I’m talking about are these:

None of the above companies are financially healthy. To cross verify, I checked their overall scores in my stock analysis worksheet. These were the numbers:

Unhealthy companies are worth ignoring. But they are eligible for deeper analysis. It is essential for investors to become aware of the reasons behind the aftermath.

Negative shareholder equity is an after-effect, it is not the cause. Generally, poor financial health has roots in poor sales and sustained losses over a period of time.

There can be other reasons which can cause the shareholder equity number to go negative. We will discuss those reasons in this article. But before that, let’s know more about shareholder equity.

Negative Shareholder Equity

We will dig into the balance sheet and income statements of an example company. Looking at those numbers will give better insights.

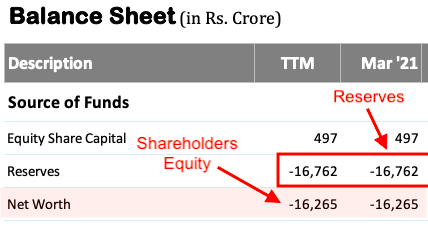

Before that, allow me to show you how negative shareholder equity looks in the balance sheet.

Shareholders Equity (net worth) has two components, equity share capital, and reserves. In terms of formula, it will look like this:

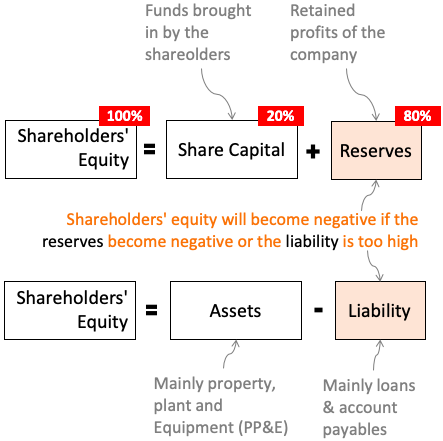

The shareholders’ equity can be expressed using the two formulas shown above. These formulas highlight two main reasons that can cause negative shareholder equity.

First, when reserves go negative. Second, when liabilities of the company become greater than its assets.

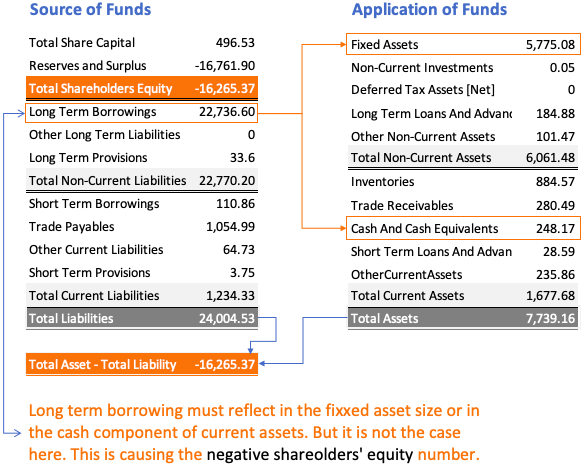

Let’s highlight this using an example (Alok Industries). For this company, the disparity between its source of funds (long-term borrowings) and the application of this fund is enormous (assets, cash).

Large borrowing must reflect either in the fixed assets or in the cash component of current assets. But this is not the case for Alok Industries. Hence we see the negative shareholder equity number in the balance sheet.

The Concept of Shareholders’ Equity

The shareholders’ equity portion (net worth) of the balance sheet has a meaning for the investors. Suppose a situation comes when the company needs to be liquidated (sale of all assets). The funds so generated by the sale of assets will be first used to clear all the liabilities (account payables, loan outstanding, etc). After all the liabilities are paid-off, the balance money will be distributed among the shareholders. A positive net worth number indicates that shareholders will get back something upon liquidation.

Suppose you bought a stock for Rs.1000 per share. Its book value per share (net worth per share) is Rs.300. It means, if this company gets liquidated, you are likely to get back at least Rs.300.

So, when the net worth number goes negative, the shareholders might get nothing upon liquidation. Though negative number does not mean that shareholders need to pay something to the company.

If one is investing in a company that has negative shareholder equity, it is a big red flag. In most cases, it’s better to avoid them because better alternatives are always available.

But if the idea is to catch a potential multibagger, looking at stocks with negative net worth is a good starting point. Such companies can turn around themselves in times to come. If this happens, they can become multibagger of the future. Though it is also true that such cases are rare.

Hence, before investing in them we must know the reason that caused the net worth to go negative. A deeper understanding of the reason will tell if the company has the ability to turn its fate around in time to come.

5 Reasons For Negative Shareholders’ Equity

The shareholders’ equity will never go negative in normal circumstances. So, if it is showing as negative, there must be some abnormality happening behind the scene. We will list down some common reasons contributing to this negativity.

#1. Negative Cash Flow From Operations

Though a negative cash flow does not directly influence the equity component in the balance sheet, it can be seen as a trigger (indirect factor) behind it.

If the operation is not yielding positive cash flow, it will lead to a working capital deficit. A company cannot run efficiently in this deficit. To make up for this deficit loans are taken which will eventually affect the asset-liability matrix of the balance sheet.

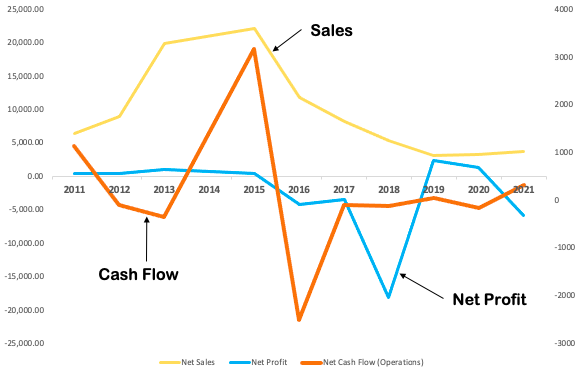

In the above chart, you can see a sustained negative net cash flow from operations between the years 2016 and 2021. Such a company is most likely to face working capital concerns.

It is also visible in the chart that the company is facing falling sales and losses. Such companies often face cash flow issues leading to falling net worth.

#2. Sustained Negative Net Profit (PAT)

Whenever a company reports losses, negative PAT, it will lower its reserves in the balance sheet. Why? Because the reported profit/losses are carried over to the balance sheet in the form of retained earnings. In this case, the carried retained earning will be negative. Hence it will reduce the reserves number of the balance sheet.

When such carryover occurs year after year, it goes on lowering the reserves. It must also be noted that negative PAT, leads to negative net cash flow, leading to the working capital deficit as explained above.

In most cases, the carryover of losses to the balance sheet is the primary reason behind negative shareholders’ equity.

#3. Excess Loan Borrowing

When cash flow is not positive and PAT is negative, to manage current liability and working capital needs, the company will borrow loans. It is a common practice. But it becomes a problem when the company continues to be nonprofitable year after year.

Why it is a problem? Because loss reporting means the equity weight is going down in the balance sheet. In this situation, availing of more loans will increase the debt to equity (DE) ratio. As the DE ratio continues to rise, the lenders will charge a higher rate of interest. It will further reduce the profit-making chances of the company.

So we can see, such companies are getting into a vicious circle by resorting to loans to manage their immediate capital needs.

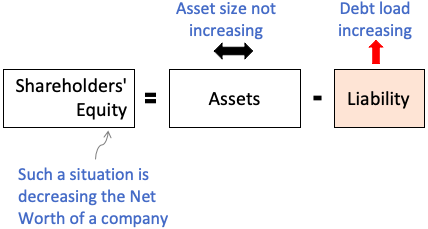

Moreover, when excess debt is taken to manage liquidity, the liability side is getting heavier. Such loans are neither increasing the companies asset size nor is staying as cash within the company. Apply this condition to the below formula, it will present a case of net worth becoming negative in times to come.

#4. Payment of Excess Dividends

The Reserve (retained earnings of the past years) of the balance sheet is the fund pool that the company uses to pay dividends. Every time the dividend is paid, it depletes the reserves. To understand if a company can afford to pay a certain dividend or not, we can look at the size of the Reserve. Unaffordable dividend payouts can bring down the shareholders’ equity to negative.

#5. Shares Buyback

A company can buy its own shares from the market. This process of stock purchase is called shares buyback. The cost of the buyback is debited from the Reserves account of the balance sheet. Sometimes, such a buyback policy of the company can pull its shareholders’ capital to negative. Temporarily it might look anti-shareholder, but in a long term, it might yield better returns.

Conclusion

Any stock displaying negative shareholders’ equity is avoidable. Why? Because it is one of the most visible indicators of weak financial health. A healthy company will never allow its net worth to go into negative.

Before investing in such companies it is paramount to do a detailed fundamental analysis of them. The analysis must be done to identify the reasons for the net worth going negative.

What a company can do when its net worth goes negative? Frankly speaking, it is one of the difficult situations to deal with. There are only a few options available:

- Increase Share Capital: It can be done by promoters and promoter group selling their shares in the secondary market. The money so generated can be used to reduce the debt load. This will make the liability side less heavy, hence improving shareholders’ equity.

- Increase Sales & Collection: It is harder to implement than it sounds. But a company which is looking to turn around its fortunes, probably this is the only sustainable step. It will give the company that extra cash in-flow it needs to reduce its debt dependency.

Have a happy investing.