The concept of pay yourself first has tremendous powers of making one financially independent. How? At least, it builds a strong foundation for it.

“Pay yourself first” was a phrase which was first used in a book called The Richest Man in Babylon.

But this simple statement has been converted into a profound personal finance rule by Robert Kiyosaki.

Kiyosaki has written a book called Rich Dad Poor Dad where he has explained the need and utility of paying self first.

While I was first reading this book, I could feel that this concept is going to change my life forever.

Ever since then, ‘pay yourself first’ concept has got embedded in my thoughts.

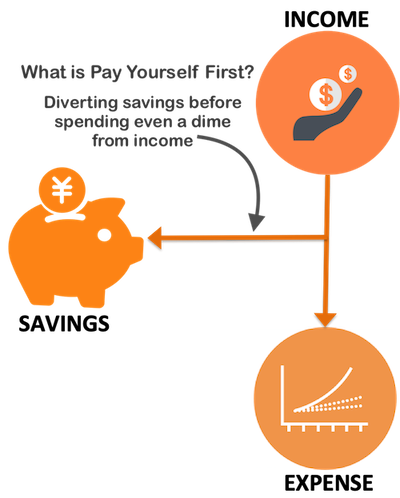

What makes pay yourself first so unique is its originality and simplicity. It means what it reads.

‘Pay yourself first’ before spending a dime anywhere else.

Why I like “pay yourself first” rule…

The benefits of following this simple money management principle is so huge that it almost feels like a gift of god.

If you think that I am overemphasising its effectiveness, stay glued to this article. I will try to explain it in more detail.

Consider this, attaining financial independence is anyhow difficult, right? So why not give this theory a try. I will say, it is worth a try.

If you succeed it is a gain. If not, you will still learn something new (deeper meaning of money management).

Having said that, I am very sure that person who can implement “the pay yourself first concept” will cent percent benefit from it. There are no doubts.

Yes, I am so confident about it. I follow this concept (in a slightly edited form). So I know that it works.

You can also follow this simple rule for a year and see its benefits.

Do not worry, this is not a hoax. Nobody will try and ask money to show you its benefits. It is only between you-and-you.

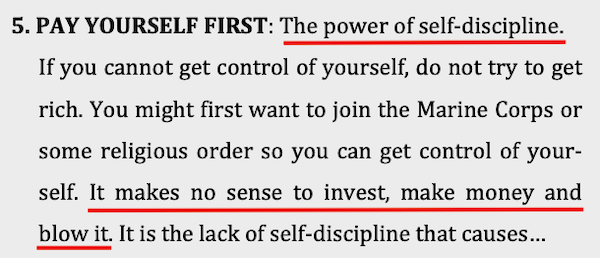

As Kiyosaki says, “following pay yourself first rule, is more a matter of self-discipline than anything else”.

What you will be asked to do is only “not” to spend the money as it comes. It also talks about how to utilise the “not spent money”.

Robert Kiyosaki has beautifully explained this concept in a very innovative way. In Chapter 9 of Rich Dad Poor Dad, he has made the reference of it like this…

I greatly admire Kiyosaki for this one concept alone. Why? Because this concept defines the necessary psychology required in a person wanting to become rich.

Allow me to share my edited version of “pay yourself first” rule with you. But before that let’s understand the unedited version.

#1. Unedited version of “Pay yourself first” concept

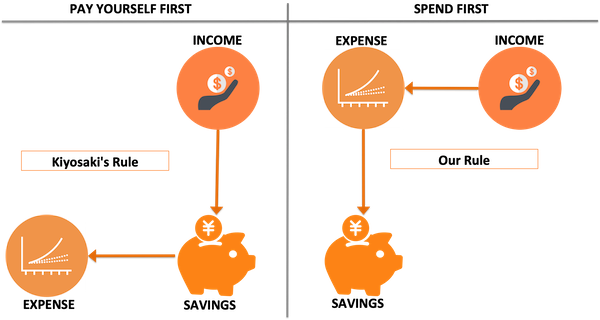

The unedited version of pay yourself first rule of Robert Kiyosaki is TOUGH. Why?

It is tough because we cannot imagine in wildest of our dreams to handle our income and expenses like this.

The rule is tough to follow more because of our psychological limitation. Our mind is not mapped to handle money like this.

What we generally do? “First spend, and then whatever is balance is our savings”.

What Kiyosaki is telling us is, to do the opposite. First save, and then let your savings take care of all expenses.

How it is possible? See, I told you our mind has not been tuned to handle money like this, hence this doubt.

Let’s see how we spend money, and how Kiyosaki is asking us to do it.

Are you able to understand the enormity of case we have in our hand here.

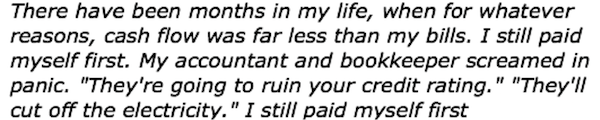

Today, our total income itself was insufficient, and Kiyosaki is asking us to divert 100% of it to savings. He must be nuts, right?

This is what is the unedited version of “pay yourself first” concept. How Kiyosaki manages such a shortfall himself?

I will quote here what Robert Kiyosaki has said in the book:

#1.1 Pay Yourself First: The Kiyosaki’s way…

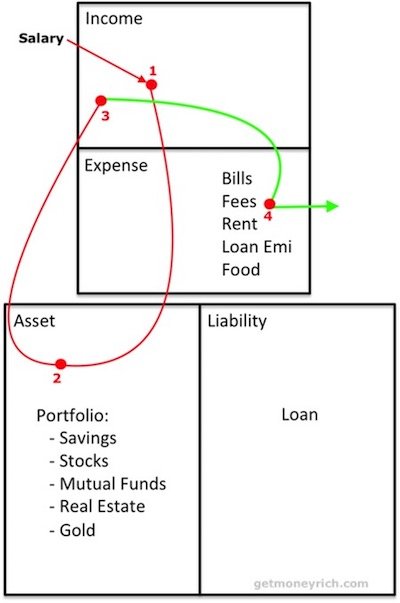

What is shown in the above infographics? This is how Robert Kiyosaki wants us to pay ourself first. Note the flow of money:

Point 1: Salary (income from job) is credited into your bank account.

Point 2: 100% salary is used to buy assets.

Point 3: The accumulated assets generates passive income.

Point 4: Passive income is used to pay for all expenses.

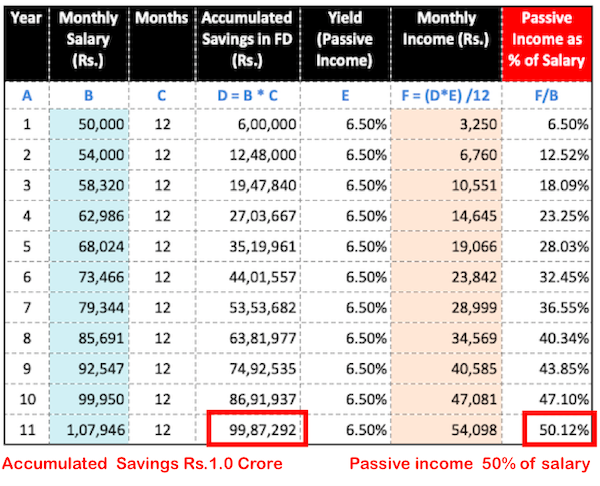

Lets take a typical example of a Person called RAJ:

- Current Salary: Rs.50,000/month.

- Average salary increment for next 11 years: 8% p.a.

- Passive income yield for next 11 years: 6.5%

Here RAJ is investing his 100% salary in a bank deposit paying him a net effective monthly return of 6.5% per annum.

See how his passive income grows from year 1 to year 11th.

- 1st year – Passive income is 6% of salary income.

- 2nd year – Passive income is 12% of salary income.

- 3rd year – Passive income is 18% of salary income.

- 4th year – Passive income is 23% of salary income.

- 5th year – Passive income is 28% of salary income.

- 6th year – Passive income is 32% of salary income.

- .

- .

- 11th year – Passive income is 50% of salary income.

By the end of 11th year, what Raj has achieved?

- Raj’s Passive income is 50% of his salary.

- He also has an asset worth one crore.

How many people in this world can claim to have an asset worth Rs.1 crore only at 11th year in job?

There is no doubt that in the initial years, Raj must have faced hardship. But today he is a crorepati.

#2. Edited version of “Pay yourself first” concept

When I first read Rich Dad Poor Dad, I already had a family. I was living in a city which was new, and away from my parents.

No way I could have afforded to divert 100% of my salary towards building assets.

But one thing was sure, I wanted to preach and practice this powerful concept. So what I followed was another few logical steps.

Though it was an aberration to what Kiyosaki said about paying oneself first, but today I am happy that at least I started.

So here is my personal experience, of how one can start paying self first.

#1.1 Estimate the bare minimum expense

What is bare minimum expense? Those expenses that must be paid for maintaining ones lively-hood.

As per my rule of thumb, our bare minimum expense is approximately 35%-50% of our present total expense.

So if total monthly expense is Rs.100,000, the bare minimum expense will be Rs.35,000-50,000 per month.

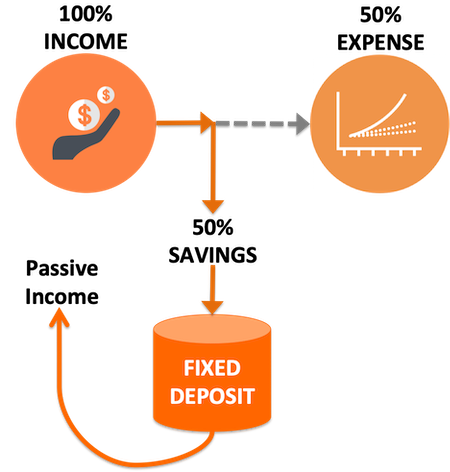

#1.2 Divert 50% income to buy a FD

As soon as the salary gets credited into your bank account, divert 50% of it to buy a FD. Do this first thing with your salary.

Do not spend a dime till 50% of salary is locked into a fixed deposit (FD).

Important is to keep repeating this process month after month till eternity.

But how to manage expenses with only 50% income? The trick is to learn to budget all expenses, and follow the budget to its core.

Final words on Paying self first…

Yes, in initial days it will pose some difficulty. We are not used to “not-spending” our money. Not able to spend money is a difficult task.

Not-spending becomes even more difficult when one has idle money. What is the idle money here? Money paid to self. Hence it is compulsory to lock the money by investing (like in FD, bonds etc).

Some might even ask that, if we are not allowed to spend then why we are earning money in first place? The question is valid, but difference of opinion is in, “why we are earning”?

We are earning not to spend, but to become financially independent.

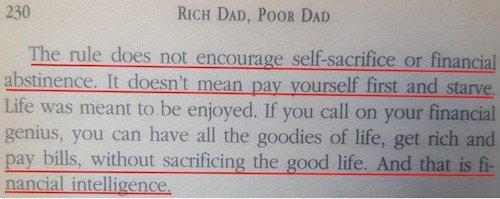

But this does not mean that we shall start living the life of a pauper. To emphasise this point, Robert Kiyosaki has concluded it very nicely in his book:

Self sacrifice or financial abstinence, is not the goal. Goal is to “pay oneself” with an idea to accumulate more and moe “income generating assets”.

If the concept is so simple, why majority in this world do not follow it? Because we ourselves have made “paying ourself first” almost impossible. How?

By living a debt ridden life. What debt? Home loan, car loan, education loan, personal loan etc.

One of the precondition to start paying 50% to oneself is to become debt free first.

One must not fall into the trap of large debts. These debts cost us dearly in form of EMIs. We must keep our expenses always in check.

We can spend on many things, but shall never overspend on anything.

Always remain within your budget. Never forget to build assets. Let asset building be as a necessary thing as eating food. Let your assets generate passive income for you.

Set a target to reach a stage where your passive income is 50% of your income from job.

Continue paying yourself first with a strong conviction that this is the fastest and most assured way to achieve financial independence.

![Wealth Building: How To Build Wealth in 30s [Wealth Formula]](https://ourwealthinsights.com/wp-content/uploads/2010/07/Wealth-Building-Image.png)

Really amazing wow

Hi Mani,

This is a great concept, though personally I didn’t like Robert’s book too much, since it had a huge focus on rental income / flipping of houses (rather than making money via stocks / FDs / other instruments), but I totally agree with the 10% rule he talked about!

But I had a quick question on what you mentioned here… Why would you choose a FD or RD (!6.5%) rather than a Mutual Fund or ETF which gives ~10-12% and then monthly redeem units to cover living exps?

WOW! You have no idea how helpful this article is. My husband and I both just finished Rich Dad Poor Dad. We’re 29 years old with a two year old and a baby on the way. We were wondering how to get started paying our self with all our other expenses. This gives me some guidance to make our plans going forward. And I really appreciate it.

Thanks for your awesome comment.

It is a very good concept. Wish I had come across years ago. Thanks for your simple explanation.

really wonderful article sir ,in initial days if i would have got these kind of financial knowledge in early days of my carier things would be different.great work sir.

WOW! that was an awesome feedback. Thanks a lot.

Hi. I am so new to this concept. I just started learning from Robert Kiyosaki book. I was confused with the concept with Pay yourself first, but you made it so clear. Thanks so much. Quick question. Sorry this could be off topic. What does “Rs” mean in Rs.100,000 for example? Thanks a lot.

Thanks for posting your comment. “Rs” is a short representation for “Indian Rupee”.

The l most engaging article I have ever read so far.Well researched and compiled. Loving it so far but have bookmarked for a detailed reading this weekend

Thanks for the awesome feedback. Loved every bit of your words.