What is the present value concept? Suppose a person invested Rs.1.0 crore in a real estate property. It will be a good investment if he gets back his invested amount, with some surplus (see this example).

A simple example. Suppose, the investment (Rs.1.0 Crore) was made today. If the person gets back Rs.1.2 Crore after one year, then is it a good investment? In this case, the return on investment is 20% per annum. Compare this return with that of a 1-Yr bank deposit of 6% per annum, it’ll look good.

Evaluating such investments, whose cash flows are simple, and time horizons are short, is easy.

But when holding times are longer, and multiple cash-flows are involved, simple analysis is not possible. In such cases, the present value concept helps.

An Example of Present Value

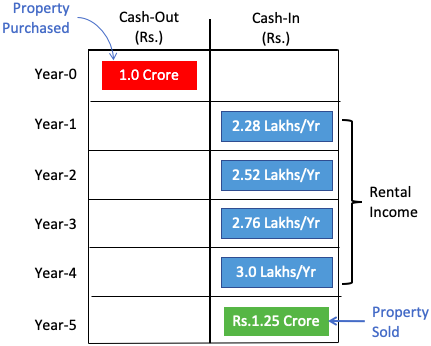

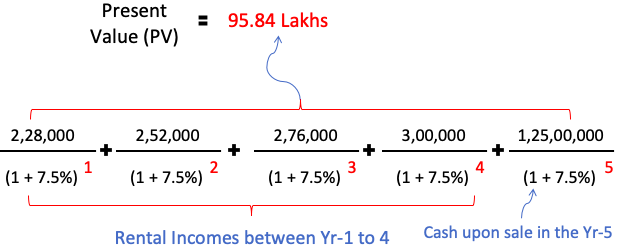

Suppose a person invested Rs.1.0 crore in a real estate property. In the next consecutive five years, the possible cash flow earnings are shown in the above infographic.

- Rental income earned In four years will be Rs.2.28 lakhs, Rs.2.52 lakhs, Rs.2.76 lakhs, and Rs.3.0 lakhs each year respectively.

- Appreciated Capital earned upon sale of the property, in the fifth year, will be Rs.1.25 crore.

On the face of it, the investment looks okay. Why? Because of the regular and increasing rental income. Moreover, the property is also getting sold at a capital appreciation of 25% in the fifth year.

Now, let’s apply the present value concept to judge if the investment is profitable or not.

Step #1 – Assume A Suitable Discount Rate

To assume a discount rate, we must think in a particular way. Ask yourself, “if the money that is used to buy the property (Rs.1.0 Crore), alternatively, where else it could’ve been invested?“

Let’s assume that, had it not been in a real estate property, the money would have been invested in a debt fund. A typical debt fund in India would give a return of 7.5% per annum. If the alternative choice is a debt fund, then 7.5% will be our discount rate.

Similarly, if the money would have stayed parked in a savings account, then 3.5% will be the discount rate. Investing the money in the stock market will earn a higher return, like 12% per annum, hence a higher discount rate.

If this approach looks complicated, then one can also pick the 10-Yr average inflation rate as the discount rate. 10-Yr government bond yield can also be a discount rate for present value calculation.

I prefer the first approach of alternative investment for assuming a suitable discount rate for my present value calculations.

Suggested Reading: The concept of discount rate in intrinsic value estimation.

Step #2 – Find Present Values of All Future Cash Flows

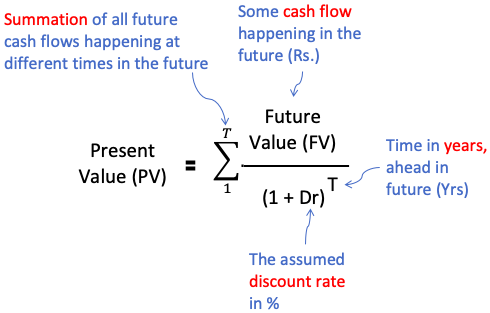

The formula for present value:

In our example, we have assumed some cash-in flows happening between year one and year five. Let’s apply the above present value formula to do the calculations. The assumed discount rate is 7.5% p.a.

The sum of present values of all future cash-in flows comes out to be Rs.95.84 Lakhs.

What we can conclude from the calculation?

- The property purchased at a cost of Rs.1.0 Crore.

- It remains cash-positive in all the years (rental income and capital appreciation)

- The present value of all future cash flows comes out to be Rs.95.84 Lakhs.

As the cost is higher than the calculated present value, the investment is not profitable.

[Note: The higher will be the discount rate, the lower will be the present value. Hence, while assuming a discount rate, care must be taken. The process explained above in step #1 helps in assuming a reasonable and a more accurate rate]

The Present Value Concept

The concept states that the money in hand today is worth more than the same amount in the future. It means that the money loses its worth with time. What is the logic behind it?

There are two ways to look at it:

- Growth Angle: Investment can make the money grow. Suppose you get an option to take Rs.100 today or after one year from now. Why you’ll take the money today? Because investment of Rs.100 at 6% per annum will make it Rs.106 after one year. It means that Rs.100 of today is equivalent to Rs.106 of tomorrow.

- Inflation Angle: The same amount of money can buy less things in future. Suppose you’ve Rs.100 and you could buy 5 Kgs of onion today. In a year, the price of onion will increase due to inflation. It means that Rs.100 of today could buy more onions now than it will do in the future. Hence, today’s money has more purchasing power.

The Utility of Present Value Concept

It is one of the better methods to judge if an investment is profitable enough or not.

For example, we have seen that an investment of Rs.1.0 Crore was not profitable. How we came to this conclusion? By calculating the present value of all future cash-in flows happening in the future. As the present value was less than the cost of investment, hence was is not profitable.

The same investment could become profitable if cash-in flows become heavier. The profitability enhancement is also possible by assuming a lower discount rate.

In practical life, increase in the quantum of cash-in flows, or lowering of the discount rate is not possible in an investment. In such cases, the person must opt for an alternative investment option. This kind of quantifyable and justifyable conclusion is possible in present value analysis.

Limitation of The Present Value Concept

Though the present value concept is extremely useful in evaluating investments, it has limitations. The accuracy of the present value concept in evaluating investment rests on two main assumptions:

- Estimation of Future Cash Flows: Making assumptions about future is a speculative activity. Why? Because we cannot forecast and control all future variables. As a result, our future cash flow assumptions might change with time. In turn, it leads to uncertain conclusions.

- Estimation of Discount Rate: Discount rate is also speculative. Based on our knowledge, we can make a wise guess. But as different people can up with their own discount rates, no two values will be the same. This gives rise to a degree of variability in present value calculation. Every person may come up with their own interpretation of a discount rate, hence a unique present value. How to judge which value is right? Practically, it is not easy.

Ultimately, the accuracy of present value calculation boils down to the ability of the analyst to forecast future cash flows and assume a near accurate discount rate.

Conclusion

The time value of money is a theory that becomes the basis for the present value concept. In the majority of cases, the present value of money is less than its future value. Why? Because our money has the potential to earn interest. The interest-earning potential of money gives it its time value.

Becoming aware of the time value of money is essential in realizing the utility of the present value concept.

Why do we assume that our money has interest-earning potential? Assume that you have Rs.100,000 parked in a fixed deposit (FD). The investment earns you interest of say 6% per annum.

Now, a friend approach you and asks you for Rs.1,00,000 help. He agreed to repay it after 6 months. You gave him your Rs.1,00,000. As you liquidated your FD, you also lost the ability to earn 6% per annum interest. In other words, you prevented your money to grow with time (time value).

So, the present value of Rs.100,000 that you will receive from your friend, after six months, will be worth less than the Rupees one lakh.