Why Government cannot print currency notes and give to needy?

After all, printing currency notes is in control of RBI and GOI. It needs no other approvals.

Why it cannot be done this way?

India’s population is 132 Crore.

Out of this, at least 18 Crore are “poor”.

Who are poor people?

According to world bank (2015), when a family’s income is less than $1.9/day (Rs.130/day), it is said to be poor.

According to this rule ($1.9/day), it was established that 18 crore people are poor in India.

In other words, income of $1.9 per day is the poverty line.

People below this line are poor. People above this line are not-poor.

How government can solve the problem of poverty?

What is the easy solution?

Print currency notes and give to poor.

If the poverty line is defined at just $1.9/day (Rs.130), why government cannot print more notes and give to poor as gifts each day?

This way there will be no poor people in India.

Moreover, if poor people will have money, they would also start spending.

Increased spendings will further boost the economic activity of the country.

It looks like a win-win solution, right? Not so right.

There is an “economics rule” that prevents RBI and Government to print currency notes at will.

What is this rule?

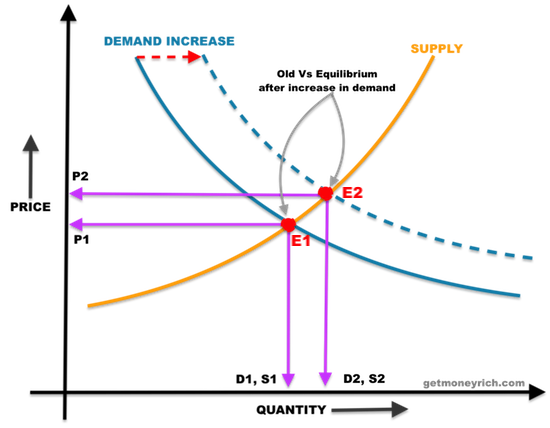

Demand – Supply – Price Balance

This is called “Market Equilibrium”.

What is Market Equilibrium?

Price P1, Demand D1 and Supply S1 are said to be in equilibrium at point E1.

What is E1?

At the equilibrium point (E1), demand of a product (D1) matches its supply (S1).

Means at E1, there is neither excess supply nor excess demand.

At this equilibrium point (E1), the price of the product is P1.

P1 = Equilibrium Price.

Suppose, now due to some reason the demand of the product increases at the same price point.

How this “increase demand” can be represented in the above graph? By shifting the demand curve towards right (shown above).

Due to demand increase, the equilibrium point also shifts to E2 from E1.

[It most be noted that, in a normal environment, market likes to function at equilibrium points like E1 and E2.]

At this new equilibrium (E2), the price of the product is P2.

P2 – New Equilibrium Price.

Remember: Due to increase in demand, the net effect is, increased price of the product.

So how does this explain why Government cannot print currency notes and give to needy?

Before answering this, we need to understand three (3) more basic concepts related to our economy.

Concept #1. What it means by GDP?

GDP estimates market value of “goods and services” produced by a country.

GDP of India as on 2017 was $2,597.49 billion.

Source: tradingeconomics

What does it mean?

It means, market value of all goods and services produced in India in year 2017 was $2597.49 billion.

Concept #2. What it means by Money Supply?

Money Supply estimates the total amount of money available in the market.

What is total amount of money? Currency with public, plus deposits in banks (further reading: A flaw in our banking system)

Money Supply (M3) in India as on Jul’2018 was $2,174.93 Billion (@Rs.65/USD)

Source: tradingeconomics

Concept #3. What cause inflation?

There are two main factors that cause inflation. “Increase in cost” or “increase in demand”.

Few most visible factors that cause surge in cost and demand are listed below.

- Causing increase in “Demand“:

- Interest rate cut by RBI.

- Increased Money Supply by RBI.

- Rise in income of people.

- Causing increase in “cost“:

- Rise in income of people.

- Increase in GST.

- Weakening Rupee.

So we can see that, when supply of money by RBI increases, it also leads to inflation.

So what does it mean, money supply should never increase? No.

What it means is, growth rate of money supply should be comparable with GDP growth rate.

When money supply increase w.r.t GDP, the result is inflation.

A balance between GDP and Money Supply, is necessary to keep the inflation in control.

So in terms of concept, these 3 will help us to understand what is market equilibrium (Demand-Supply-Price Balance).

Now lets answer the main question…

Why Government cannot print currency notes and give to needy?

As per world bank, family earning less than $1.9/day (Rs.130) is tagged as poor.

So our contention is, why government cannot print currency and pay Rs.150 each day to poor.

What will be the benefits (assumption)?

- No poor in country.

- Poor will have money to spend.

- Increased spending will enhance the economic activity.

So if these are the benefits, why no wise government in the world does it?

Because it will cause more harm to the economy than its assumed benefits. What is the harm?

Devaluation of currency & Hyperinflation.

Main drawback of excess money supply

What is Devaluation?

70 INR can buy one USD. This is valuation of our Indian Rupee (INR) compared to USD.

But suppose, if valuation of INR becomes like this: 100,000 INR = 1 USD

If this happens, we can say that INR has greatly devalued. It will cause hyperinflation.

What is Hyperinflation?

When price of goods and services start to rise at an abnormal pace, it is said to be hyperinflation (at least 50% per month).

Generally devaluation and hyperinflation occur at tandem. One fuels the other.

Examples of Hyperinflation (Source- Wikipedia):

- Soviet Union (1921-22): Inflation 213%.

- Germany (1920-23): Inflation 20-50% per day

- Greece (1941-46): Inflation 3.0 × 10^(10) %.

- Hungary (1945-46): Inflation 4.0 x 10^(10) %.

- Philippines (1944-45): Inflation 60%.

- Venezuela (2016-Current): Inflation 234%.

- Zimbabwe (2007-08): Inflation 79.6 billion%.

What caused such hyperinflation in these countries?

The root cause was “excess currency in circulation”. How it happened?

All of these countries decided to print their currency incessantly.

Why excessive currency printing is dangerous?

Lets understand this phenomenon with help of a simple example.

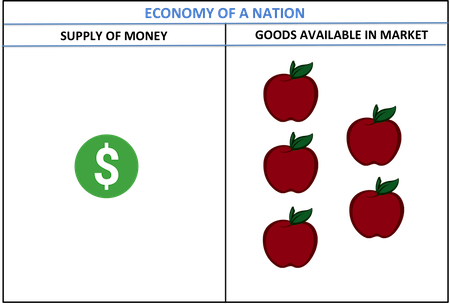

Suppose there is a nation which has the following constituting its economy:

- Money supply : One Dollar.

- Goods & Services: Five Apples.

What does it signify? Two ways to see it:

First, a person who has that one dollar, can buy all five apples.

Second, a person who has all five apples, can earn full one dollar.

Selling price of apple: Rate $0.2/Apple.

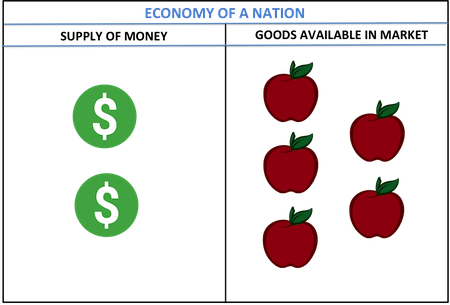

Now suppose the government decided to print one more note.

This way, one more person got hold of a dollar.

Means, the nation now has two dollars (increased money supply). But goods and services remain same.

- Money supply : Two Dollars.

- Goods & Services: Five Apples (remains same as before).

How to see this new event? Again, two ways to see it:

First, both the person with $1 each will approach the apple shop.

Second, a person who has all five apples, can now earn two dollars.

How he can do it? In two steps:

- Step 1: He will sell 3 apples @$1 to the first person reaching his shop.

- Unit rate: $0.333/Apple.

- Step 2: He will sell 2 apples @$1 to the second person.

- Unit rate: $0.5/Apple.

Note how the price of same apples increased from $0.2 to $0.333 to $0.5.

Why this happened?

Due to a phenomenon of “excess money chasing few goods and services”.

How should be the ideal case?

There can be two cases here.

Case #1. No inflation

Before: Money Supply = $1, Apples: 5 Nos

After: Money Supply = $2, Apples: 10 Nos

Case #2. Nominal inflation

Before: Money Supply = $1, Apples: 5 Nos

After: Money Supply = $2, Apples: 9 Nos

Conclusion

It is necessary to balance the “increase in money supply” with a simultaneous “growth in GDP” (Increase in goods & services).

Printing more money (increasing money supply) can never eradicate poverty.

To eradicate poverty, the bigger focus should be on the following:

- Education.

- Employment.

- Decent salary.

- Access to health care.

- Development of other basic infrastructure.

But encompassing all of the above factors should be a “strong economic policy” of the government.

Key result areas for the government & nation as a whole should be on:

- Increase exports.

- Reduce imports.

- Inflation control.

- Improve strength of currency.

- Etc.

Printing currency is just an activity which should not be given more weightage. Why?

We are living in a world of “Fiat Money”. This type of money should always be kept in control like a slave.

Because if it gets unleashed, it can cause devastation like devaluation and hyperinflation.

Really liked this post!! Thank you for keeping it so simple and explaining it.

Thank you for taking time to post your comment.

Excellent article for people to start understanding economy.

Just one more point.

If govt starts supplying money to people, then people have no reason to work. For eg, if you supply money to farmers, there is no need for them to do agriculture. So the production falls and this way people will have money but no product to buy.

Afterall everyone is after the money.

Nice post. Thanks for explaining in layman terms. !

Thanks

Really great article and nicely explained. you must add more examples to look more transparent.