Generally, when we analyze stocks, it is based on quantitative data. But everything about a company is not quantifiable. Judging the quality of Management based on the numbers alone is not possible.

Hence, before digging into the numbers, starting stock research by just observing a company is considered good. What to watch in a company? We can look at the group of people who run the business. In colloquial terms, we call those people the “Top Management” of a company.

Why the “top managers” are critical for the company? It is because they are the drivers and decision-makers. Without a good management team, steering a company toward success is not possible.

When competent managers run a company, it can go a long way. Even Warren Buffett loves them. Here is what Buffett says about the importance of quality management.

“I think you judge management by two yardsticks. One is how well they run the business, and I think you can learn a lot about that by reading about both what they’ve accomplished and what their competitors have accomplished, and seeing how they have allocated capital over time.”

– Warren Buffett

Suggested Reading: Liquidity and Solvency Analysis.

Why Quality of Management is Critical?

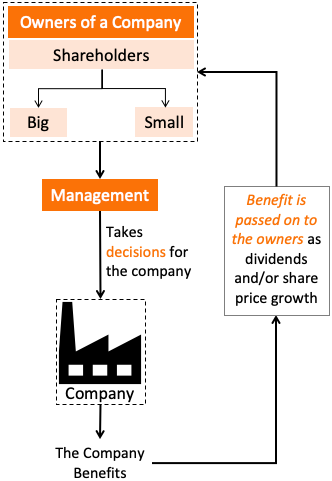

Shareholders of a publicly listed company are its owners. The decision taken by the management of such companies should benefit the company. Hence, if the company will gain, it will ultimately enhance the shareholder’s value.

The decisions taken by the management drive the company to success. The qualified and experienced will be the managers, the better will be their decisions.

Management must take only company-friendly decisions. But sometimes there may miss this critical point. To ensure compliance, it essential that the priority of the company and its management are aligned. How to do it? By tieing incentives of the top managers with the company’s performance.

It is also a way to align the management’s interests with that of their shareholders. Such a management team eventually takes shareholders-friendly decisions by default.

How to Analyze Quality of Management of a Company?

Analyzing the propensity of management is not easy. The difficulty is because of the non-quantifiable parameters. Hence the study and analysis become more theoretical.

Even experts on this topic judge the management of a company based on their qualitative factors. But there are some quantifiable parameters of a business. We can use them to identify the management’s quality.

Let’s know more about both quantitative and qualitative factors we can use to analyze the management of a company:

Quantitative Factors

The management of a company has a responsibility. When we are talking about them, we are referring to the top managers. These people do not involve themselves in the day-to-day operations of the company. Their job is mainly concerning the future aspects of the business.

To do this, they care more about growth, margins, resource utilization, use of capital, shareholders’ interest, etc. Quantifying these factors can lead us to assess the management’s strengths and weaknesses. Let’s see how.

#1. Growth

A company that is constantly growing cannot achieve this feat ad hoc. It is the result of the painstaking efforts of the whole team. More importantly, the top managers should get the credit.

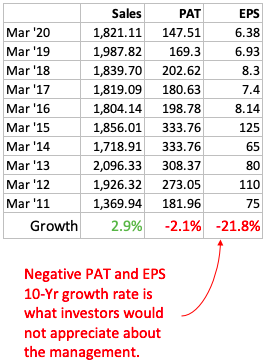

Management which was able to push the sales, PAT, and EPS of the company in the last 10-Yr deserve praise.

Why top managers deserve the credit? Because rendering growth is very tasking. Given a choice, the employees would like to continue doing the same things again and again. But it requires the vision and motivation of top managers to push the team to ensure growth.

#2. Resource Utilization

The management has two types of resources at their disposal: employees and capital. Effective utilization of the resources can take a company long-way. Here, we will talk about the utilization of employees.

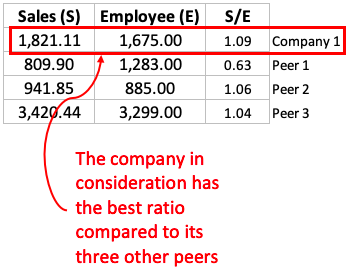

How to know if the company is utilizing its employees as per industry standards? For that, we will have to take the following steps:

- Step A: Note the sales and net profit (PAT) of the company. Also, note its total permanent employees as indicated in their annual report. Calculate the ratio, Sale/Employee and PAT/Employee.

- Step B: Calculate the same two ratios of three more companies operating in the same sector as the company in Step A. Compare the ratios.

The company with the highest number (S/E-ratio) is utilizing its employee the best.

#3. Enhanced Profitability

Only a handful of companies can claim enhanced profitability over time. It is one of the arduous performance parameters to achieve. Why? Because the company must build an economic moat to do it. Moreover, without gaining a competitive advantage in its sector, for a company, profitability enhancement by other means is less feasible.

If profitability enhancement is a top manager’s priority, every employee will work for it. Cost reduction, work simplification, product development, brand promotion are few ways to better profitability.

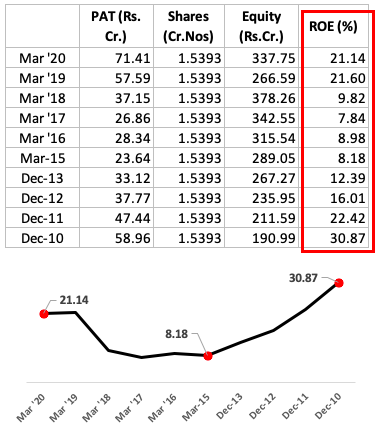

As an investor, we would like to see a company whose profitability numbers (ROE) have increased in the last 10-Yrs.

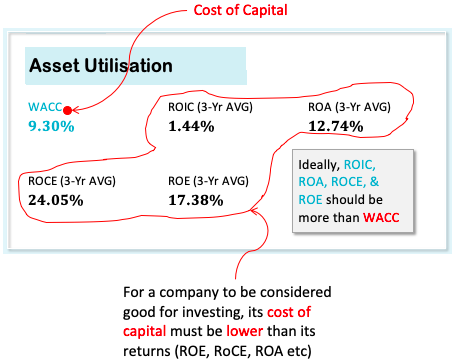

#4. Capital Allocation

There are two parts to capital allocation. First, to be aware of one’s cost of capital, and then ensuring that the return on capital employed (RoCE) is more than that. Second, ensuring that the reinvestment of profits is in line with the shareholders’ interests.

Top managers must always be aware of their cost of capital. Ensuring RoCE above this cost is critical. A management that is not maintaining a higher RoCE is actually destroying the wealth of its shareholders.

Cost of Capital

To know about the Cost of Capital, please check the provided link. Companies need capital to do business. Equity or Debt can be two good sources of Capital, but both have a cost. It must pay back its debtors a fixed interest. It must also yield the needful returns for its equity financiers (shareholders).

How to ensure that a company is able to pay its shareholders and debtors their due rewards? By comparing the cost of capital with profitability parameters like RoCE, ROE, etc.

Reinvestment

It is critical to understand why a company retains its profits (reinvestment). The objective is to use that capital for conducting the business. A business needs funds for its working capital and also for its CAPEX plans (future growth). Ultimately, execution of everything is done to serve the needs of the owners (shareholders) of the company.

What is the need of the shareholders? They expect at least above-average returns. The returns could be in the form of dividends and/or share price growth.

Now suppose a company is retaining its profits, but those profits are not getting converted into either dividend income or price appreciation. What do you think shareholders would like such a company (management)? They’ll not like it.

One way of checking if the reinvested money is rendering its utility is by comparison. Just compare equity growth with dividend and price growth.

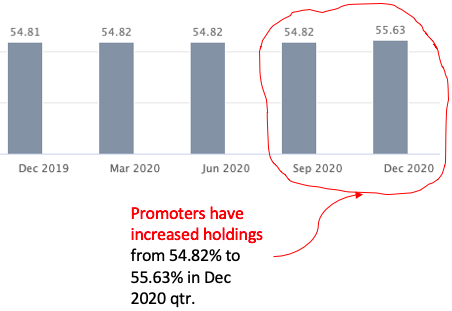

#5. Promoters Stake

The high stake of promoters in a company is one indirect indicator that its management will be “shareholder’s friendly.” If not, then the Promoters have the power to change them. That is why investors must look for companies where the promoter’s stake is high (like 50% or more).

How the promoter’s stake has changed over time must also be taken into consideration. Increasing promoter’s stake is a confidence booster for the shareholders. Whereas, if the stake is decreasing, it is a questionable action.

Who are the promoters? In the “Shareholding Pattern” section of the annual report, the company is obliged to declare the holdings of their promoters. Here, they also declare their names.

#6. Dividend Affordability

There are stocks of many quality companies in the stock market. Shareholders do not mind holding on to these stocks for the long term. But they also like short-term gains in terms of trickling dividends.

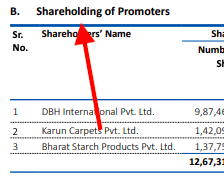

The decision of dividend payment is taken by the top manager (Board of Directors) of a company. It will be interesting to check if the company has dividend-paying affordability or it is doing so to fool its shareholders.

How to do this check? By comparing net profit (PAT) reported versus total dividend distributed. If the company is paying more dividends than its PAT, it is a questionable action. If management does it time and again, it does not show them in a good light.

You can see, our example company was paying 66-95% of its PAT as dividend to shareholders. These are high payout numbers, but we cannot criticize management based on high dividend payout.

But in the period between Mar’12 and Mar’21, the share price of the company rose at a dismal rate of 4.3% per annum. When share was not doing so well, we can ask, why the management was paying so high dividends. They could have retained the cash and made the stock stronger.

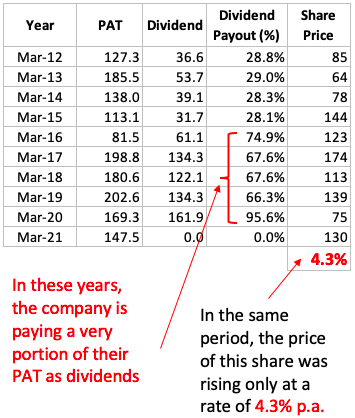

#7. Remuneration of Management

Chairman, the CEO, CFO, among other top managers of a company, do get paid handsomely. There is no problem with that. The kind of responsibilities they have on their shoulders, they must get properly compensated.

But it becomes a problem when they are being compensated irrespective of the company’s bad performance. Hence, often a part of their salary is tied to the performance of the company.

In the above example, between Mar’12 and Mar’16 (5-Years), the EPS was continuously falling (reduced by 60%). But in the same duration, its CEO’s salary grew by almost 25%.

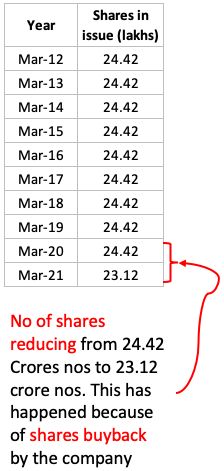

#8. Shares Buyback

Whenever the management decides to buyback its shares from the market, it says two things about them:

- First, the decision of buyback goes in favor of the existing shareholders. It is one better way of utilizing the accumulated reserves of the company. It immediately affects the stock price. For good companies, shares buyback is a welcome move.

- Second, a company buys back shares only when it thinks that it is trading at undervalued price levels. The management of a company that is also tracking its intrinsic value can take the buyback call wisely. But tracking it is not so easy. So management which is doing so must be good.

Tracking the numbers of shares outstanding of a company will give an idea about shares buyback. An increase in the ‘number of shares outstanding’ is negative for shareholders. Though, a decreasing number is a positive sign.

#9. Manipulation in Books of Accounts

It is almost impossible for a retail investor to find if the ‘accounts’ of a company are cooked or not. Please note that a company can manipulate its accounts without crossing the line of legality. So, external help will be needed.

A useful metric to identify bungling in accounts can be James Montier’s C-score. For Indian companies as well, their C-score is published. The companies are rated based on nine (9) parameters. If a company gets a score of below four (4), it hints at manipulation.

The responsibility of manipulation of a company’s financial records sits straight with its top managers.

Qualitative Factors

#1. Management Discussion & Analysis (MD&A)

MD&A is a portion of the annual report which is published right at the beginning. In this section, the top management presents its analysis of the company’s performance.

For me, this section of the report is one of my favorites. There are some company’s that do a realistic analysis of their performance. But some tend to be more boastful. Just reading MD&A gives an insight into the minds of the company’s management.

MD&A also gives a peep inside the minds of people like the Chairman, MD, CEO, CFO, Directors, etc. In this section, the company declares its goals, plans, CAPEX initiatives, among other things.

#2 Related Party Transactions

It is another portion of the annual report which is unavoidable. We have heard about people siphoning the company’s money to outside. They take a loan in the company’s name and then do not use it for the company. They divert that money elsewhere.

Generally, the money gets diverted among group companies, promoters, etc. Though such transactions are not illegal at the outset, a case of conflict of interest is possible. Hence companies must file all such transactions in the annual report.

Look for companies that are neck-deep in debt. Then, open their annual report and go to the section (Related Party Transactions). For good companies, that section is mostly blank.

But accounts of dodgy companies are comparatively more loaded here. Transactions like loans to promoters, directors, group companies are not acceptable. Moreover, if these loans are low-interest bearing, it becomes questionable.

Sometimes a company may also take high-interest-bearing loans from its promoters or group companies. It is also a doubtful deal. There are also examples of the company selling their assets to their promoters or group companies at hugely discounted prices.

The idea is to keep an eye on such transactions. Check if those are one-off examples or they are appearing there time and again.

[P.Note: Dividends paid to promoters, commissions paid to the sitting directors of the board (who are also the company’s promoters) qualify as a legitimate transaction.]

#3. Tenure of the Management

People who administer a company do come and go. When good managers come in, it benefits the company and vice versa. But the top managers of the company like Chairman, Managing Director/CEO, CFO, etcetera must be a stable group.

As an investor, we would not like to see frequent changes in this group. When a company is not doing well, even these people change.

Download the last 10-Yr annual reports of a company. Check who are the people at the helm of affairs. Also check, how long they have maintained that position. The longer they are on the board, the better.

For example, when the MD/CEO, CFO, etcetera of a company changes every 5-Yr, it is not a good sign.

Conclusion

Analyzing the quality of management of a company is not so easy. It can become subjective, and different analysts may see it differently.

It is one reason why I thought to approach this subject more analytically. I try to quantify the parameters based on which the management can be judged. This way, it reduces the room for subjective interpretation.

In my stock analysis worksheet, I’ve tried to incorporate some of these points. It helps the worksheet to give a score for the quality of management of the company.

Sometimes, few readers question my worksheet’s score on management. It mainly happens when they see a low score for group companies like Tata’s.

We often confuse between ethics and good performance. Ethical management does not always translate into good governance. Also, only a couple of years of good or bad performance does not make management great or dull.

I’ll like to sum up the subject with a very apt line from Warren Buffett:

“You want to figure out … how well that they treat their owners,”. “Read the proxy statements, see what they think of — see how they treat themselves versus how they treat the shareholders. … The poor managers also turn out to be the ones that really don’t think that much about the shareholders, too. The two often go hand in hand.”

– Warren Buffett

![Stock Investment For Beginners – A Detail Guide [India]](https://ourwealthinsights.com/wp-content/uploads/2010/11/Stock-Investment-for-Beginners-image.png)

![Compare Indian Banks: A Quick Fundamental Analysis [2023]](https://ourwealthinsights.com/wp-content/uploads/2021/05/Compare-Indian-Banks-Image4.png)

Very Detailed and practical approach to evaluate the management.

The James Montier’s C-score explanation on VRO is pretty basic, could be useful if you could do a write-up on the C-Score.

Thank you for posting your comment.