Why I’m talking about monthly income from investments?

Because I’m an ardent fan of the concept of financial freedom.

For anyone, the only way to find this freedom is to look elsewhere for monthly income.

Where to look? Alternative sources (other than job/business).

One of the best alternative source of monthly income is investment.

“Income based investments” can lead us to financial freedom.

But these investments are slightly different from growth focused investments.

Let’s know more about it.

[Road map to become rich…]

Income Vs Growth

Investing money for monthly income generation is not very popular in India.

People mostly invest money for growth.

We think and talk more about doubling money by investing in quick time, right?

This (fast capital appreciation) can happen only in growth investing.

Income investing may not give fast growth, but what it can give is also rewarding.

Benefits of Income Investing

What ‘income investing’ gives which ‘growth investing’ cannot, are listed below:

- Alternative Income: It is an alternative to income from job/business. This is called passive income. It can continue to yield forever, and no one has to work for it. Read more.

- Consistent Returns: Income generating portfolio consists of more “risk free assets”. These are mainly debt based options. Hence their returns are consistent (but low). Why to go for low returns? If priority is income generation, low return is an understandable compromise. Read: SIP in debt funds.

- Real Returns: Why I’m calling it real returns? Because what the investors earn here is “real money”. Rupee is actually getting credited to ones bank account each month. But in case of capital appreciation, we can only guess the possible return (if we sell), and feel happy. This is not real money. Read: Invest for good returns.

- Short Term Income: The paycheck that we earn from job is a short term income. How? Because money is credited each month in our bank account. Monthly income from investments is like income from job. Read: Retire early from job.

As we have seen, income investing has true benefits. But there is a problem attached with it. What is it?

Problem With Income Investing. How To Deal With It?

How to get monthly income from investments?

By accumulating such assets which can yield frequent & consistent returns.

But the problem with such assets is that, their yield is low.

So, how to deal with this limitation? There is a way…

Combine growth & income investing. How?

Combining Growth & Income Investing

This strategy can be used by people who have time in hand to build income based portfolio.

What one must do here?

Instead of directly buying ‘income assets’, buy ‘growth assets’ first. See the typical representation shown above.

What is represented in the above flow chart is this:

- #1. Start: First start building a growth portfolio. Buy equity regularly. The best way to do it? SIP in equity based mutual funds. Keep contributing to this SIP long enough. Read: SIPs in Mutual Funds.

- #2. Book Profits: Let this equity keep accumulating return for 3-4 years minimum. When you can see a sizeable capital appreciation, book profits. Read: investing for beginners.

- #3. Buy Income Assets: This is the end goal – buying income generating assets. It is at this step that monthly income from investments will start to drip in. Read: how to remove salary dependency.

What is the benefit of following this long loop? Why to delay the purchase of income based assets?

Because this way the overall yield of the investment will improved. How?

Because it can average the returns.

Which assets to buy to build income based portfolio?

Not all asset is a reliable income generator.

The focus should be to identify few and keep accumulating it till eternity.

What is the goal?

The passive income generated from these assets will give financial freedom.

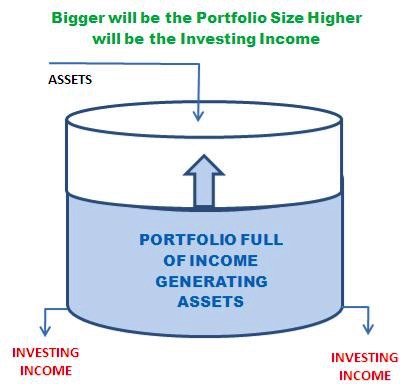

Remember, in income investing, size of the portfolio is key. The bigger is the portfolio, higher will be the income. Check here: The impact of portfolio size on passive income.

Allow me to list down few reliable income generating investments:

- Fixed Deposits (FD): Fixed deposits ensure interest earnings of 7.0% p.a. Bank’s can pay the interest in the form of monthly income. The interest income gets deposited to linked savings account each month on a fixed date. Example: A FD of Rs.100,000 can generate a monthly income of Rs.550/month. Read more on how to earn high interest on FD.

- P.O. Monthly Income Scheme (POMIS): These are one of safest vehicles for income generation. Open a savings account in post office (PO). Put money in the savings account. Then, directs the post office to put these funds in POMIS. The money will start generating monthly income. Every month the income gets credited to this savings account. Interest yield of POMIS is 7. 8% p.a. Read: about POMIS here.

- Mutual Fund’s Monthly Income Plans (MIPs): In 2019, these mutual funds are known as “Regular Savings Funds“. They have a dividend option (monthly quarterly etc). Buying units in this mutual fund, and selecting the dividend option will yield monthly income. Its typical portfolio composition is 65% Debt, 15% Equity. Yield from a MIP can be 8% per annum. Read: SIP in debt based funds.

- Company Deposits: This is one of the reliable income generator. Generally Finance companies like Bajaj Finance, DHFL, PNB Housing, LIC Housing etc offer such deposit plans. The interest paid on these deposits can range from 7% to 8.5% p.a. Based on the credit rating of these deposits, one can buy them for income generation. Check here a list of company deposits.

- Bonds (Non Cumulative): Bonds which offers non-cumulative interest can generate regular income. Non cumulative means interest is not allowed to accumulate. Instead, it is paid to the investor on regular intervals. This interval can be monthly, quarterly, annually, and annually. Such bonds are generally high quality bonds issued by G.O.I. Check a list of non-cumulative bonds.

- Annuity: Annuity is an investment option which is tailor made to generate income. There are annuities which can begin the payout from as early as 30 years of age. But generally people buy annuity as an income generator post retirement. An annuity can yield a return of about 7% p.a. Read: about annuity.

- Income post retirement: I have written a separate blog post about how to invest retirement corpus for income generation. There also I’ve highlighted few investment options which are tailor made for ‘income generation’ post retirement. Please check this post.

- Real Estate Investment Trust (REITs): This is a new investment options for India launched in Mar’19. This is also a tailor-made investment options for income generation. Considering the nature of REIT, it is one of the “safest” and a “high yielding” investment in India. Read more about REITs here.

- Real Estate: One of the orthodox way of generating monthly income from investments is through physical properties. If one has large capital, it can be used to buy a 1BHK/2BHK etc apartments. Upon purchase, put the property on lease/rent. Henceforth, it will start generating monthly income. Read: about property investment.

- Reverse Mortgage: This is a reasonably good income generator for retired people. Reverse mortgage is basically a type of home based loan where banks pay the EMI each month for the full tenure. EMI acts like an income. Upon the demise of the beneficiary, the bank can take control of the property. Read: about Reverse Mortgage.

- Dividend Paying Mutual Funds: This type of mutual fund is different from mutual fund MIP’s discussed in SL.#3. Here we are talking about traditional equity or hybrid mutual funds with a dividend options. These mutual funds has an objective of capital appreciation, but under their divided plan, they book profits and share it with the unit holders. Read more about dividend paying mutual funds.

- High-Interest Saving A/c: Though technically it is not an income generator, but I still like it for its utility. Why? Suppose your bank account supports SWEEP facility. What Sweep does is to automatically lock certain funds in FD. This amount in turn start earning higher interest rate. Moreover, the amount which is swept can still be withdrawn using ATM. Read more about Sweep facility.

These are few ideas using which one can get monthly income from investments.

Let’s dig deeper into the BASICS of monthly income generation. It will give us a better feel about its benefits and requirement.

Start investing for monthly income: Fix A Goal

Set A Goal. This is a first step.

What should be the goal? My favourite is this: “reduction of dependency on salary“.

Example: Jack’s present dependency on salary is 100%.

All expenses are paid from the monthly salary he earns from his job. He cannot skip even one month salary.

Jack set a goal to reduce his dependency on salary from 100% to 75% in next 3 years.

How to quantify the dependency?

Suppose ones monthly expense is Rs.100,000/month. Income generated from investment is Rs 25,000.

It means, the person is only 75% dependent on his salary.

[Monthly income generated from assets is termed as passive income.]

Ask difficult questions…

Imagine that there will be no salary from next month.

How to pay bills? Fuel car? How to pay EMIs?

Salary dependent people will find it hard to answer such question. Why?

Because we’ve become so dependent on salary that, we have stopped asking such difficult question to ourselves.

Lets start from today, ask yourself, how to pay the EMI if I loose my job?

Throw this puzzle to yourself once every week.

May be you’ll never have problems with your job, but asking these difficult will push you to seek financial freedom.

Think and Invest Differently

People generally invest with an idea to buy low and sell high (capital appreciation – growth).

But investment can also be done for income generation. Income and growth investing is different.

What is the difference?

- In growth investing – focus in on returns.

- In income investing – focus is on asset accumulation.

The assets so accumulated generate stable income.

Income generating assets are different

Assets that promise capital appreciation are not eligible for income investing.

People should not mistakenly buy ‘growth asset’ if objective is income generation.

It is true that assets that can yield stable and high income are not many.

So as an investor, care must be taken in selecting one.

Size of Portfolio & ‘Monthly Income From Investments’

The ‘size of portfolio’ decides the level of ‘passive income’.

In above infographic, it is clearly visible how the size of investment portfolio decides ‘financially freedom’ or ‘salary dependency’.

The expense of the person 1 and 2 is Rs.100,000 per month.

- Person 1: Has an investment portfolio size of Rs.1.5 Crore. This portfolio can generate income @8% p.a. to yield a passive income of Rs.100,000 per month. As passive income is taking care of full expense requirement, hence person 1 is financially free.

- Person 2: Has an investment portfolio of size Rs.75 Lakhs. This portfolio can generate income @8% p.a. to yield a passive income of Rs.50,000 per month. As passive income is taking care of only 50% expense, hence the person is still 50% dependent on salary from job. Read more about financial planning in first job.

Quick Tip:

Visualize Investment Portfolio Like a Big Tank of water…

Investment portfolio can be imagined like a ‘big tank’ of water.

Higher is the level of water in tank, longer one can draw-out water.

- Water in tank represents assets in portfolio. Higher water level means more assets.

- Dripping water from tank represents ‘income’.

- The time for which water will continue to drip is dependent on the height of the water column inside the tank.

- In order to strengthen the asset column, investors shall keep adding income generating assets.

- Selection of right income generating options is also a key.

Conclusion

For a beginner, if the objective is to get monthly income from investment, the best starting point will be, investment in fixed deposits. Why?

First, these bank deposits are super safe. Secondly, in the backdrop of safe investment, they can also give a feel of ‘monthly income’ to its investors.

Once a person becomes comfortable with incomes coming out of FD’s the next step can be mutual fund’s MIP’s.

Select a suitable “Regular Savings Plans”. Check this for example.

Post Office MIS, Company Deposits and Government Bonds (non-cumulative) can be also be added in the portfolio with time.

For more experienced income-investors, REITs, Rental property and Annuity can be the next additions.

I hope you liked the article. In case you have any feedback/remarks please consider posting them in the comment section below.

Have a happy investing.

Hello Mani,

I can’t begin to tell you how much informative your post is to me. I am trying to be 100% dependent upon passive income a year and a quarter from now and this post of your gave me information of different kind of investment options I should opt for.

Most importantly the way you presented – with examples and diagrams was fantastic for any layman person – I understood it so clearly.

Just wanted to Thank You for all your efforts!

The logic is correct, but not mentioned about what exact assets to accumulate (stocks)

Lovely, so informative

Very nice and informative article. Finally a found a blog that covers this topic for Indians who are starting or thinking of starting their journey in investing.

Most blogs, channels, and other media houses talks about growth and equity, though it increases you net worth, but you are still dependent on the salary for most cases.

Very nice article once again, kudos.

Thank you

Thanks a lot…it was this kind of an article which I was looking for …to give me other real ideas about generating passive income … n not about posting videos, writing books/ blogs etc..which I m not good at…n will actually have to spend time on… excellent info

Excellent information , Thank you very much for writing and sharing such useful blog.

Well written Mr. Mani. Your articles changing my way of savings and planning of passive income.

Thank you

best article I’ve read about investment so far. thanks

Thanks for positing your comment.

Hi.very good explanations and basic knowledge . I want opinion from u.can I invest in safe regular saving fund in 3yrs.and do a swp for monthly income?.since equity will not safe for 3 yrs period.

Very informative ! Thanks a lot for sharing such a detailed and useful article.

Superb, new idea of monthly income to me and also that should be started from your 1st salary itself to become independent. As per above financial plan, Salaried can retire earlier too. Awasom

Super article, give me confidence to take some action

Great informatic article.Its really helpful . Waiting for your next post.

Very well written sir, I’m new in this field and it helps me a lot in clearing my doubts.

Indeed, the article is something I need these days like never before.

I’m really appreciated for this peace of work you’ve done.

Nice Article! Thanks for coming up with new articles. Really helped me a lot.

Thanks, the pleasure is all mine

what about INVITs ? IRB Invit offers a yield of 18% and Indigrid Invit offers a yield of 13% which is higher than the instruments listed here.

Yes, INVIT’s were launched before REITs in India. But the companies they represent are mainly PSU’s. Hence there are good and bad point about INVITs. For people who has appetitive for PSU’s can go for it after reading the fine print.

Thanks for your comment.

Very well written. Cleared most of the doubts. Thanks a lot for this!

Thanks for taking time to read and post the feedback.