Residual income method is a unique and a comparatively easier way to estimate intrinsic value of companies. What makes it unique is the factor called “residual income“.

I’m a big fan of valuing companies using discounted cash flow method (DCF). Why? Because if done accurately, its computed intrinsic value can be very accurate. But its problem is, its use is very intertwined with the analysts financial skill.

If the analyst is skilful, the computed intrinsic value of DCF will be closer to the ‘true value’. But if the analyst is not so skilful, intrinsic value may be far away from reality.

I also like estimating intrinsic value of companies using Net Current Asset Valuation Method (NCAVPS). This method also has a limitation. Though it is easier to compute, but it is a very stringent method.

Hence the value computed using NCAVPS is often on an exaggeratedly lower side. It is like impossible to find good companies trading at NCAVPS price levels.

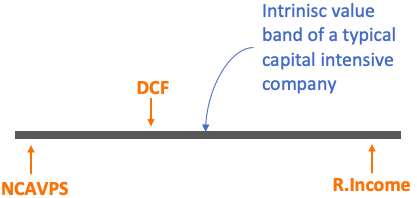

Why I like Residual Income Method is because it a good compromise between the complicated but accurate DCF model, and an easy but stringent NCPVPS model. [Check: Estimate intrinsic value in EXCEL].

Residual Income Valuation Model?

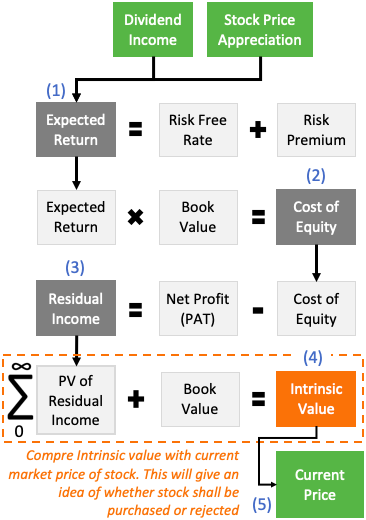

Residual income valuation model can calculate intrinsic value of a company. It does it by adding book value with “present value (PV)” of all residual incomes to be generated by the company in its lifetime (see here).

Though computations in residual income method may look complicated in the first look, but it is simple. It is simple because most of the data used in the model is picked right from the company’s financial reports. The analyst need not assume much from his/her end.

Basically there are five (5) steps that an analyst must follow in the study of intrinsic value of companies using residual income model:

Process

- Expected Returns: Before one can start the process of intrinsic value estimation, it is necessary to start on the right foot. We can do it by tuning our return expectations. We will see how this can be done.

- Cost of Equity: Estimating right return values will lead us to ‘cost of equity’. It is one of the key ingredients of residual income. Understanding the concept of cost of equity is important.

- Residual Income: It is essential to understand the concept of residual income. What we should know? What is residual income? How it is meaningful for investors? How it can help analysts to estimate intrinsic value?

- Intrinsic Value: Once we have followed all of the above three steps, calculation of intrinsic value will be easy. But what is important at this step is to convert all residual incomes calculated in step #3 to their present value.

- Compare Price: Comparing the estimated intrinsic value with current price will give an idea about stock being overvalued or undervalued. Why undervaluation check is necessary? Because undervalued stocks have a stronger tendency of future price appreciation.

We will see more about each of the above 5 steps in more detail now. This will eventually help one to execute the above 5 steps effortlessly.

Step#1: Expected Returns

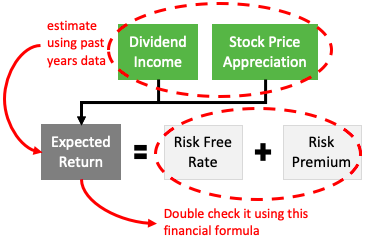

Before assuming a value of expected future returns from a stock, it is better to do some fact checks. How to do it? In two ways:

- Past Returns: First take a look into the historical return given by stock in the past years. This can be done by checking on their price growth pattern and dividend payouts. Price growth, plus dividend earning so computed, will gives a ‘total return’. Suppose a stock gave 10% p.a. total returns consistently in the past years, can duplicate the same in coming years as well.

- Double Checking: This can be done by using a financial formula. This formula can estimate the expected returns based on a risk premium that a stock must yield for its investors. Why I’m stressing on the word ‘must’? To understand this we must know something about risk premium first.

Financial Formula & Risk Premium

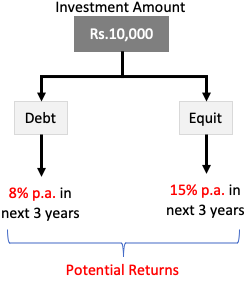

Suppose you have Rs.10,000 in your savings. You are interested to invest this money. You have two options to do it? First, in a risk-free debt scheme. Second, in a risky equity scheme. Debt scheme yield low returns and equity’s returns are high.

How to justify the decision between the two options? It has to be justified based on the return potential of the two options.

For debt schemes, returns are published by the issuer (example bank’s FD, bonds etc). But in equity (stocks, mutual funds etc), potential returns are not declared. It has to be estimated by the investors themselves.

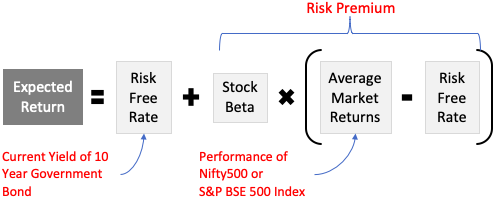

How to estimate equity’s return? By using the above formula. This is an important formula that all investors must by-heart. Why? Because it is not just a formula, it can also work as ones investment philosophy.

Let’s go back to our example of Rs.10,000 (debt vs equity) to understand the concept.

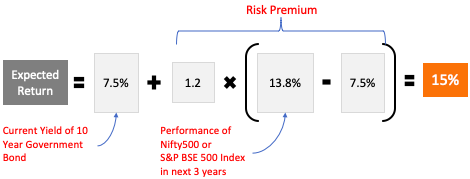

Suppose, debt based investment is able to generate 8% p.a. returns, and equity can yield 15% p.a. returns. As probability returns from equity is so high compared to debt, majority will go for equity investment. But how to know if it is reasonable to expected a 15% return from the said equity? This can be confirmed by using the below formula:

- Risk free rate = 7.5% p.a.

- Stock Beta = 1.2

- Expected Performance of Nifty500 Index: 13.8%

[P.Note: The above formula can be used to estimate expected returns from a stock. But it is also essential to know that, to earn the calculated return, it is also important to buy the equity at undervalued price levels (below its intrinsic value). Hence experts do not stop at this level. They go ahead from step #1 to step #5 to confirm if the stock is really capable of generating the expected returns or not]

Step #2 Concept of Cost of Equity

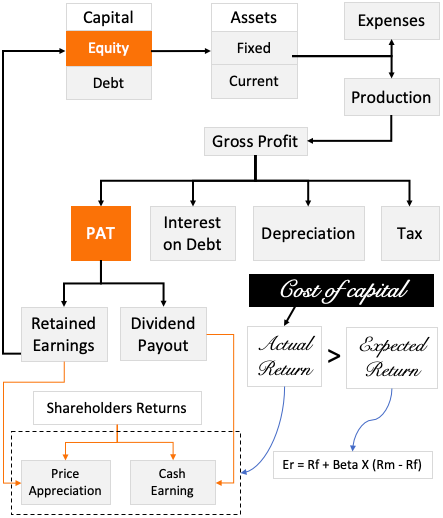

To do business, company’s need capital. There can be two forms of capital: equity and debt. Company use capital to buy assets. The assets can be fixed and of current in nature. These assets in turn helps the company to produce goods and services, thereby yielding profits (Gross/net profit).

A part of net profit (PAT) is paid to shareholders as ‘dividends’ (cash). A portion of PAT is kept by the company as “retained earnings”. Dividends are immediate returns for shareholders, while retained earnings will/must yield capital appreciation over time.

Suppose a company’s stock is yielding 1.4% as dividend yield and is also showing a 1 year price increase of 10% per annum. In this case actual cost of capital is 11.4% (1.4% + 10%). We can also call ‘actual cost of capital’ as “actual return” of the shareholders.

Good companies always try to ensure that ‘actual returns’ are always higher that the ‘expected returns’. What return is expected? It is based on the financial formula Er = Rf + Beta x (Rm-Rf) – check here.

Broadly speaking, we can say that cost of equity is a compensation that shareholders expect from the company for buying and holding on to their shares.

If the company will not ensure expected returns for extended periods, shareholders will start selling shares. This will further bring the shares price down. In this case, the company will come under the threat of hostile takeover.

Hence, though cost of capital is not an obligation for company (unlike payment of interest on debts), but good companies take it seriously (more than the debt obligation).

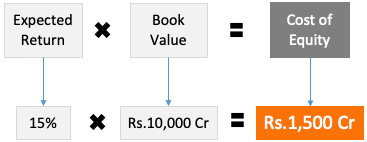

Example: Cost of equity

Suppose a company’s equity base (net worth) is say Rs.10,000 Crore. Shareholders and potential investors of the company are expecting a return of 15% per annum. In this case, the cost of equity for the company will be RS.1,500 Crore (see calculation shown below):

Step #3 Concept of Residual Income

Experts believe that in the process of valuation of a company, use of residual income is more valuable than net profit (PAT). Why? Because it is the residual income which is truly a symbolic of “owners income” (like Free Cash Flow in case of DCF valuation).

To understand this, let me narrate a hypothetical story. Suppose you have Rs.100 available for investment (to buy 100% stake in a company). You have two options in front of you – Company A and Company B. Both companies are showing Rs.12 as their net profit (PAT). How you will take the ‘buy’ decision?

- Company A: Suppose it is in a business of steel making like (JSW, Tata Steel, JSPL etc). These are extremely capital intensive business, and also face tough competition among themselves, and also from cheaper Chinese imports. Hence to keep its shareholders happy it must reinvest more capital back into the business. Thereby, out of Rs.12 PAT, at least Rs.8 must be reinvested to ensure shareholders expectations. Owners Earning = Rs.4 (12-8). Investment Yield = 4% (4/100).

- Company B: This company operates in say coal mining sector like (Coal India). They have almost a monopoly business in India and hence operates at high margins. So, to keep shareholders happy, less effort needs to be taken by the owners. Thereby, out of Rs.12 PAT, only Rs.4 can be reinvested to ensure shareholders expectations. Owners Earning = Rs.8 (12-4). Investment Yield = 8% (8/100).

So you can see that, though both companies A & B have same PAT, but inherently the company B is more profitable for its owners. How we have quantified that? By checking the residual income of the owner.

In case of company A & B, residual income was Rs.4 and Rs.8 respectively. Hence for the same cost of investment (Rs.100), company B is more profitable as an investment option.

Example: Residual Income

Suppose a company’s net profit (PAT) is Rs.1,000 Crore. Its computed cost of equity is Rs.1,500 core. In this case its residual income will be as shown below:

This is an example of a company which has posted a healthy net profit of Rs.1,000 crore but displays a negative residual income. Intrinsic value of such companies gets substantially reduced.

Step #4 Intrinsic Value

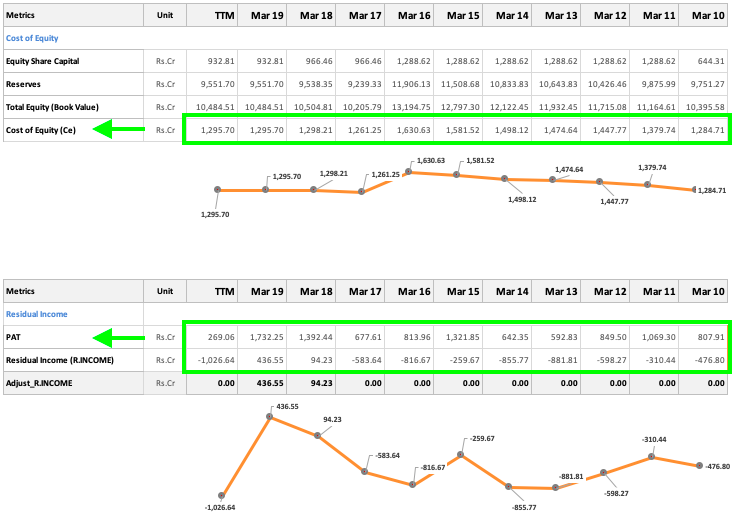

Till now what we have done from step #1 to step#3 is to find a way to estimate residual Income of a company. Using these 3 steps we must calculate the ‘residual income’ for a particular year. But in order to estimate residual income accurately, study of residual income pattern of last 10 years is advisable.

Below you can see the screenshot of my stock analysis worksheet. What is visible here is the residual income pattern of an Indian stock. You can see that though the stock has consistently posted positive net profit (PAT) numbers, but its residual income is mostly negative.

Once the pattern of last 10 years residual income is known, we can try to estimate the residual income of the company for its remaining years (in future). How to do it? This can be done by calculating the present value of all residual income which is going to yield in times to come.

Once these values are known, it must be discounted suitably to calculate their present value. You can also use my stock analysis worksheet to get these calculations done automatically.

P.Note: You can also learn in detail about ‘present value’ estimation by going through this article. It explains in detail how to estimate present value of all future free cash flows of a company. The same analogy can be used to calculate present value of all future residual incomes.

Once the ‘present value of residual income’ is known, we can use the below formula to calculate the intrinsic value of stock.

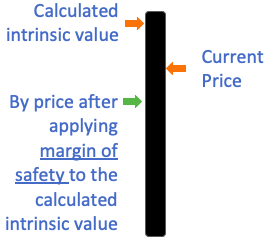

Step #5 Compare: Price with Intrinsic Value & Margin of Safety

Price comparison is an important step because it acts as a final checker.

No intrinsic value estimation is fool proof. Why? Because estimation of intrinsic value is done based on assumptions of what is going to happen in future. How we make those assumptions? By looking at the past. But often, past cannot guarantee the future.

Hence application of margin of safety on the estimated intrinsic value is essential. For me a suitable margin of safety (MOS) is not one hard number (like one third-rule). It is better to apply MOS differently from company to company.

If I’m dealing with proven companies like ONGC, GAIL, HDFC Bank, Pidilite, Cummins, Siemens, TCS, HUL etc, I can go ahead even with a smaller margin of safety. Check a list of blue chip stocks.

An unknown company, would also demand a higher factor of safety. Which company is unknown? That company about which we know less. What we must know about a company? Knowledge about its products, services, business model, cash flows, past years performances, quality of management etc must be known before buying its stocks.

Moreover, I would also like to see the quality of residual Income so calculated. A wavering net profit (PAT) makes the calculated value less dependable. Hence, a higher margin of safety will be necessary.

Limitation of Residual Income Method

Generally, intrinsic value computed using this method gives higher number for capital intensive companies. Why? Because of the factor “book value” in its intrinsic value formula. Even if residual income is zero, a company will still be valued at its book value.

For large companies which already has a big asset base, book value is often a large number. This eventually puts a big number in front of intrinsic value.

But suppose that this company has been starting to produce negative profits in last 2 or 3 years. These negative numbers may not start to reflect (dominantly) in the intrinsic value so early. There is a chance that the investor might land-up buying this stock and then in later years, feel the burnt of the decision.

So what is the solution? It is always better to follow NCAVPS, DCF Model etc along with residual income method to gauge a company’s intrinsic value.

When using the Residual Income model the final step involves adding the Present Value to the Book value. The number that will result will be large in comparison to the price of the stock. Do I divide it by the number of shares outstanding or is there another way to arrive at a number that can be compared to the price of the stock

I liked your hard work which you put in arriving at the concepts by preparing and analysing ( in fact having invested your own values of time,effort and money ) so many documents/papers/magazines/texts.

I really liked very much the lucidity you maintained in presenting the concepts/crux in this blog

for persons like me came out from barren lands( who walked a long and very very recently thinking to enter into share-the investment-platform ).

Only one thing is STILL the FATE IS MAINTAINING THE STILLNESS . So liking heartfully the phrase you said ‘FINANCIAL INDEPENDENCE ‘ em mm mmmmmm no you really EXPERIENCED , PALNNED TO ACHIEVE , SATISFYING YOURSELF WITH THE SATISFACTIONS COMING OUT OF YOUR SERVICE-WHICH-YOU-ARE-DELIVERING-NOW, THE CONTENT/KNOWLEDGE YOU OBTAINED. THANKS A LOT , YOU ARE ONE AMONG MANY RIGHT PERSONS/ATMAS THE GREAT GOD HAS GIVEN TO ME AS PURE-BREATHING/LIVING ASSETS.