ROCE (Return on Capital Employed) is a financial ratio. ROCE formula has two components, EBIT and Capital Employed. EBIT represents the profit, and Capital Employed represents the funds used to generate the profit.

The ratio between EBIT and Capital Employed shows how much profit is being generated for every Rupee of the employed capital. The higher is the ratio, the more efficiently the capital is employed to yield profits.

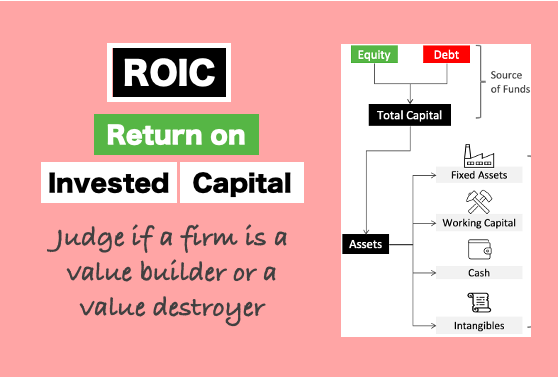

A similar ratio like ROCE is ROIC. In this article, we see how ROCE is different from ROIC. I’ve written a detailed article on ROIC (Return on Invested Capital). I’ll suggest you kindly read that piece as well.

People draw parallels between ROCE and ROE (Return on Equity). Some think that ROE is a superior financial ratio for shareholders. We will also touch upon this topic. For some companies, the use of ROCE is advisable over ROE. However, I personally use both ROCE and ROE in tandem. Looking both at a time builds a better perspective (read here).

ROCE Formula

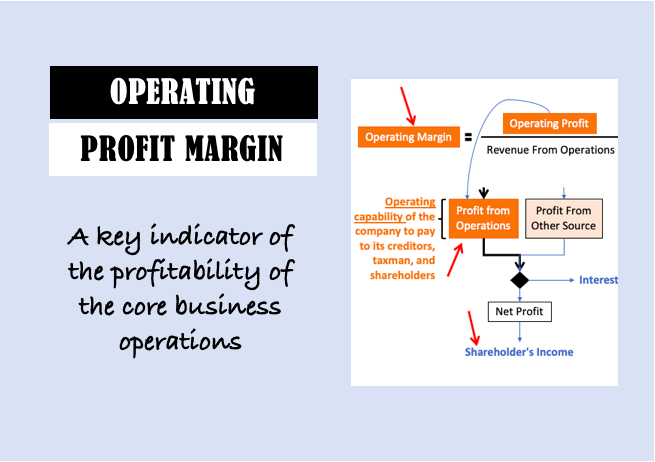

EBIT used in the ROCE formula represents profit generated by the company. In common corporate finance terms, EBIT is also referred to as operating income. But EBIT is actually not operating income. Why? To read more about operating income, please check my post on operating profit margin.

For the moment, let’s settle with EBIT being operating income. To calculate EBIT, the best way is to first open a P&L account. Scroll down to the bottom where you will find mention of net profit, tax, and interest. Use these numbers to calculate EBIT.

EBIT = Net Profit (PAT) + Interest + Tax

Significance of the use of EBIT over PAT in ROCE Formula.

EBIT represents a portion of the profit that’s available to serve the long-term investors of a company.

Who are long-term investors? Shareholders are for sure long-term investors. The company’s borrowers (like banks, NBFC’s), who have issued long-duration loans are also long-term investors.

What portion of profit (EBIT) is available to the investors?

Net profit (PAT) is for the shareholders. Interests due on loans are for the borrowers. The tax dues of the company are for the government.

In the ROCE formula, as the component in the denominator is capital employed, hence use of EBIT in the numerator is more apt. Why? Because it serves all long-term investors. We will get this answer in the next section of this post.

Capital Employed

It represents a fund, that is used by the company to generate profits. In terms of formula, we can represent Capital Employed in the following three (3) ways.

Formula #1

The most used formula of capital employed is total assets minus current liabilities. we’ll discuss this formula very quickly.

A company uses its source of funds (total capital) to build assets. All built assets have a purpose to generate profits. So we can say that the size of the total asset is the employed capital.

But we have to consider a thing. A portion of the total asset must be kept aside as a provision to manage current liabilities. Why? Because non-payment of current liabilities will lead to insolvency. Hence, this provisioned fund cannot be considered as employed capital.

Formula #2 (Source of Fund Side)

Capital employed can also be represented as shareholder’s funds plus non-current liabilities.

- Shareholder’s fund is the money sourced from all shareholders. These funds are specifically collected for the long-term growth of the company. So, it is an ideal example of capital employed.

- Non-current liabilities are mainly that portion of the borrowed money (also account payables) that is not due for payment in the next 12 months. In finance terms, it is also an employed capital.

Formula #3 (Asset Side)

I personally like this formula of capital employed. It is a more visible representation of employed capital.

- Tangible assets include all fixed assets also denoted as property, plant, and equipment (PP&E).

- Intangible assets that ultimately lead to sales and profits for a company will also come under the head of employed capital. Examples of intangibles are brand names, patents, etc.

- Working capital is the portion of the current asset that is available for deployment in times to come. If you’ll like to know more about the concept of working capital, I’ll request you to kindly follow the link.

Why EBIT is used in the numerator of ROCE Formula

We have seen three iterations of the employed capital formula. It gives us an idea of the quantum of the employed capital versus the total capital. For example, if a typical company’s total capital is 100, then its employed capital will be about 75-90. So, we can say that the extent of the employed fund is wide.

If we will consider formula #2, the employed fund is equal to shareholder’s funds plus non-current liabilities.

It means, the capital base includes the funds collected from the shareholders and long-term borrowers. This is the value that goes into the denominator of the ROCE formula.

To cater to this wide capital base, the profit number that must be used for comparison must also have a wide scope. It must cater to the needs of both shareholders and borrowers.

In the EBIT section above, we have seen how the component of EBIT caters to the needs of shareholders, borrowers, and the government.

Hence EBIT is the most suitable metric to be used in the numerator of the ROCE formula as compared to PAT (Net Profit).

ROCE Calculation – Example

We’ll take the example of three companies operating in the same sector/industry. I’ve considered three ball-bearing suppliers of India. We will do the ROCE analysis of these three companies.

| Description | Schaeffler | SKF | Timken | |

| Net Profit (PAT) | A | 290.97 | 297.73 | 143.18 |

| Interest | B | 5.24 | 2.13 | 1.44 |

| Tax | C | 106.24 | 98.56 | 51.88 |

| EBIT | D=A+B+C | 402.45 | 398.42 | 196.50 |

| Total Assets | E | 4,151.43 | 2,302.65 | 1,888.49 |

| Current Liabilities | F | 911.88 | 693.11 | 437.27 |

| Capital Employed | G=E-F | 3,239.55 | 1,609.54 | 1,451.22 |

| ROCE | D/G | 12.42% | 24.75% | 13.54% |

In terms of EBIT, Schaeffler and SKF are almost of the same size. Timken India is significantly smaller in comparison. In terms of total assets, Schaeffler is almost double in size that of SKF and Timken. The total assets of SKF and Timken are similar.

For investors, the size is of less importance than the efficiency of a company. How to measure the efficiency of a company?

- First, quantify the profit-generating capacity of the company. In this case, we’ve quantified profit in terms of EBIT.

- Second, estimate how much capital is employed by the company to generate profit.

- Third, the measure of efficiency will be the ratio between profit and the capital employed (ROCE).

In the above three example companies, though Schaeffler is bigger in size, its efficiency is the least. SKFs are the most efficient with a ROCE of 24.75%. Timken’s ROCE is 13.54% Scheffler’s has 12.42%.

Difference Between ROCE and ROIC

Both ROCE and ROIC evaluate the capital-utilizing efficiency of a company. Conceptually they do the same thing. To better understand it, let’s compare them in a table format.

| Description | ROCE | ROIC |

| What is its use? | It compares profit with the employed capital | It compare profit with the invested capital |

| Formula | Profit / employed caital | Profit / invested capital |

Now, the difference between ROCE and ROIC comes in its constituents. What they consider as “profit” and the “capital in use” makes them different. Let’s see the components of a ROCE and ROIC as a formula in the below table:

| Description | ROCE | ROIC |

| Profit | EBIT | NOPAT |

| Capital in Use | Total Asset – Current Liability | Fixed Asset + Intangibles + Working Capital – Cash |

| Formula | EBIT / (Total Asset – Current Liability) | NOPAT / (Fixed Asset + Intangibles + Working Capital – Cash) |

Two things make ROCE and ROIC different:

- Profit: ROIC considers NOPAT as profit. NOPAT better represents the profit-generating capability of a company. How? Because only operating revenue is considered for the calculation of profit. Other incomes of the P&L account are not considered for calculation. To know more about NOPAT, please check the link.

- Capital in Use: In formula #2 of ROCE, employed capital is PP&E + Intangibles + Working Capital. In ROIC, the formula for invested capital will be PP&E + Intangibles + Working Capital – Cash. The cash lays idle in the bank account, it is not capital in use. To know more about invested capital, please check the link.

ROIC calculation is more detailed than ROCE. Hence people may find ROIC more complicated. But ROIC is also more accurate than ROCE. I personally used both the numbers; both serve their purpose.

ROCE vs ROE

Both these metrics are a measure of a company’s capital efficiency. It means, they highlight how well the company uses its funds (capital). But ROCE gives a better measure of a company’s profitability than ROE. How?

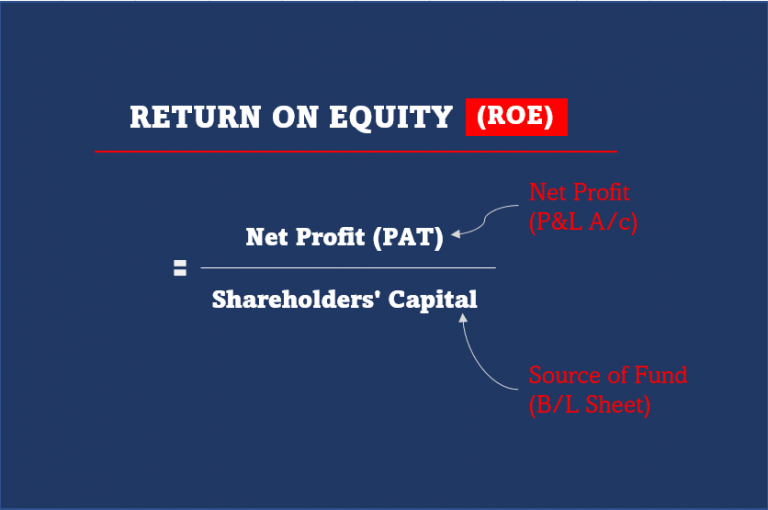

- ROE: Return on Equity (ROE) is a measure of how much net profit a company is making for every invested Rupee of shareholders’ money. ROE highlights the profitability from the point of view of shareholders only. But a high ROE does not necessarily mean that the overall business is also highly profitable.

- ROCE: Return on Capital Employed (ROCE) is a measure of how much EBIT a company is making for every Rupee of the employed capital. ROCE highlights the profitability of the overall business. High ROCE invariably means that the business is profitable. But there are limitations. We will see how.

High ROE is an essential metric for shareholders. But high ROCE benefits a wider audience. How?

When EBIT is high, Government will collect more tax. Borrowers are assured that their loans will be paid back. Shareholders are assured of returns (dividend, appreciation, or both).

So for a prospective stock investor – looking at a combination of ROE and ROCE is better.

But which is a superior metric for stock evaluation? For companies that keep their debt levels to zero, for them ROE is a better metric.

But for capital-intensive companies, ROCE is a better metric to evaluate profitability. Debt becomes a large component of the total capital. Hence, it becomes essential to include debt in evaluating its capital efficiency.

For companies that have excess cash, for such companies, ROIC will be a better metric than ROE and ROCE.

What is a Good ROCE number?

There is no absolute number for ROCE which is considered good. Why? Because ROCE is different for different business models. We cannot compare the ROCE of companies operating in different industries. It will not be fair to compare the ROCE of a product-based company with a service-based company.

So how to evaluate if a ROCE is good or not?

- WACC: The bigger the difference between WACC (Weighted Average Cost of Capital) and ROCE the better. Suppose a company’s WACC is 10% per annum. For me, a ROCE of 14% or higher will be ideal. So, an absolute way of knowing if a ROCE is good or not must be compared with the company’s WACC.

- Similar Companies: We can compare the ROCE of our company with other companies in the same industry (like we did above). The company with a higher ROCE is better.

- Industry: One can also compare the ROCE of a company with the average ROCE of its industry. If the company’s ROCE is higher than that of the industry’s, it is good. You can check this article to get an idea about the ROCE of various industries.

- Cost of Equity & Debt: A good ROCE number can also be estimated by considering interest rates offered on debt to companies. Suppose a company gets debt at 8% per annum from a bank. To pay back this debt, the company must generate a minimum return on capital of 8%. Furthermore, the profit must also serve the shareholder’s interest. Suppose the company decided to ensure a shareholder’s return of 12% per annum. Hence the desired return on capital will be the weighted average of 8% (debt load), and 12% (equity load). If the calculated ROCE is greater than the average, it is good.

Conclusion

How a layman can compare two business models? How to know which is superior? There are many variables in deciding a suitable business model. But the first step must be profitability analysis. What is profitability analysis?

Suppose you want to start a business and you have two alternatives on hand. The first option will yield a profit of Rs.10 for every Rs.100 invested in it. The second option will yield a profit of Rs.15 for every Rs.100. This comparison clearly points out that the second business model is more profitable.

Conceptually, the ROCE analysis brings forth the same conclusion as in the above example.

Great article sir. I just wanted to understand what the impact on ROCE / ROE would be for a company with accumulated losses (i.e. negative reserves and surplus)?

When returns are falling (EBIT and PAT), it will negatively effect ROCE and ROE (they will also fall).

Negative reserves and surplus will make ROE irrelevant.

Negative reserves and surplus can make ROCE artificially very high. Hence, it is always better to see the following metrics all together:

– Income Growth

– Profit Growth

– Reserves Growth

– ROE trend, and

– ROCE trend

It is also better to keep an eye on the trend of the “net cash flow of operations.”

Thanks for the response! So in that case should we exclude accumulated losses while computing the ROCE?

Markets have become cheaper and foolish people are saying to stay away from markets now.

Thanks to this blog which educates the opposite i.e. Buy on dips.

Valuable information explained in a very simplified manner that any naive investor could understand..

Nicely explained with an example in a simplified way. It is easy to understand for any person who is new to this concept. It will definitely helpful for stock analysis.

Thanks for clearing my doubt

SIR IN ROE FORMULA YOU ARE INDICATING

ROE=NET PROFIT/EQUITY (ACTUALLY ITS EPS)

BUT IN CALCULATION YOU ARE SHOWING

ROE=NET PROFIT/(EQUITY+RESERVES) (I THINK ITS CORRECT)

Equity means = Share Capital + Reserves

ROE = Net Profit / Equity

EPS OR ROE IS SAME OR DIFFERENT

FOR CALCULATING ROE FORMULA U MENTIONED THE SHARE HOLDER EQUITY. IS IT DIFFERENT FROM TOTAL EQUITY OF COMPANY.

Both are same. Thanks for asking.

Hi, I am very fresher in stock market. During lockdown I have started investment in shares. The reason is low bank FD interest. When I was searching in Google regarding various investment plans, find this website. After reading your articles my view on stock market is totally changed. Now I have a good portfolio and still learning a lot day by day. Thanks.

Awesome. Keep going please. Thanks.

good explanation Mr mani

nutshell roce and roe should be close to 25 and roce >roe

am i right

It’s just my rule of thumb. Ya right.

I admire the valuable information you offer in your articles. I will bookmark your blog and I am quite sure they will learn lots of new stuff here than anybody else!Thank you

Dear Mr. Mani . Excellent article. I want to know this ROCE is applicable for finance companies and banks? Please clarify

Any company which has a total capital break-up between Equity and debt will have RoCE. Bank’s, NBFC’s, financial institutions have RoCE. Among them, commercial banks has the lowest RoCE and Fintech’s will have the highest. Why? Because of the nature of banking business. Read more about the business model of banks.

DEAR MANI SIR,

I AM GLAD TO WRITE THIS COMMENT. I READ MANY ARTICLES ON VALUE INVESTING. I APPRECIATE YOU FOR SHARING A VALUABLE INFORMATION. I COULD NOT KEEP QUIET AFTER READING YOUR ARTICLE. I HOPE YOU ARE WELL FINANCIAL ADVISOR. I TRY TO INVEST IN STOCK MARKET WITH MY LIMITED RESOURCES. I REQUEST YOU TO GUIDE ME FOR BETTER INVESTING PORTFOLIO. I AM MUCH THANKFUL TO YOU IF YOU PROVIDE ME YOUR E-MAIL ADDRESS TO RESOLVE MY QUERIES.

REGARDS.

Thanks for your comment. I’m glad that you liked my work.

I am just a blogger who shares ideas (self learnings) about investment.

I am not a financial advisor.

Please keep reading and posting your views.

Mani sir, Himanshu have a point here seems. From the calculations you made later part of this article, it is apparant titles of ROE/ROCE in the top table got interchanged,

SL Name ROE ROCE

1 Grasim 2.98% 3.95%

I think there is an error in this post. You are checking ROE>ROCE, but give examples(Nestle and Grasim) where ROCE>ROE.

Sorry but there is no error. I will advice you to read the full article to see the point. Thanks for putting your comment.