Share buybacks have emerged as a powerful tool for Indian companies to optimize their balance sheet and improve shareholder value. In this article, we explore the ins and outs of share buybacks and their impact on the financial health of Indian companies.

Investors can potentially benefit from participating in a share buyback. When a company buys back its own shares, it increases the value of the remaining shares. The existing shareholders can either participate by selling their shares or can also continue holding. It is important for investors to thoroughly evaluate the details of the share buyback to decide about participating or holding.

Let’s know more details about the buyback.

Introduction

Share buybacks are an alternative way, to dividend payment, for companies to return capital to their shareholders. A share buyback is a process by which a company repurchases its own shares from the open market. The concept of share buybacks is also common in India. Several companies announce buybacks in order to improve shareholder value.

For example, in Oct-2022, Bajaj Auto announced a share buyback of about 64 lakh number shares from the public. The quantum of this buyback was about Rs.2,500 crore. The average buyback price was about Rs.3900 per share.

This article will cover a range of topics on the subject of share buybacks in India. We’ll also touch base on regulatory frameworks, types of buyback, benefits & drawbacks, among other points.

Share buybacks are a powerful tool for companies to optimally use the available capital to enhance shareholders’ value. This article will provide a comprehensive overview of share buybacks in India. It will equip its readers with the knowledge and insights they need to make informed decisions about their investments in Indian companies.

Regulatory Framework for Share Buybacks in India

The legal and regulatory framework for share buybacks in India is governed primarily by the Companies Act of 2013. It is also regulated by the SEBI’s Buyback of Securities Regulations of 2018. These regulations are necessary to ensure transparency and fairness in the buyback process and to protect the interests of shareholders.

Why regulation is necessary?

It helps to protect the interests of shareholders, particularly minority shareholders. It prevents any misuse of funds by the company. Here are some examples that illustrate the need for regulation of shares buyback:

- Preventing misuse of funds: Without proper regulation, companies may use the funds meant for buyback for other purposes. These funds can be used to make acquisitions or invest in unrelated businesses. This can harm the interests of shareholders who were expecting a buyback.

- Protecting minority shareholders: Share buybacks can sometimes benefit majority shareholders more than minority shareholders. Companies sometimes structure buybacks in a way that benefits certain shareholders. For example, the company may offer to buy back only preference shares. It will benefit only one group of shareholders over others.

- Ensuring transparency: The regulation requires companies to disclose all relevant information before executing the buyback. The disclosure can be like the number of shares to be bought back, the maximum offer price, the duration of the offer, and the maximum amount to be spent on the buyback.

Conditions of the Share Buybacks

Under the Companies Act, a company can buy back its own shares subject to certain conditions.

Some of the conditions on shares buyback issued by SEBI are these:

- AOA: The buyback should be authorized by its Articles of Association (AOA).

- Public Announcement: Companies must make a public announcement of their buyback proposal. The disclosure should contain necessary details, such as the number of shares to be bought back, the offer price, the duration of the offer, and the maximum amount to be spent on the buyback.

- Maximum Limit: The total amount of buyback should not exceed 25% of the aggregate of its paid-up share capital and free reserves.

- Source of Funds: Companies are allowed to buy back shares only from their free reserves, securities premium account, or proceeds of any shares or securities sold by the company.

- Lock-in Period: Companies are not allowed to make any offer of buyback within a period of one year from the date of the closure of the preceding buyback.

- Duration Limitation: Companies are required to complete the buyback process within a maximum period of six months from the date of the public announcement.

- Post Buyback Declaration: Companies must disclose the details of the buyback in their annual reports, along with the reasons for the buyback and the sources of funding.

- Merchant Bank: Companies must appoint a merchant banker to oversee the buyback process, and to disclose details of the buyback in their annual reports.

- Future Fund Raise: Companies engaging in the buyback of shares are not allowed to raise funds for a period of one year from the date of completion of the buyback.

Types of Share Buybacks

There are three main types of share buybacks. Let’s discuss each one here.

- Open Market Buyback: Here the company buys back its own shares from the open market over a period of time. In this type of buyback, the company does not specify a fixed price or quantity of shares to be bought back. Instead, they purchase shares at prevailing market prices. The advantage is that it provides flexibility to the company to buy back shares at a lower price gradually over time. However, the disadvantage of this type of buyback is that it can take longer to complete and may not achieve the desired impact on the company’s stock price.

- Tender Offer Buyback: Here the company offers to buy back a fixed number of shares at a fixed price from its shareholders within a specified period. This type of buyback provides certainty to shareholders regarding the price and quantity of shares to be bought back. It can result in a quick and significant increase in the company’s stock price. Its disadvantage is that the company may end up paying a higher price for the shares than it would have through an open market buyback.

- Hybrid Buyback: It is a combination of the open market and tender offer buyback. In this type of buyback, the company specifies a maximum price and quantity of shares to be bought back. The company can then buy back shares through a combination of open market purchases and a tender offer. This type of buyback is flexible. However, the disadvantage is that it can be more complex and at times more expensive to execute.

Why do Companies Choose To Buyback Their Shares?

Companies may choose to undertake share buybacks for a variety of reasons. Let’s see some of the reasons:

- Shareholders Value: Share buybacks are a way for companies to return capital to their shareholders by reducing the number of outstanding shares. This can result in an increase in the value of the remaining shares.

- Financial Ratios Improvement: Share buybacks can improve financial ratios such as earnings per share (EPS) and return on equity (ROE) by reducing the number of shares outstanding.

- Prevents Hostile Takeovers: Shares buyback is a way to increase the shareholding of the promoters. Hence, by reducing the number of shares outstanding, a company can make itself a less attractive target for a hostile takeover.

- Show of Confidence: A share buyback can signal to the market that a company is confident about its future prospects. Buyback is a way to display to the market that the company has enough cash available for investment.

- Offsets Dilution: When a company issues new shares for employee stock options or other purposes, it can dilute the value of existing shares. A share buyback is a way for companies to offset this dilution.

- Take advantage of undervaluation: If a company believes that its shares are undervalued, it can buy back shares to support the stock price. It is an opportunity for the company to increase its shareholding at a minimum cost.

The Process of Share Buyback

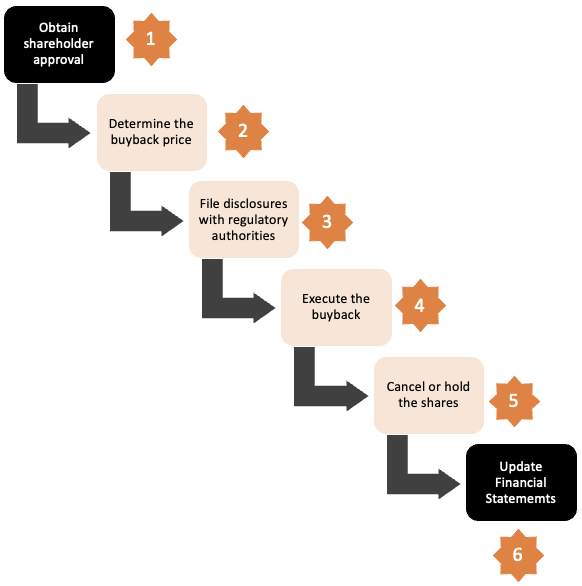

The process of executing a share buyback involves several steps. Let’s discuss each step in their logical order:

- Step#1: Shareholders’ Approval: A company must obtain shareholder approval before executing a share buyback. This is typically done through a special resolution passed at a general meeting of shareholders. The resolution will specify the maximum amount of shares that can be bought back. It must also include the maximum buyback price and its period of execution.

- Step#2: Determining the buyback price: The buyback price is usually determined based on the highest price that the company is willing to pay to buy back the shares. The price determination can also be done based on the bids received from shareholders (book building). The company can also use financial ratios like the price-to-earnings (P/E) ratio etc, or the DCF method to determine the price.

- Step#3: Make the buyback: The company can make the buyback either through a tender offer or through open market operations. In a tender offer, shareholders are invited to offer to sell their shares at a specified price. The company will then buy back shares from those shareholders who have offered to sell at or below the specified price. In open market operations, the company will buy back shares from the market at the prevailing market price.

- Step#4: Cancel the shares: Once the shares are bought back, the company must cancel them. This reduces the number of outstanding shares and increases the ownership percentage of the remaining shareholders.

- Step#5: Disclose the buyback: As per SEBI regulations, the company must disclose the details of the buyback within two working days from the date of the closure of the buyback offer. The disclosure must be made to the listed exchange like NSE and BSE.

Benefits & Drawbacks of Share Buybacks For Companies & Shareholders

Share buybacks have the potential to offer several benefits and drawbacks for both companies and shareholders. As an investor, we must be aware of these factors because they will help us build a perspective about buybacks. Sometimes, these buybacks are only gimmicks played by weak companies to flare up the demand for their shares. But more often, they indicate a potential for higher future returns for their shareholders.

Let’s look at the advantage and disadvantages of buybacks from the eyes of a company and a shareholder.

Benefits for companies:

- Improved financial ratios: Share buybacks can improve key financial ratios such as earnings per share (EPS), return on equity (ROE), and return on assets (ROA). This is because the buyback reduces the number of outstanding shares, which increases the earnings per share and the ownership percentage of remaining shareholders.

- Flexible capital management: Buyback is a way for companies to return excess retained earnings back to the shareholders. An alternative way of looking at it is, post-buyback the shareholder equity decreases. Hence, the debt-to-equity (D/E) will increase. A profitable company, that is also leveraged, indicates that the cost of capital of the company is low.

- Signal to the market: Share buybacks act like a signal to the market that the company’s management believes that the stock is undervalued. Hence this action can boost investor confidence and potentially increase the share price.

Drawbacks for companies:

- Opportunity cost: Share buybacks require the company to spend cash that could be used for other purposes such as investment in new projects or acquisitions. A company that requires heavy cash inflow for their CPAEX or working capital needs, if such companies opt for buy-back they are either fooling themselves or the investors. They are missing the opportunity to use the cash for urgent needs.

- Short-term focus: There are companies that are not so cash-rich, but they still opt for share buybacks. They do it only with a short-term focus on boosting share prices at the expense of long-term growth. Buyback method may tempt companies loose the long term focus.

Benefits for shareholders:

- Increased ownership percentage: Share buybacks increase the ownership percentage of remaining shareholders as the number of outstanding shares decreases.

- Potential for capital gains: Share buybacks can increase the share price as the demand for the remaining shares may increase due to a reduced supply.

- Alternative To Dividends: Share buybacks can be looked at as an alternative to dividend payments. Here the shareholders do not get cash, but the benefit of assured long-term capital appreciation. Of course, for weak companies, this rule will not apply.

Drawbacks for shareholders:

- Decreased liquidity: Suppose there is a company, like MRF or Berkshire Hathaway, whose shares outstanding in the market are already too low. If such companies do buybacks, the shares outstanding will further fall. It will make it difficult for existing shareholders to sell their shares.

- Uncertainty About Growth: A company that has the potential to grow, will use its cash to fund CAPEX and working capital demands. If a company is spending on buybacks, it is a hint to the shareholders that the future growth prospects are uncertain. The majority shareholders would pick fast future growth as their priority.

- Missing The Right Exit: There are a lot of shareholders who hold on to their shares even during buybacks. They do it with an expectation of future growth. Recently in Feb’23, Paytm completed its buyback worth Rs.850 crores. Many investors sold their shares and booked profits. Suppose, Paytm’s business did not do as expected and its shares continue to slide further down. Those investors, who did not sell Paytm’s shares in the buyback would lose even more money, right? Buybacks provide a good opportunity for the shareholders to exit a bad company.

Case Study

Bajaj Auto: In July 2022, Bajaj Auto announced buyback details wherein they will spend about Rs.2500 crores at a maximum price of Rs 4,600 per share. The buyback was completed in Oct 2022. In Mar 2022, the company reported an EPS of Rs.173.6. In Dec 2022, their EPS (TTM) was Rs.207. This is an EPS growth of 18.9%.

Paytm: In Feb 2023, Paytm completed its shares buyback worth Rs.850 crores. The average cost of purchase of each share was Rs 545.93. As per the disclosure of the company, the shares were bought back in the price band of Rs.480 to Rs.702. The company is still making losses. Hence, for many experts, it was a surprise that the company used its cash for the buyback. Though, Paytm tried to give the impression that at the current price levels, its shares are undervalued.

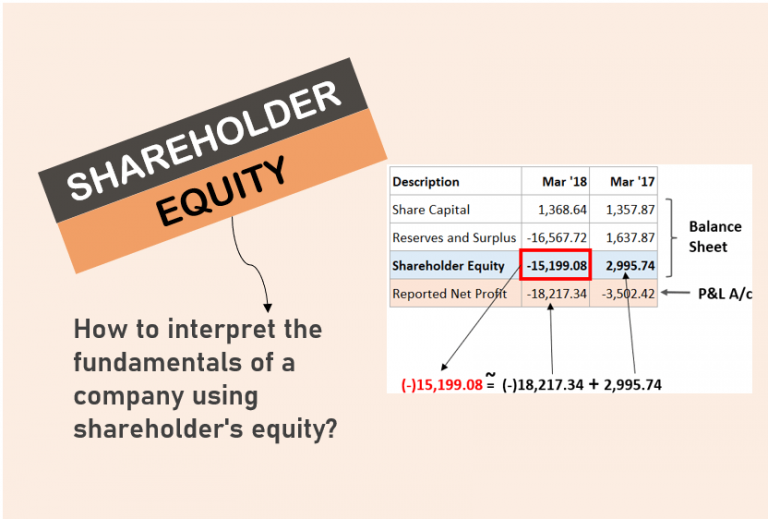

How are Share Buybacks Accounted for?

When a company buys back its own shares, it reduces the number of outstanding shares. As a result, it reduces the equity on its balance sheet. The accounting treatment for share buybacks depends on whether the company purchases the shares in the open market or through a tender offer.

Let’s take an example of a hypothetical company ABC Ltd, which has decided to undertake a share buyback through both an open market offer and a tender offer.

- For the open market offer, ABC Ltd buys back shares from the stock market at prevailing market prices. The shares bought back are first canceled. Then, the amount paid for those shares is debited to the company’s retained earnings account in the balance sheet.

- In the case of a tender offer, once the tender offer closes, ABC Ltd buys back the shares from the shareholders who tendered their shares. The same accounting treatment is followed as in the case of an open market offer.

Let’s say a company buys back 10,000 shares at Rs. 100 each, for a total cost of Rs. 10 lakhs. The company would first record a reduction in the share capital of Rs. 10 lakhs. Then, it’ll also record a reduction in the company’s cash or cash equivalent account of the same amount.

The treasury shares (10,000 shares) would be recorded as a contra-equity account on the balance sheet, which means it would be subtracted from the company’s total equity.

Conclusion

Share buybacks have become an increasingly popular strategy for companies to optimize their capital structure, improve financial performance, and enhance shareholder value.

There are potential benefits and drawbacks associated with share buybacks. Companies must carefully weigh their options and consider the impact on stakeholders before implementing a buyback program.

With the appropriate regulatory framework and oversight, share buybacks can be an effective tool for companies to manage their finances and support long-term growth.

FAQs

Generally, a share buyback can increase the earnings per share (EPS) and Return on Equity (ROE) of the company. This boosts investor confidence, potentially leading to an increase in share price. But of course, there are exceptions. For weaker companies, the positive effect of a buyback may not last long.

No, as a shareholder, you are not obligated to sell your shares in a buyback. If your company announces a share buyback, you have the option to either participate in the buyback or hold on to your shares

A company can buy back any of its outstanding shares, including common shares, preferred shares, or other classes of shares that the company may have issued. However, the company must adhere to the regulations of the SEBI.

Share buybacks can provide several benefits. The immediate benefit is the increase in earnings per share. It also improves financial ratios such as P/E and ROE thereby enhancing shareholder value. It also helps to support stock price stability.

Ideally speaking, a share buyback can increase shareholder value by reducing the number of outstanding shares and increasing earnings per share. This potentially boosts the stock price.

![How To Build A Winning Stock Portfolio [India]](https://ourwealthinsights.com/wp-content/uploads/2010/06/Stock-Portfolio-Image.png)