The purpose of this article is to share my point of view on the concept of shareholder value. The piece is written from the perspective of an investor. For an investor, a company that is managed with the goal of enhancing the shareholder’s value is a good company. But it is also necessary to check if the company is using business-friendly methods to achieve the goal. Else, a total focus only on the shareholders may become detrimental to the business itself. For quick answers, read the FAQs.

Introduction

Shareholder value means what? It is the value delivered to the shareholders of the company during the course of their holding period. How is the value delivery ensured by the company? It is done by making business-friendly decisions that eventually translate into increased shareholder value.

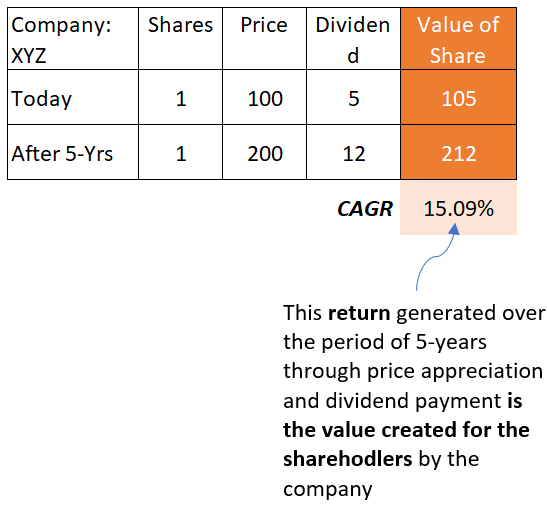

The objective of a good company should be shareholder value creation. To know if a company is a value creator or not, one must know how to quantify value creation. It can be done using simple mathematics. Let’s understand it using a hypothetical example.

- Current Status: Suppose there is a company called XYZ whose current share price is Rs.100. It also pays a dividend of Rs.5 per share. At this point in time, each share of the company is valued at Rs.105 per share (100+5).

- After 5 Years: The share price rises to Rs.200 and the dividend is Rs.12 per share. Hence, the shareholder value appreciates to Rs.212 per share (200+12).

- Value Creation: In these five years, the share value has appreciated at the rate of 15.09% per annum. This is how the company created value for its shareholders in 5 years.

Inference

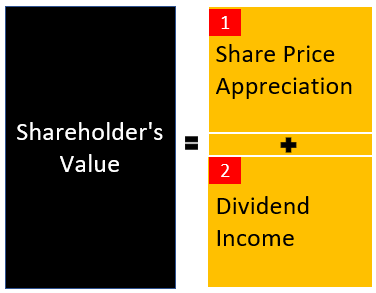

What do shareholders expect from their holding companies? They expect to be compensated by the way of dividend payments and/or at least decent price appreciation of the stock. When companies make decisions that enable their shareholders to earn more by way of dividends and price appreciation, the company is creating value for them.

So, there are two components of shareholder value, share price, and dividend.

Video [Hindi]

This video explains the concept of sustainable shareholder value creation. There are companies that on the surface may look shareholder-friendly, but their underlying business practice is not complimentary. The video explains a good business practice that creates value for all stakeholders.

Sustainable Shareholder Value Creation

Value creation for the shareholders will be sustainable only when it is yielding from good business practices. Incorrect business practices may lead to value creation in the short term but will be unsustainable. Hence, it is essential for companies to focus on good and efficient business practices. If that is implemented, shareholder value creation will happen automatically as a byproduct.

What is Good and efficient business practice?

- Good Business Practice: the top management of a company should focus primarily on sustainable value creation for all stakeholders of the company. Who are the stakeholders? It includes majority & minority shareholders, lenders, employees, suppliers, and the society in which the company operates. Read more.

- Efficient Business Practice: Efficient use of the company’s resources, especially capital, so that the return on capital (ROC) is high enough to cater to the needs of all stakeholders. Read more.

Good Business Practice

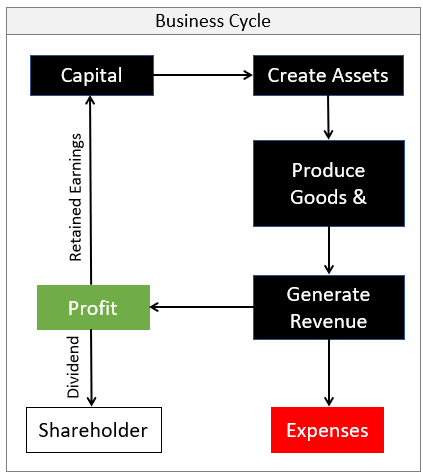

What is a good business practice? It is one where the company is passionately focused on production of goods and services to render complete customer satisfaction.

Good companies implement it by using their capital resource to build new and efficient asset bases. These assets in turn produce improved goods and services for the company. These products are then sold to customers to earn a consistent revenue and profits.

The revenues so generated is large enough to meet all expense needs of the company and yield a handsome profit.

What is a handsome profit? It is profit big enough render value to both shareholders and debtors. How? This is what we’ll read in the next section, efficient business practice.

The Takeaway: A good business practice is one where the company is channeling its capital for asset creation. The asset creation is done by expanding or modernizing the operating capabilities of the company. Funding the company’s working capital another way of asset creation that benefits the company in the forthcoming quarters.

Efficient Business Practice

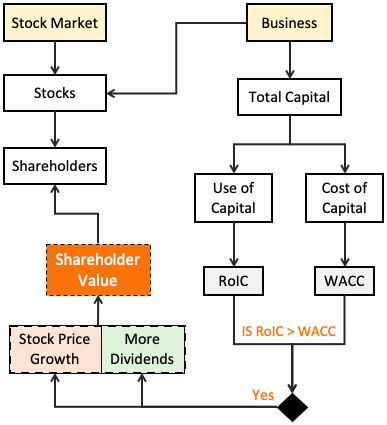

A business is efficient when it generates returns higher than its cost of capital. How to quantify it? By comparing WACC with ROIC. Let’s start with WACC.

WACC

WACC is the Weighted average Cost of Capital.

- Cost of Equity (Ce): Shareholders expect returns for the risk they are taking. The returns can be in the form of dividends and a decent capital appreciation. The expectation of shareholders is what builds the cost of equity. Though the company is not obliged to meet the expectations, they do it anyway. Why? If shareholders are not obliged with at least decent returns, the demand of shares will continue to fall.

- Cost of Debt (Cd): Companies also borrow money from banks/NBFCs in the form of loans. The interest paid by the company on the loan is the cost of debt.

The sum total of the cost of equity and the cost of debt is the cost of capital.

A efficient business practice is where the total capital is efficiently used to generates returns higher than its cost of capital. The return can be measured in the form of return of assets (ROA), return of capital employed (ROCE), or Return on Invested Capital (ROIC). I prefer the use of ROIC.

Companies that can keep their RoIC higher than WACC, can be tagged as an efficient company.

How To Enhance Shareholder’s Value

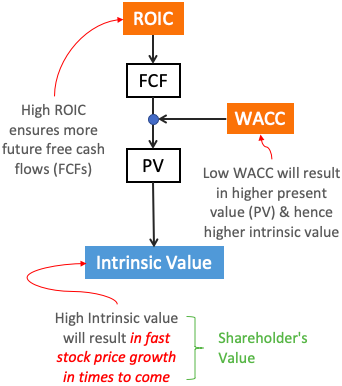

Good companies tries to enhance shareholder’s value by maximizing ROIC and minimizing the cost of capital (WACC).

Both ROIC and WACC affects the intrinsic value of a company (stock). How? To answer this, let’s first know a basic about the ‘intrinsic value.’

The present value (PV) of all future free cash flows (FCF) that a company will generate in its lifetime will give us its intrinsic value.

A company that has a higher ROIC has more capital that can be reinvested back into the business (Net profit minus dividend). This helps the company to expand and modernize its facility more efficiently (at a low cost). Such businesses tend to produce more future free cash flows.

WACC is a product of the cost of capital and the cost of debt. Keeping WACC low is not easy for companies. Companies have the least control over their cost of debt. Why? Because banks and lending institutions decide the interest rates on loans.

Even less can be done by the company to lower its cost of equity. Why? Because shareholder’s expectations decide the cost of equity. What the company can do best is to keep its ROIC as high as possible. That itself will take care of the shareholder’s expectations.

High FCF and a reasonable WACC will result in a high present value of future cash flows. This eventually means a high intrinsic value. A company whose intrinsic value is ever-increasing, preferably beating inflation, becomes an automatic value creator for the shareholders.

Conclusion

What is the easiest way to check if a company in consideration has a focus on shareholder value or not?

There will be two steps to it:

- First: Check if the company’s ROIC and ROCE are higher than WACC. For companies that do not have this, are actually value destroyers. I would personally stay away from them till they’ve amended their profitability numbers. See this video for details.

- Second: Check the company’s Return on Equity (ROE). But we must not stop with only one year ROE. It is important to understand the trend. Calculate Return on Equity (ROE) of the last 10 years. If the trend in last 10 years is increasing, it is a clear hint of improving shareholders value.

This is also true, a company that focuses only on shareholder value might not do well. The focus of good companies is on all stakeholders. Who are the stakeholders? Customers, employees, suppliers, and investors. In fact, a company whose customers, employees, and suppliers are satisfied, that itself will take care of the investors’ expectations (shareholder’s value).

FAQs

The value of one share is a sum of its current share price and dividend per share. To estimate the shareholder value creation in a period, we can use a simple method. Suppose value of a share, five years back, was Rs.105 (Price Rs.100 plus dividend Rs.5/share). Today, the value of this share is Rs.200 (200+Rs.12/share). In 5-years, the value of a share rose from Rs.105 to Rs.212. Check this example.

Shareholder value is the value of one share of a company to its holder. How is the value quantified? Value of a share = Current Share Price + Dividend Per Share. One of the priority of the company is to keep increasing the value of their shares over time. It is called shareholder value creation. It is done by implementing good and efficient business practices. Read about it here.

Shareholder value is a sum total of share price and dividend per share. But an investor must not limit their understanding to share price or dividend alone. The focus must be on how the company is managing its business to ensure share price growth and dividend growth.

Good and efficient business practice drives shareholder value. A good business practice is the use of capital to create an asset base that eventually produce more goods and services. An efficient business practice us the use of capital in a way that the return on capital (ROIC) is higher than the cost of capital (WACC). Asset creation and efficiency of capital in combination drives shareholder value.

As usual…informative but lucid. Thanks.Audio not working in the Video.

very informative article Mani sir. I get value from your article. I always enjoy reading your article. i like your way of explanation through flow diagram.

Nice and Very detailed explanation.

Very informative article. Thanks Mani

Thank you