The stock market for beginners can be intimidating and confusing. This article will serve as your guide to stock investing. It’ll provide an overview of key concepts like fundamental analysis, portfolio diversification, and risk management. With the right mindset and strategies, investing in the stock market can provide significant returns over the long term.

What is a stock market?

The stock market is an integral part of the global financial system. In all developed economies, the stock market is a key contributor to their rise. In India, the stock market plays a crucial role in the country’s economy. It serves as a platform for businesses to raise capital. It also allows the investors to invest in the listed companies and earn returns.

The stock market is a marketplace where shares of publicly listed companies are bought and sold. A share market is like a vegetable market. Just like how one can buy and sell different types of vegetables, in a share market, one can buy and sell shares of other companies. Just like how the prices of vegetables fluctuate based on supply and demand, the prices of shares also fluctuate. The price fluctuation is driven mainly by the performance of the company and the demand for the share in the stock market.

“The stock market is a place where you can buy a small piece of ownership in a company. By owning shares, you have a stake in the success of that company, and if it does well, the value of your shares can go up, allowing you to earn a profit.”

– Karen Ford, Financial Coach and Author

India has two main stock exchanges, the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). The shares of companies are traded on NSE and BSE. The stock market in India offers its investors a range of investment options, from blue-chip stocks to new IPOs.

Video

What is the difference between a stock market and a stock exchange?

The terms “stock market” and “stock exchange” are often used interchangeably, but they are actually slightly different:

| Stock Market | Stock Exchange |

|---|---|

| Refers to the overall system that facilitates buying and selling of securities | Refers to a specific platform where securities are bought and sold |

| Includes all institutions, companies, and mechanisms that enable securities trading to take place | Provides a centralized location for buyers and sellers to trade securities |

| – | Examples include NSE, BSE, NYSE, NASDAQ |

| Can have multiple stock exchanges operating within it | Can be part of a broader stock market, or operate independently |

| Generally, used in a broader context when referring to securities trading | Generally, used in a narrower context when referring to securities trading |

What is a stock (a share)?

A stock, also known as a share or equity, is a unit of ownership of a company. The stocks of listed companies trade in the stock market.

When a company wants to raise funds for growth, it can do so by selling ownership in the company in the form of shares. In return, investors purchase these shares to become part-owners of the company. These investors then become entitled for a portion in the company’s profits.

“A share of a company represents ownership in the company. When you buy a share, you become a part-owner and have a stake in the company’s growth and success. Owning shares of companies can be a great way to build wealth over time and participate in the growth of the economy.”

– Ravi Subramanian, Managing Director and CEO, Shriram City Union Finance,

A stock represents a fraction of ownership in the company and can be bought and sold on stock exchanges. A share is like a slice of pizza. When you buy a slice of pizza, you own a small part of the entire pizza. Similarly, when you buy a share, you own a small part of the company.

The price of a stock (share) can change every second. The factors that cause this change can be the company’s financial performance, market conditions, etc. Generally speaking, if the company performs well and its profits increase, the value of its stock will go up and vice versa.

A few examples of known stocks in India are Reliance, TCS, Infosys, HDFC Bank, etc.

How much return can be earned from the stock market?

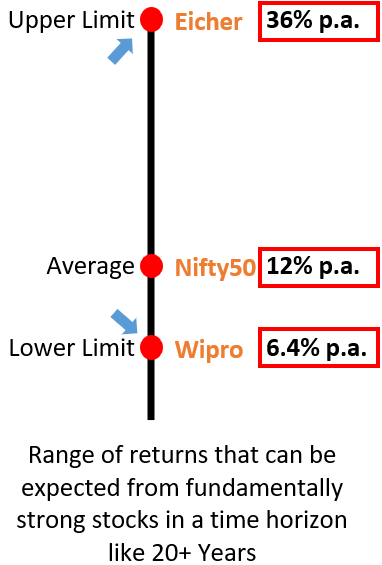

We must remember the return potential of the stock market as a range and not as a specific number. So allow me to take three examples, that will help us to establish of range of returns possible from stocks. We’ll consider the performance of the Nifty50 index, Eicher Motors, and Wipro between January 2001 and March 2023.

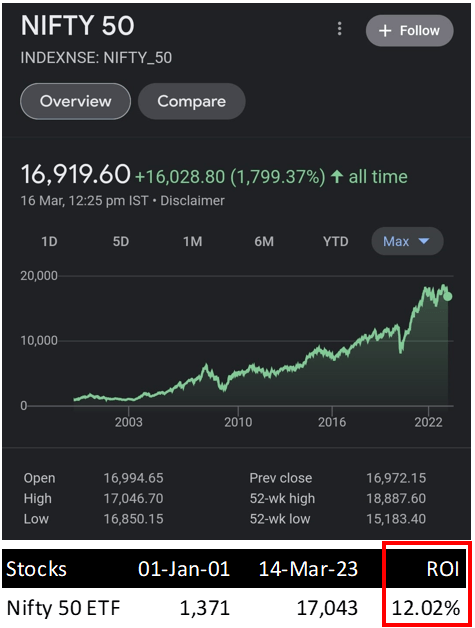

Nifty 50 Index

During this period, the Nifty50 index, which represents the performance of the top 50 companies listed on the National Stock Exchange (NSE) of India, has delivered a CAGR return of approximately 12.02%. This means that if an investor had invested Rs.10,000 in the Nifty50 index in January 2001, their investment would have grown to approximately Rs.1,24,311 by March 2023 (in 22-Years)

This is an example of an average return that the Indian stock market can potentially earn for its investors in a time horizon of about 22 years. If one does not want to take the risks, following a mere index investing approach can fetch a return of 12% per annum in India.

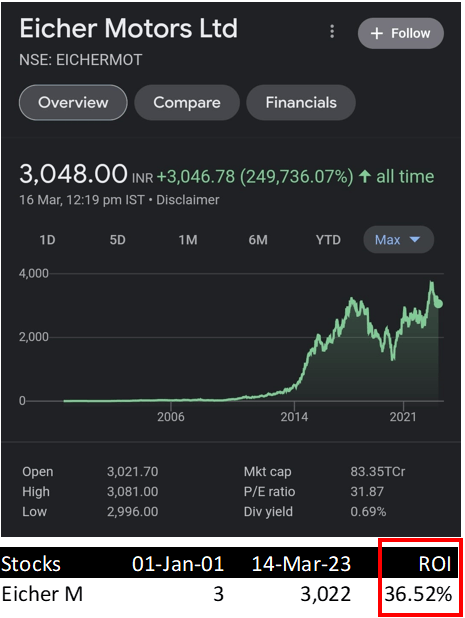

Eicher Motors

Eicher Motors, a well-known Indian automobile manufacturer, has delivered even stronger returns over this period. A CAGR growth rate of approximately 36.52% was observed in this stock. If an investor had invested Rs.10,000 in Eicher Motors in January 2001, their investment would have grown to approximately Rs. 1.01 crores by March 2023.

This is an example of the upper limit of the return that the Indian stock market can potentially earn for its investors in a time horizon of about 22 years.

Eicher motors is a present-day blue chip stock that has shown phenomenal growth in the last 22 years. For me, it is a benchmark of return that one can earn from individual stocks.

Wipro

Wipro, a leading Indian IT services company, has delivered only modest returns over this period. The CAGR growth of Wipro is approximately 6.39%. If an investor had invested Rs.10,000 in Wipro in January 2001, the investment would have grown to approximately Rs.39,500 by March 2023.

This is an example of the lower limit of the return that the Indian stock market can potentially earn for its investors in a time horizon of about 22 years.

Why I am considering 6% as the lower limit? Surely, some fundamentally weaker stocks would have given even lower returns than this, but we are not considering those stocks. We are figuring out the range of return good stocks can give in the long term. Hence, I’m considering Wipro as an example of the lower limit.

These three examples help me to figure out the range of returns, average, lower limit, and upper limit of returns possible from the stock market.

“Over a long period of time, Indian equities have generated a CAGR return of around 15-16%, which is much higher than returns from other asset classes such as fixed deposits, gold or real estate. However, returns from the stock market are not guaranteed and can vary significantly depending on market conditions and individual stock performance.”

– Saurabh Mukherjea, Founder and CIO of Marcellus Investment Managers

How to buy and sell stocks in India?

Buying and selling stocks online in India has become quite simple and convenient. Here’s a step-by-step guide on how to get started:

- Open a Trading and Demat Account: To buy and sell stocks, you’ll need to open a trading account and a Demat account. Both accounts can be opened with brokerage houses like ICICI Securities, HDFC Securities, Axis Direct, Zerodha, Upstox, etc. It is possible to open these accounts online upon submission of documents.

- Requirements to Open the Account: To open a trading and Demat account, you’ll need to provide some basic personal and financial details, like your PAN card, Aadhaar card, bank account details, and in some case income proof.

- Need for a Savings Account: In addition to the trading and Demat accounts, you’ll also need a savings account with a bank. All transactions related to buying and selling stocks are settled through this account.

Once the trading account is active, one can log into the trading platform to place buy and sell orders for stocks. These accounts also can be used to track the portfolio, view stock quotes, etc.

Whenever one buys shares, they are credited to one’s Demat account. Whenever shares are sold, they are debited from one’s Demat account. This eliminates the need for physical share certificates and simplifies the process of trading and accounting for the shares transactions.

How much money can be made from the stock market?

To make money in the stock market, it is essential to build an investment portfolio of fundamentally strong stocks. Once the right stocks are identified, one must keep buying those stocks at every available opportunity. It is also essential to hold stocks for a very long term to benefit from the power of compounding.

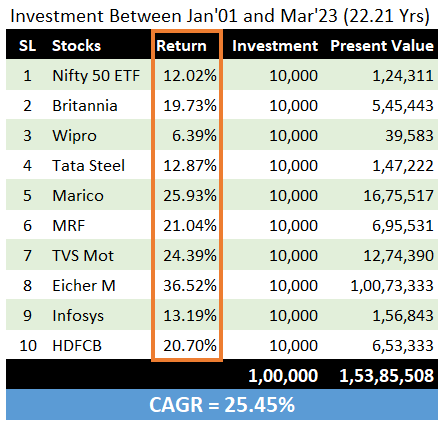

Allow me to give you an example to quantify how much money can be made from stocks. Consider a collection of ten stocks.

A person bought these stocks in January’2001. He invested Rs.10,000 in each of these ten stocks. So, in total, he invested Rs.1,00,000 in the year 2001. After purchasing these stocks, he also went on to hold these stocks for the next 22 years (till March 2023).

In these 22 years, the investment amount of Rs.1.0 Lakhs appreciated and went on to become Rs.1.53 Crores. This happened at an average annualized growth rate (CAGR) of 25.45% per annum.

So, if the question is how much money can be made from the stock market, it can convert the Rs.1 lakhs into Rs.1.53 crore in 22 years. But the conditions are mainly three, buy strong stocks, keep the portfolio sufficiently diversified, and hold the stocks for a couple of decades.

Which stocks shall be picked for investing?

When it comes to picking stocks for investing, there are several factors that one should consider.

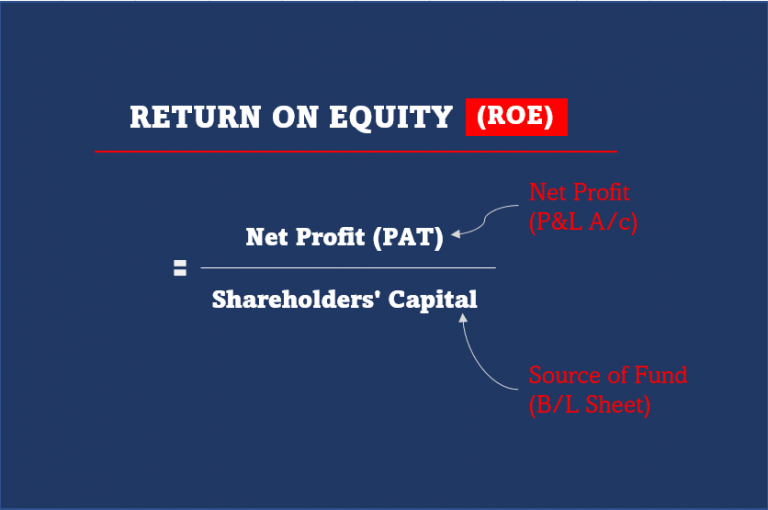

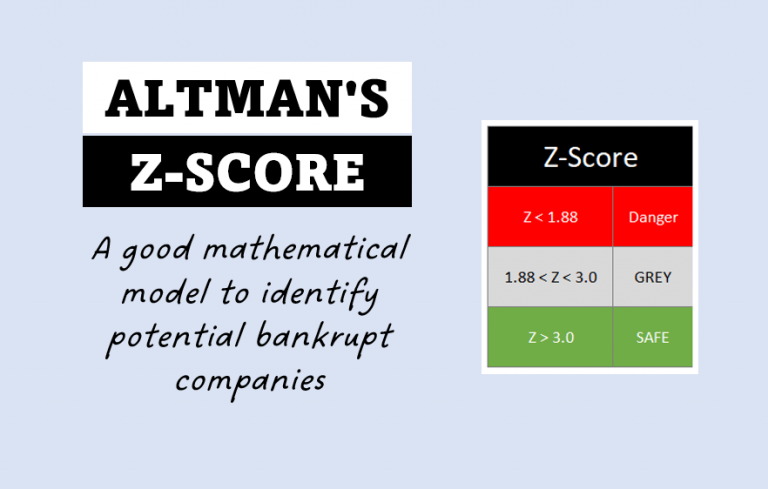

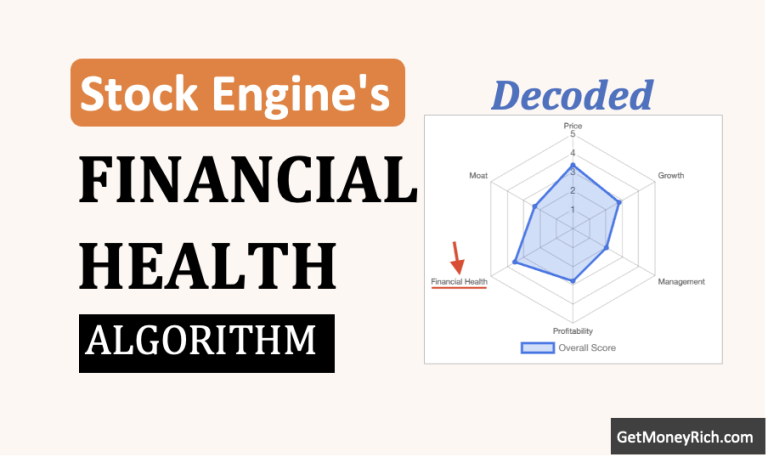

Fundamental analysis is one such factor that plays a crucial role in making investment decisions. It involves analyzing the financial health of the company and its future prospects. This can be done by reading and interpreting the company’s financial reports, such as balance sheets, profit & loss accounts, and cash flow statements.

By doing so, one can assess the company’s revenue, profits, debt levels, cash flows, and other financial ratios that can provide a better understanding of the company’s financial health.

Value investing philosophy is also essential in stock picking. This approach involves identifying undervalued companies whose current stock price does not reflect their true value. By investing in such companies, one can benefit from the potential price appreciation when the market realizes their true worth.

Picking stocks for investing requires a thorough analysis of the company’s fundamentals and a long-term investment horizon.

“Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

– Warren Buffett

This quote emphasizes the importance of buying quality stocks, that remain undervalued by the market.

He also said, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

– Warren Buffett

This quote highlights the need to focus on the fundamentals of the company rather than just looking for cheap stocks.

How much money shall be invested in the stock market?

There is no dearth of money that can be invested in the stock market. But even small-small investments can help big a big corpus over time.

In this example, we will use a philosophy of a step-up SIP. In a step-up SIP, the investor increases the SIP amount by a fixed percentage at regular intervals.

Let’s take an example of an investor who starts with a SIP of Rs.1000 per month and increases it by 10% every year for 30 years, with an assumed return of 15% per annum.

Here’s how the investment would grow over time:

- In the first year, the investor invests Rs.12,000 (12 months x Rs.1000 per month).

- In the second year, the investor increases the SIP amount by 10% to Rs.1100 per month and invests Rs.13,200 (12 months x Rs.1100 per month).

- This process continues for the next 28 years, with the SIP amount increasing by 10% every year.

- At the end of 30 years, the total investment made by the investor would be Rs.15.98 lakh.

- With an assumed return of 15% per annum, the investment would grow to a corpus of approximately Rs.1.67 crore (use this step-up SIP calculator).

This example demonstrates that even starting with a relatively small amount like Rs.1000 per month, and gradually increasing it over time, can lead to a significant corpus in the long run. It also highlights the power of compounding, where the returns earned on the initial investment are reinvested to generate additional returns.

The key to successful investing in the stock market is to have a long-term perspective and a disciplined approach to investing, regardless of the amount invested.

What are the risks of investing in the stock market?

Here are the risks of investing in the stock market that one should be aware of:

- Market risk: The stock market can be volatile and unpredictable. Hence, investments can lose value due to changes in the overall market conditions. It is important to realize that, the market can cause change even if the underlying fundamentals of your stocks remain unaltered. For example, during the COVID-19 pandemic, stock prices of even the best companies fell sharply as investors were worried about the impact of the pandemic.

- Company-specific risk: This risk is associated with a particular company’s performance. For example, a company may underperform due to poor management, product recalls, or declining sales. A share will underperform if its business itself is weak. For example, in 2018, Jet Airways’ stock prices fell sharply after the company faced financial difficulties.

- Liquidity risk: Not all stocks are traded in enough quantity. Some stocks have low trading volumes and are not easily bought or sold. This makes it difficult for investors to sell their shares quickly when needed. For instance, if a person invests in penny stocks, they might have difficulty selling their shares quickly because of low trading volumes.

- Inflation risk: Inflation can erode the value of stocks over time. For example, if a person invests in stocks that don’t keep up with inflation, their investments might not be able to keep pace with the cost of living. It will ultimately result in a loss of purchasing power over time.

- Geopolitical Risk: The stock market can be affected by events such as recessions, wars, natural disasters, and changes in government policies. For example, the Russia-Ukraine war has most negatively affected these two countries along with other economies of the world.

How to reduce the risk of investing in the stock market?

Investing in the stock market is always associated with a risk of loss. But there are ways to reduce that risk.

Here are some of the ways to reduce the risk of investing in the stock market:

- Investing only in fundamentally strong companies: Analyzing the fundamentals of a company means the study of its revenues, profits, debts, and other factors. Including fundamentally strong stocks can reduce the risk of loss due to a sudden fall in the stock price. For example, the stocks of strong companies like TCS and HDFC Bank will correct comparatively less when market nosedives.

- Not selling when the market is bearish: The stock market is volatile, and it’s common to see sudden drops in the market. However, it’s important to avoid panic selling during such times. By holding onto your investments, you can wait for the market to recover and get better returns in the long run. For example, people who held on to their strong stocks in the COVID-19 crash witnessed huge gains later.

- Diversification of investment portfolio: Diversification involves investing in different types of stocks across various sectors, industries, and asset classes. By diversifying your investment portfolio, you can reduce the risk of loss due to a downturn in a specific sector or industry. For example, instead of investing all your money in one company or sector, you can diversify your portfolio by investing in companies from different sectors like banking, technology, pharma, etc. It will also be good to invest in REITs, Gold ETFs, and Bank deposits to diversify further.

As Peter Lynch, an American investor, and mutual fund manager, said: “Diversification is a protection against ignorance. It makes little sense if you know what you are doing.”

Whether to invest in mutual funds or stocks?

Investing in stocks and mutual funds are two different ways of investing in the stock market. Stocks are individual company shares that are bought and sold in the stock market, while mutual funds are a collection of stocks or bonds managed by professional fund managers.

When it comes to choosing between stocks and mutual funds, it depends on the individual’s preference for the investment style.

- Stock investing requires a deeper understanding of the market and individual companies. It requires an analysis of financial statements, market trends, and economic indicators to make informed investment decisions. Timing the entry and exit from stock is also important, as stocks can be highly volatile and subject to market fluctuations.

- On the other hand, mutual funds offer a more diversified approach to investing. By investing in a variety of stocks or bonds, a mutual fund can reduce the risks associated with investing in individual stocks. Additionally, mutual funds are managed by professional fund managers who have the expertise to make informed investment decisions on behalf of investors. Read more about shares vs mutual funds.

However, mutual funds charge a management fee for their services, which can reduce the overall returns earned by investors. Mutual funds also have restrictions on when investors can buy or sell shares, which can limit the flexibility of investment decisions.

Stock vs Mutual Funds Comparison

| Stocks | Mutual Funds |

|---|---|

| Ownership of a single company’s stock | Ownership of a basket of multiple company’s stocks |

| Higher potential for returns, but also a higher risk | Lower risk due to diversification, but the lower potential for returns |

| Requires more knowledge and research | Less knowledge and research required |

| Requires more time and effort for monitoring | Professional management of funds, no monitoring required |

| Flexibility to buy and sell at any time | Liquidity may be limited due to redemption rules |

| Direct control over investment decisions | Decisions are made by professional fund managers |

| Lower transaction cost | The overall cost is high due to the expense ratio |

| Higher potential for capital gains and losses | Lower potential for capital gains and losses |

Conclusion

The stock market can be a lucrative investment option for beginners. However, it is important to understand the risks associated with it and follow a disciplined approach to investing. Before investing, beginners should educate themselves about the basics of the stock market and the different investment options available, including stocks and mutual funds.

One of the most important factors in stock investing is fundamental analysis. Investors should look for companies with strong financial performance, good management, and growth potential.

A long-term investment approach, with a focus on holding strong stocks for several years, can also be beneficial.

Diversification of the portfolio is another key factor to reduce the risk of investment. A well-diversified portfolio can help balance the risks and returns.

Investing in mutual funds can also be a good option for beginners who don’t have the time or expertise to analyze stocks.

Selling stocks is also an important part of investing. Investors should sell weak stocks that are underperforming or have no potential for growth. However, strong stocks can be held for a longer duration, preferably 10-15 years.

Final Words

“In the short term, the stock market is a voting machine. In the long term, it’s a weighing machine.”

– Warren Buffett

This means that in the short term, stock prices can be influenced by market sentiment and speculation, but in the long term, the true value of a company will be reflected in its stock price. Therefore, it’s important to invest for the long term and focus on fundamentals when choosing stocks or mutual funds for investment.

Have a happy investing.

I found great pleasure in reading your thoughtful blog article. The views and concepts you expressed were tremendously useful.