It’s been more than a decade since the 2008 financial crisis – originated in the USA. Since then, there have been several publications pointing at the causes of the crisis. The most common cause is assigned to ‘subprime mortgage’.Subprime mortgage refers to Mortgage Backed Securities (MBS), but of a very special category. We will read more about why I’m referring to it as very special.

It was “Lew Ranieri” who first coined the theory of securitization of mortgages. This eventually led to the formation of our modern-day mortgage-backed securities. So first blame for the crisis must be on him. 🙂

In theory, Lew Ranieri can be blamed. But practically there were a series of mistakes, ignorances, and malpractices that eventually led to the global crisis.

In this article, we will try to discuss the chain of activities that gave birth to subprime mortgages, which in turn caused the 2008 financial crisis.

Allow me to explain the events in a sequential manner.

Topics

- Subprime Mortgage.

- 1. About Mortgage.

- 2. Involvement of Investment Banks.

- 3. Need for Mortgage-Backed Security (MBS).

- 4. How Investment Banks Made Money?

- 5. How Investors of MBS Made Money?

- 6. Over Demand for MBS.

- 7. Collateralised Debt Obligations (CDOs).

- 8. Booming Real Estate Market.

- 9. Role of Other Agencies (Credit Rating, Insurance).

- 10. Why People were Taking Loans?

- 11. Bursting of The Housing Bubble.

- 12. More Bad Loans.

- 13. What Big Investors Did…

- 14. Recession Arrived.

Subprime Mortgage

To understand what is a subprime mortgage, it is essential to know the scheme of things about how the mortgage business operates in the US. Once we are clear about this flow – we can pinpoint & understand the root cause of the crisis.

A subprime mortgage is the root cause. But it is also important to appreciate the ripple effect caused by the subprime mortgage, which eventually led to the 2008 financial crisis.

Here are a few terms (concepts) explained in brief, which is necessary to remember to understand the enormity of subprime mortgage.

The Terms

- Mortgage: It is a loan taken from a bank to buy a house. It is an agreement between homebuyers and banks. The homebuyer agrees to pay back money to the bank over time. The payback will be the principal amount plus interest. Till such time, the ‘house’ remains as a lien with the borrower.

- Banks: There are two types of banks which are involved. First, are the retail banks that lend money to the borrowers. The second type is the investment banks to whom, the retail banks eventually sell the loans. We’ll read more about this in this article.

- Bonds: These are fixed income, risk-free investment options. They can generate very predictable returns. Why? Because they are backed by US Treasury Department. But on the downside, their yields are low. A few examples of it are treasury bonds etc.

- Mortgage-Backed Security (MBS): These are like bonds. Their shares are also traded in the secondary market. But the only difference is that they pose a bigger risk of loss (compared to government bonds). Hence, to compensate for this risk, they offer higher returns.

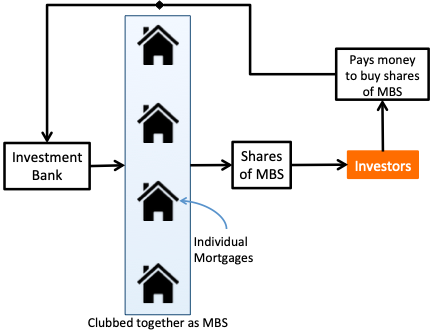

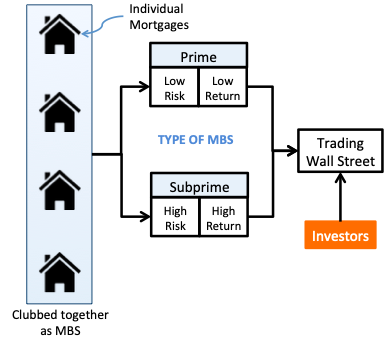

- What is MBS: All mortgages bought by investment banks are clubbed together, and an MBS is formed. What is MBS? It is a financial instrument whose assets are loan agreements. Why it is called an asset? Because loans generate income in form of monthly payments – which the borrowers regularly pay to the bank.

- Types of MBS: The way mortgages are clubbed, gives birth to different types of MBSs. For example, one type of MBS will include those mortgages whose borrowers’ profile has a credit score above 720 (prime borrowers). Another MBS may be formed whose credit profile is below 700.

- Investment in MBS: MBS shares are traded in the secondary market. Interested people can buy and sell shares of MBS (like stocks). There will be some investors who will buy only MBS>720. There will be some investors who are willing to take more risks and will even buy MBS<700. Why? Because in normal times, riskier investments can fetch higher returns.

- Subprime mortgage: Those Mortgage Backed Securities whose borrower’s risk profile is too low (for example MBS < 650) are classified as a subprime mortgage.

- Loan for everyone: In an MBS-backed mortgage market, anyone can get a loan. Suppose there is an MBS whose borrower’s risk profile is below 650. In traditional banking, people with scores below 650 will not get a loan. But in the MBS market, even these people can get a loan – till this MBS’s shares have buyers on Wall Street.

Now with these concepts known to us, we are ready to listen to the story about the cause of the 2008 financial crisis. This story will explain in simple language the sequence of reasons which led the U.S. economy to the 2008 financial crisis

1. About Mortgages

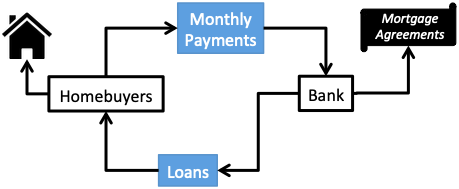

People seeking to buy homes, approach retail banks and ask for a loan. The loan application is filled out and submitted to the bank.

These banks in turn check the credentials of the borrower. If the borrower pays their minimum criteria, the loan will be issued.

A person who has a steady job/business, a high income, and a good credit score (like above FICO 720) will get a loan easily and at a lower interest rate compared to others.

People with lower FICO scores may not get a loan. They also might get a loan, but for them, the criteria will be stringent – like larger downpayment, higher interest rates, shorter loan duration, etc.

But here also the banks will have a bare minimum criterion. If a person is not falling within these criterias, he/she can forget about the loan.

2. Involvement of Investment Banks

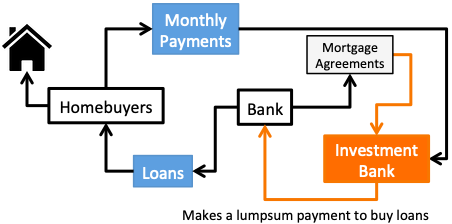

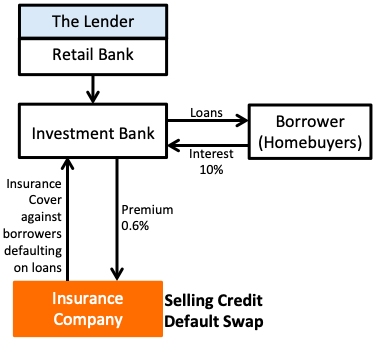

In traditional banking, there are only two agencies dealing with loans – borrower and lender (homebuyer and retail bank). But in the year-2000s, a third party got involved – investment banks.

These investment banks started buying the “mortgage agreements” from the retail banks. This way, they became entitled to receive the monthly payments from the borrowers.

The role of retail banks became substantially marginalised. Their responsibility was limited to issuance of loan only. After this step, their job was to sell the loans to investment banks. Period.

Henceforth, it was investment banks who became the holder of the mortgage agreements.

Why retail banks sold the loans? Because this way, their balance sheet had zero liability, and only cash assets (received from the investment bank).

Why investment banks bought loans? To use them as Mortgage-Backed Security (MBS).

3. Need for Mortgage Backed Security (MBS)

In the year-2000s, the yield of government back securities (like treasury bonds) was very low. All risk-free, fixed-income instruments were yielding very low returns. Hence bankers were busy inventing a low-risk, high-return investment option. This gave rise to mortgage-backed security (MBS).

As MBS had ‘mortgage loans’ as their assets, it was considered safe. At a time when treasury bills were yielding less than 3.5% returns, MBS could promise 5-6% fixed returns.

4. How investment banks made money?

Investment banks bought loans from retail banks. Several such mortgages were clubbed together to form a Mortgage Backed Security (MBS). This MBS was valued based on its future income potential.

What is the future income of MBS? Monthly payments are received from the homebuyers.

Suppose there is an MBS whose net worth is $ 1 billion. This MBS is divided into equal one billion number shares. It means each share of MBS is valued at $1 (net worth / no of shares). These shares of MBS were then traded in the secondary market (Wall Street).

Suppose, each share of MBS was sold at an average price of $1.2. It means, the MBS could generate funds of $1.2 Billion ($1.2 x 1 billion number of shares).

The investment bank paid a total of $1 billion to buy mortgages from retail banks. Through shares issue, they earned $1.2 Billion. The gross earnings of the investment bank are $0.2 Billion.

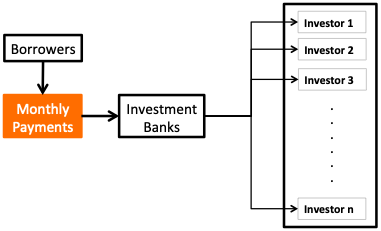

5. How investors of MBS made money?

Suppose there is an MBS that was worth $1 billion. It was capable of earning $57.2 million p.a. for the next 30 years.

From where this earning was coming? From the monthly payments made by the borrowers again their mortgages.

These monthly payments received by the investment bank (MBS), will be proportionately distributed among the investors in proportion to their shareholdings. If there are one billion number shares, then the income per share of this MBS will be $0.0572.

- What will be the yield per share for the investors?

- Share Price: $1.2 per share.

- Income: $0.0572.

- Yield: 4.77% (0.0572 / 1.2).

It means that by buying a share of MBS, the investor will earn a return of 4.77% upon his/her investment.

6. Over demand for MBS

Till loans were issued to credit-worthy borrowers, the mortgage-backed security market flourished. It was a perfect investment vehicle for matured economies (like the USA, UK, Australia, etc). The demand for MBS skyrocketed.

To feed the rising demand, MBS needed more mortgages. But the problem was, that credit-worthy borrowers in America are only limited.

In this scenario, the retail banks tweaked their lending criteria. They started issuing loans to even not-so-credit-worthy borrowers.

But they charged higher interest rates on such loans.

Then a stage came when the demand for MBS further grew. Retail and commercial banks, wanted to match the pace. Hence, they started issuing loans without even verifying the credentials of the borrowers.

This way, the list of borrowers was rising at the desired pace.

7. Collateralised Debt Obligations (CDOs)

When retail banks started issuing loans to less credit-worthy borrowers, investment banks knew the risk. They could gauge that these borrowers have a high chance of defaulting. The overall credit ratings of MBSs were dangerously low (like B+, CCC, and below).

Hence, what they did was create another investment vehicle called CDOs. These CDOs had a mix of mortgage-backed securities:

- Prime mortgages (Credit Rating A to AAA)

- Subprime mortgages (Credit Rating A- and below).

This helped them to hide the so-called “subprime mortgages” under the blanket of prime mortgages.

Moreover, the buyers of CDOs were not common men. They were purchased mainly by hedge funds, investment banks themselves, pension funds, etc.

Hence the public audit of subprime mortgages could be prevented. Investment banks could keep it hidden for an extended period of time.

Nevertheless, investment banks were not so bothered. Why? Because there was a market for such MBSs and CDOs. People were buying its shares with open arms.

8. Booming Real Estate Market

As more people were becoming eligible for mortgages, the demand for homes started increasing. More people had money (borrowed) to buy a new home.

This created a price bubble in the real estate sector. The price of residential properties only went up. In such a booming market, a pretense was building that nothing can go wrong with MBSs. How?

What was the income source for MBS? Monthly payments are made by the borrowers against the mortgage loan. The risk of loss here was only when the borrowers fail to make payments (loan default).

For the MBS market, this was not a problem, why? Because the property which was used as a collateral – could be sold to make up for the loss.

This assumption was not wrong – but it remained true only till the property prices were only moving upward.

9. Role of Other Agencies

There were two agencies whose contribution could not be underestimated in the rise of subprime mortgages. The involvement of these two agencies only added to the false euphoria related to subprime mortgages.

- Credit Rating Agencies

The credit rating agencies (Moody, S&P, Fitch, etc) gave AAA ratings to most of MBSs – even when loans were issued to subprime borrowers. They gave high ratings based on past historical data. But what they missed was that in recent times, mortgages were issued to any and everyone.

- Credit Default Swaps (Insurance)

This was another financial instrument that compounded the negative effect of subprime mortgages. Credit default swaps are basically insurance cover for the MBS. They protected the MBS against any loss in revenue due to ‘loan defaults’ or ‘prepayments’. As the MBSs were insured, investors had that false sense of protection.

In 2008-09, the majority of borrowers were defaulting on loans. The insurance companies (Like AIG) could not cover this urgency. They also declared themselves bankrupt.

10. Why people were taking loans?

In those times, even those people who had no source of income were getting loans to buy homes. These people had near zero capability to pay back the mortgage, but they still took the loan. Why?

Their logic was, that as the price of homes was only going up, they can use it to their advantage. Example: Take a $100,000 loan, and buy a home. After a few months sell the home for $102,000. Use the sale proceeds to pay back the loan, and pocket the balance as profit.

People were taking mortgages to do trading of real estate properties. To help such borrowers, banks offered incentives. The loans had lower monthly payments for the first few months.

11. Bursting of the housing bubble

A stage was reached in the US housing market where the borrowers started defaulting on their loans. Why the default? Because it was inevitable. How?

The cause was subprime mortgages. The loans were issued to people who had little capability to pay back the loan. Hence, they eventually could not afford the ‘monthly payments – and their property went into foreclosure.

At a point in 2007-2008, there were more houses on sale than there were buyers for it. This triggered a steady price fall. The housing bubble burst.

12. More Bad Loans

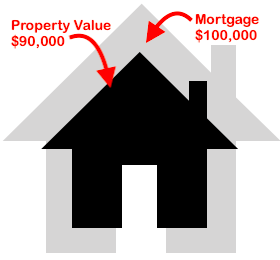

When property prices started going down, people who had bought the property with the sole purpose of “buying low and selling high” stopped paying the mortgage. Why?

Because their property value started becoming smaller than the mortgage value. This led to more loan defaults, leading to more foreclosures. This further brought down the real estate prices.

13. What Big Investors Did Further Aggravated the Situation

When financial institutions saw this trend of falling prices, they became defensive. They stopped buying shares of subprime mortgage-backed security.

Instead, they started doing the reverse. They started dumping their already held shares of those CDOs which had subprime mortgages as their assets.

As a result, the share price of MBSs started to fall steeply. This eventually started to reflect on wall street.

Who were these big investors? They were investment banks like Lehman Brothers, Bear Sterns, etc.

This way the earnings of investment banks (MBSs) stopped, and eventually, they had to declare themselves as bankrupt.

14. Recession Arrived

The panic first spread across common Americans, and then across the world. The stock market crashed, and the credit market froze.

Loans became almost impossible to get. The economies across the world became cash-starved. In absence of sufficient liquidity, growth rates became negative.

Due to negative sentiments, public spending was also falling. This eventually led to the recession.

Conclusion

To sum up the whole story, allow me to list down the main causes which led to the formation of subprime mortgages and eventually to the 2008 financial crisis:

- Bad Loans: The root cause of the crisis was “bad loans”. Had the retail banks checked themselves from issuing bad loans, subprime mortgage-backed securities-based CDOs would have never been born.

- Why retail banks issued bad loans? Because they knew that, the responsibility of bad loans will not be on them (it will be on investment banks). Their risk of loss was almost zero. Moreover, there was a demand for subprime mortgages, and they also fetched higher interest rates for the banks

- Investment Banks: The formation of CDOs with subprime mortgages was their first mistake. Their second mistake (which also amounts to crime), is hiding the true credit rating of the CDOs and MBSs.

- Insurance Companies: Insurance cannot be sold to anyone. Like a cancer patient will not be able to buy health insurance, similarly, unhealthy CDOs should not have got the protection of Credit Default Swaps.

- Bailout: USA’s economy is huge. It is so big that, even a small change here affects the economies around the globe. On top of this, in the modern economy, banks just cannot fail. Too many people are dependent, on even the basic functions of banks. Hence, in the back of their mind, the banks knew that US congress will eventually bail them out.

- Congress & SEC: First it was the US congress that restricted the powers of the SEC over the regulation of MBS, CDO, and Credit Default Swaps. The Department of Justice (DOJ) also kept quiet seeing the wrongdoings by congress and SEC.

- People: It will not be wrong to say that common people also contributed to the mess of subprime mortgages. People who knew that they will not be able to pay the ‘monthly payments of the mortgage, should not have taken the loan in the first place. Their greed for easy money made the matter worse.

Final Words

What we have learned from the subprime mortgage crisis? Probably little.

After the 2008 financial crisis, subprime mortgages vanished from the US market. There were too many critical eyes, watching the next steps of the investment banks.

Even SEC was acting tough on retail banks which were the first window to issue loans to the public. But today in 2019, they may be banks have found another loophole in the law books.

A very similar type of loan is again being issued to Americans. Instead of calling it a ‘subprime mortgage’, it has been rebranded as ‘student loan debt‘.

Principally, student loan debt is not a bad thing. But when the size of this debt is touching $1.5 Trillion, it raises questions.

What is more worrying about student loan debt is its ‘burden’ on students. As of 2019, it is said that 44 million students have availed of student loans. On average, each student is carrying a loan burden of $32,000.

Starting a career with this kind of burden is a concern.

Thanks for writing such wonderful article. I enjoyed while reading. Explaining with example for Returns for Investment Bank in numbers, would have been a greater help. Although article explains the yiels for investors in MBS, but its not enough to understand that whole number game. I struggled to understand that.

Thank you for your kind words and feedback! I’m glad you enjoyed the article. I appreciate your suggestion about providing more specific numerical examples regarding the returns for investment banks. You’re absolutely right that a deeper dive into the numbers can enhance the understanding of the entire financial process.

While the article did touch on the yields for investors in Mortgage-Backed Securities (MBS), I understand that a more detailed breakdown would be helpful. If you have any specific questions about the numbers or would like to explore any aspect of the topic further, please feel free to ask. I’m here to provide additional information and clarification to make the whole financial system easier to grasp. Thanks again for your feedback!

Why the compliments for such an illiterate article?

Why do you say so?

Really very well explained….step by step explanation on each and every aspect…..hats off to the way you make things simple to understand….keep going

Thanks

Can I also tell you there was a scheme going around with Wells Fargo, my sisster husband is wells fargo NA, he had a 10 year end of life pyuramid scheme, he was doing MBS on duped people. Give him $325K, you get a home in 10 years for $405,000. You have to take out 4 full value loans, One you keep one pays him the $325, and you can pocket the rest, one pays for all 4 loans, and one pays for $7K a month on a duped person. It was about taking down other banks, and bringing in stocks and securities, properties and homes via probates and bankrupcies, yes PROBATES! Desgined by a Developer who now owns part of AmEx and Citi, Chase and Discover, one of the officders of Ct, my brother in law.He was grouping people to take out HELOCs on his victims, and trading socks for them, and the PONZi never gets discovered because it is paid off by the life insurance. He uses the money to invest in properties, and people die, like my my mom was the only Diana Engstrom in 2004, now there are 100s, he does phony probates, and brings in developments via dead people, example “the Villages in Yorba Linda” my mom lived at 6080 Vrmont Ct. YL CA 92886, My sister puts her down as the original owner of the developmnet??? How does that benfit Brandy wine homes, do they foreclose on the property??? My mom onlly knew she owned the condo in 2000, yet on every background it shows she owned it in 1992, and on a final tax return she shows as having owned it since 1980. Same with my in-laws, my husbands dad is gifted a trailer park “sleepy Joe’s”, (but he never knew it), he dies, the wife gets it, she dies, then STANLEY Ho buys it from a trust that the ex wife is pretending to belong to. SHE GOT EVEN.EX Raymond Dioneda owned my mom’s 9345 Calmada Ave. Whittier, CA 90605 home for $405K as a “gift”, it was an Ed deal for the pyramid scheme, his wife dies 10 years later, he moves to Florida and dies with a 660,000,000. loan. Likely for the development of the property. Coroner never heard of him, he just died last month. Ed was American Securities, so he is bringing in lots of properties due to covid, and an officcer of Datex (they make ventilators). And, i even heard them discussing pandemic bonds in 2006 and how they would not be repaid. No one cares???

$7K a month was for life insurance on a duped person. He even pools the life insurance money.

Great Explanation & Presentation of words Mani … Please keep the flag and spread the knowledge…

Thanks,

Krish

208 Recession explained in simple terms. Thumbs up!

Thanks

Hi Mani – Thanks for a fantastic write up on the 2008 crisis. I have bookmarked your page and read it a few times. Very well explained! Please do more posts of this type – how about one that explains how the economy works – inflation/interest rates/GDP/gold prices/depression – how all these factors work in tandem..

Thanks Rohit. It was one of the tougher posts to write.

About how economy works, please try this article.