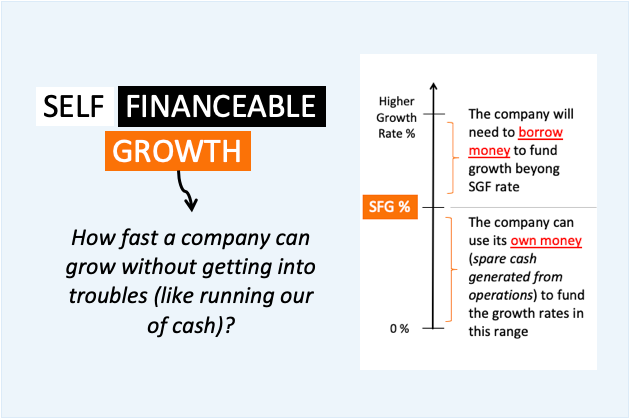

Sustainable Growth Rate (SGR) is the growth rate that a firm’s current profit levels can sustain on its own (Self financeable growth). Suppose a company’s SGR comes out to be 8% per annum. It means the company can grow its sales, profit, share price at this rate just by reinvesting its earnings.

For such a company, to grow at a rate faster than 8% per annum, it will need additional capital. From where this capital will come? The company can borrow loans (debt) or it can issue more of its shares to the public (equity).

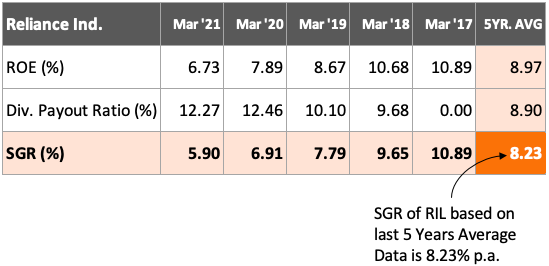

Example of Sustainable Growth Rate (SGR)

Let’s take a look at Reliance Industries’ (RIL) numbers. The computation done for RIL, based on its last five years’ average data, the sustainable growth rate (SGR) comes out to be 8.23%. How to interpret this SGR metric? It shows that RIL can continue to grow at a rate of 8.23% without taking any loans or by liquidating more shares in the market.

RIL can continue to grow at 8.23%, for about the next 5 years, by just reinvesting its retained earnings.

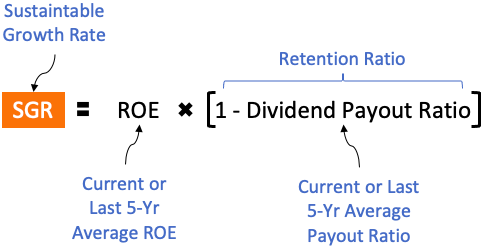

Formula for Sustainable Growth Rate (SGR)

SGR = ROE × [1 − Dividend Payout Ratio]

[1 − Dividend Payout Ratio] = Retention Ratio

The formula highlights the following two components of sustainable growth rate:

- Return on Equity (ROE): The whole concept of SGR revolves around the fact the long-term ROE is an indicator of future growth. What is ROE? It is a profitability indicator that compares a company’s net profit with its net worth. It tells, how much profit yields for every dollar of the shareholders’ funds.

- Dividend Payout Ratio: Majority good companies pay dividends to its shareholders. Hence, subtracting the dividend payout ratio from one (1) highlights the retention ratio. This is the amound of net profit (PAT) that the company retains and carries over to its balance sheet.

Why Some Companies Fail To Capitalize on Their SGR Potential?

All companies try to grow fast. But before that, they try to grow at least at their sustainable growth rate. Why so? Because to grow at SGR, the company just need to deploy their retained earnings effectively. To grow at the rate of SGR, they will need no additional capital.

But some companies may fail to capitalize on their SGR potential. Why? Because of few external and internal factors as highlighted below.

Limitations to SGR:

- Economy: No matter how high is a company’s SGR, in a long-term horizon, it cannot surpass it’s country’s GDP growth rate. Here the long-term means 15-20 years. Suppose there is a company which is focused only in India. For next 20 Years, India’s GDP growth rate will grow at 8.5% per annum. It means, it will not be reasonable to assume a SGR rate higher than 8.5% for the company. Yes, the company can grow faster, but for that it must expand and spend more on market and customer acquisition.

- Competition: Companies that operate in a competitive industry may have to give discounts to retain customers. Such companies also invest more on R&D to develop new products to maintain their already narrow economic moat. In such a scenario, growth at SGR becomes restricted.

- Capital Intensive Business: For capital intensive business, like Automobile, Steel, Cement, Oil & Gas, etc sustainable growth rate (SGR) indicator may not be accurate. Why? Because the retained earnings may not be enough to buy expensive assets (for CAPEX needs). Such companies often resort to bank loans and equity financing to fund the Capex requirements. Such actions will reduce the ROE in the near term, and hence the SGR.

How To Interpret High Sustainable Growth Rate (SGR)?

We must remember that a company cannot continue to grow at the same rate all it’s life. Conceptually it is possible, but the resource that needs to be deployed to achieve it might become impractical. If too much importance is given to growth alone, the company might loose its competitive moat.

All markets have a saturation point. Beyond this point, the sales will start to freeze. No matter how low is the price or how good are the products, sales will miss the targets. This phenomenon explains why high SGRs are not forever.

In a saturated market, the company’s cannot grow at their SGRs. To grow faster they need more capital. But again, this means the company has to venture outside the limits of “self financeable growth”.

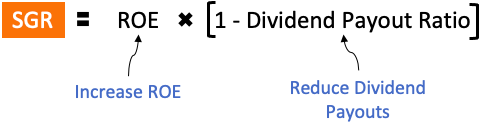

How a Company can increase its SGR?

As it is visible from the formula, there are two broad parameters that must be altered to increase the sustainable growth rate (SGR). By increasing the ROE and/or decreasing the dividend payout, SGR can be increased.

SGR = ROE × [1 − Dividend Payout Ratio]

Let’s know more about these two SGR influencing factors:

- Increase ROE: Shares buyback is one way of increasing the ROE. The company can also increase its net profit margin, and sales number to achieve a higher ROE. A company whose cost of capital is lower than its returns, they can increase their PAT and hence ROE by availing debt.

- Reduce Dividend Payout: A company that wants to grow faster, pays less dividends. All the earnings which is retained is used for future growth. The money can be used for Capex, customer acquisition, product development, marketing, service, etc. Reduced dividend payout means more capital in the hands of the company, hence higher SGR.

Another indirect factor that can improve a company’s SGR is managing account receivables (due payments from customers). Suppose a company improves its account receivable days from 60 to 30 days. It means cash is flowing into the company’s bank accounts faster. Faster cash flow means less dependency on short-term debt to manage current liabilities and working capital. It will improve the company’s margins and hence the ROE.

Conclusion

Suppose there is a company whose SGR is 12% per annum. But the Board has decided to grow the company at a rate of 18% per annum for the next 7 years. As the planned growth is higher than SGR, reinvestment of profits alone will not help to meet the goal.

The first step for such a company will be to reduce the dividend payout. The second step will be to do a cost (WACC) vs return (ROIC) analysis. If WACC is substantially lower than ROIC, they can take debt to increase the leverage. The borrowed money can be used for expansion, sales, marketing, R&D, etc. This way the company will increase its market share and hence net profits at the desired growth rate.

Another example. Suppose there is a company whose SGR is 12% per annum. No matter how hard they are trying, they are not able to grow at the SGR rate. It is an indicator of the market saturation or the company becoming too big. Such a situation does not allow the company to match its SGR. In this scenario, it is better for the company to distribute the majority of its PAT and dividends among the shareholders.

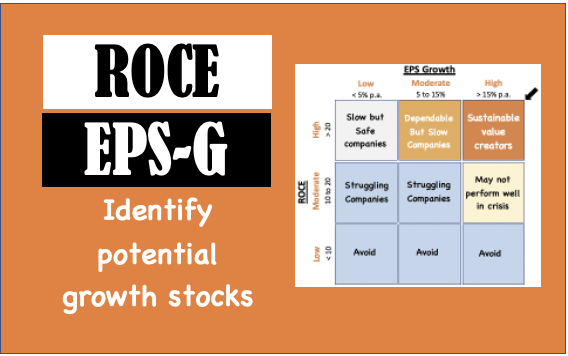

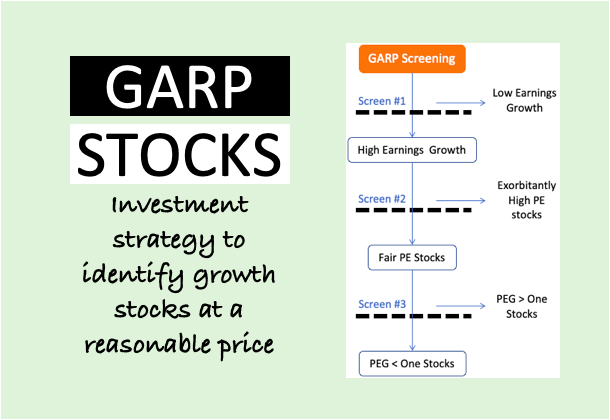

How an investor can use SGR for identifying potential stocks? First, we can identify a preferred stock. Then list down the names of its competitors. The next step will be to calculate the sustainable growth rate of all these companies. The company which displays a higher SGR number should be the preferred choice.

Once this exercise is finished, a deeper analysis of the company must be done to understand its fundamentals.