There is a concept of finance that says that there is a ‘time value of money.’ It is one of those concepts which works as a foundation of all money management.

But before we can understand the time value of money, we must know who should care about it. Theoretically speaking, everyone is affected by this concept. But practically, there is a certain section of people for whom it makes no difference.

Who are these people? People who live hand to mouth. These are people who spend almost everything that they earn each month. They can manage only negligible savings out of their income. Read: How to avoid salary dependency?

For such people, knowledge about the time value of money is just a theory that has no relevance in real life. Even if they want to implement the concept in day-to-day life, they cannot do it. Why? Because to do it, the person must first learn the tricks to save money.

‘Time Value of Money’ Concept is Useful For Whom?

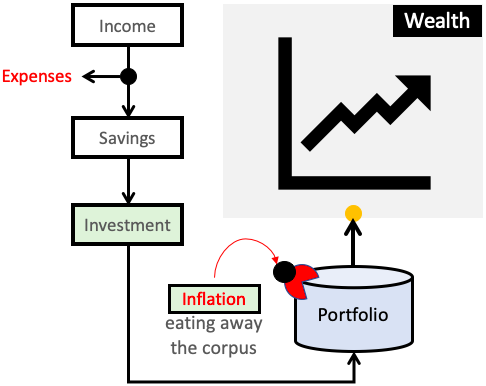

It is useful for people to whom building wealth is a priority. Such people are always aware of the wrath of inflation on their purchasing power. Hence accordingly, these people judiciously save and also invest their savings.

The objective of investing the saved money is to make it grow faster. The growth rate must be faster than inflation. In a growing economy like us, inflation is more rampant and unpredictable. To beat inflation, undertaking risky investments is unavoidable.

Role of Time Value of Money

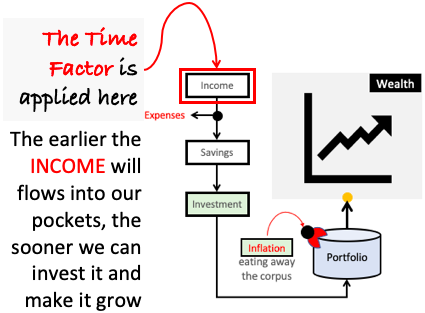

Now in this scenario, the ‘time value of money’ also plays its role. How? Because the earlier the income flows into our pockets, the sooner we can invest it and make it grow.

For example, Suppose income was about to arrive in a bank account in Jan’2021. But it reached only in June’2021. What is the effect of this delayed payment? The money stays uninvested for six months. The money neither grew, instead, it became devalued due to inflation.

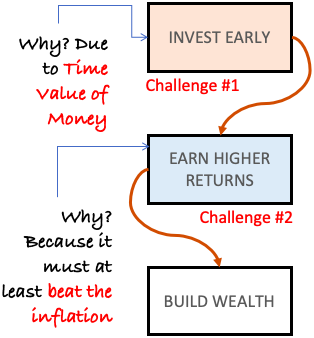

So we can say that we are fighting two challenges here. First is the battle of cash flows. The earlier we receive the money, the better. Second, to beat the wrath of inflation, we must invest the money wisely in the risky proposition. The idea is to earn higher returns.

What is the ‘Time Value of Money’?

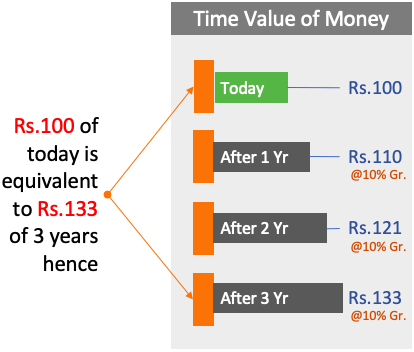

Time value of money is a financial concept which says that the worth of money depreciates with time. In simple words, Rs.100 today is more worthy than it will be one year from now. Why? Because money in hand today can be invested and hence will yield future cash flows.

The above infographic is symbolic of a time-value of Rs.100. Assuming that the money can grow at a rate of 10% p.a., worth of money after the first, second, and third-year are mentioned. How to read the above numbers? For example, Rs.100 of today is equivalent to Rs.133 after three years from now.

What is the utility of this concept for us? To understand the use, let’s learn about it using two examples.

Example #1

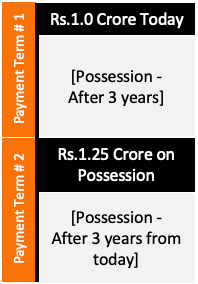

Suppose you want to buy a real estate property worth Rs.1.0 Crore. It is a new property for which the construction will end in the next three years. The developer has proposed two payment terms (see below). You would like to know which payment term is better for you.

To make the computation simpler, suppose you have Rs.1.0 Crore in cash. It means you’ll not opt for a bank loan. So in terms of cash flows, your capability for payment term #1 is set. Now, let’s check if payment term #2 is suitable or not. How to check it?

Before we can go ahead and do the calculations, we will have to answer a small question. How much investment return you can surely generate for a time horizon of 3 years? Suppose your answer is 8.5% per annum.

What will happen if you invest Rs.1.0 crore in such an investment option? In the next 3 years, the corpus of Rs.1.0 crore will become Rs.1.28 Crore.

Let’s try to understand what is happening. You have selected the second payment term. So you’ve paid nothing today for the property. Instead, you’ve invested your savings (Rs.1.0 Crore) at 8.5% per annum. In the next 3 years, you will have Rs.1.28 Crore.

Now, what happens after the third year? You can make the payment of Rs.1.25 Crore for the property. After making the payment, you will still have Rs.3 lakhs as spare cash. This way, the second payment term is more profitable for you.

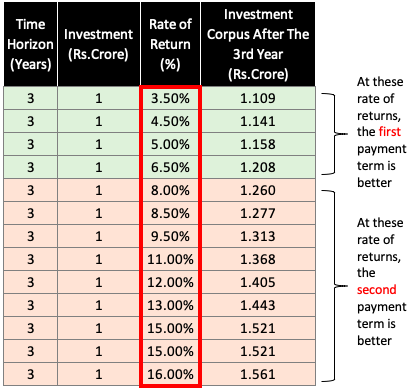

Check the below matrix for the size of corpus built at a different rate of investment returns. You can see, for investment returns below 8.0% per annum, the first payment term is proving better.

This is a first example of utility of the concept of time value of money using which we have found which payment alternative was better.

Example #2

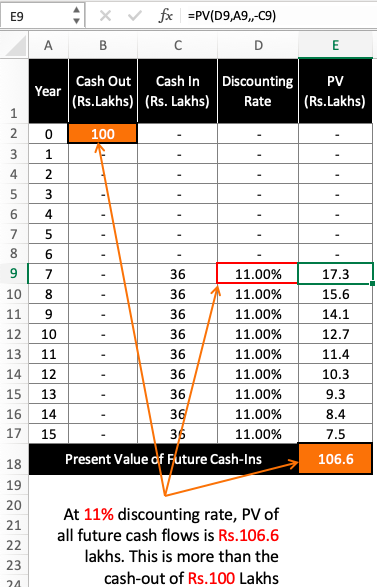

Suppose there is an investment plan which is asking you to invest Rs.1.0 Crore now. Upon investment, it will start yielding a cash inflow from the 7th year onwards. The cash in-flow will be Rs.36 lakhs in the 7th, 8th, 9th, 10th, 11th, 12th, 13th, 14th and 15th year (Rs.36 lakhs x 9 = Rs.3.24 Crores).

On the face of it, Rs.1.0 crore becoming Rs.3.24 Crores in 15 years looks fair. But how to know this for certain? How to judge if this investment plan is worth investing in or not?

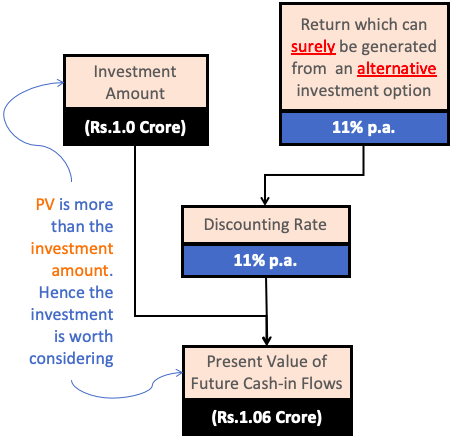

Again, start with answering a question. How much investment return you are sure to generate from an alternative investment (for a time horizon of the next 15 years)? Suppose your answer is 11% per annum.

To judge the investment plan, we would have to calculate the present values (PV) of all future cash flows. Calculation of Present Values can be done by assuming a suitable discounting rate. What will be the discounting rate? It will be 11% per annum as assumed above.

At this discounting rate, if the sum of PV of all future cash flows is more than Rs.1.0 crore, the investment plan is worth a buy.

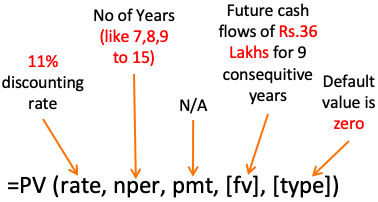

How to calculate the Present Value (PV)? It can be done using the PV formula of Excel. The PV formula in excel looks like this:

Now lets use the PV formula and calculate the present values of all future cash flows happening in 9 years as stated above.

The above calculation shows that the sum of “Present Values” of all future cash flows is Rs.106.6 Lakhs. It has arrived at a discounted rate of 11% per annum. As the present value is more than the investment amount, hence the investment plan is worth considering.

[P.Note: The investment plan has made your money grow – Rs.1.0 crore became Rs.1.06 crore]

Conclusion

The best utility of the time value of money is when the present value of future cash flows is calculated (as shown in example #2). The more staggered are the cash flows, the more complex will be present value calculations.

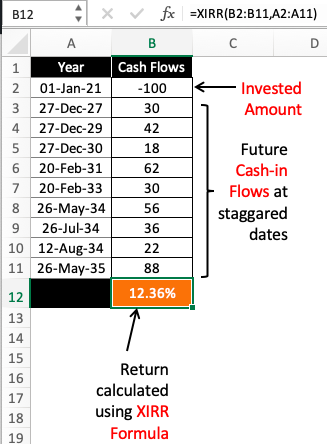

I’ll like to suggest an easier way of judging the investment plan that has complex cash flows. We can use the XIRR formula of excel to do the maths.

How to do it? First, assume what investment returns you can safely generate from your preferred investment option. Let’s assume it is 12% per annum.

Once this is done, we can go ahead and plot all the future cash flows (as shown below). This will prepare the Excel sheet for calculation of the return on investment (ROI) using the XIRR formula.

Finally, we can compare the calculated ROI of the investment plan with your safe rate of return. If the XIRR of the investment plan is higher than your safe return assumption, the Plan is worth investing-in.

The best use of the ‘time value of money’ concept is while estimating the intrinsic value. The method we can use to do the calculation is Discounted Cash Flow (DCF) method.

Thank you Mr Mani.. for simplifying the concept of Time value of money. I have been practicing this concept to assess the projects (Investments in Industrial / Manufacturing) viability… however, i really got my concepts cleared…after reading this article. I like your articles. Keep it up… all the best wishes for your future endeavors.

Thank you for the fedback