You know, one can use clever tricks to save money. This way one can fool self, and save more. But why to resort to fooling self? Because most of us are better spenders of money; we can spend money more effortlessly.

Saving money does not come naturally to people. We are psychologically better spenders than savers of money.

This is why we need to use tricks to save money. When I first conceived this idea, it was not clear that how effective will be its implementation. But today, after self practice, I know that these trick are super beneficial.

These tricks to save money cannot make one a millionaire, but for sure, one will be more better-off than he/she is doing today.

Problem with saving money…

As I said, we all are natural spenders of money. Some spend more and other spend less. But all in all, if given a choice we will pick spending over saving.

Hence, it is not easy to consistently save money year after year. Moreover, saving money look less lucrative due to high inflation. Why?

Because the saved money looses it’s value with time (due to inflation). So what is the use of savings?

This is not the right way of looking at savings….

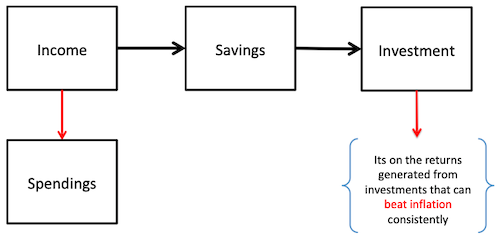

No matter if the inflation is high or low, one cannot stop saving money. Because if the target is to beat inflation, we have to invest money. And to invest money, we will have to save it first.

Read more about “which is the Best Alternative to Savings Account”…

Saving money and innovation….

We need to think innovative, to maintain the habit of saving money. Yes, innovation helps to save a lot more than one can do in normal ways.

In this article we will discuss few innovative tips and tricks to save money. This will make saving easy and effective.

Try these tricks for one month and you will see the benefits.

As a rule of thumb, one must save at least 25% of the monthly take-home salary.

But the problem is, how to implement this rule of thumb?

Lets see some clever tricks to save money

Which are these tricks? These are tricks about which I have either read about in a book, or have have devised it myself.

Why I had to resort to devising tricks to save money?

Over a period of time, I have noticed that saving money does not come naturally to me. But I was bent to savings. Why? Because it is a necessary thing to do in life.

Hence, I thought to give it a hard try. I devised my own “comfortable” methods to save money, and it worked.

Saving Tricks which I unearthed myself was these:

- Give Yourself a Tip (min. 5%).

- Forget Your Annual Perks.

- Never stop paying an EMI’s.

But apart from the above listed three tricks, the most effective trick I borrowed from the book of Robert Kiyosaki. It is called “Pay Yourself First“. I have written an elaborate post on it. You can read it for more insights.

So lets start the discussion about tips & trick to save money from my favourite method…

#1 Pay Salary to Yourself (min. 5%)

Yes, if you can pay everyone who works for you then why not pay yourself? Do this first thing every month.

Pay yourself 5% of your monthly income. Before you spend a dime anywhere else, make sure to pay self. How you can do it?

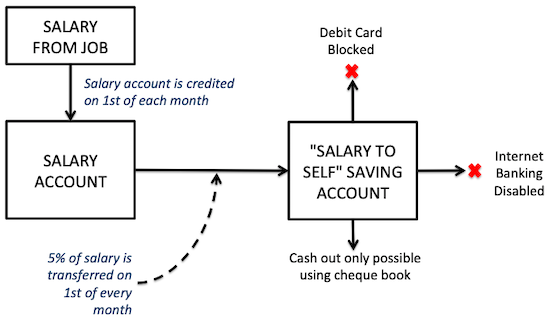

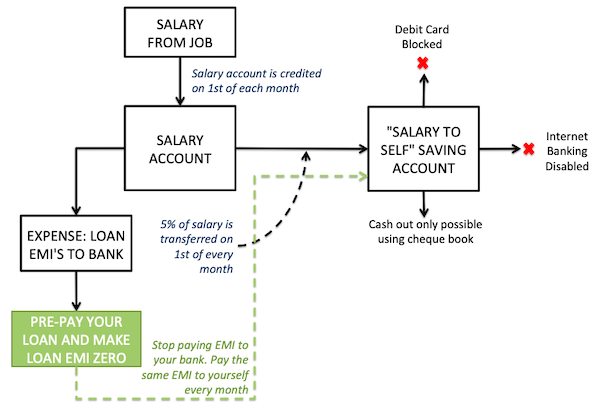

Simply transfer 5% from your salary account to your another savings account. Which is this saving account?

This is that savings account about which you have taken the liberty of loosing its Debit Card. You’ve also willingly, forgot its online banking password.

So this savings account is almost like a dark-well, which only swallows every penny you put-in. The only way to take the money out from this savings account is by cheque.

This trick is really effective. Try it, and see the savings grow each month. [P.Note: Make sure to map this savings account with your other salary/savings account]

Read more about how to save money in India from ones salary…

#2 Give Yourself a Tip (min. 5%)

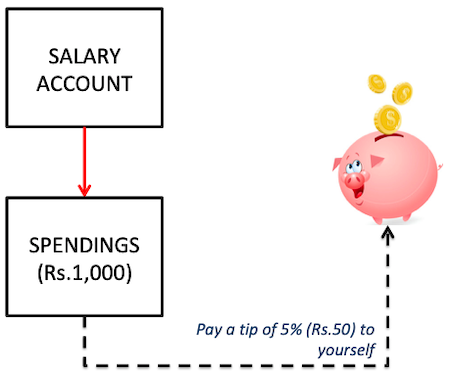

Every time you shop, give yourself a tip of 5%. If you spend Rs.1,000, it means you become eligible for Rs.50 tip.

Initially, these tips may look irrelevant, but such multiple five percent’s will add up handsomely at the end of the year.

The beauty of this trick is that, it generates savings automatically. This is awesome!

Suppose you go to buy a grocery and the bill was Rs.1,000. As soon as you reach back home, take Rs.50 (5% of Rs.1,000) and put it straight in your piggy bank.

Over a period of time the piggy bank will fill-up faster than your expectation.

Moreover, this is one trick which will also make you very sensitive to your spending habits. You will remind yourself every time you spent, that how much you have actually done.

This may sound simple and irrelevant, but this is one habit we must develop. Why?

Because in our daily routine of spending, we have actually become habitual spenders.

We almost spend our money as if it is done subconsciously. It will not be wrong to say that we spend almost on autopilot.

But in the process of paying tip to oneself, you will actually become more aware of your spending habits.

In course of time, this simple habit can save you lakhs of money. How? In two ways:

- On one side you are earning 5% on every spending.

- On other side you will try to curb unnecessary spendings, as you will be repeatedly reminded of it.

Read more:

- About how to stop overspending money…

- Few of my articles on spending wisely…

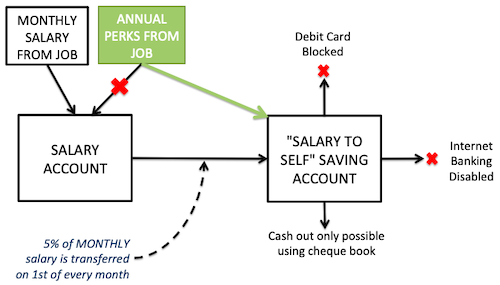

#3 Forget Your Annual Perks

Use only your monthly income to take care of your cost of living.

The perks (like bonus etc) that you get only at the end of the year, Keep them as your savings. If not 100%, save at least 75% of your annual perks.

Budget all your spending considering only monthly paycheck. Do not budget any expense for your annual perks.

Means, as soon as the annual perks are credited in your account, it gets transferred to your “dark-well” savings account.

This is harder said than done. Trick is to try and keep the details of annual perks a top secret even from your family.

Preferably, do not discuss its existence even with your spouse/children.

Idea is to keep it a secret, so that there will be no social pressure to spend it.

#4 Never stop paying an EMI

This is a sharp contradiction to what personal finance gurus will tell you to do. They ask you to pay-off your debt, to bring down the EMI load to zero.

The concept is perfect. But what I’m suggesting here is a small variation to this golden rule. This variation has capability to save us huge amounts of money.

The effectiveness of this trick is the maximum. This trick to save money is my personal favourite.

Let’s see how it works…

Suppose you were paying an EMI for your car loan (Rs.15,000 per month). Last month you finished paying all EMI’s. As soon as the EMI tenure gets over, you will have an extra cash of Rs.15,000 each month.

At this point of time, what we mostly do is think of availing another loan. Don’t do this.

Instead, transfer these Rs.15,000 to your “dark-well” savings account each month. Why do to like this?

Because at this time, you mind is most ready to save Rs.15,000 each month. When we keep paying EMI’s for a long time, our mind adjusts to this cash-outflow. We can take advantage of this mindset.

Though the loan is over, keep diverting the EMI value every month to your dark-well savings account. Believe me, as your mind is already trained to not-using this amount, you will not crave for it.

You are already in a habit of paying this EMI, so saving this amount will not be a big effort.

Read more about home loan prepayment to save lakhs of rupees…

What to do with the savings?

Saving money each month is only the first step. It is is equally important to invest the saved money. How to do it?

For us there can be no better investment option than mutual funds. But before investing in mutual funds, it is necessary to fix the financial goals.

I will take the following steps for myself as a beginner:

- Step #1: Budget & Track my expenses.

- Step #2: Finalise the goals of my life.

- Step #3: Start investing in mutual funds.

- Step #4: Start learning about stocks.

- Step #5: Understand how our economy works.

If these steps are sounding too much for you, begin with 1,2 and 3. But my advice is, completing step 4 and 5 will make one a more effective investor.

Final words…

Saving money need not always be tough. If we can think out of the box, we can save a lot more.

Saving money is more like a mind game where one needs to fight and win over ones self-temptations.

Fighting with ones own mind is not easy.

Hence it becomes necessary to use tricks, to puzzle our mind and save more money. I have shared some tricks here.

It will be great if you too can share your tricks in comments to help other readers.

Handpicked Articles:

![Goal-Based Saving - Your Path to Financial Control [ A Method] - Thumbnail](https://ourwealthinsights.com/wp-content/uploads/2025/04/Goal-Based-Saving-Your-Path-to-Financial-Control-A-Method-Thumbnail.png)

![Income Tax Slabs: Tax Liability Comparison Between 2020 and 2019 [Calculator]](https://ourwealthinsights.com/wp-content/uploads/2020/02/Income-tax-slabs-Image.png)

very interesting and knowledge oriented blog. bumped in to it accidently but very thankful i bumped in to it keep writing and sharing are u linkedin

Thanks

Hiding the details of Dark well savings from family members, is very dangerous… in case of any unfortunate event with investor, the money in the dark well saving account will literally goes in the DARK WELL….

You are right.

But what do you think, what happens to non-dark well type savings account in case of such an unfortunate event? There is always a nomination facility right?…Dark well literally does not mean a DARK WELL. It is just an ‘expression’ which asking us to reducing the fluidity of the marked parked in that savings account (by surrendering your ATM/debit-card and making the internet banking inactive).

dear mani 1.trick is simply superb,from next month i will follow this till my retirement,thank you for your fantastic trick (advice)love reading your blogs.keep sharing

I am glad that you liked the tricks. Though my personal favourite is SL No. 4 🙂