Understanding a company is essential before buying its stocks. Why? Because Stocks represent proportional ownership in a company. So, what is the utility of this information about stocks/business?

Let’s understand this with an example. Consider yourself looking at two companies, Nestle India and Jet Airways. Former represents a healthy business, while the latter is languishing with NCLT.

Now the question is, you will buy stocks of which company? For sure, you will not buy stocks of Jet Airways? Why? Because currently, it is not doing good business.

So before buying stocks of a company, it is essential to judge the fundamentals of its business. In the case of Nestle versus Jet Airways, the interpretation was obvious. But in most cases, identifying a weak company just by looking at its name is almost impossible.

How to do it? By understanding a company better by analyzing its business. The process of doing so is called fundamental analysis. Here the main focus is on the company’s financial health’.

Topics

- How do investors understand a company?

- Profit & profitability – which is more important?

- Investors – lenders vs shareholders.

- Risk and returns.

- What a company does with its profits?

- The market can be wrong.

- Conclusion.

How investors can go about understanding a company?

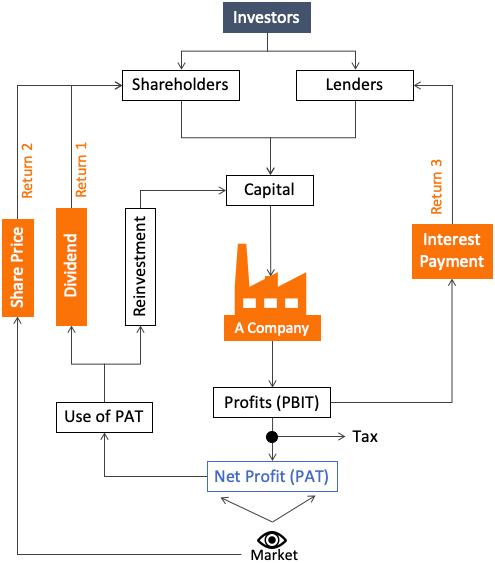

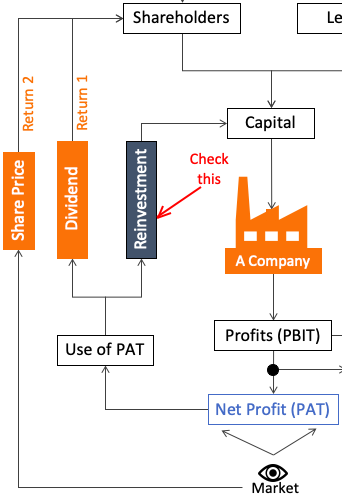

The above flow chart is a symbolic representation of how a company does its business. It all starts with the capital. The company has to source its capital from either shareholders/partners or lenders.

The company then uses its capital to produce goods and services for its customers. This activity, in turn, generates revenue and profits.

From the company’s profit, lenders earn a fixed return in the form of interest payments. The shareholder’s investment can also yield a non-fixed return. The return will be in the form of dividends and share price appreciation.

The risk profiles of shareholders and lenders are different from each other. Lenders will earn a fixed return no matter if the company makes a profit or loss. But shareholders may not be rewarded, with dividend or share price appreciation, in case of a loss.

On the contrary, a shareholder’s return may go in negative if the company reports a loss. How? Due to the share price fall. So what does it mean? It means that it is the shareholders who are carrying the risks of doing a business. They bear the loss when PAT is negative. They benefit when PAT is positive and growing.

Suggested Reading: Cost of Capital: How Businessmen and Investors use it to evaluate investments?

This explains another fact. Investors have an option to put their money in other investments over Stocks. Though stock investing is risky, experts still prefer it because of its potential to yield higher returns.

Profit & Profitability – Which is More Important?

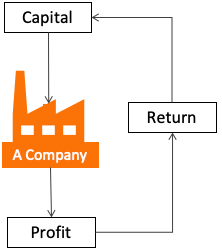

There is a company that needs capital to establish and run its operations. It will also need money for its CAPEX (for expansion and modernization of its facilities). The company is doing business to generate profits. The profits will yield returns to its investors (shareholders and lenders).

So people might think that it is the profits which is the most important thing for the investors. But something else is more important. It is profitability and growth rate. Allow me to explain it with a hypothetical example.

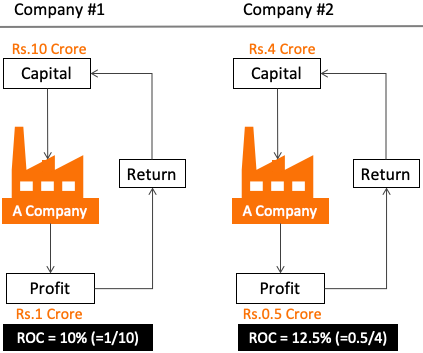

What you can see above is a symbolic representation of two companies, #1 and #2. Company #1 and #2 generates a profit of Rs.1 Crore and Rs.0.5 crore respectively. For an untrained eye, company #1 will sound fundamentally healthier than #2.

But for pro investors, the ratio between profit and capital is more important. This ratio is also called return on capital (ROC). It is one of the most important profitability ratios used by investors to analyze a business.

In our example, company #1 has a profit of Rs.1.0 Crore and profitability of 10%. Company #2 has Rs.0.5 crore profit and 12.5% profitability. For pro investors, company #2 will score a higher rating than #1.

In addition to profitability, investors would like to buy stocks of a growing company. Sales and profit growth is the first thing that pro investors see in a company. But more importantly, they would like EPS growth rate and enhancement in the company’s profitability.

Investors – Lenders vs Shareholders

Lenders and shareholders are both considered ‘investors’ by the company. But there is a difference in how a company treats both of them.

Shareholders are more like “family.” They are entitled to a proportional share of the company profits (if any). But shareholders would also need to take a burnt if the company makes a loss. It is one reason why shareholders are proportional owners of the company.

Lenders are more like a “family friend.” They are also a part of the ups and downs of the company. But they get preferential treatment. The company borrows the lender’s money with a promise to pay back the principal within due time, with interest.

Risk and Return

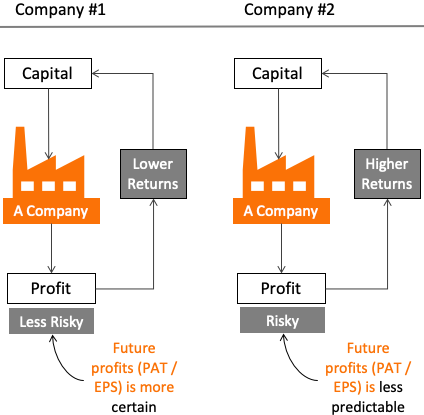

Let’s understand the concept of risk-return balance using an example. Suppose two companies are operating in the same sector. In the past, company #1 has posted consistent sales and profits (PAT and EPS). Hence it becomes easier for analysts to predict future profits. Such kinds of companies are considered safe for investing.

As the company is considered safe, the investors would like to invest in it even if their return potential (interest, dividend, price appreciation) is not as high. Which are these types of companies? We better know them as blue-chip companies.

Now, suppose there is a relatively new company. They are making efforts to grow. They are spending money extensively on marketing and sales. The spending is also on CAPEX to expand their business. Such companies may not post consistent profits. They may even report losses in some years. In the short term, such companies may look risky for investing.

Hence, the majority-investors, who do not know what is going behind the scenes, may not invest in such companies. But the company needs capital to do business. How they get it? By promising higher return on investment to their investors.

Suggested Reading: How to analyze companies having less than ten years of financial data.

What a company does with its profits?

Investors give lots of weightage to a company that handles its PAT wisely. A company can do the following with its profits:

- Pay Interest: Payment of loan interest is an obligation of the company. So, a company must pay its lenders on time. What they have to pay? The due interest on the debt and maturing principal amounts. Payment of interest is done out of the current year’s profits. The principal amount is paid from the company’s liquid-cash reserves.

- Pay Dividends: Paying dividends to shareholders is a form of giving them immediate gratification. Companies that are very sure of their future cash flows pay handsome dividends to their shareholders. Other companies either pay less or no Dividends.

- Retain Earnings: A company may decide to pay or not-pay dividends to its shareholders. In both the case, no company will distribute all its net profits (PAT) as dividends. The portion of unpaid PAT becomes retained earnings.

Retained earnings tell a lot about the company. How? Suppose there is a company having a ROC of 20%. It is a high ROC number. Now suppose this company retains its PAT (say Rs.10 Crore). At the rate of 20%, ROC retained-earning of Rs.10 Crore will yield Rs.2 Crore PAT next year.

This is a phenomenal return. Compare it with the returns you will make in a one-year bank FD, Corporate deposit, liquid mutual funds, or any equity mutual fund.

So what can be understood from this theory? A company that has high ROC should consider reinvesting its profit. For them, distributing profits as dividends to shareholders is not so wise.

On the contrary, what a low ROC company (like 5%) should do with its PAT? If such a company is reinvesting its PAT, it is cheating its shareholders. Why? Because a 5% per annum returns people get from a fixed deposit. They need not invest their money in this company’s stocks.

The market can be wrong

What we can learn from what we have read till now? Two lessons:

- First: we should invest in companies having high ROC. There is no point in investing in wealth destroyers (low ROC companies).

- Second: In the short term, it may be possible that a high ROC company may not see the price appreciation of its shares. We must remember that it is only a temporary phenomenon. Soon, the market will realize the worth of such a company and, its shares will get rewarded.

It might take time for the market to realize the quality of the company. It is the reason why some quality small and mid-cap stocks can trade at undervalued price levels.

But we must also remember that quality companies cannot stay ignored forever. In the long run, fundamentally strong companies are the ones who emerge as a winner in the stock market. The key is to stay invested in them.

So, identifying a good business, buying its stocks at a fair price, and then holding it for the long term is what stock investing is all about.

Conclusion

Buying stocks of the company means one is buying proportional ownership in the company. Hence understanding a company before buying its stocks is essential.

Ownership in a company comes with its share of risk and reward. Hence we as an investor need to tune our expectations (from stocks) accordingly.

Stocks are not like Fixed Deposits of banks which will continue to yield a fixed return (though low), even if the world is in crisis. But this is also true that, when the world is earning only average returns, shareholders of quality companies make handsome money.

In the long term, healthy businesses will dominate the stock market. In the short term, the share price of even such companies will be volatile. But this is not the time to get scared/confused and sell the holdings.

If we can remember only two things, stocks will behave to our expectations. First, the stock market eventually rewards companies that have a high return on capital (ROC). Secondly, buying stocks at a fair price and practicing long-term investment is very rewarding.

Next >> How to start stock research

I have gone though all your explanation to stock terms, ratio’s with examples, it’s very good and in simple language.

Appreciate your efforts.

It would be great if you can mention the optimum ratio values, for new comers in the stock market.

New comer. Hit by chance.

Enjoying reading. Value! Treasure!!

👏👌👍

Thanks