In the realm of financial analysis, understanding operating profit is crucial. It serves as a key measure of a company’s operational efficiency and profitability. However, it is essential to grasp its limitations and consider it in conjunction with other metrics. This article explores the significance of operating profit, its components, calculation, and interpretation. It will provide a comprehensive understanding of its role in assessing a company’s financial health.

Operating profit is a key financial metric that evaluates a company’s profitability. The profit considered for evaluation is solely from its core operations. It excludes all non-operating activities. Operating profit provides insights into the efficiency of a company’s day-to-day core business activities.

Operating profit holds significance for investors, analysts, and business owners. It provides valuable insights into the operational efficiency and profitability of the core business activities.

By focusing on operating profit, analysts can assess how well a company generates profits from its fundamental operations. Operating profit does not consider “other incomes” and “non-operating expenses” like interest income, income from investments, taxes, or one-time events.

Operating profit allows for a clearer understanding of the company’s ability to sustain profitability and growth over time.

This article will provide a comprehensive understanding of operating profit. It’ll explore its components, calculation methods, and interpretation. Let’s start exploring.

#1. Definition and Purpose of Operating Profit

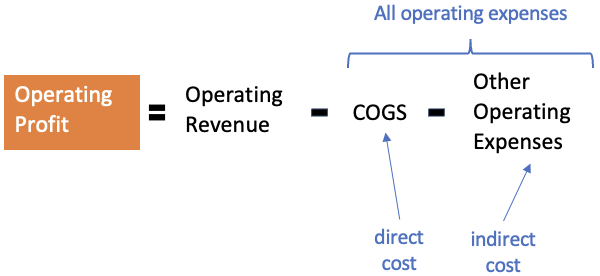

Definition: Operating profit refers to the profit generated by a company from its core operations, excluding non-operating activities. It represents the amount of operating revenue remaining after deducting the cost of goods sold (COGS) and operating expenses.

The Purpose

- In business: The purpose of operating profit is to assess the profitability and efficiency of the company’s core activities. It indicates how well a company generates profits from its day-to-day operations. Why do businesses focus on operating profit? This way they can evaluate their operational performance and identify areas for cost improvement. This awareness will let them make informed decisions regarding pricing and cost management.

- In accounting: It enables investors and analysts to assess the financial health and profitability of a company’s core business activities. Operating profit is not influenced by non-operating factors such as interest income, investment income or loss, or tax implications. Hence, analysts can compare it across companies and industries as it focuses on the income generated directly from operations.

#2. Gross Profit, Operating Profit, and Net Profit

Operating profit, gross profit, and net profit are all profitability measures. But they differ in terms of what they include and how they assess a company’s financial performance. Here’s a comparison of the three measures:

| Profitability Measure | Definition | Components Included |

|---|---|---|

| Gross Profit | Operating Revenue minus the cost of goods sold (COGS) | Operating, COGS |

| Operating Profit | Operating Revenue minus COGS and other operating expenses | Operating Revenue, COGS, other Operating Expenses |

| Net Profit | Total Income (operating revenue plus other income) minus COGS, operating expenses, interest, taxes, and non-operating items | Total Income, COGS, Operating Expenses, Interest Expenses, Taxes, Non-operating Items |

Explanation

- Gross Profit:

- Gross profit represents the operating revenue remaining after deducting the direct cost of producing goods or services (cost of goods sold – COGS).

- It focuses solely on production costs. It does not include operating expenses such as marketing, R&D, and administrative costs.

- Operating Profit:

- Operating profit goes beyond gross profit. It includes not only the COGS but also other operating expenses incurred by the company.

- Other operating expenses encompass various costs, such as the cost of marketing, R&D costs, employee salaries, rent, utilities, and administrative expenses.

- Operating profit is a more comprehensive measure of a company’s operational efficiency compared to gross profit.

- Net Profit:

- The income source considered in the net profit calculation is the total income (operating income and other income).

- It represents the final profitability measure after deducting all expenses. The expenses include all operating and non-operating expenses like interest, taxes, and depreciation.

- It reflects the income remaining for shareholders after all expenses have been accounted for.

Gross profit focuses solely on production costs. Operating profit considers both production costs and other operating expenses. While net profit encompasses all types of income and expenses.

Each measure provides a different perspective on a company’s profitability and financial performance. Operating profit offers a more focused view of the operational efficiency and effectiveness of the company’s core business.

#3. Importance of Operating Profit

Focusing on operating profit is crucial when evaluating a company’s operational efficiency for several reasons:

- Core Business Evaluation: Operating profit excludes non-operating factors and focuses only on core operations. Stakeholders can focus on operating profit to know how well the company is generating profits from its primary business activities.

- Efficiency Benchmarking: Operating profit allows for benchmarking and comparisons within the industry. Investors and analysts can assess a company’s operational efficiency by comparing its operating margins with competitors or industry standards. This benchmarking provides insights into whether the company is performing better or worse compared to its peers.

- Identification of Operational Strengths and Weaknesses: By analyzing the components of operating profit, such as operating revenue, COGS, and other operating expenses, stakeholders can identify specific areas where improvements can be made. Read more about it in the next section of this article.

Suppose there are two companies A & B. Both companies have reported Rs.100 crores as operating revenue and Rs.50 crores as operating profit. But they differ in COGS and other operating expenses. COGS (A = Rs.30 crore, B = Rs.20 crore). Other operating expenses (A = Rs.20 crore, B = Rs.30 crore). As Company B has a lower direct cost (COGS) and higher non-direct cost (other operating expenses), in terms of cost efficiency it looks better.

Consistently positive and growing operating profit indicates that the company has a robust and efficient business model. It provides confidence that the company can withstand market fluctuations, economic downturns, and industry challenges.

#4. Components of Operating Profit

Operating profit is determined by three main components that contribute to its calculation. These components include operating revenue, cost of goods sold (COGS), and other operating expenses. Here’s a breakdown of each component:

Operating Revenue

Operating revenue is also known as operating revenue or sales. It represents the total amount of money generated from the sale of goods or services. It includes all income generated directly from the company’s core operations. Operating revenue can include revenue from the sale of products and services.

The total revenue of a company can be broadly classified into two types, ‘operating revenue’ and ‘other income.’ In the calculation of operating profit, only operating revenue is considered.

Cost of Goods Sold (COGS)

COGS is also an operating expense but it considers only direct costs. Cost of Goods Sold (COGS) refers to the direct costs incurred in the production or delivery of goods or services. COGS typically includes expenses such as raw materials, direct labor costs, manufacturing overhead, or direct service costs.

COGS is subtracted from revenue to calculate gross profit, which represents the profitability of the company’s primary operations before considering operating expenses.

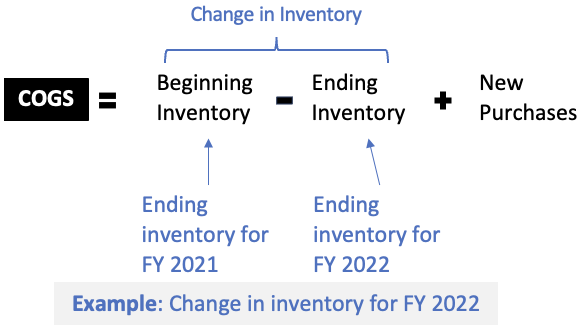

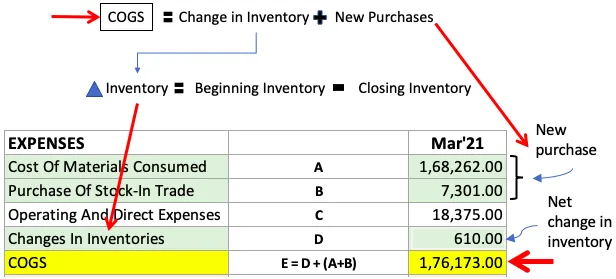

In financial reports published by Indian companies, COGS is not directly mentioned. So, here is how one can calculate COGS using other numbers. To calculate the COGS, one can use the following formula:

To obtain values of new purchases, we can use the below numbers from the company’s P&L account.

[Note: The companies of the Service sector, like TCS, Infosys, etc maintain no inventory. For such companies, COGS is calculated as zero. Hence, such companies will have gross profit and operating profit equal to each other.]

Other Operating Expenses

Other operating expenses are non-direct costs necessary to run the company’s operations. It encompasses all costs associated with running a company’s day-to-day operations, excluding COGS.

Operating expenses can include items such as marketing and advertising expenses, R&D costs, employee salaries, rent, utilities, administrative expenses, and other overhead costs.

#5. Interpreting Operating Profit

Operating profit is a valuable financial metric that provides insights into a company’s operational efficiency and profitability. However, to gain a comprehensive understanding of a company’s financial health, it is essential to consider it in conjunction with other financial metrics.

Here’s how operating profit can be used in combination with other metrics:

Net Profit

Net profit represents the final profitability measure after deducting all expenses. It includes operating expenses, interest expenses, taxes, and non-operating items.

By comparing operating profit with net profit, stakeholders can assess the impact of non-operating factors on overall profitability.

A significant difference between operating profit and net profit may indicate the presence of non-operating items. Non-operating factors can be one-time gains or losses, interest expenses, or tax implications, etc.

Evaluating the relationship between operating profit and net profit helps understand the comprehensive financial performance of the company.

Gross Profit Margin

Gross profit margin is calculated by dividing gross profit (revenue minus COGS) by revenue. It represents the profitability of a company’s core operations (production) before considering other operating expenses.

By comparing the gross profit margin with the operating profit margin, analysts will know where are the cost concerns. If the gross margin is sufficiently higher than the operating margin, it means that the company is spending more on sales and marketing, R&D, salaries, etc. To bring a party between gross and operating margins, there is a possibility of cost-cutting on the other operating expenses side.

Cash Flow

Analyzing operating profit alongside cash flow metrics provides insights into the company’s cash-generating capabilities.

Cash flow from operating activities reflects the actual cash generated from core operations. Comparing operating profit with cash flow helps assess the quality of profit.

A critical question that will be answered here is that, whether the company’s reported profits are translating into actual cash flow.

If operating profit is significantly higher than cash flow, it may indicate potential cash flow challenges or non-cash accounting items affecting profitability.

Return on Invested Capital (ROIC)

ROIC measures the profitability of an investment relative to the invested capital. It is a ratio between after-tax operating income and the invested capital.

By comparing the operating profit margin to ROIC, analysts can assess the company’s efficiency in generating returns on its investments.

A higher ROIC indicates better capital utilization and long-term sustainability. Operating Profit Margin, on the other hand, reflects the profitability of the company’s core operations by indicating the percentage of revenue that translates into operating profit.

A higher Operating Profit Margin signifies better operational efficiency and cost management.

Debt Levels

Evaluating operating profit in relation to the company’s debt levels helps gauge its ability to service its debt obligations.

Assessing metrics such as the interest coverage ratio-ICR (operating profit divided by interest expense) helps determine the company’s capacity to cover interest payments from its operating earnings.

A higher interest coverage ratio suggests a lower risk of default and a stronger financial position.

A high operating margin and high ICR give a clear indication that the company has no debt-related problems.

Industry Comparisons

Comparing the operating profit margins of a company with industry peers or benchmarks provides context. It helps assess the company’s relative performance.

Understanding how the company’s financial health measures up to industry standards and competitors’ metrics can identify areas of strength or weakness and support informed decision-making.

#6. Limitations of Operating Profit

While operating profit is a valuable measure of a company’s financial performance, it does have limitations when used as a standalone measure.

Here are some key limitations to consider:

- Ignores Financing and Capital Structure: Operating profit does not consider the impact of a company’s financing decisions or capital structure. It does not account for interest expenses, debt repayments, or the cost of capital. As a result, it does not provide a comprehensive view of the company’s financial obligations and the efficiency of its capital utilization.

- Lack of Cash Flow Consideration: Operating profit is an accounting measure that focuses on revenue and expenses. It does not directly reflect the company’s cash flow. Cash flow from operating activities, which includes changes in working capital, can differ significantly from operating profit. It can be due to factors such as the timing of payments and receipts.

- Industry-Specific Factors: Operating profit alone may not be sufficient for comparing companies across different industries. Industries have varying cost structures, business models, and capital requirements, which can affect operating profit margins. Comparisons between companies in different industries solely based on operating profit may lead to inaccurate conclusions.

To overcome these limitations of operating profit, it is important to consider additional financial metrics while analyzing a company. Other metrics can be net profit, cash flow, ROIC, etc as explained earlier.

Conclusion

Operating profit is a critical financial metric that provides insights into a company’s operational efficiency and profitability. Its focus is on the profits generated from core operations. It allows analysts to assess the company’s ability to generate sustainable income from its fundamental business activities.

However, it is important to recognize the limitations of operating profit as a standalone measure of a company’s financial performance.

Operating profit has its drawbacks. It excludes all non-operating items. It kind of neglects the financing and capital structure of the company. Operating profit also does not take note of the cash flow potential of a company. Hence, operating profit may not provide a comprehensive view of a company’s profitability.

To gain a comprehensive understanding of a company’s financial health, it is crucial to consider operating profit in conjunction with other financial metrics.

Ultimately, operating profit serves as an essential component in assessing a company’s financial performance. What is that component? The efficiency of the company to produce goods and services. Generally speaking, companies with good operating profit margins are considered financially healthy. But it is also true that there are exceptions. Excessively debt-burdened companies may not follow this general rule.